suppressPackageStartupMessages({

library(readxl)

library(ggplot2)

library(plotly)

library(tidyr)

library(dplyr)

library(ggcorrplot)

library(PerformanceAnalytics)

library(trend)

library(seastests)

library(tseries)

library(forecast)

library(tsoutliers)

library(EnvStats)

library(RJDemetra)

library(TSA)

library(lubridate)

library(tsoutliers)

library(leaps)

library(MASS)

library(car)

library(lmtest)

library(BeSS)

library(nlme)

library(here)

})Mémoire

Sensibilité des prix agricoles face aux chocs climatiques

Séries temporelles au Brésil de janvier 2000 à décembre 2022

Présentation

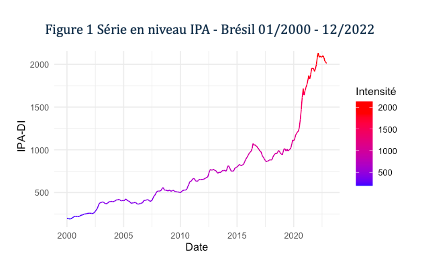

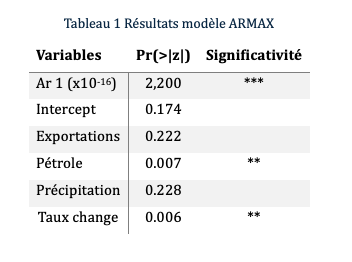

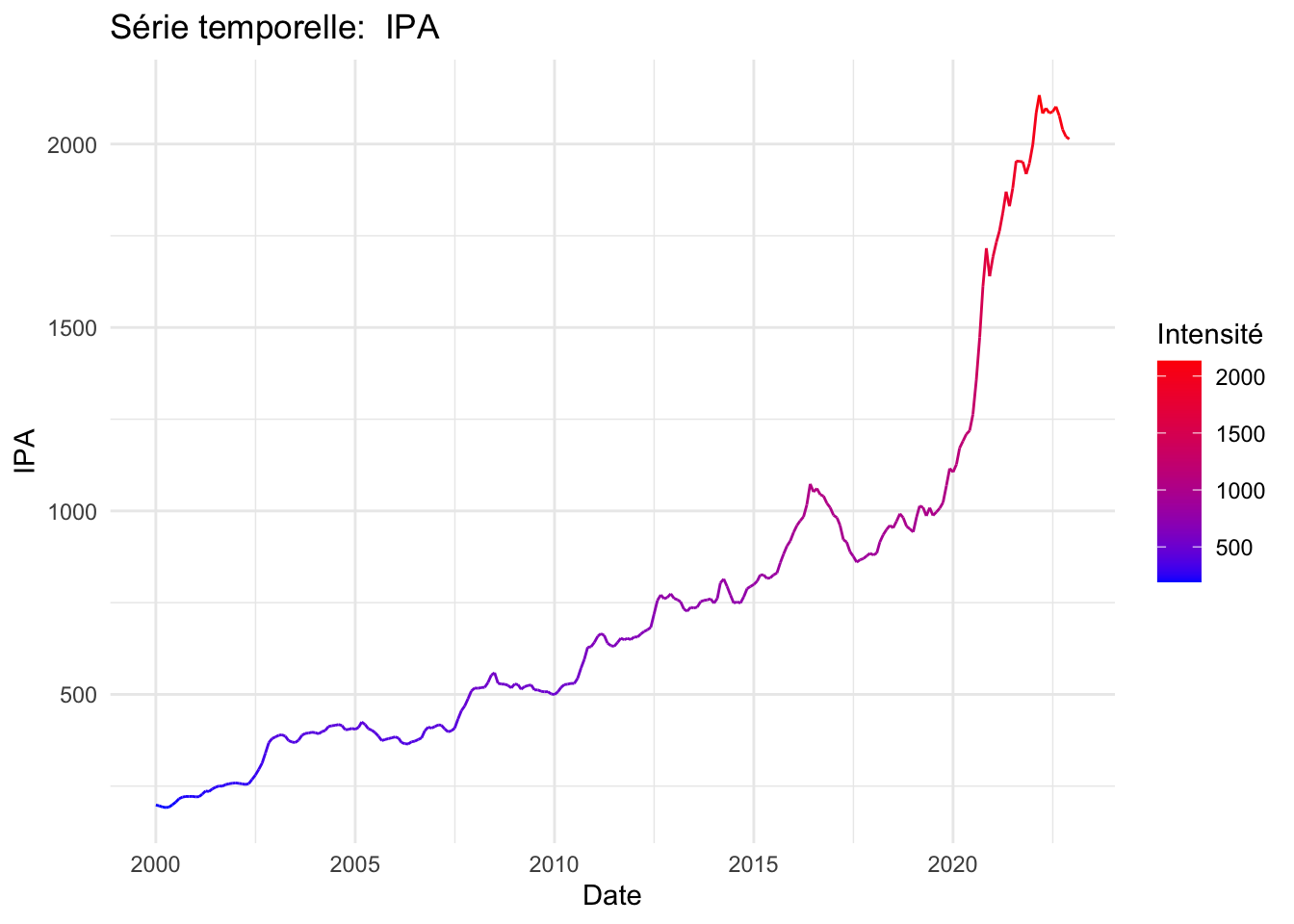

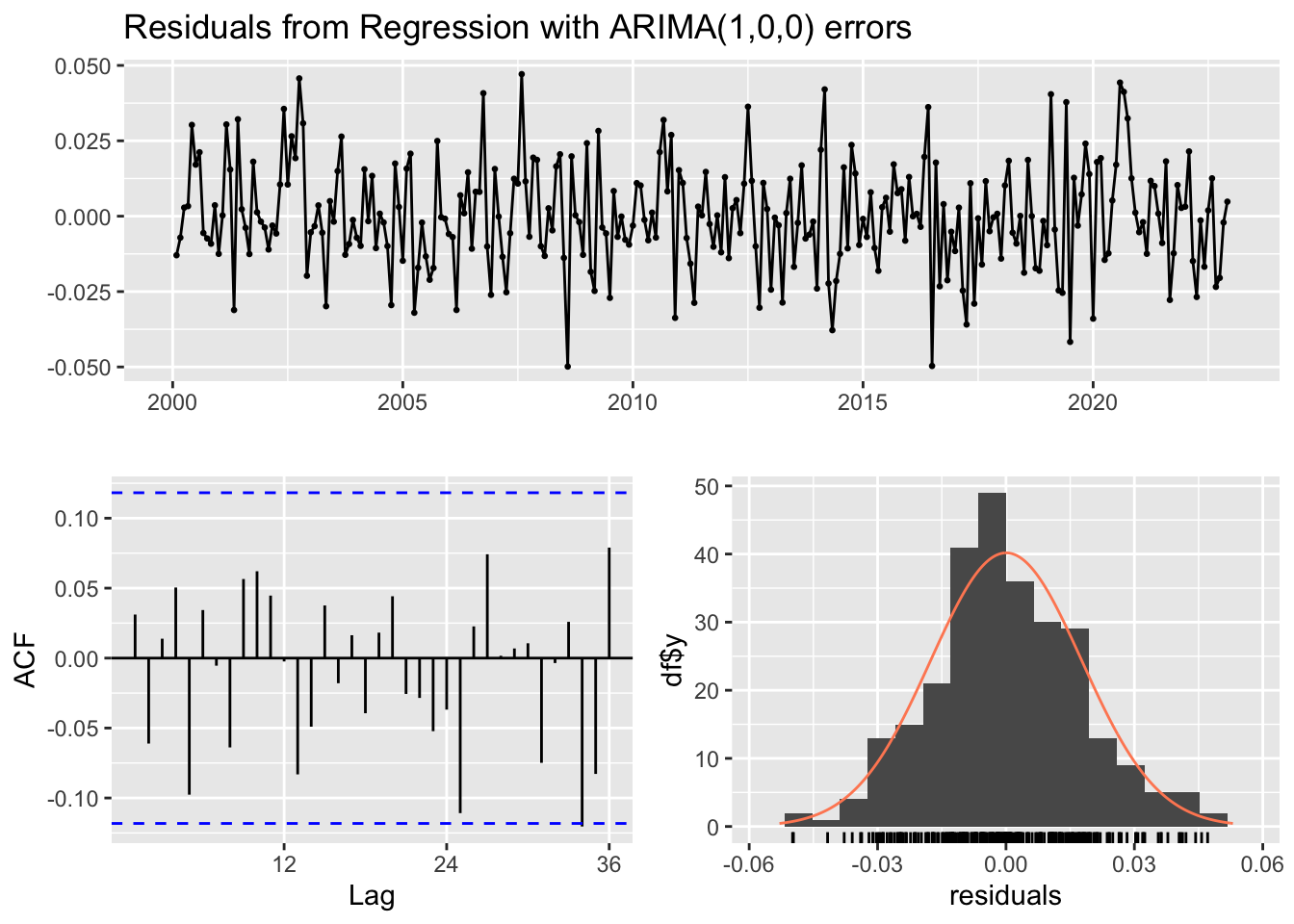

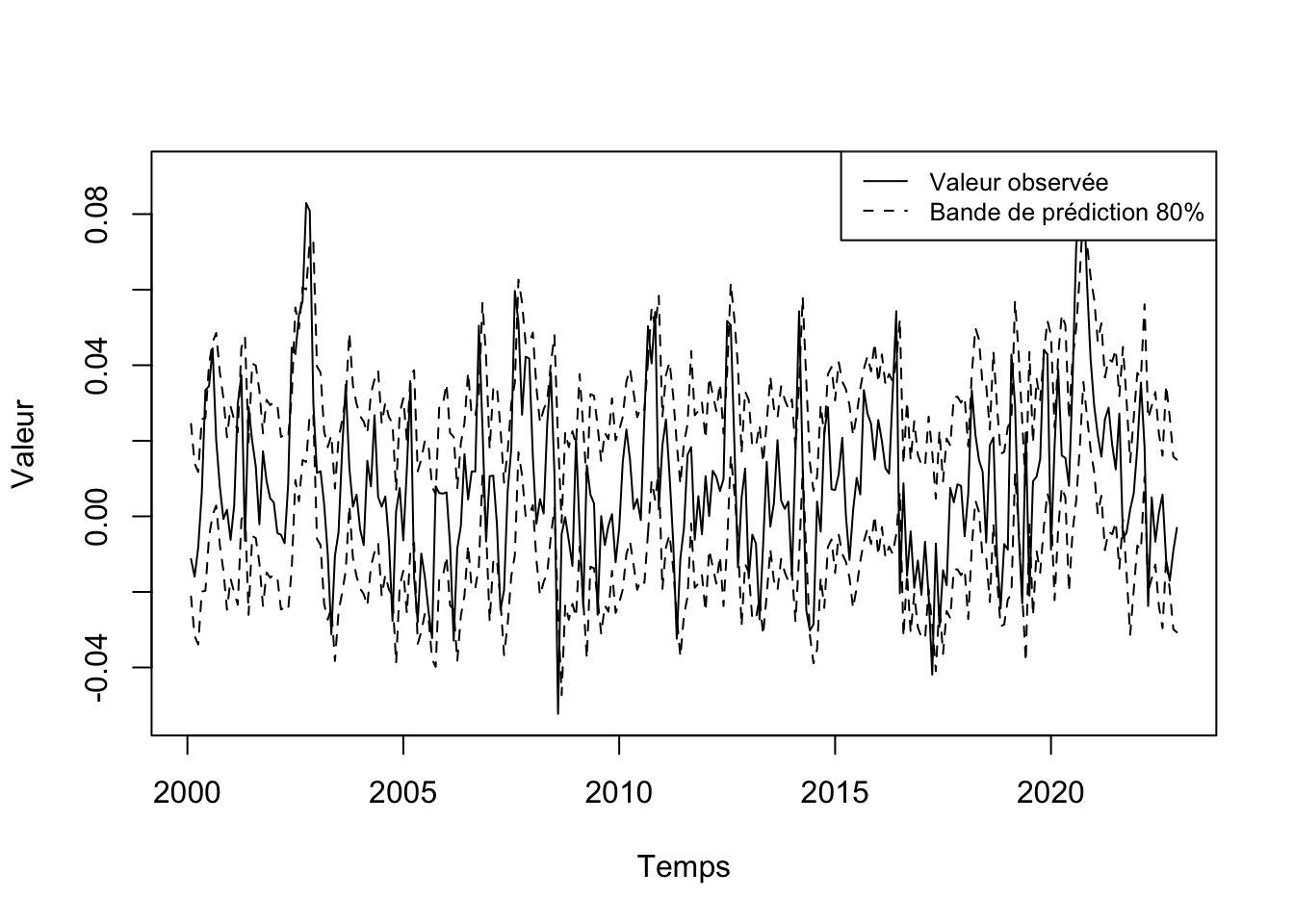

Cette étude analyse les prix des produits agricoles au Brésil, un acteur clé des enjeux agricoles mondiaux, en utilisant l’indice des prix à la production agricole (IPA) de janvier 2000 à décembre 2022. L’étude a intégré des variables climatiques pour évaluer leur impact, en utilisant des modèles de régression tels que les Moindres Carrés Ordinaires (MCO) et ARMAX. Dans notre approche par les MCO, nous avons rencontré des difficultés telles que l’autocorrélation des résidus et l’hétéroscédasticité. Malgré plusieurs tentatives, le modèle MCO n’a pas pu être validé et nous avons adopté le modèle ARMAX qui s’est avéré plus efficace. Les résultats montrent que le taux de change, le prix du pétrole et l’influence des valeurs passées de l’IPA ont eu un impact statistiquement significatif. Nos recherches révèlent que, bien que les variables climatiques n’aient pas eu un effet notable, la complexité du système agricole suggère qu’une approche globale et uniforme n’est pas adéquate. Ainsi, nous préconisons, tant dans les études que dans l’élaboration des stratégies, l’adoption de mesures localisées qui répondent mieux aux besoins spécifiques des communautés agricoles.

Mots clés : Prix agricoles, Brésil, MCO, ARMAX, R

Sujet d’étude

Le Brésil, l’un des plus grands producteurs agricoles mondiaux, est également riche en biodiversité et ressources environnementales. Toutefois, le pays est marqué par d’importantes disparités économiques et sociales, reflétées dans son secteur agricole qui se divise entre l’agriculture familiale et l’agrobusiness. Depuis 2000, les politiques brésiliennes ont alterné entre progrès et régression. Sous Lula da Silva, des avancées significatives ont été réalisées, tandis que les administrations suivantes ont vu des reculs, notamment avec la suppression de ministères clés et la libéralisation de la politique de réforme agraire. L’administration de Bolsonaro a augmenté les tensions entre développement agricole et conservation environnementale, en particulier avec l’augmentation de la déforestation en Amazonie. En tant que membre des BRICS et du MERCOSUR, le Brésil joue un rôle important dans les discussions internationales. Le traité de libre-échange entre l’UE et le MERCOSUR est un bon exemple de l’importance croissante du pays sur la scène internationale. L’objectif est de comprendre les facteurs qui influencent les prix à la production agricole du pays que beaucoup surnomment « la ferme du monde ».

Présentation des données

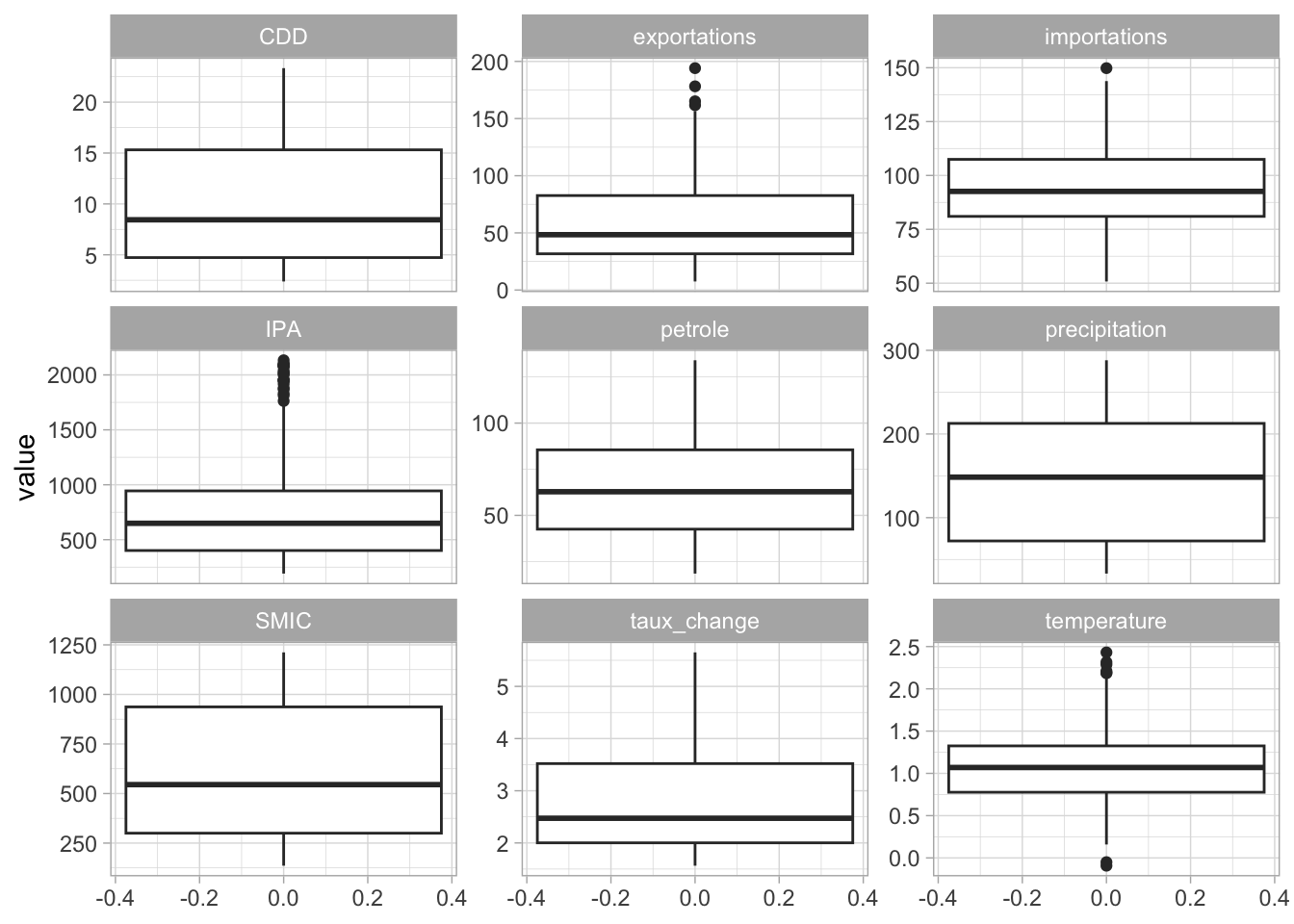

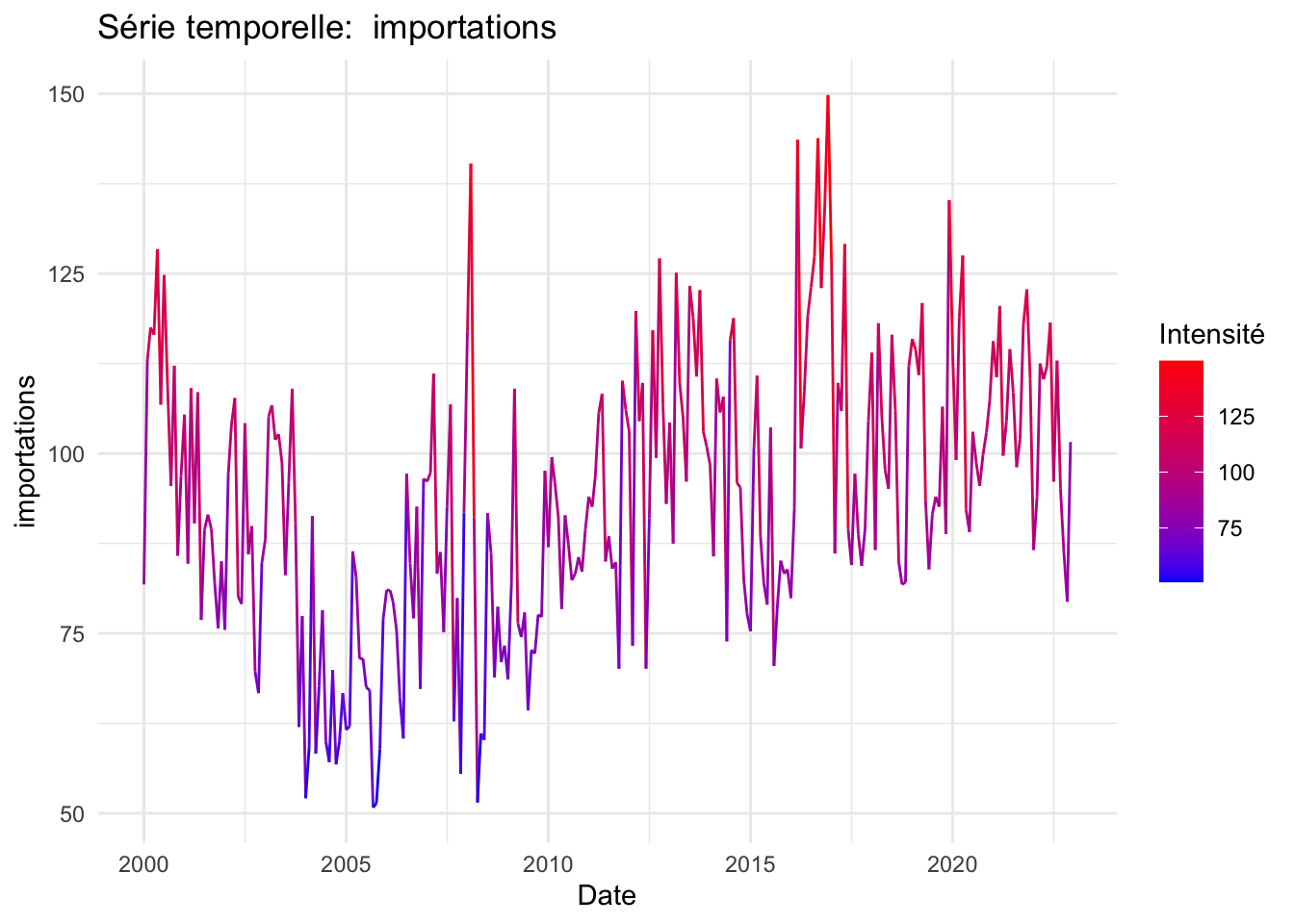

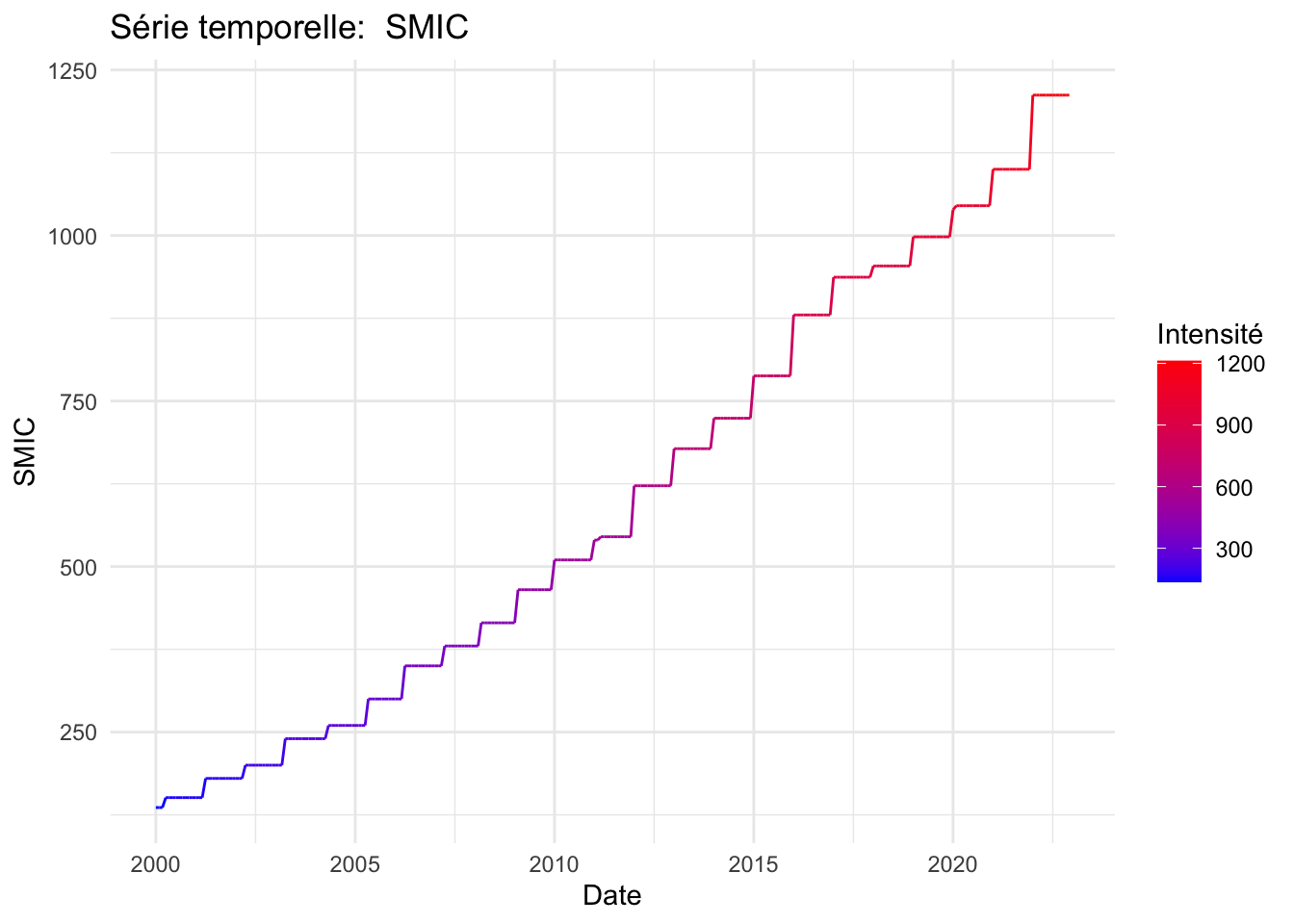

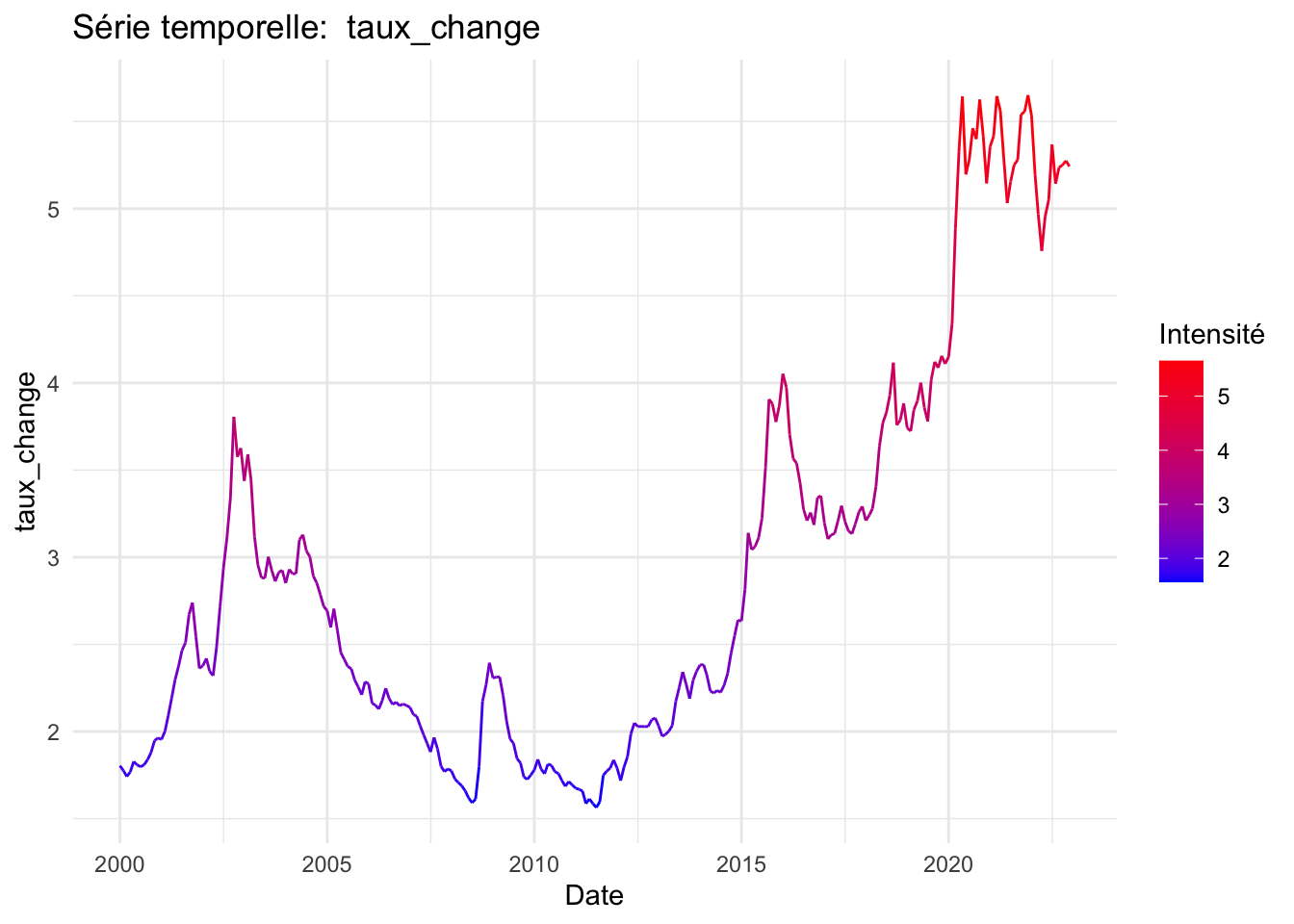

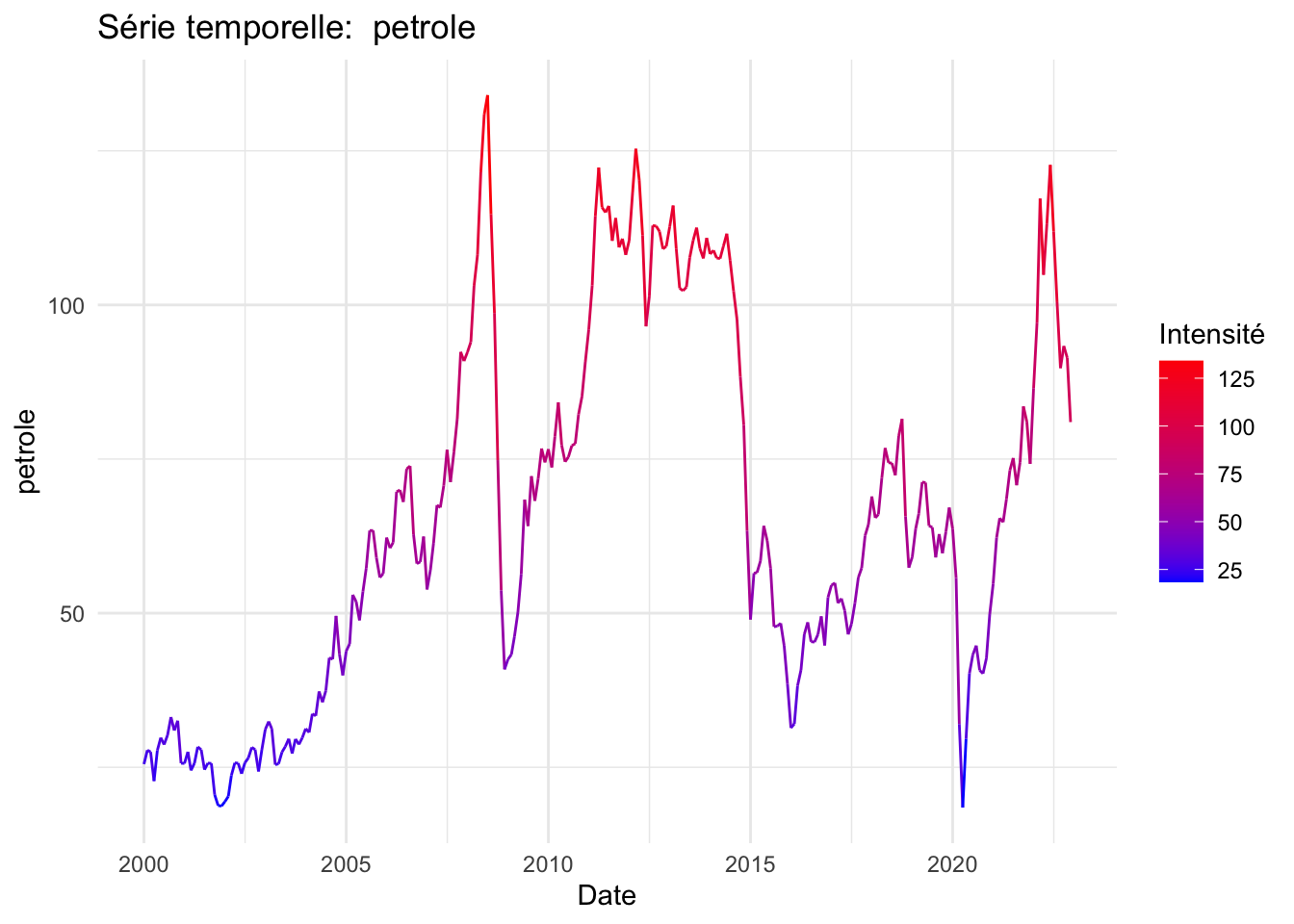

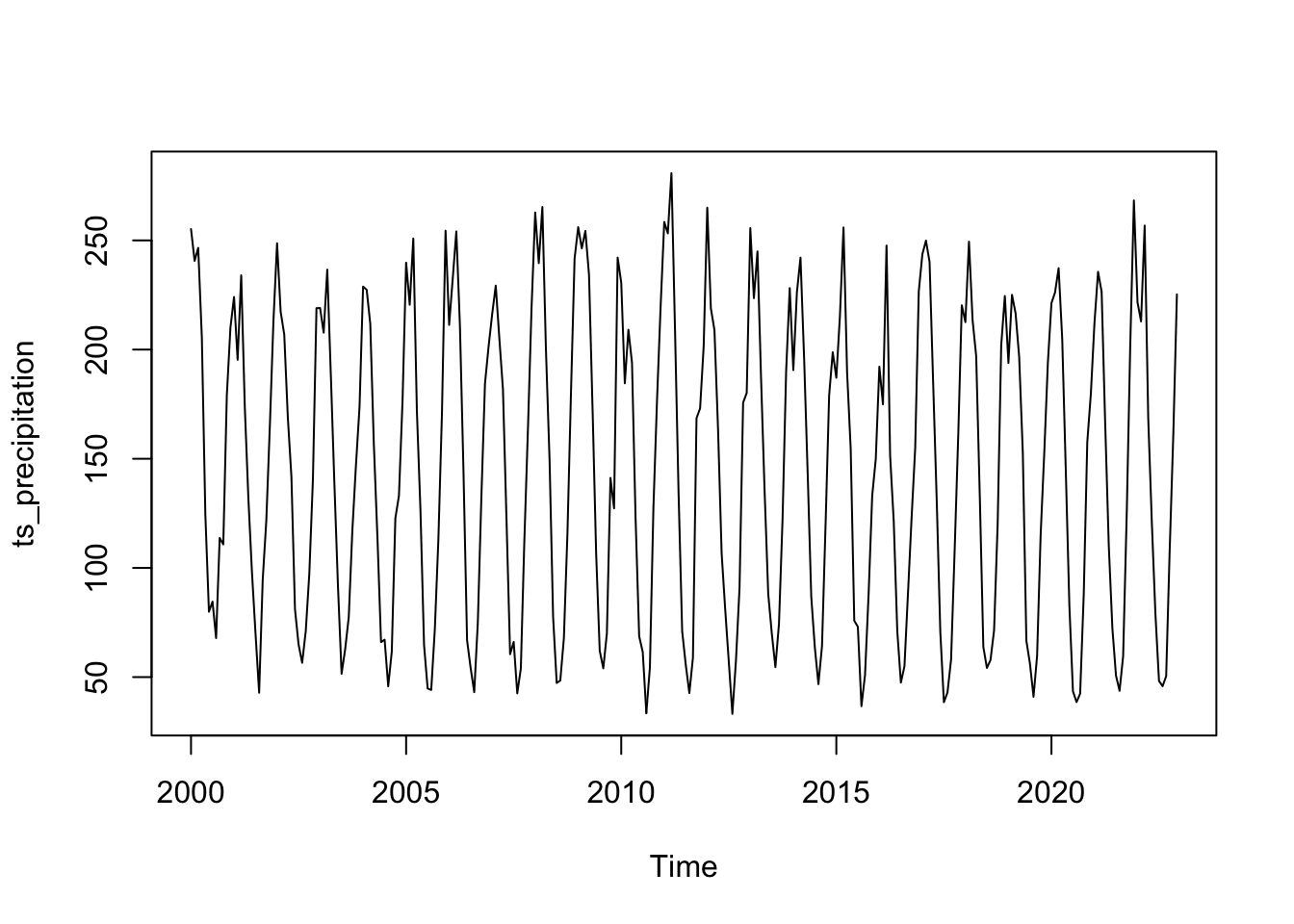

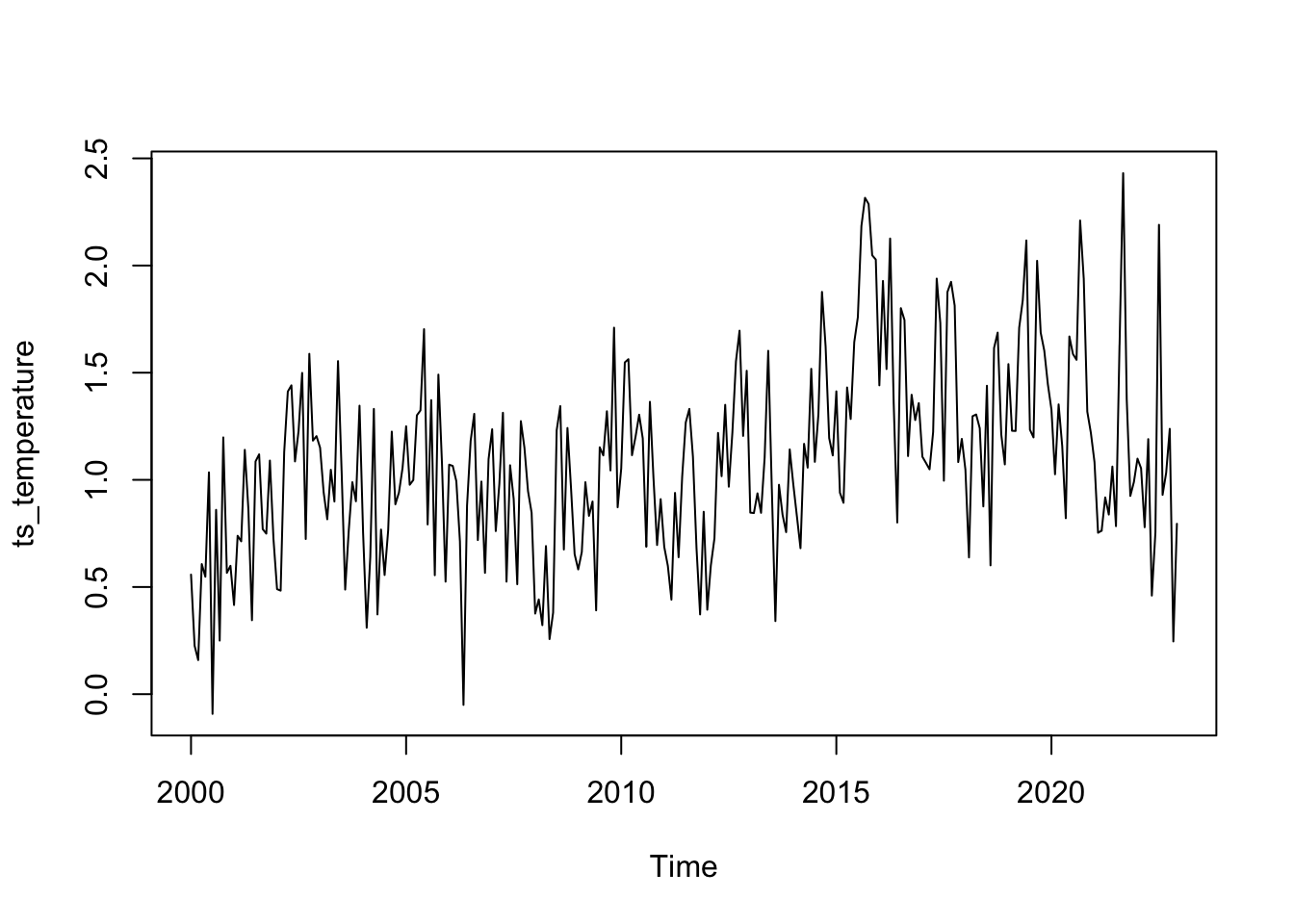

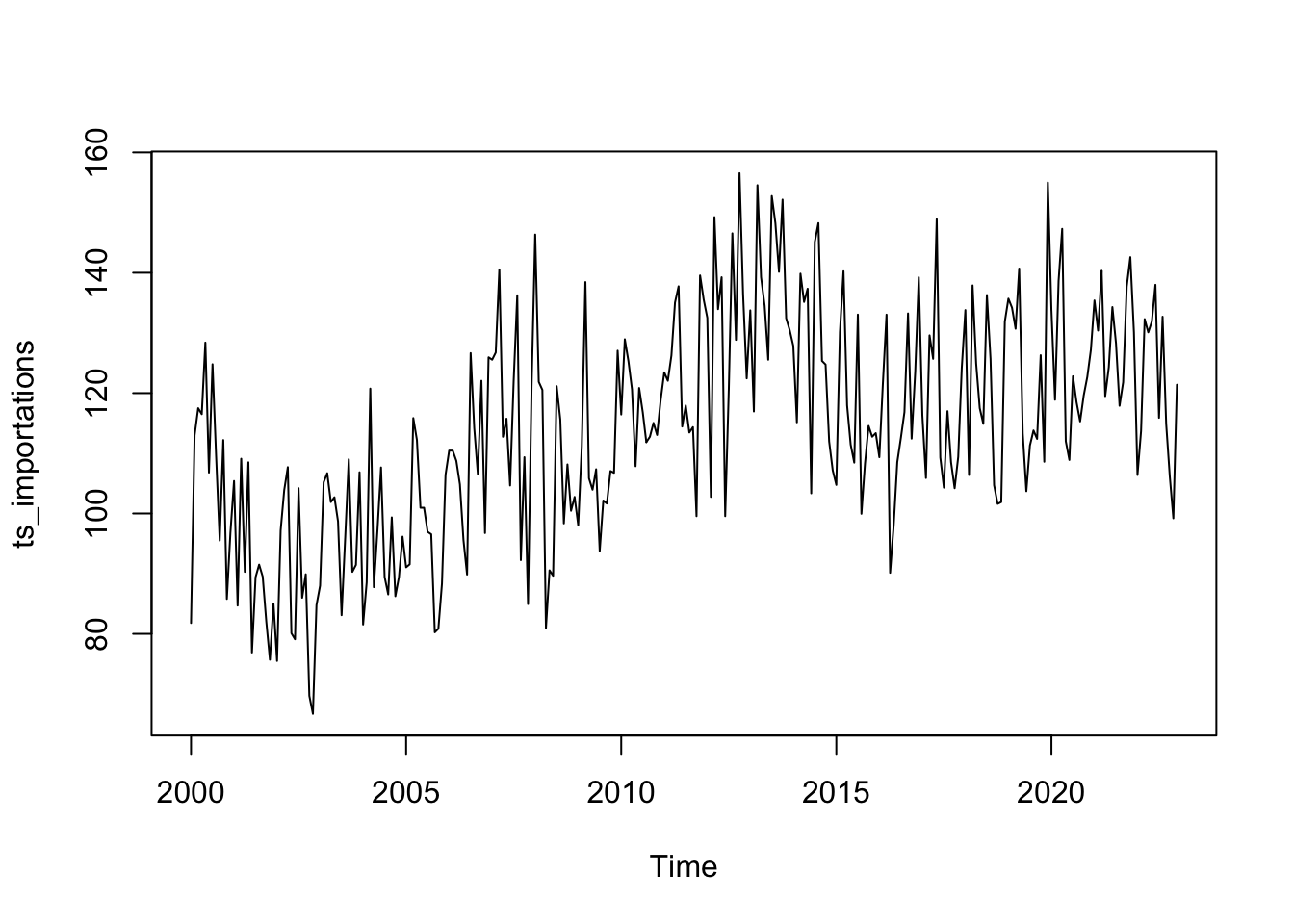

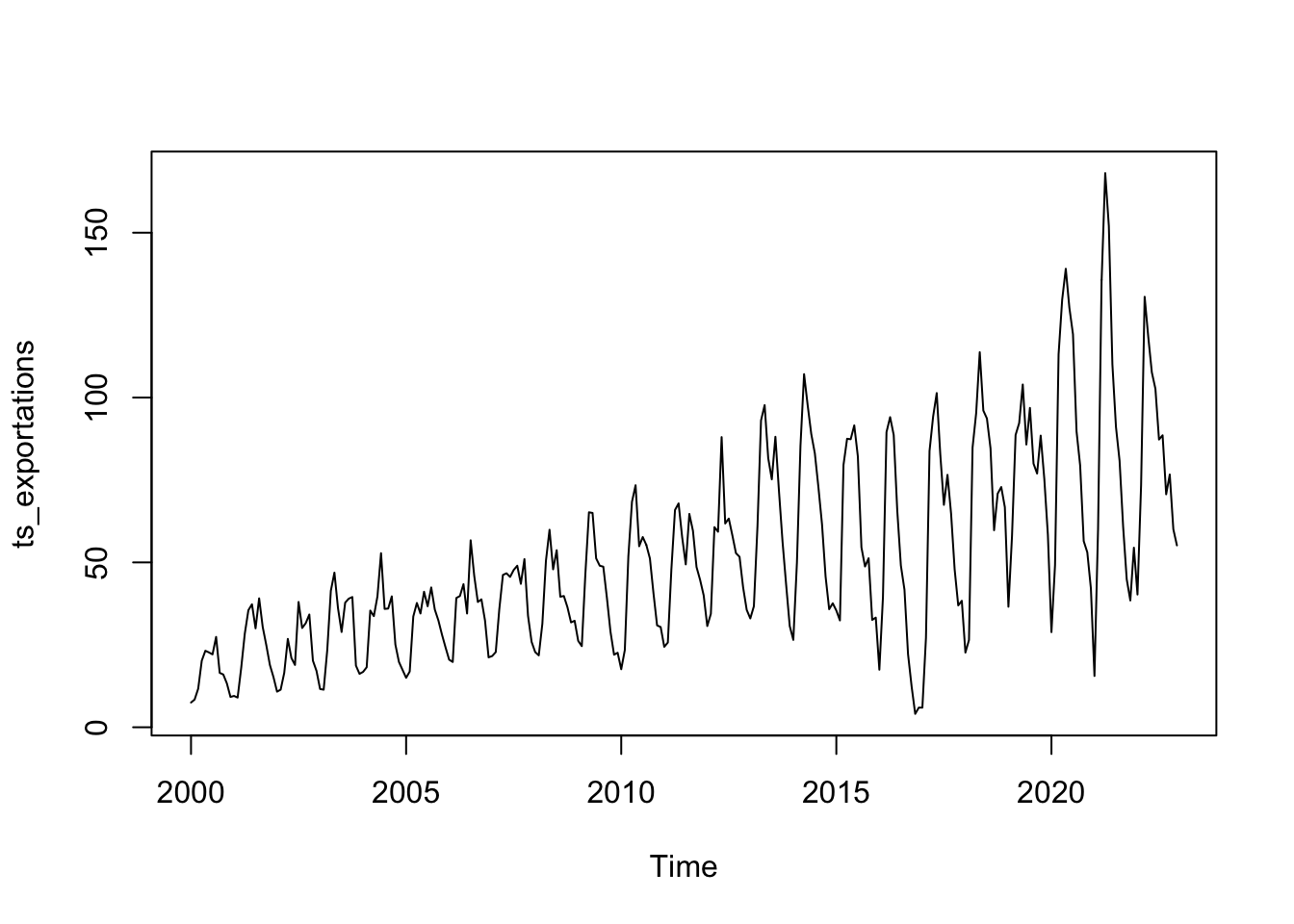

Les données s’étendant de janvier 2000 à décembre 2022 avec une fréquence mensuelle, proviennent de trois sources : l’Institut de Recherche Économique Appliquée (IPEA DATA), les Statistiques de l’ONU pour l’alimentation et l’agriculture (FAO STAT), et le Portail de connaissances sur le changement climatique de la Banque mondiale (CCKP). Les variables explicatives incluent les variations de température (°C), les précipitations (mm), le nombre de jours secs consécutifs, le prix du pétrole, le taux de change (BRL/USD), le salaire minimum nominal (SMIC), et les indices des exportations et importations agricoles.

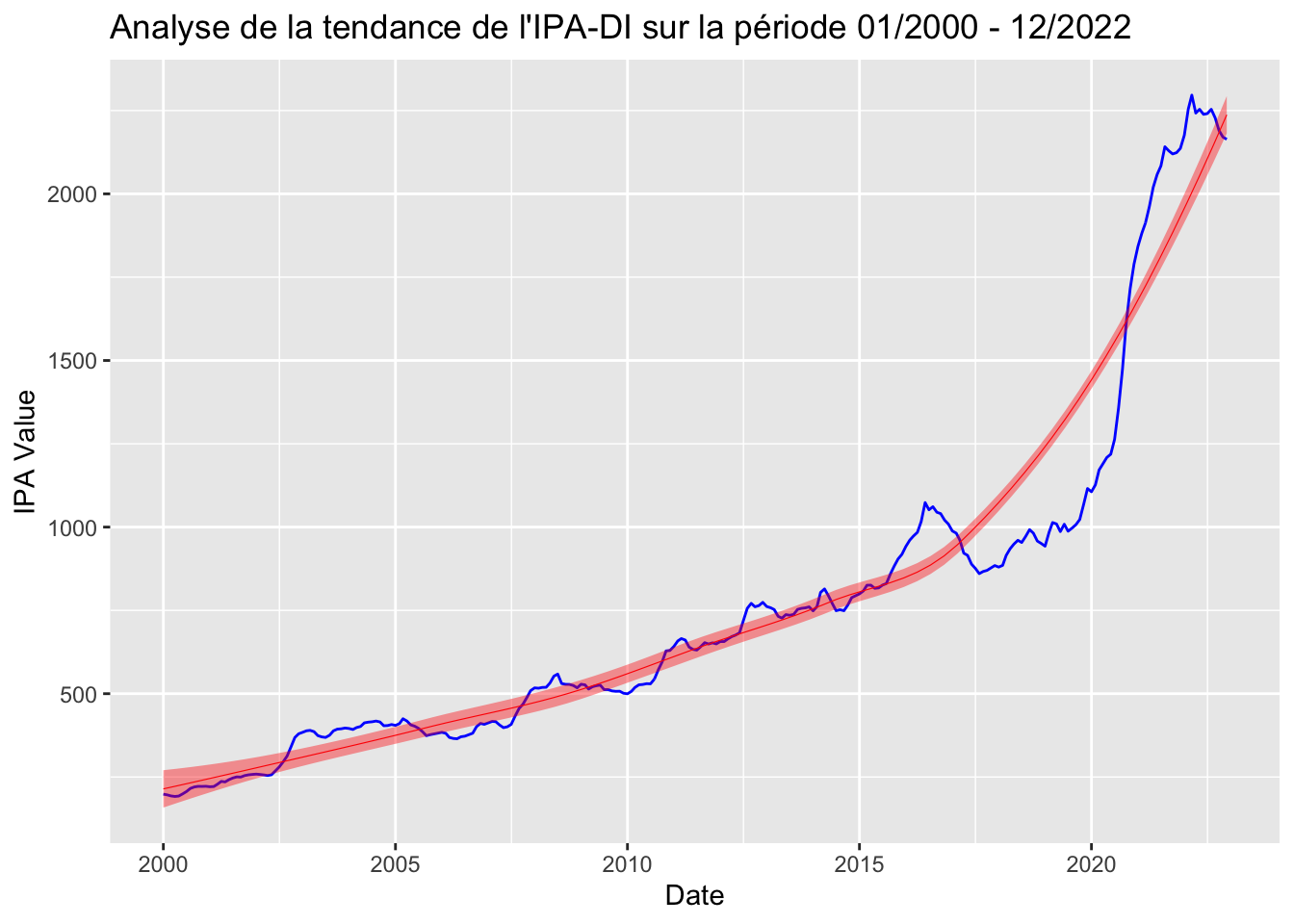

Des statistiques descriptives ont mis en évidence une hausse marquée de l’IPA, particulièrement après 2016.

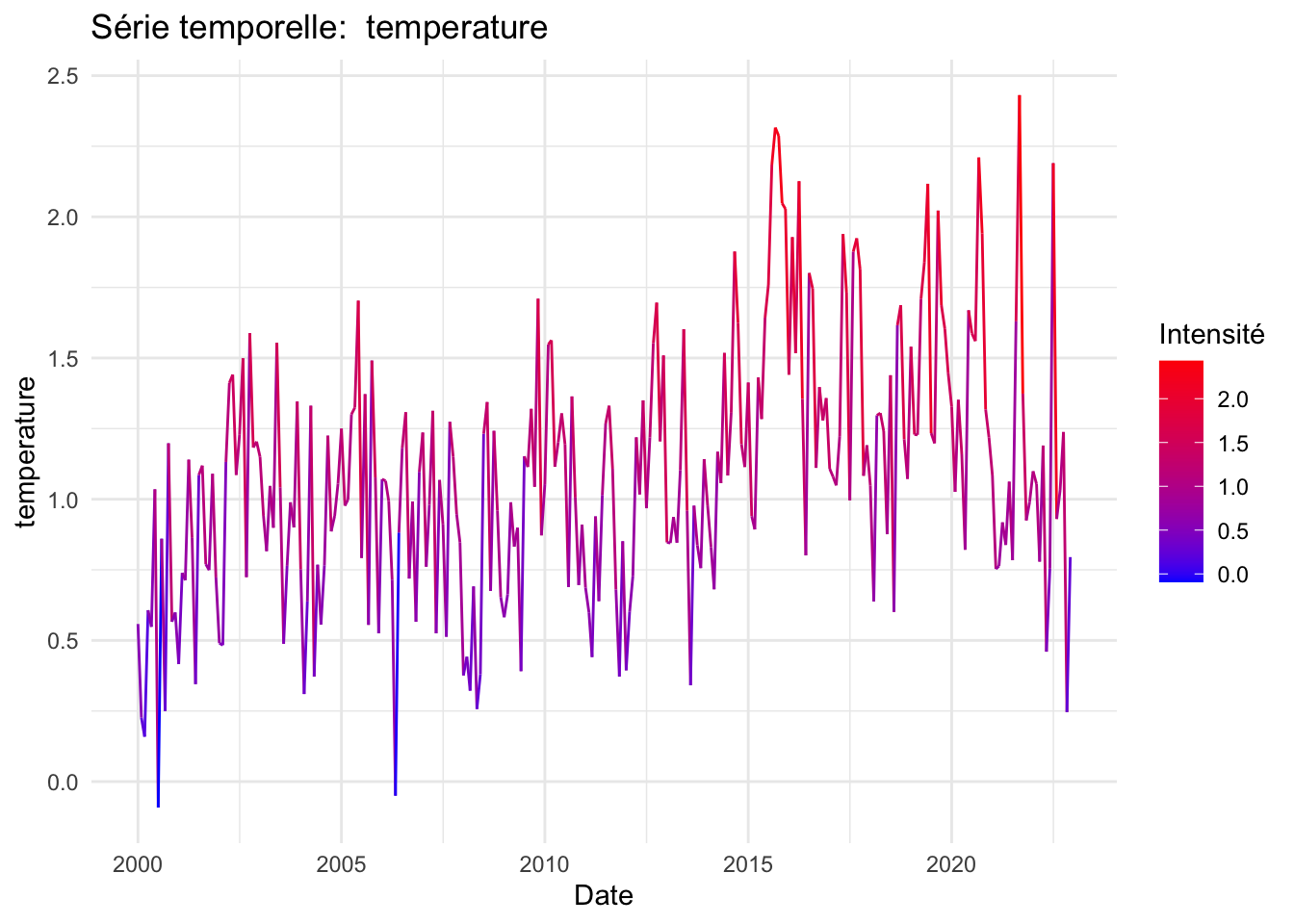

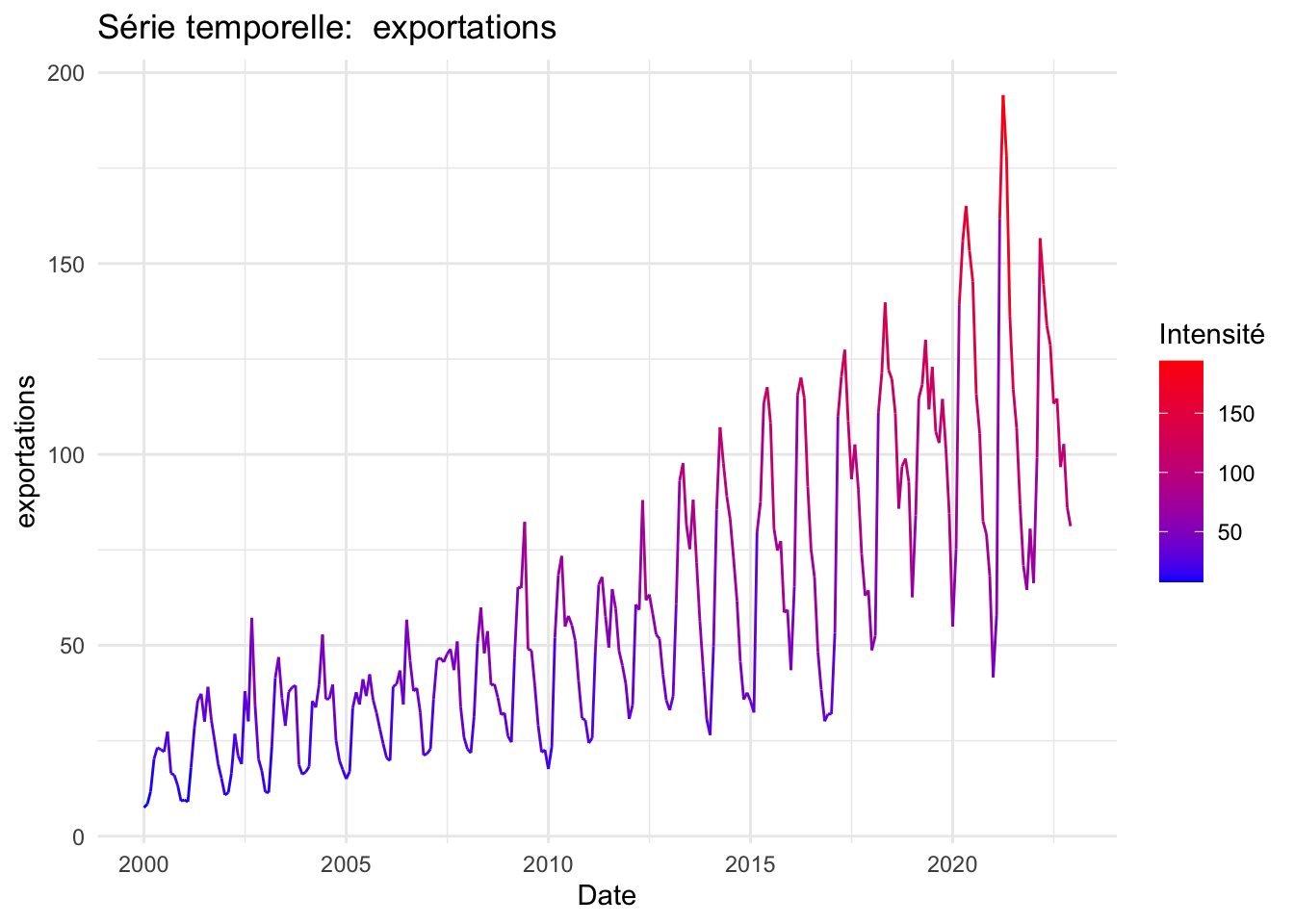

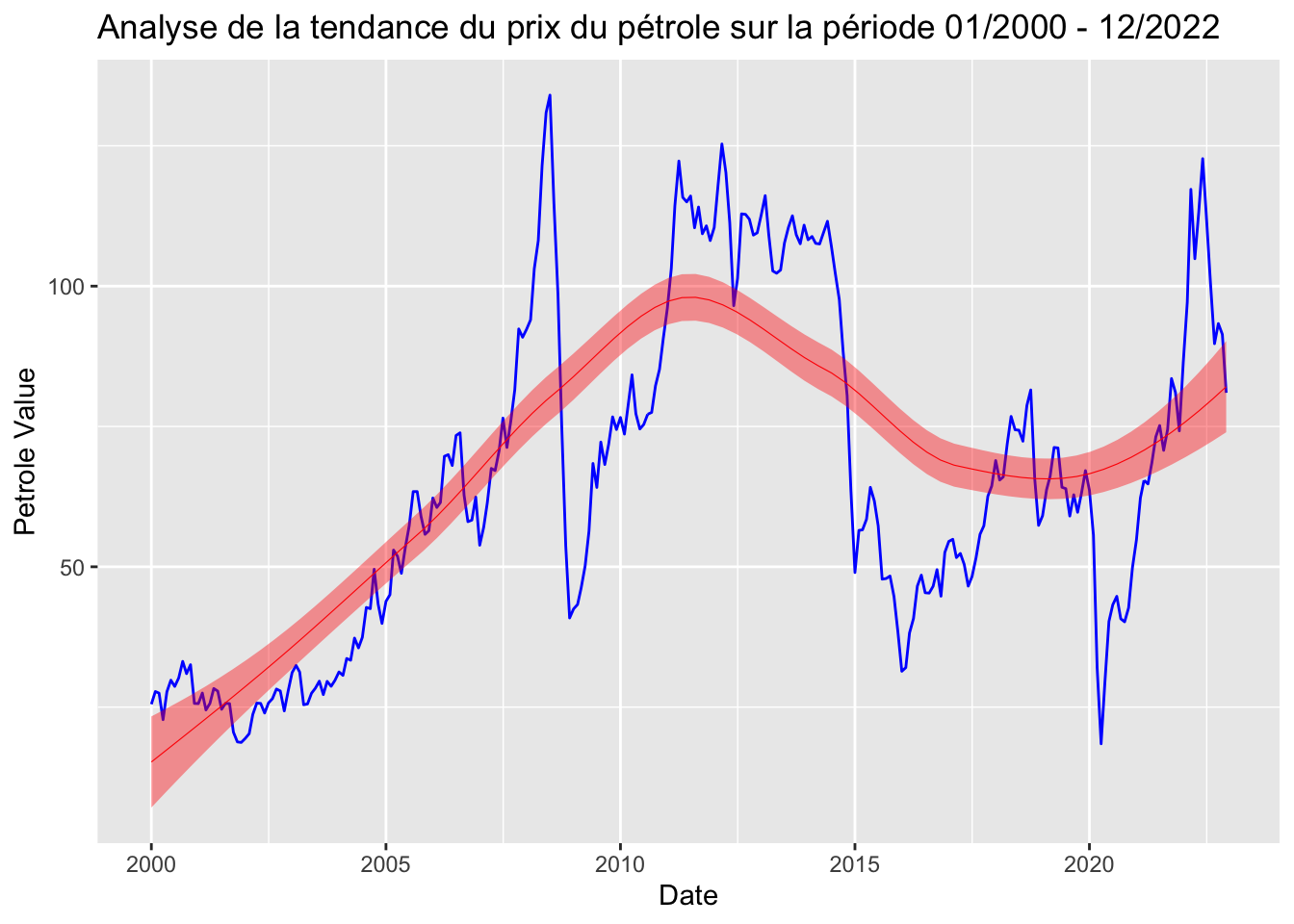

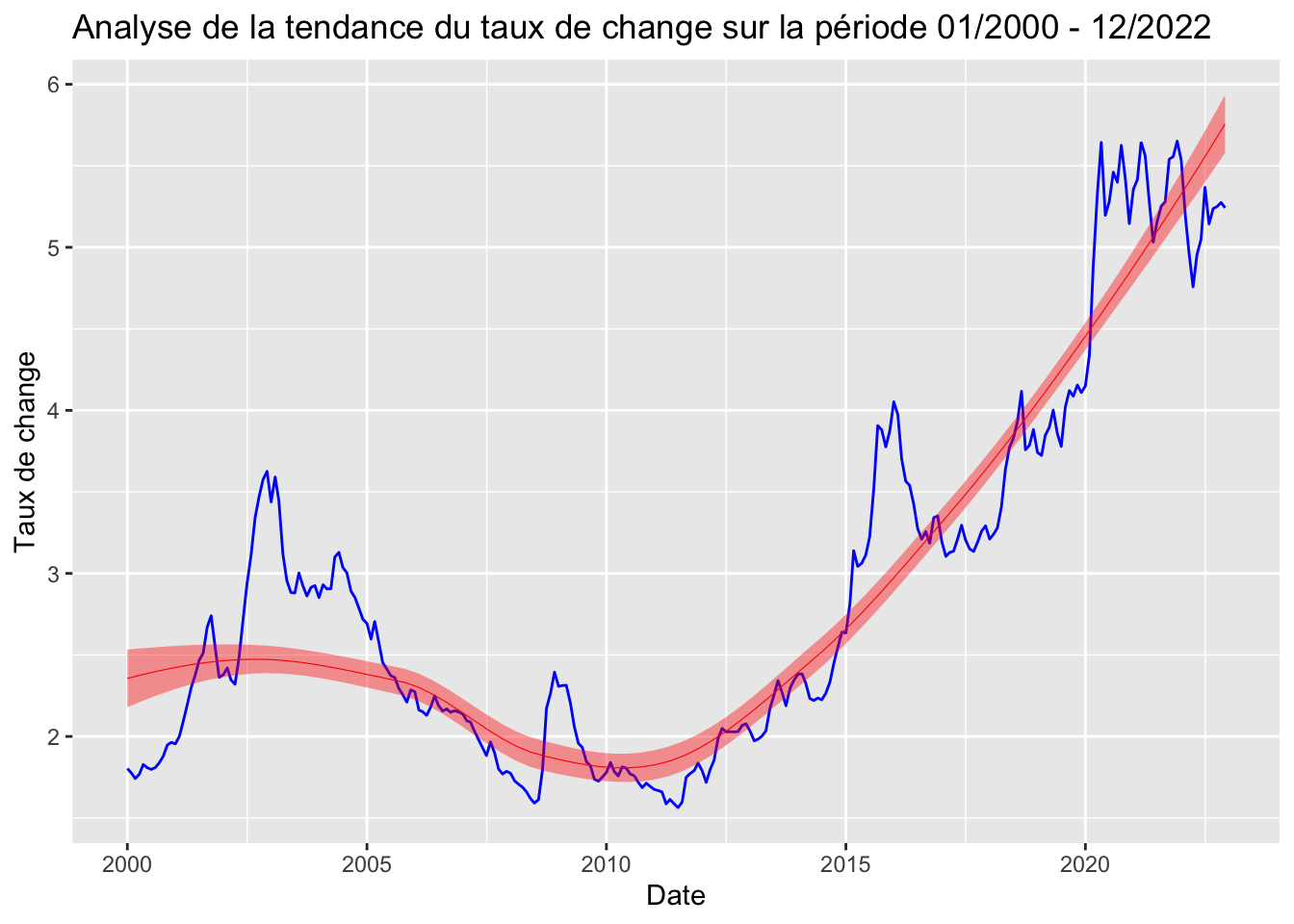

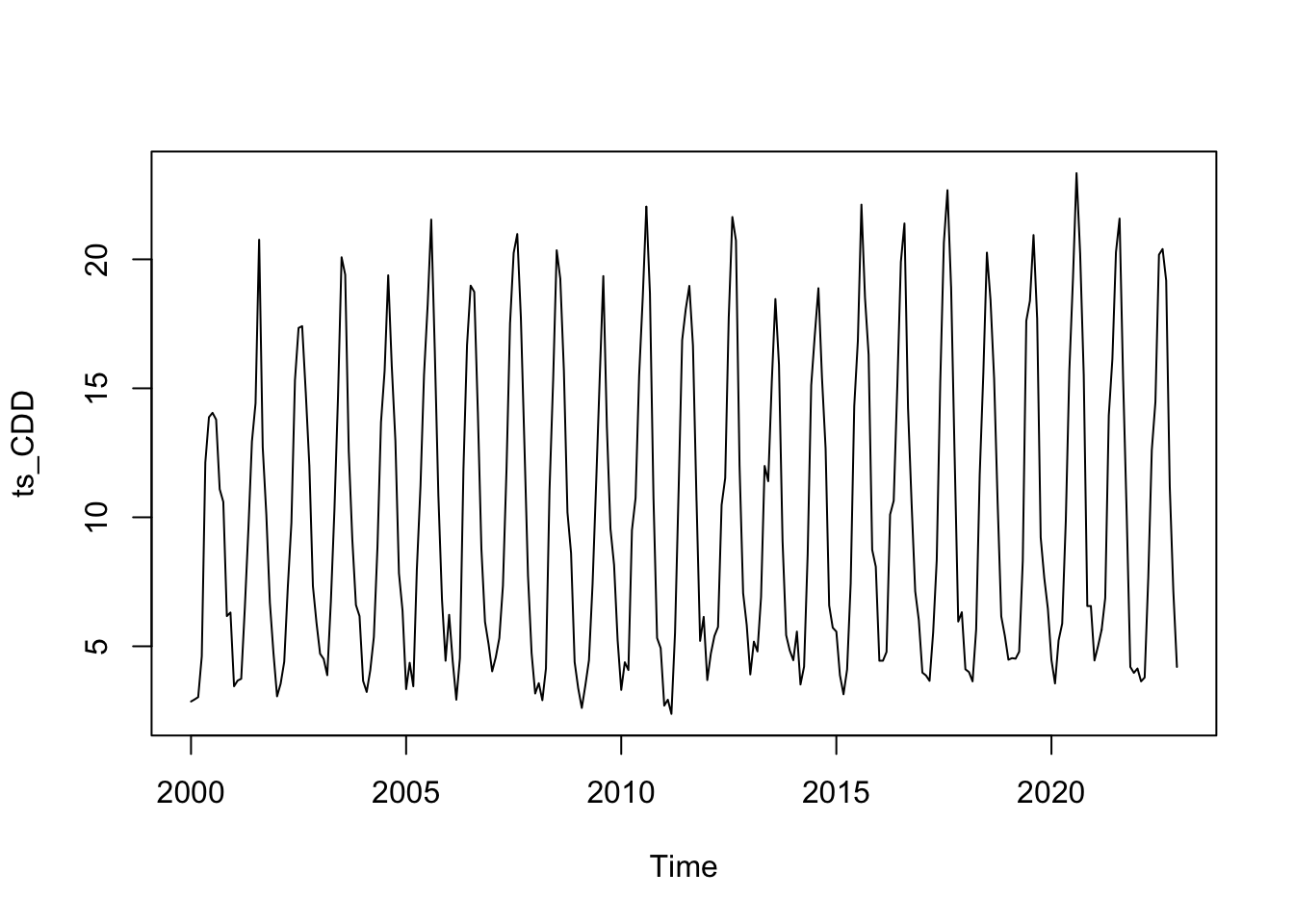

Sur le plan climatique, les données indiquent des périodes de sécheresse plus longues et des fluctuations de température tendant vers des valeurs maximales. En ce qui concerne les variables économiques, le prix du pétrole a subi de fortes fluctuations au cours des deux dernières décennies, principalement en raison du contexte géopolitique mondial. Le taux de change a connu une dévaluation notable depuis 2019, en réponse à la crise du COVID-19, ce qui a contribué à une augmentation exponentielle des exportations, accentuant une tendance déjà forte depuis 2010. Un prétraitement de nos données a été nécessaire en raison de la présence de valeurs atypiques.

Méthodologie

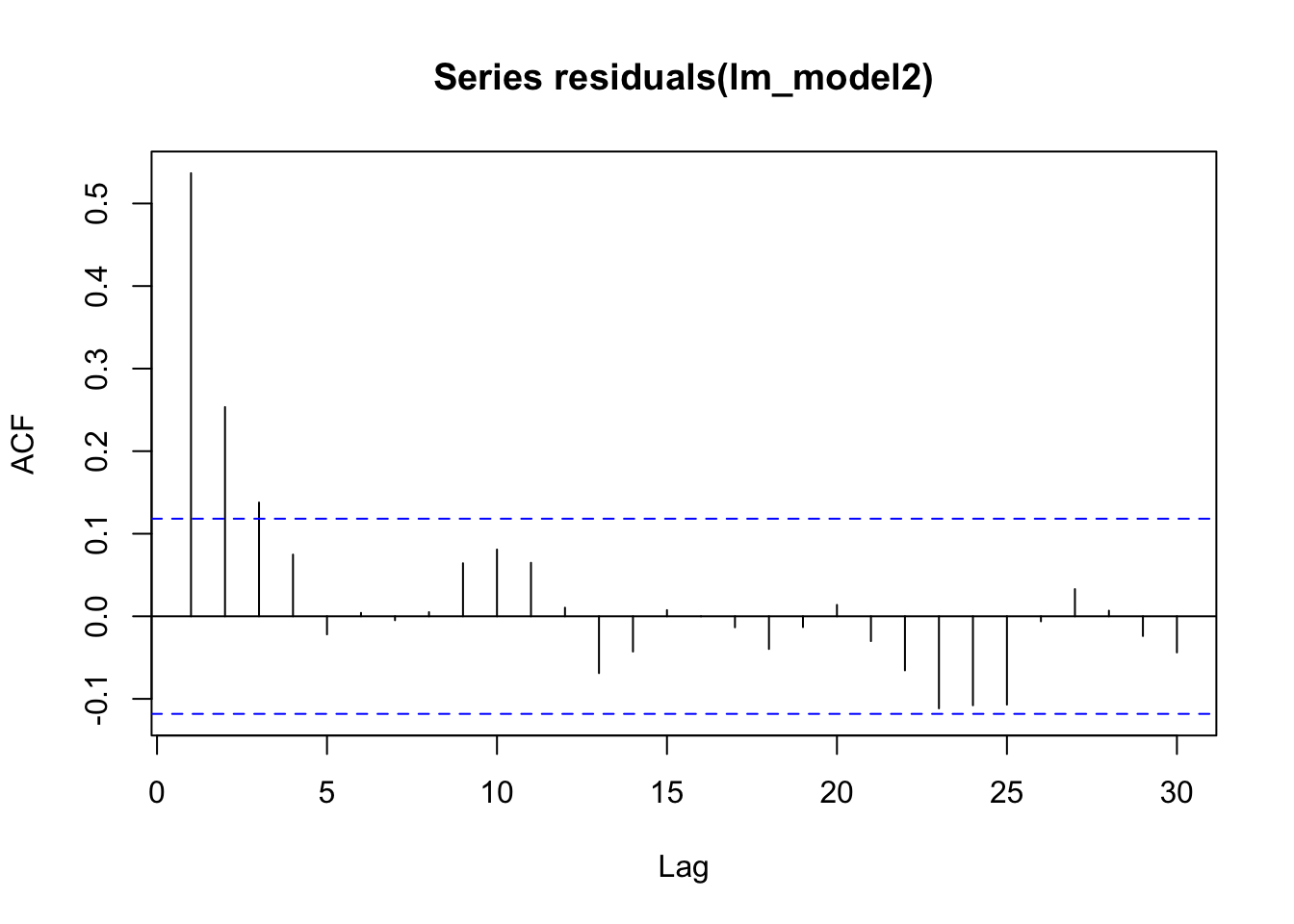

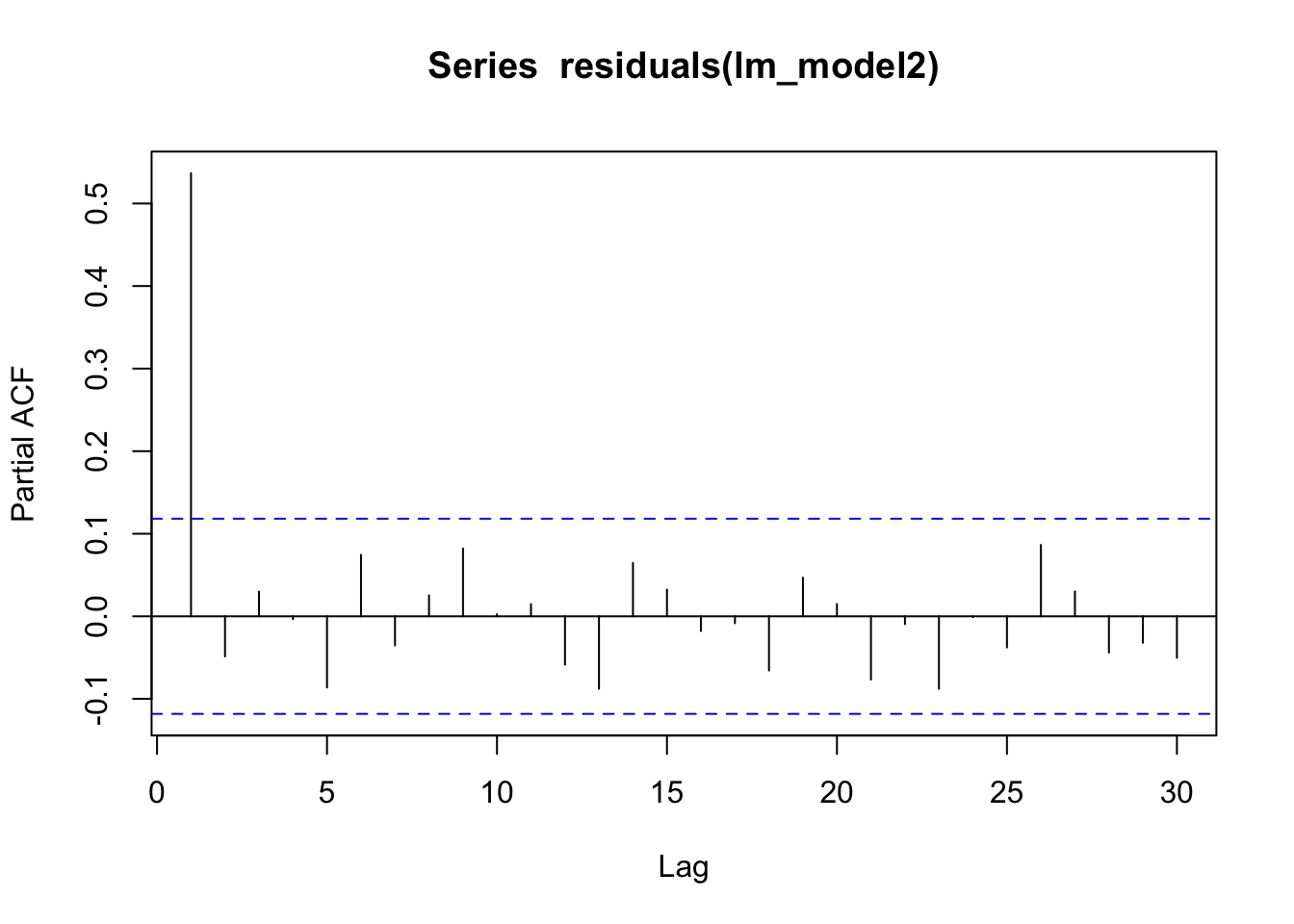

Pour analyser les variations de l’IPA, nous avons utilisé deux méthodes : MCO et ARMAX. Afin d’éviter les régressions fallacieuses et assurer la validité de nos modèles, nous avons vérifié la stationnarité avec les tests ADF et KPSS.

Les séries temporelles présentant une saisonnalité ont été décomposées afin de corriger les variations saisonnières, permettant de mieux isoler les effets des variables explicatives. Nous avons aussi utilisé les tests de Breusch-Godfrey et Breusch-Pagan pour détecter l’autocorrélation et l’hétéroscédasticité, le test de Kolmogorov-Smirnov pour la normalité des résidus, et le test RESET pour la spécification du modèle, confirmant l’adéquation des modèles et la fiabilité des estimations des coefficients.

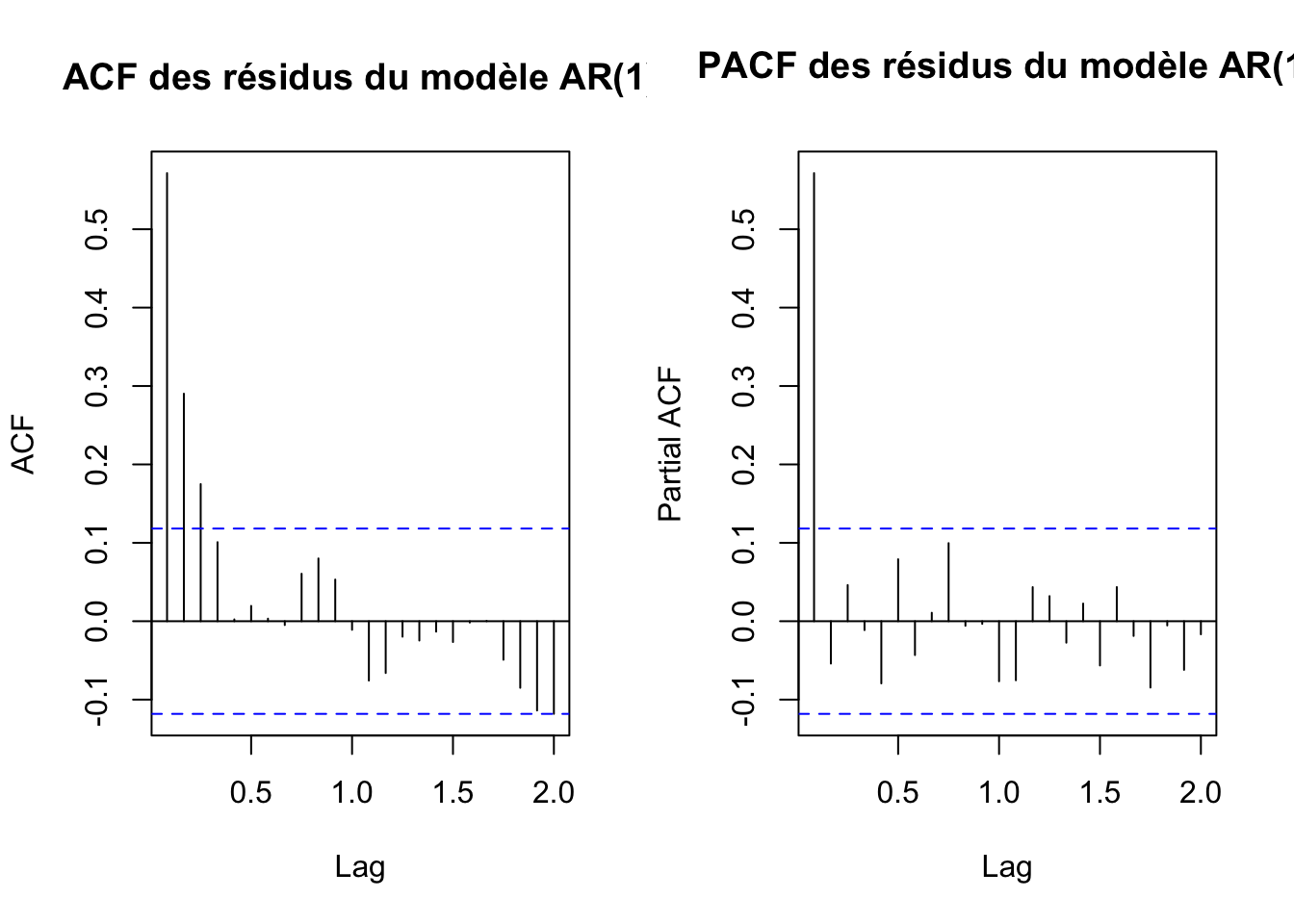

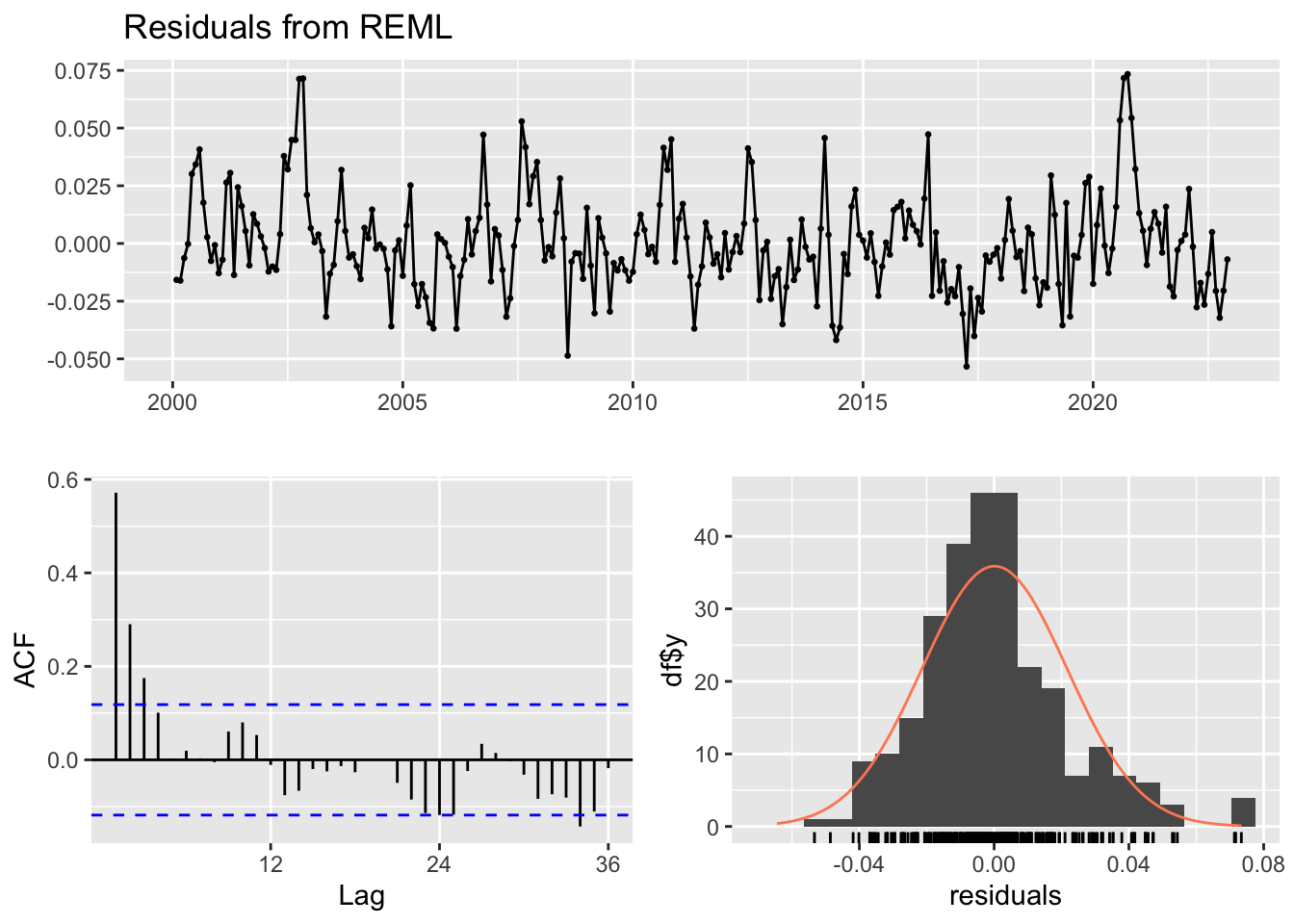

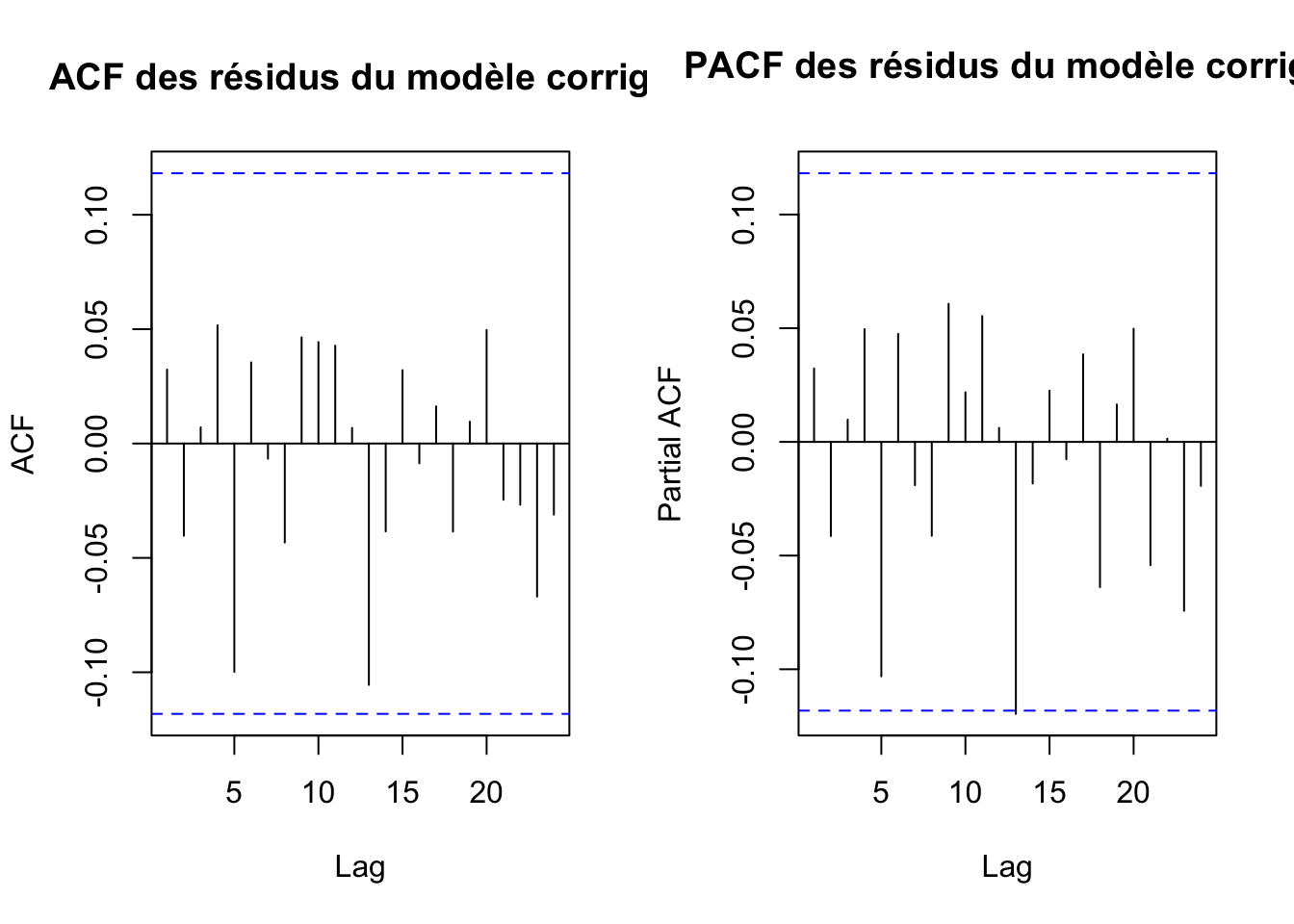

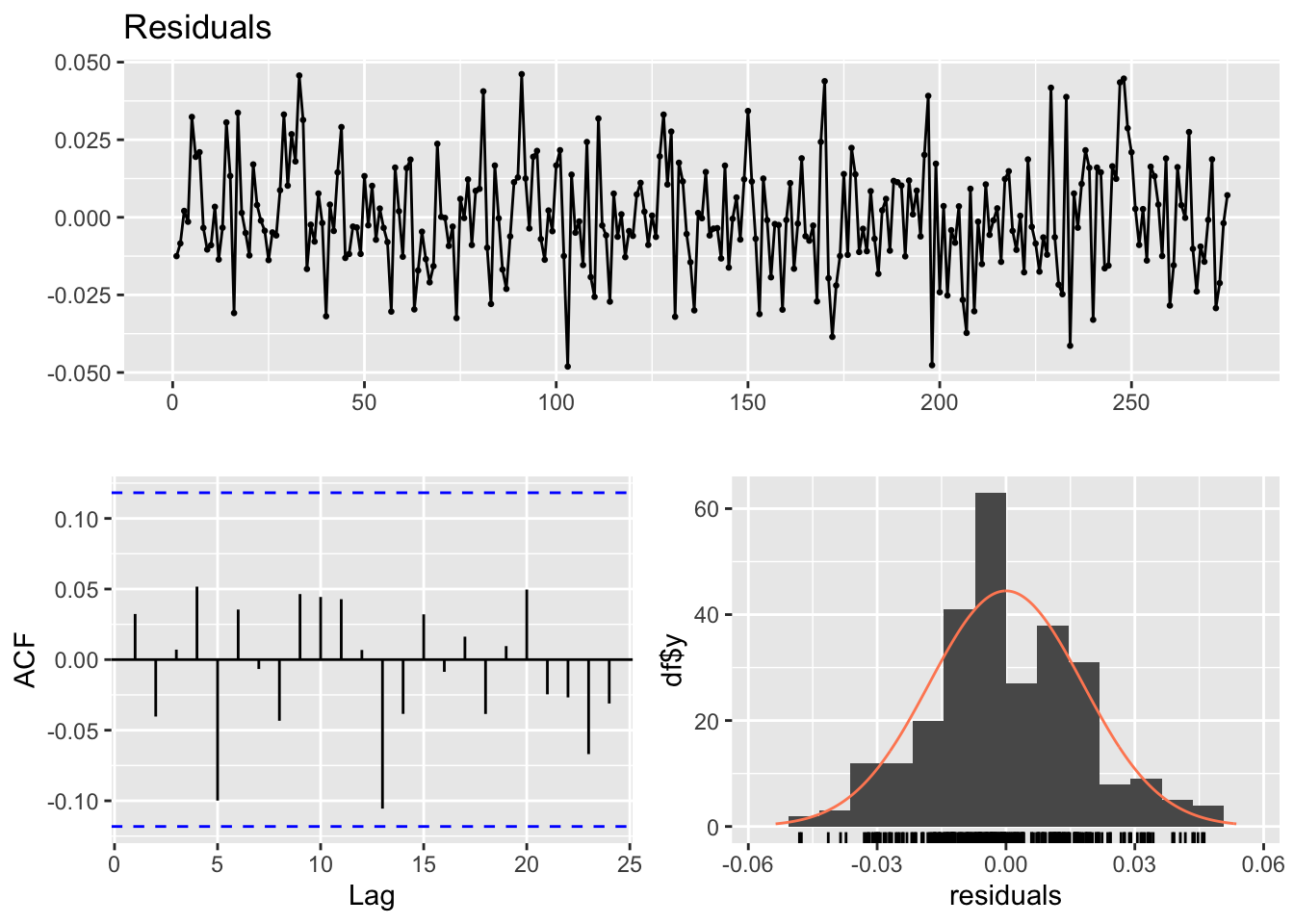

Nous avons exploré plusieurs modèles en utilisant l’approche MCO. Les problèmes d’hétéroscédasticité et de spécificité ont été corrigés en adoptant une forme semi-logarithmique. Cependant, malgré diverses tentatives, telles que l’introduction d’une variable temporelle, la correction de la tendance déterministe, et l’ajustement des résidus avec un modèle AR(1), les modèles ont continué de présenter une capacité explicative limitée et des problèmes de conformité aux hypothèses. Nous avons alors opté pour des modèles ARMAX, lesquels intègrent les effets des variables exogènes ainsi que la dynamique interne des séries temporelles.

Le modèle révèle que les valeurs futures de notre série temporelle sont significativement influencées par les valeurs immédiatement antérieures, avec un niveau de significativité de 1%. Par ailleurs, le prix du pétrole est statistiquement significatif au seuil de risque de 5%. Avec un coefficient positif, lorsque les prix du pétrole augmentent, l’indice IPA augmente également. Il en est de même pour le taux de change, cela signifie que lorsque le real brésilien se déprécie, les prix à la production agricole tendent à augmenter.

Concernant les autres variables du modèle, elles ne montrent pas d’impact significatif . Quant à notre variable climatique, la précipitation, elle s’est révélée non significative, indiquant que , dans le cadre de cette étude, les variations des précipitations n’ont pas un impact notable sur l’indice des prix à la production agricole de manière statistiquement mesurable.

Conclusion et discussion

Cette étude nous a montré la complexité du système agricole brésilien et, bien que nos résultats n’aient pas été ceux attendus, cela peut s’expliquer par la manière dont l’agriculture s’adapte aux changements climatiques. Alors que certaines régions voient leur production agricole diminuer en raison de conditions défavorables, d’autres connaissent une augmentation ou délocalisent leur production. Lorsque ces variations régionales sont agrégées au niveau national, les impacts locaux peuvent être masqués, minimisant ainsi les effets perceptibles sur les prix nationaux.

Par ailleurs, les progrès technologiques en agriculture, bien qu’ils puissent améliorer les rendements et la gestion des cultures, introduisent une complexité supplémentaire dans l’évaluation des impacts directs du climat. Les innovations, comme les variétés résistantes à la sécheresse et l’optimisation des intrants, ont renforcé la résilience des cultures face aux aléas climatiques, permettant de maintenir des niveaux de production élevés même dans des conditions difficiles. Cependant, cette intensification pose des défis environnementaux significatifs, tels que l’épuisement des sols et une dépendance accrue aux produits chimiques, qui compliquent l’attribution précise des impacts du changement climatique dans les analyses économiques agricoles.

Il est donc important de mettre en œuvre les avancées technologiques de manière réfléchie pour éviter des conséquences indésirables et de revoir les politiques agricoles pour assurer la durabilité et la sécurité alimentaire dans un climat changeant, en adaptant les pratiques agricoles aux nouvelles réalités climatiques et économiques.

Vous avez la possibilité de télécharger le document ici :) 📥 Télécharger le fichier PDF

Présentation du code

Je vous présente ci-dessous, le code utilisé pour mener à bien ce projet, avec les étapes et explications correspondantes.

Librairies

Analyse exploratoire

Chargement de données

Les données de la variable du prix du pétrole ont une fréquence journalière, nous calculons donc la moyenne pour avoir un prix moyen mensuel

petrole <- read_excel(here("data", "donnees_br.xlsx"), sheet = 'prix_petrole')

petrole$date <- as.Date(petrole$date)

# Colonnes pour l'année et le mois

petrole <- petrole %>%

mutate(

year = year(date),

month = month(date)

)

prix_petrole <- petrole %>%

group_by(year, month) %>%

summarise(

prix_moyen = mean(prix, na.rm = TRUE),

.groups = 'drop' # regroupement après le summarise

)

rm(petrole) # supprime pétrole en joursRécupération de l’ensemble de nos variables et remplacement de la variable prix du pétrole en jours, par le prix moyen mensuel

# ensemble de variables

data <- read_excel(here("data", "donnees_br.xlsx"))

data$petrole <- prix_petrole$prix_moyen Valeurs manquantes et format des données

sum(is.na(data)) # vérification des valeurs manquants[1] 48data <- drop_na(data)

dim(data)[1] 276 10str(data) # vérification formattibble [276 × 10] (S3: tbl_df/tbl/data.frame)

$ date : chr [1:276] "2000.01" "2000.02" "2000.03" "2000.04" ...

$ IPA : num [1:276] 199 196 193 192 193 ...

$ CDD : num [1:276] 2.86 2.94 3.03 4.61 12.14 ...

$ precipitation: num [1:276] 255 241 247 206 124 ...

$ temperature : num [1:276] 0.558 0.226 0.159 0.607 0.548 ...

$ exportations : num [1:276] 7.5 8.4 11.7 20.2 23.2 22.7 22.1 27.4 16.5 16 ...

$ importations : num [1:276] 81.8 113 117.5 116.5 128.4 ...

$ SMIC : num [1:276] 136 136 136 151 151 151 151 151 151 151 ...

$ taux_change : num [1:276] 1.8 1.78 1.74 1.77 1.83 ...

$ petrole : num [1:276] 25.5 27.8 27.5 22.8 27.7 ...# On transforme la variable smic en numérique

data$SMIC <- as.numeric(data$SMIC)

# Conversion la colonne de date en type yearmon

data$date <- as.yearmon(data$date, "%Y.%m")Les données climatiques sont complètes jusqu’au mois de décembre 2022, on conserve donc l’ensemble des données du mois de janvier 2000 à décembre 2022. Au total nous avons 276 observations pour 13 variables.

Statistiques descriptives

summary(data) date IPA CDD precipitation

Min. :2000 Min. : 191.6 Min. : 2.380 Min. : 33.16

1st Qu.:2006 1st Qu.: 401.5 1st Qu.: 4.728 1st Qu.: 72.14

Median :2011 Median : 649.3 Median : 8.440 Median :148.39

Mean :2011 Mean : 748.4 Mean :10.107 Mean :147.15

3rd Qu.:2017 3rd Qu.: 944.3 3rd Qu.:15.315 3rd Qu.:212.66

Max. :2023 Max. :2133.2 Max. :23.340 Max. :288.10

temperature exportations importations SMIC

Min. :-0.0920 Min. : 7.50 Min. : 50.80 Min. : 136.0

1st Qu.: 0.7768 1st Qu.: 31.70 1st Qu.: 81.00 1st Qu.: 300.0

Median : 1.0695 Median : 48.40 Median : 92.60 Median : 545.0

Mean : 1.0869 Mean : 59.26 Mean : 93.65 Mean : 602.5

3rd Qu.: 1.3250 3rd Qu.: 82.65 3rd Qu.:107.47 3rd Qu.: 937.0

Max. : 2.4310 Max. :194.10 Max. :149.80 Max. :1212.0

taux_change petrole

Min. :1.564 Min. : 18.47

1st Qu.:2.002 1st Qu.: 42.53

Median :2.473 Median : 62.81

Mean :2.901 Mean : 65.40

3rd Qu.:3.521 3rd Qu.: 85.50

Max. :5.651 Max. :134.03 Boxplot

data|>

pivot_longer(

cols = where(is.numeric)

) |>

ggplot() +

aes(y = value) +

facet_wrap(~ name, scales = "free_y") +

geom_boxplot() +

theme_light()

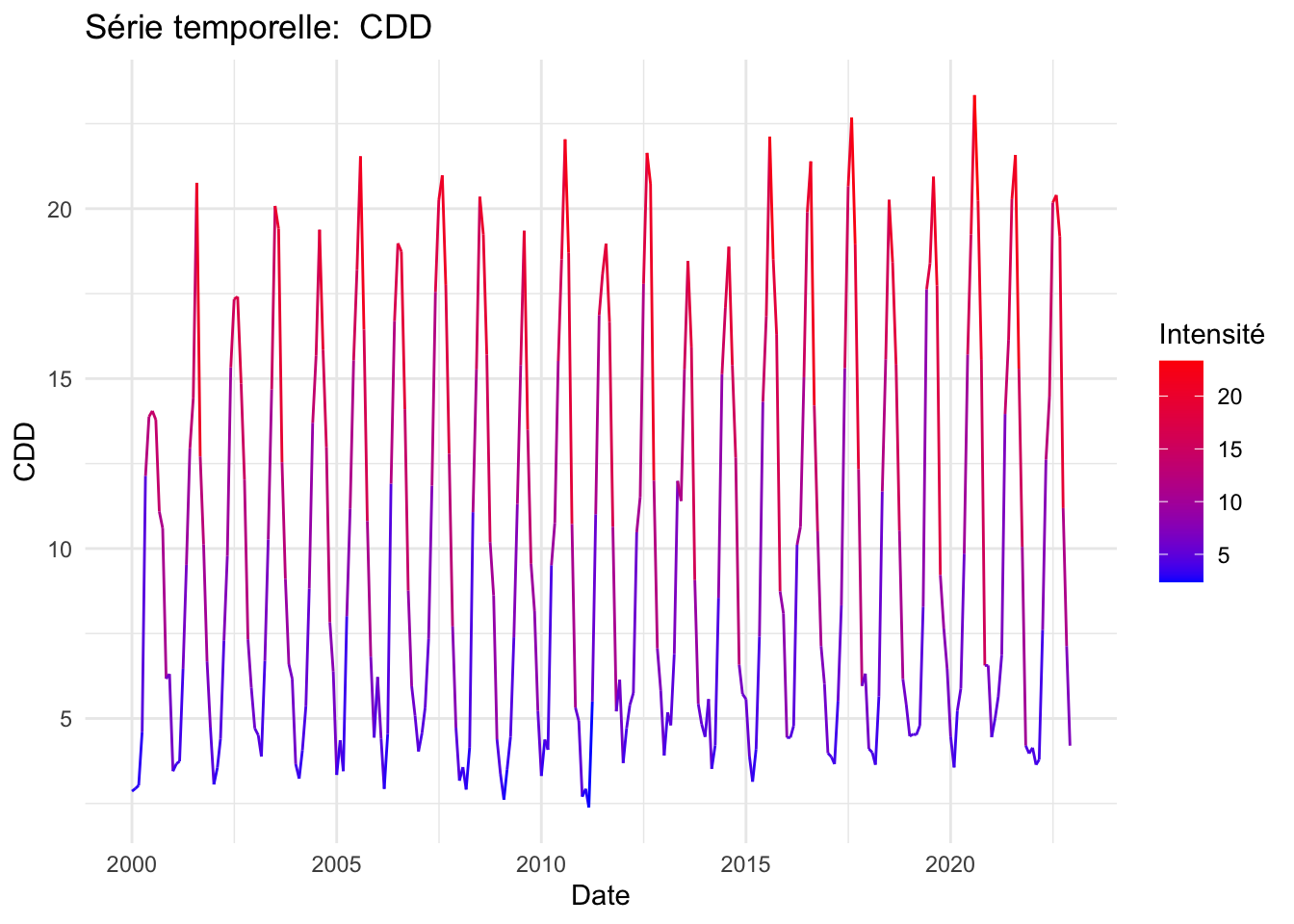

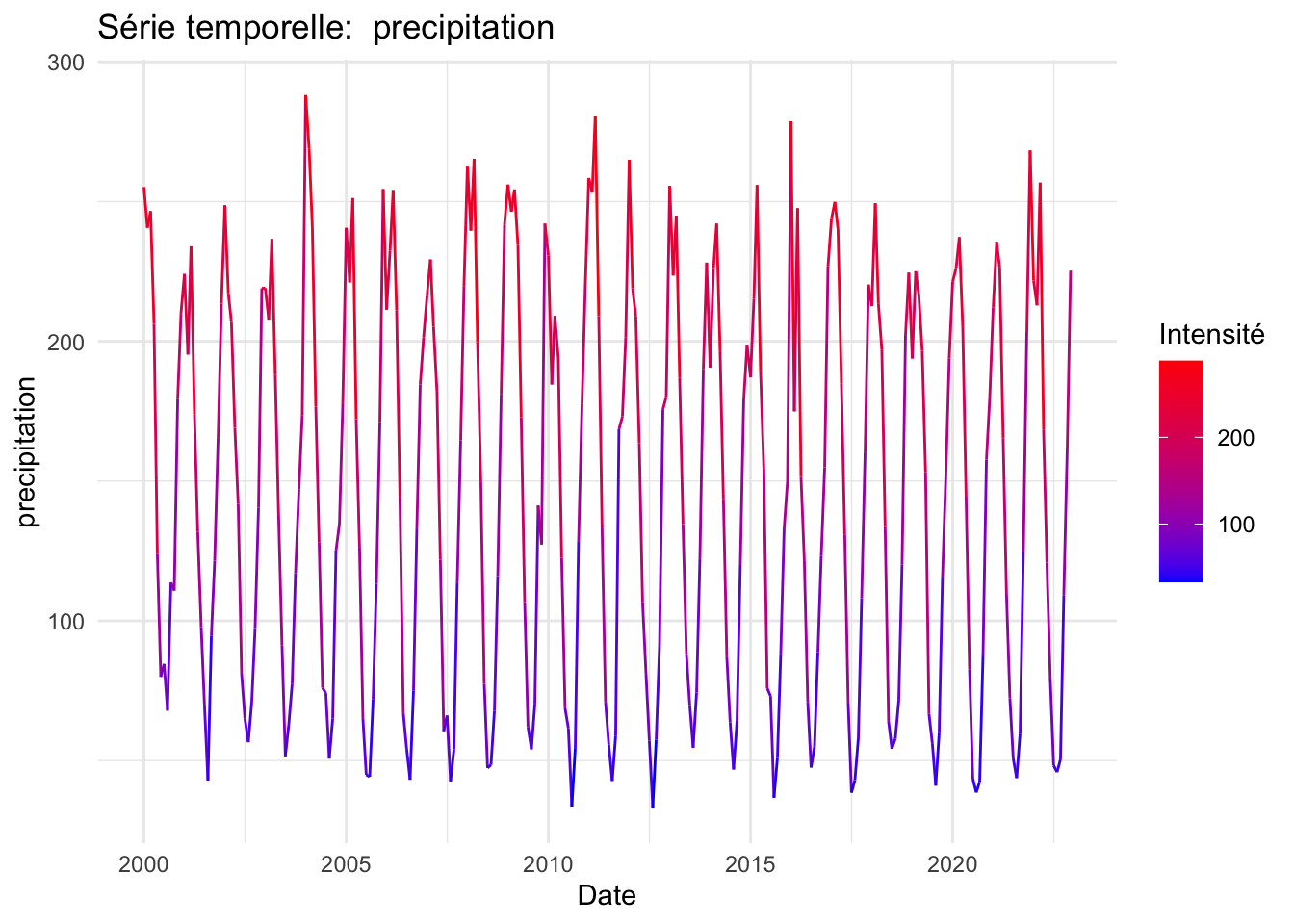

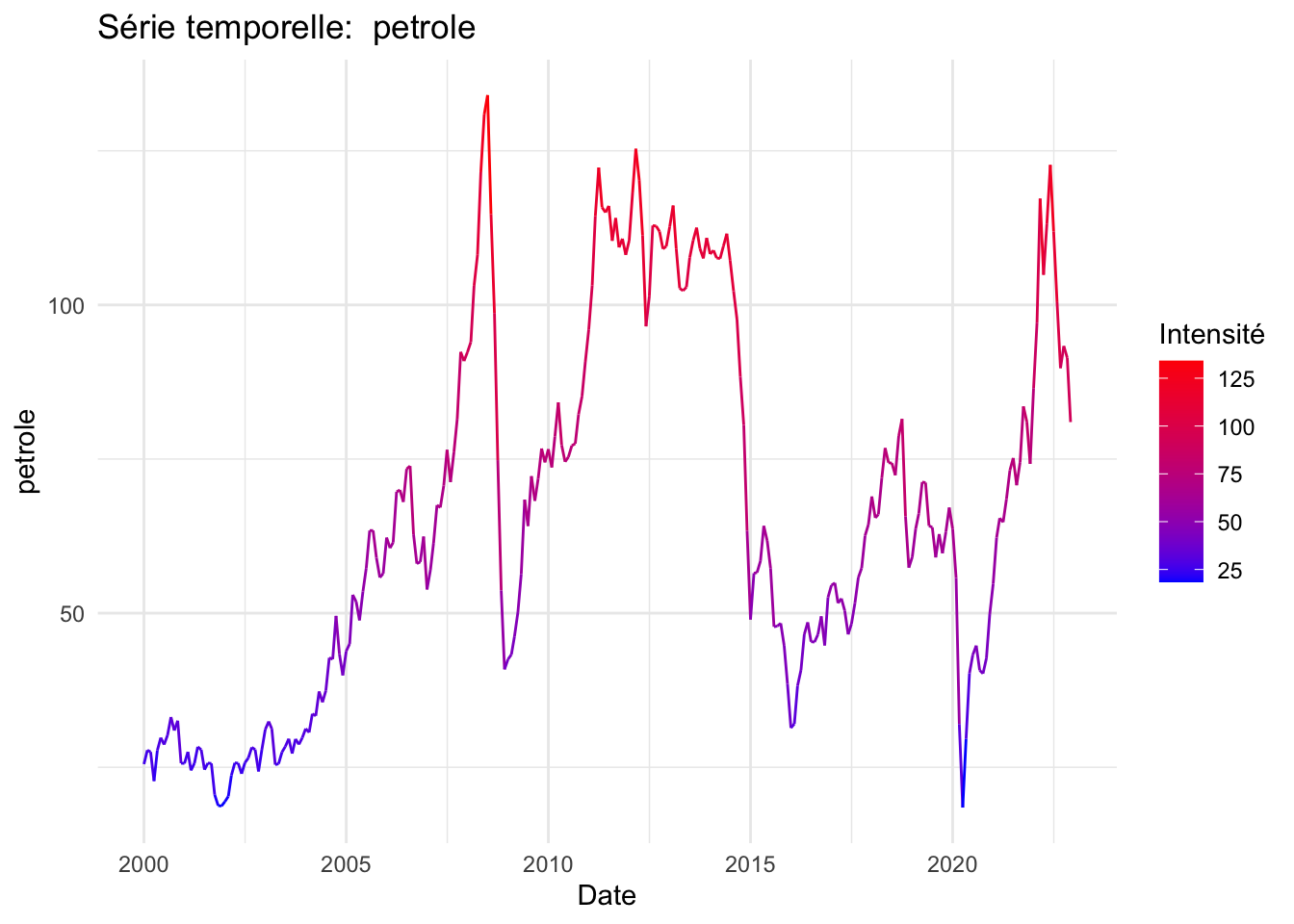

Graphiques des séries

data$date <- as.Date(as.yearmon(data$date))

# Boucle sur chaque colonne sauf la date pour créer des graphiques

for (column_name in names(data)[-1]) {

p <- ggplot(data, aes(x = date, y = .data[[column_name]], colour = .data[[column_name]])) +

geom_line() +

scale_color_gradient(low = "blue", high = "red") +

labs(title = paste("Série temporelle: ", column_name),

x = "Date",

y = column_name,

colour = "Intensité") +

theme_minimal()

print(p)

}

print(p)

Convertir en time series

# Boucle pour convertir chaque colonne en ts et les stocker comme variables séparées

for(column_name in names(data)[-1]) { # Exclure la colonne de date

# Créer une série temporelle pour la colonne actuelle

ts_data <- ts(data[[column_name]], start = c(2000, 1), frequency = 12)

# variable dans l'environnement global avec un nom dynamique

assign(paste0("ts_", column_name), ts_data)

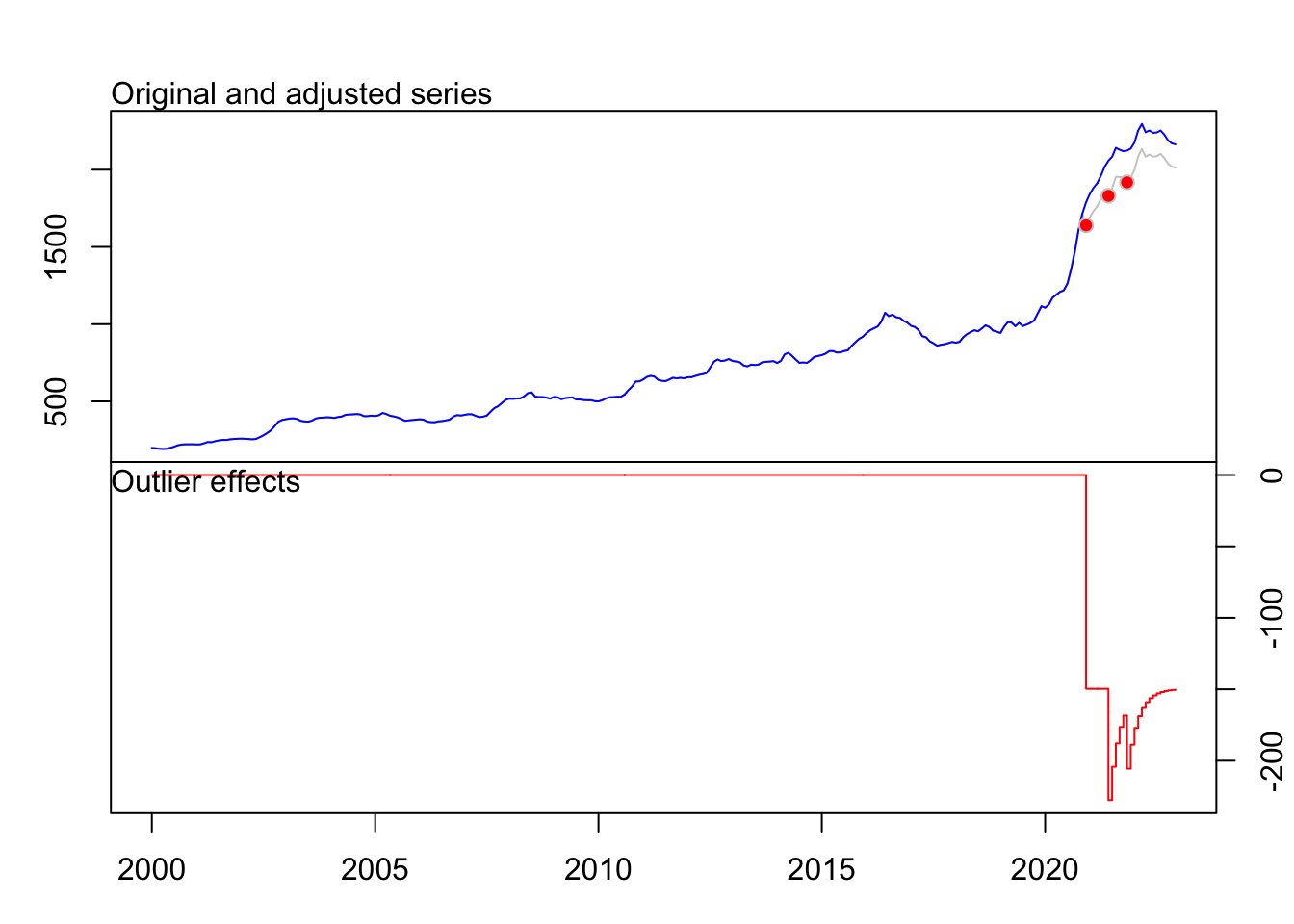

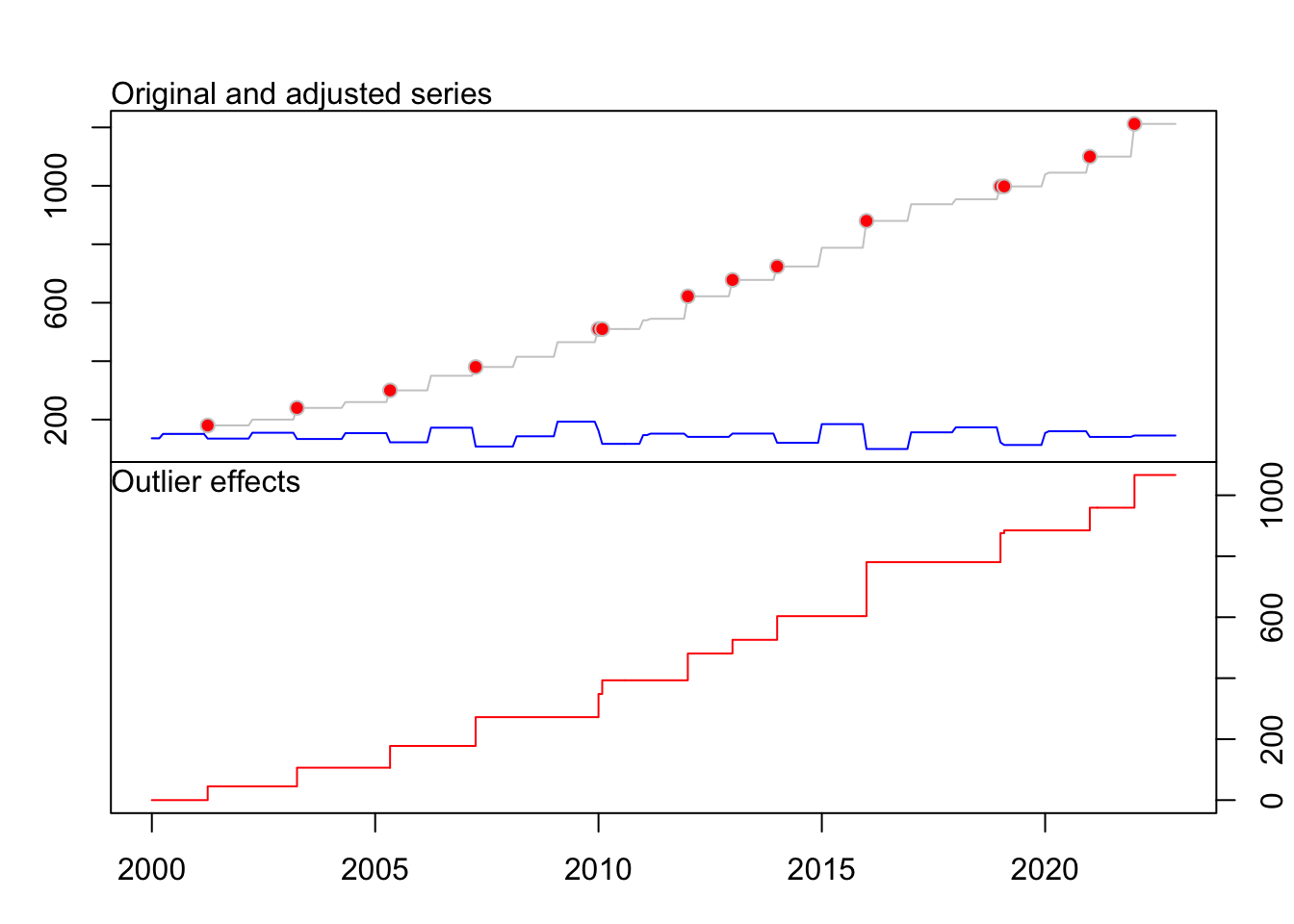

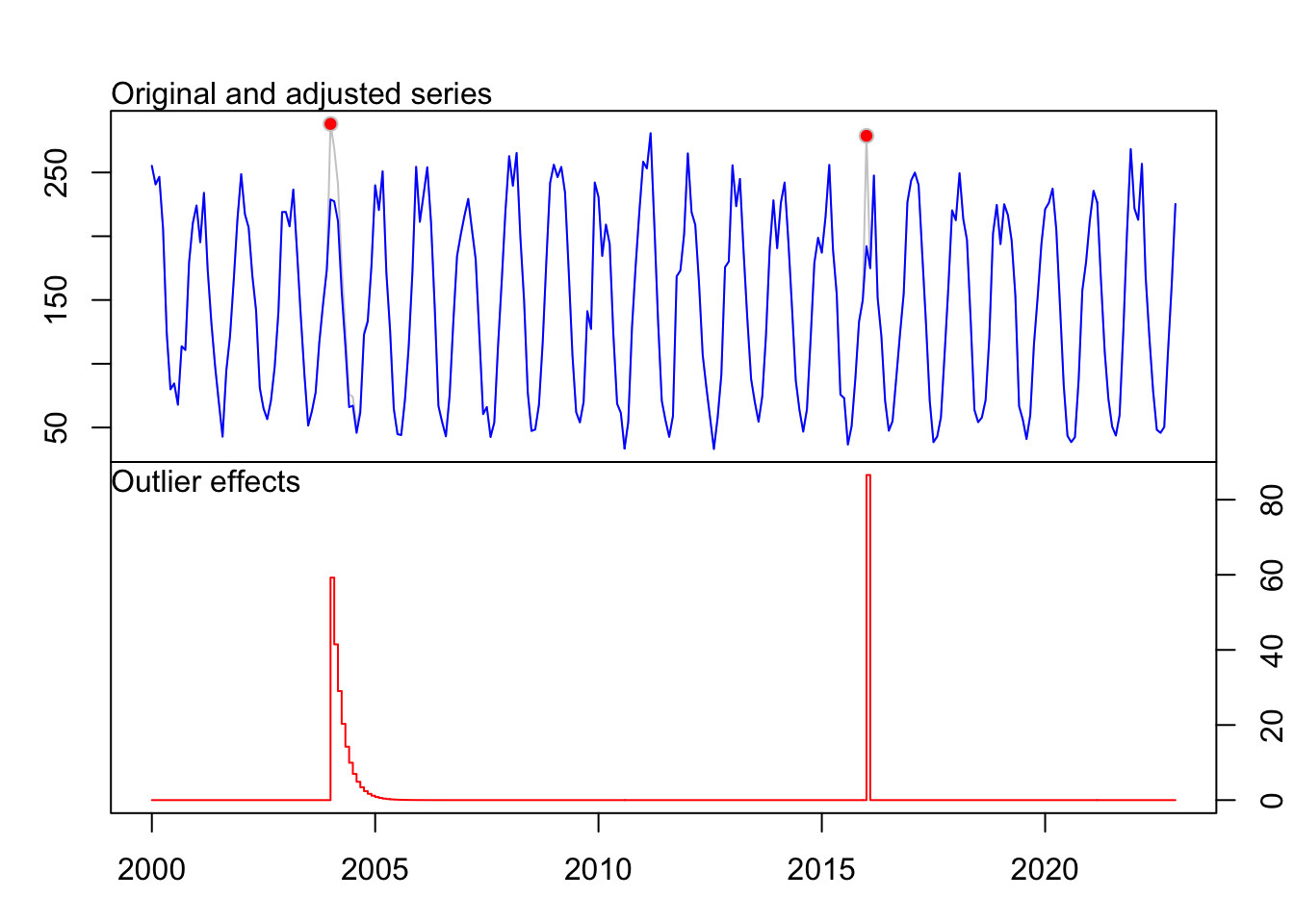

}Points atypiques ou Outliers

(attention cela peut prendre quelques minutes, possibilité de charger le fichier après correction data.adj (pour données ajustées))

#|warning: false

#|message: false

# on utilise tso() pour chercher les outliers

fit_CDD <- tso(ts_CDD)

fit_IPA <- tso(ts_IPA)Warning in locate.outliers.iloop(resid = resid, pars = pars, cval = cval, :

stopped when 'maxit.iloop' was reachedWarning in locate.outliers.oloop(y = y, fit = fit, types = types, cval = cval,

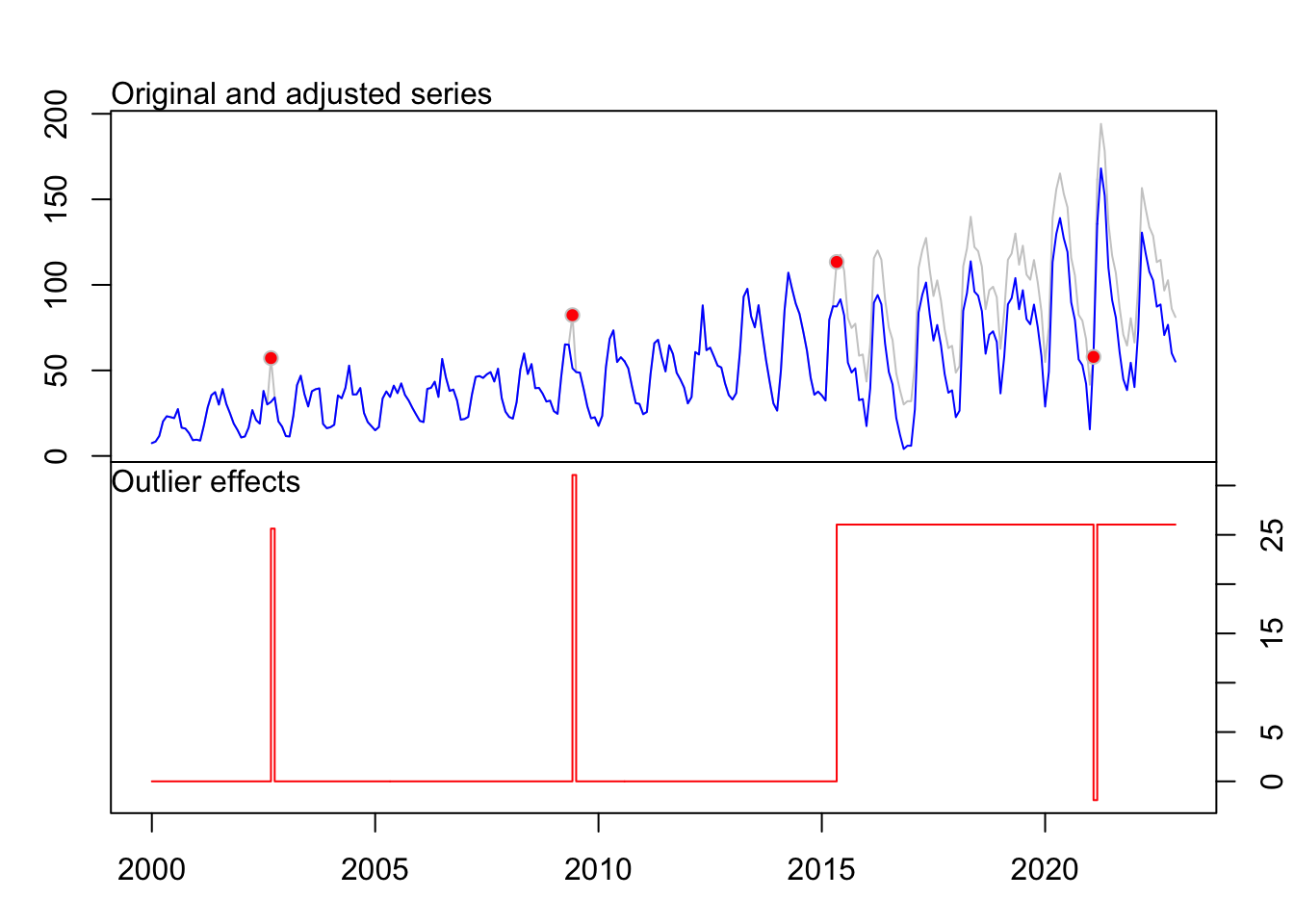

: stopped when 'maxit.oloop = 4' was reachedfit_importations <- tso(ts_importations)

fit_exportations <- tso(ts_exportations)Warning in locate.outliers.iloop(resid = resid, pars = pars, cval = cval, :

stopped when 'maxit.iloop' was reachedfit_petrole <- tso(ts_petrole)

fit_taux_change <- tso(ts_taux_change)

fit_SMIC <- tso(ts_SMIC)Warning in locate.outliers.iloop(resid = resid, pars = pars, cval = cval, :

stopped when 'maxit.iloop' was reached

Warning in locate.outliers.iloop(resid = resid, pars = pars, cval = cval, :

stopped when 'maxit.oloop = 4' was reachedfit_precipitation <- tso(ts_precipitation)

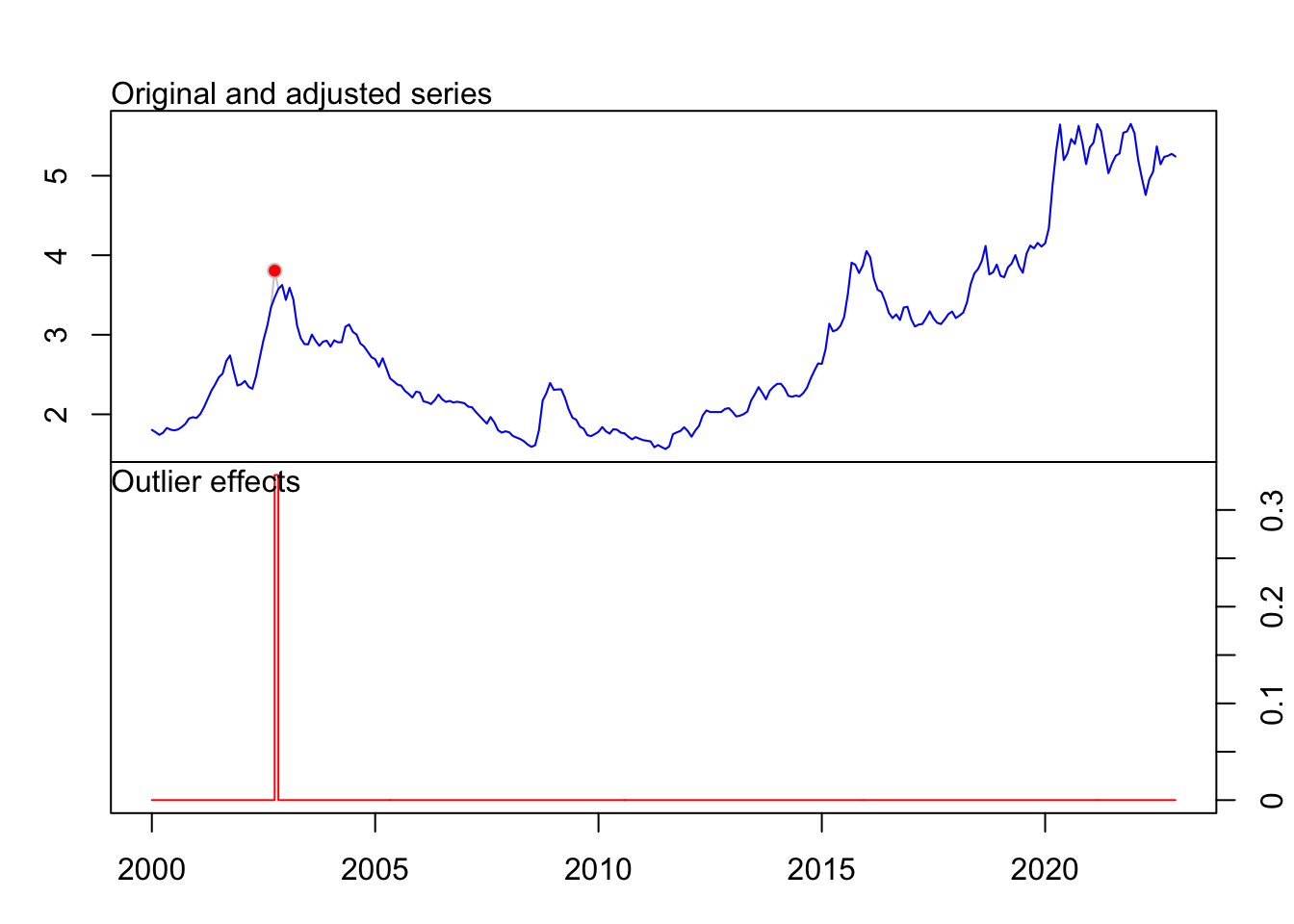

fit_temperature <- tso(ts_temperature)

# pour regarder les points atypiques de chaque serie

fit_CDD # sans outliers Series:

ARIMA(0,0,2)(2,1,2)[12]

Coefficients:

ma1 ma2 sar1 sar2 sma1 sma2

0.4183 0.2297 -0.8083 -0.0933 -0.0277 -0.6980

s.e. 0.0635 0.0596 0.1733 0.0830 0.1735 0.1586

sigma^2 = 2.206: log likelihood = -484.75

AIC=983.5 AICc=983.94 BIC=1008.53

No outliers were detected.fit_IPA Series: ts_IPA

Regression with ARIMA(1,1,0) errors

Coefficients:

ar1 LS252 TC258 TC263

0.6912 -149.6890 -77.9185 -42.7527

s.e. 0.0435 13.6418 11.6972 11.6982

sigma^2 = 275.1: log likelihood = -1160.87

AIC=2331.73 AICc=2331.96 BIC=2349.82

Outliers:

type ind time coefhat tstat

1 LS 252 2020:12 -149.69 -10.973

2 TC 258 2021:06 -77.92 -6.661

3 TC 263 2021:11 -42.75 -3.655fit_importations Series: ts_importations

Regression with ARIMA(1,1,2)(1,0,0)[12] errors

Coefficients:

ar1 ma1 ma2 sar1 LS47 AO98 LS195 LS206

0.0432 -0.7165 -0.1532 0.2900 -29.4529 47.8804 40.0092 -30.3560

s.e. 0.3300 0.3263 0.2703 0.0597 7.4462 12.0018 7.3329 7.3662

sigma^2 = 175.7: log likelihood = -1097.94

AIC=2213.88 AICc=2214.56 BIC=2246.43

Outliers:

type ind time coefhat tstat

1 LS 47 2003:11 -29.45 -3.955

2 AO 98 2008:02 47.88 3.989

3 LS 195 2016:03 40.01 5.456

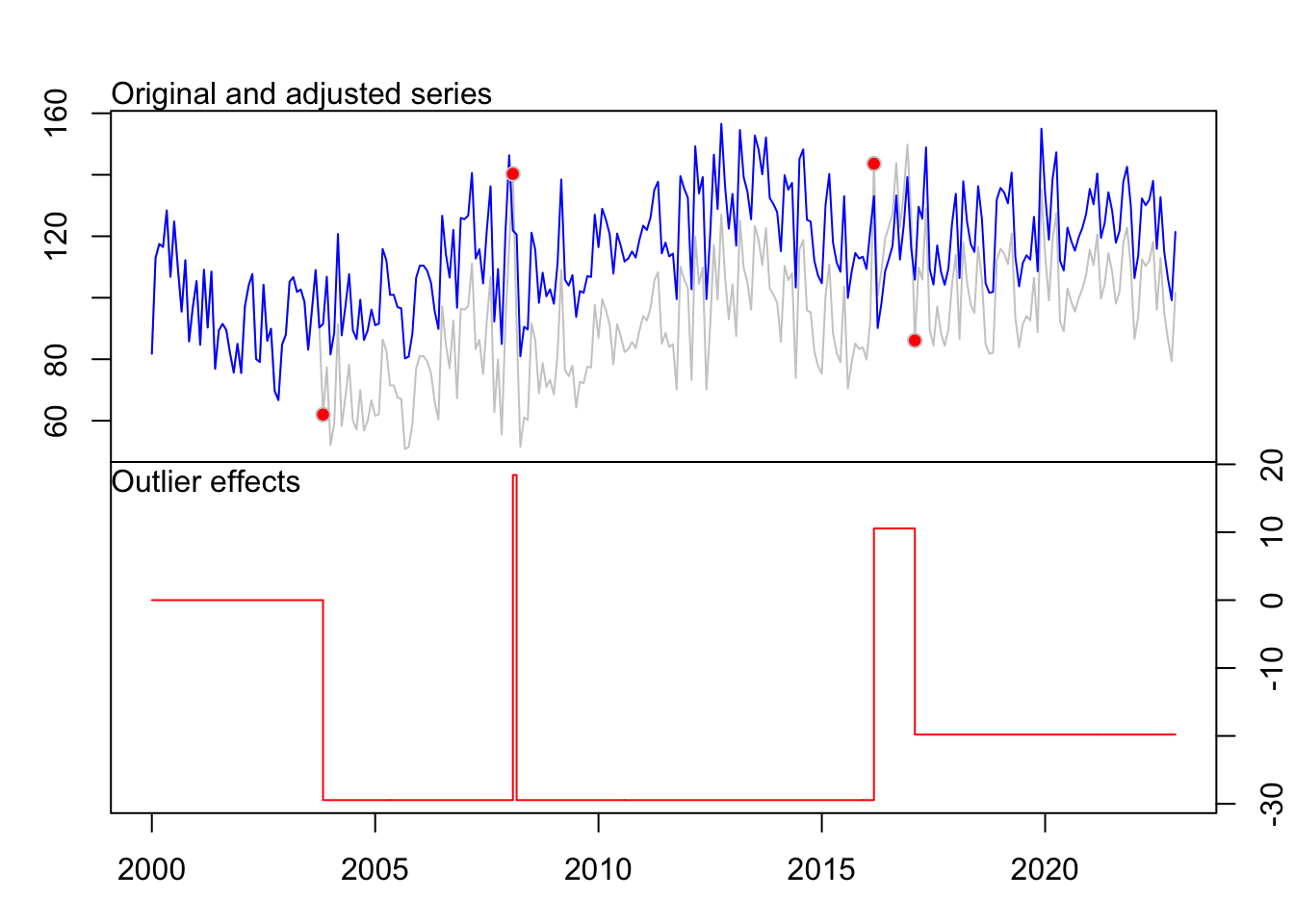

4 LS 206 2017:02 -30.36 -4.121fit_exportations Series: ts_exportations

Regression with ARIMA(1,0,0)(0,1,1)[12] errors

Coefficients:

ar1 sma1 AO33 AO114 LS185 AO254

0.7625 -0.6238 25.6306 31.0681 26.0407 -27.9435

s.e. 0.0426 0.0510 6.9851 6.8995 6.8729 7.1521

sigma^2 = 94.47: log likelihood = -975.31

AIC=1964.61 AICc=1965.05 BIC=1989.65

Outliers:

type ind time coefhat tstat

1 AO 33 2002:09 25.63 3.669

2 AO 114 2009:06 31.07 4.503

3 LS 185 2015:05 26.04 3.789

4 AO 254 2021:02 -27.94 -3.907fit_petrole # sans outliersSeries:

ARIMA(1,1,0)

Coefficients:

ar1

0.3497

s.e. 0.0567

sigma^2 = 32.51: log likelihood = -868.48

AIC=1740.95 AICc=1741 BIC=1748.19

No outliers were detected.fit_taux_change Series: ts_taux_change

Regression with ARIMA(0,1,1) errors

Coefficients:

ma1 AO34

0.3165 0.3361

s.e. 0.0573 0.0697

sigma^2 = 0.0143: log likelihood = 194.75

AIC=-383.5 AICc=-383.41 BIC=-372.65

Outliers:

type ind time coefhat tstat

1 AO 34 2002:10 0.3361 4.824fit_SMIC Series: ts_SMIC

Regression with ARIMA(0,0,5)(0,0,2)[12] errors

Coefficients:

ma1 ma2 ma3 ma4 ma5 sma1 sma2 intercept

0.8636 0.6544 0.5548 0.3908 0.1828 -0.9308 0.3063 144.4274

s.e. 0.0632 0.0802 0.0792 0.0747 0.0548 0.0625 0.0594 4.3551

LS16 LS40 LS65 LS88 AO121 LS122 LS145 LS157

44.9926 61.3801 71.3287 94.4402 76.0256 120.9066 88.0599 44.6969

s.e. 5.7660 4.2806 3.8698 3.8999 5.0530 4.4605 8.0303 10.7124

LS169 LS193 AO229 LS230 LS253 LS265

77.6692 177.1326 95.2608 104.2519 74.4118 107.2180

s.e. 7.9620 4.3219 5.1179 4.4431 8.0232 11.0379

sigma^2 = 69.78: log likelihood = -972.05

AIC=1990.11 AICc=1994.49 BIC=2073.38

Outliers:

type ind time coefhat tstat

1 LS 16 2001:04 44.99 7.803

2 LS 40 2003:04 61.38 14.339

3 LS 65 2005:05 71.33 18.432

4 LS 88 2007:04 94.44 24.216

5 AO 121 2010:01 76.03 15.046

6 LS 122 2010:02 120.91 27.106

7 LS 145 2012:01 88.06 10.966

8 LS 157 2013:01 44.70 4.172

9 LS 169 2014:01 77.67 9.755

10 LS 193 2016:01 177.13 40.985

11 AO 229 2019:01 95.26 18.613

12 LS 230 2019:02 104.25 23.464

13 LS 253 2021:01 74.41 9.275

14 LS 265 2022:01 107.22 9.714fit_precipitation Series: ts_precipitation

Regression with ARIMA(0,0,1)(2,1,0)[12] errors

Coefficients:

ma1 sar1 sar2 TC49 AO193

0.2476 -0.6126 -0.3736 59.2558 86.5774

s.e. 0.0571 0.0580 0.0589 14.5850 18.3329

sigma^2 = 424.8: log likelihood = -1174.07

AIC=2360.14 AICc=2360.46 BIC=2381.59

Outliers:

type ind time coefhat tstat

1 TC 49 2004:01 59.26 4.063

2 AO 193 2016:01 86.58 4.723fit_temperature # sans outliersSeries:

ARIMA(0,1,2)

Coefficients:

ma1 ma2

-0.6600 -0.1641

s.e. 0.0588 0.0651

sigma^2 = 0.1426: log likelihood = -121.87

AIC=249.74 AICc=249.83 BIC=260.59

No outliers were detected.# Graphique

plot(fit_IPA)

plot(fit_SMIC)

plot(fit_precipitation)

plot(fit_taux_change)

plot(fit_exportations)

plot(fit_importations)

plot(fit_CDD )'x' does not contain outliers to displayNULL# recuperation des séries ajustés

adj_IPA <- fit_IPA$yadj

adj_CDD <- fit_CDD$yadj

adj_importations <- fit_importations$yadj

adj_exportations <- fit_exportations$yadj

adj_petrole <- fit_petrole$yadj

adj_taux_change <- fit_taux_change$yadj

adj_SMIC <- fit_SMIC$yadj

adj_precipitation <- fit_precipitation$yadj

adj_temperature <- fit_temperature$yadj Enregistrement données ajustés

# création d'un dataframe où les séries ajustés seront stockés pour êtres réutilises si nécessaire plus tard

data_adj <- data.frame(

Date = data$date,

IPA = adj_IPA,

CDD = adj_CDD,

importations = adj_importations,

exportations = adj_exportations,

petrole = adj_petrole,

taux_change = adj_taux_change,

SMIC = adj_SMIC,

precipitation = adj_precipitation,

temperature = adj_temperature

)

#write.csv(data_adj, "data_adj.csv", row.names = FALSE)Récupération base de données ajustées

#data_adj <- read.csv("/Users/Isabel/Desktop/memoire3/data_adj.csv")

data_adj$Date <- as.Date(data_adj$Date)

# variables

variables <- c("IPA", "CDD", "precipitation", "temperature", "exportations", "importations", "taux_change", "SMIC", "petrole")Skewness, kurtosis

skew_kurt_df <- data.frame(

Variable = variables,

# Calcul de skewness

Skewness = sapply(data_adj[variables], PerformanceAnalytics::skewness),

# Calcul de kurtosis

Kurtosis = sapply(data_adj[variables], PerformanceAnalytics::kurtosis)

)

skew_kurt_df Variable Skewness Kurtosis

IPA IPA 1.587451131 2.02938496

CDD CDD 0.515154009 -1.09215980

precipitation precipitation 0.003335255 -1.39981138

temperature temperature 0.354093594 0.24637826

exportations exportations 0.991190627 0.83599348

importations importations -0.035585053 -0.48953698

taux_change taux_change 0.982023281 -0.04678673

SMIC SMIC 0.038077541 -0.44421037

petrole petrole 0.340169157 -0.94096896Test de normalité

#vérification de la normalité des variables

lapply(data_adj[variables], shapiro.test)$IPA

Shapiro-Wilk normality test

data: X[[i]]

W = 0.81162, p-value < 2.2e-16

$CDD

Shapiro-Wilk normality test

data: X[[i]]

W = 0.90346, p-value = 2.662e-12

$precipitation

Shapiro-Wilk normality test

data: X[[i]]

W = 0.92737, p-value = 2.312e-10

$temperature

Shapiro-Wilk normality test

data: X[[i]]

W = 0.98853, p-value = 0.02765

$exportations

Shapiro-Wilk normality test

data: X[[i]]

W = 0.93141, p-value = 5.389e-10

$importations

Shapiro-Wilk normality test

data: X[[i]]

W = 0.99312, p-value = 0.2348

$taux_change

Shapiro-Wilk normality test

data: X[[i]]

W = 0.87498, p-value = 3.167e-14

$SMIC

Shapiro-Wilk normality test

data: X[[i]]

W = 0.97073, p-value = 2.005e-05

$petrole

Shapiro-Wilk normality test

data: X[[i]]

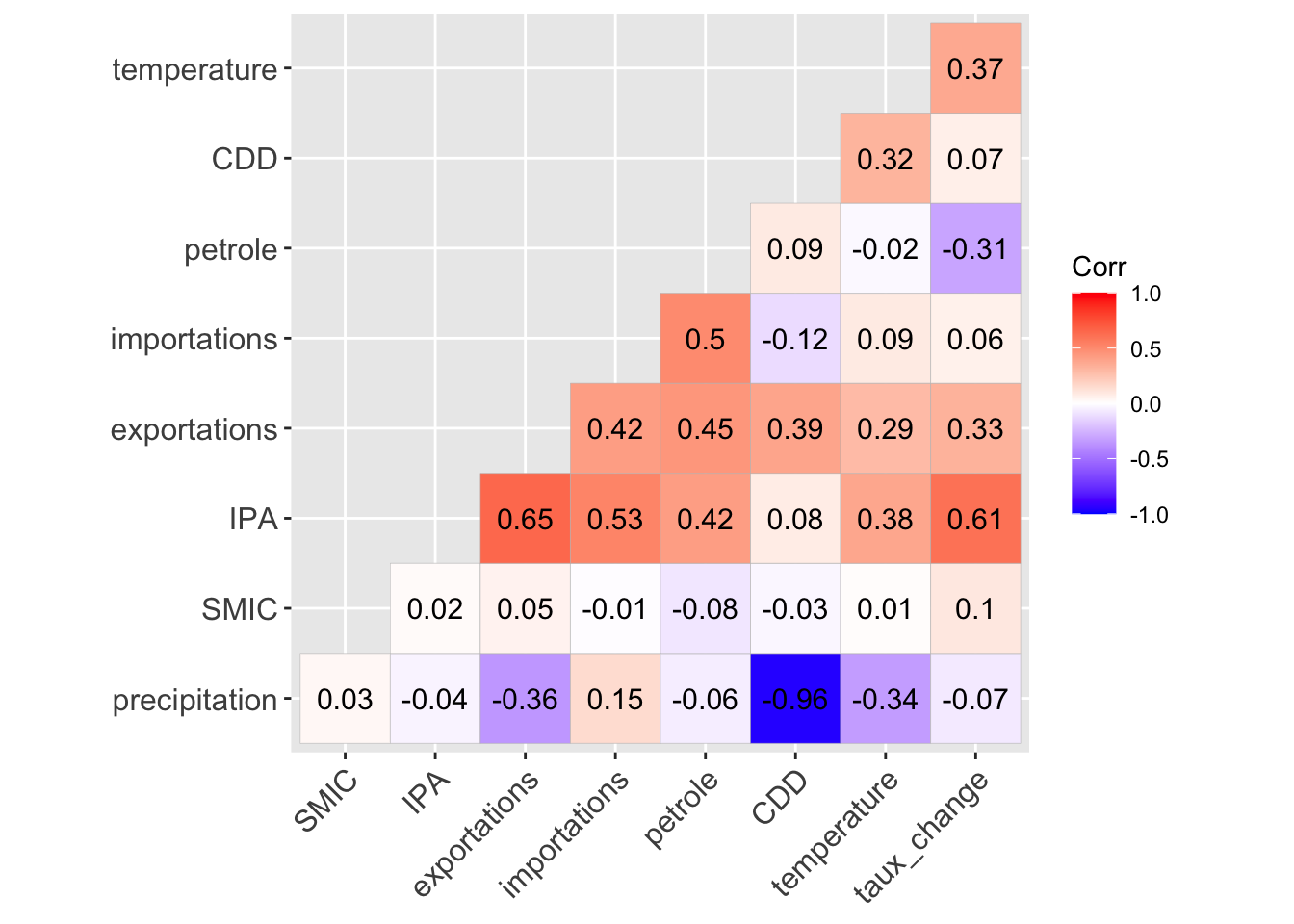

W = 0.94924, p-value = 3.449e-08Corrélation

#|warning: false

#|message: false

# Matrice de corrélation

cor_matrix <- cor(data_adj[, variables], use = "complete.obs", method = "spearman")

cor_matrix IPA CDD precipitation temperature exportations

IPA 1.00000000 0.07576372 -0.04386296 0.37647867 0.64924172

CDD 0.07576372 1.00000000 -0.96428022 0.32220175 0.39372744

precipitation -0.04386296 -0.96428022 1.00000000 -0.33938317 -0.35647340

temperature 0.37647867 0.32220175 -0.33938317 1.00000000 0.28936878

exportations 0.64924172 0.39372744 -0.35647340 0.28936878 1.00000000

importations 0.53493377 -0.11595776 0.14735573 0.09049610 0.42171195

taux_change 0.60748523 0.07445183 -0.06679673 0.36570691 0.32702233

SMIC 0.01955579 -0.02748573 0.02980255 0.00564068 0.04615657

petrole 0.42210699 0.08940170 -0.05840727 -0.02391271 0.44837226

importations taux_change SMIC petrole

IPA 0.534933773 0.60748523 0.019555787 0.42210699

CDD -0.115957758 0.07445183 -0.027485733 0.08940170

precipitation 0.147355729 -0.06679673 0.029802545 -0.05840727

temperature 0.090496098 0.36570691 0.005640680 -0.02391271

exportations 0.421711949 0.32702233 0.046156570 0.44837226

importations 1.000000000 0.06006558 -0.008959876 0.50385277

taux_change 0.060065584 1.00000000 0.098030177 -0.30572061

SMIC -0.008959876 0.09803018 1.000000000 -0.08122171

petrole 0.503852770 -0.30572061 -0.081221712 1.00000000# Visualiser la matrice de corrélation

ggcorrplot(cor_matrix,

hc.order = TRUE, type = "lower",

lab = TRUE,

ggtheme = ggplot2::theme_gray,

colors = c("blue", "white", "red"))

# spearman correlation test

#chart.Correlation(data_adj[variables], histogram=TRUE, pch=19,method = c("spearman"))Le calcul de la corrélation de Spearman est recommandé lorsque les variables ne suivent pas une loi normalece type de corrélation est dit robuste car il ne dépend pas de la distribution des données. (cours M.Travers)

Composants

Nous commençons cette partie par deux tests : le premier est le test de tendance monotone de Mann-Kendall,et le deuxième est le test de saisonalité

Test de tendance Mann-Kendall

# Test de tenance pour chaque variable

lapply(data_adj[variables], function(x) {

mk.test(x, alternative = "greater")

})$IPA

Mann-Kendall trend test

data: x

z = 22.407, n = 276, p-value < 2.2e-16

alternative hypothesis: true S is greater than 0

sample estimates:

S varS tau

3.434000e+04 2.348683e+06 9.048748e-01

$CDD

Mann-Kendall trend test

data: x

z = 1.4414, n = 276, p-value = 0.07474

alternative hypothesis: true S is greater than 0

sample estimates:

S varS tau

2.210000e+03 2.348661e+06 5.825141e-02

$precipitation

Mann-Kendall trend test

data: x

z = -0.87893, n = 276, p-value = 0.8103

alternative hypothesis: true S is greater than 0

sample estimates:

S varS tau

-1.348000e+03 2.348683e+06 -3.552042e-02

$temperature

Mann-Kendall trend test

data: x

z = 6.3914, n = 276, p-value = 8.22e-11

alternative hypothesis: true S is greater than 0

sample estimates:

S varS tau

9.796000e+03 2.348657e+06 2.582176e-01

$exportations

Mann-Kendall trend test

data: x

z = 12.289, n = 276, p-value < 2.2e-16

alternative hypothesis: true S is greater than 0

sample estimates:

S varS tau

1.883500e+04 2.348658e+06 4.964745e-01

$importations

Mann-Kendall trend test

data: x

z = 9.3009, n = 276, p-value < 2.2e-16

alternative hypothesis: true S is greater than 0

sample estimates:

S varS tau

1.425500e+04 2.348659e+06 3.757397e-01

$taux_change

Mann-Kendall trend test

data: x

z = 10.163, n = 276, p-value < 2.2e-16

alternative hypothesis: true S is greater than 0

sample estimates:

S varS tau

1.557600e+04 2.348681e+06 4.104456e-01

$SMIC

Mann-Kendall trend test

data: x

z = 0.57934, n = 276, p-value = 0.2812

alternative hypothesis: true S is greater than 0

sample estimates:

S varS tau

8.880000e+02 2.344153e+06 2.385489e-02

$petrole

Mann-Kendall trend test

data: x

z = 8.2693, n = 276, p-value < 2.2e-16

alternative hypothesis: true S is greater than 0

sample estimates:

S varS tau

1.267400e+04 2.348683e+06 3.339657e-01 Test Saisonnière

# On transforme en format tsv

ts_data <- ts(data_adj[, 2:10], frequency = 12, start = c(2000, 1))

## Verfication de la saisonnalité

test_saison <- vector("logical", ncol(ts_data)) # vecteur pour stocker les résultats

names(test_saison) <- colnames(ts_data) # nomme les résultats selon les variables

for (i in 1:ncol(ts_data)) {

test_saison[i] <- isSeasonal(ts_data[, i], test = "wo")

}

test_saison IPA CDD importations exportations petrole

FALSE TRUE TRUE TRUE FALSE

taux_change SMIC precipitation temperature

FALSE FALSE TRUE TRUE # Deuxième test Seasonal dummies

for (i in 1:ncol(ts_data)) {

nom_var <- colnames(ts_data)[i]

result <- seasdum(ts_data[, i])

cat("\nTest Seasonal dummies: ", nom_var, ":\n")

print(result)

}

Test Seasonal dummies: IPA :

Test used: SeasonalDummies

Test statistic: 1.27

P-value: 0.2414814

Test Seasonal dummies: CDD :

Test used: SeasonalDummies

Test statistic: 283.33

P-value: 0

Test Seasonal dummies: importations :

Test used: SeasonalDummies

Test statistic: 6.31

P-value: 2.993919e-09

Test Seasonal dummies: exportations :

Test used: SeasonalDummies

Test statistic: 23.43

P-value: 0

Test Seasonal dummies: petrole :

Test used: SeasonalDummies

Test statistic: 1.06

P-value: 0.390488

Test Seasonal dummies: taux_change :

Test used: SeasonalDummies

Test statistic: 1.31

P-value: 0.218587

Test Seasonal dummies: SMIC :

Test used: SeasonalDummies

Test statistic: 0.06

P-value: 0.999995

Test Seasonal dummies: precipitation :

Test used: SeasonalDummies

Test statistic: 351.69

P-value: 0

Test Seasonal dummies: temperature :

Test used: SeasonalDummies

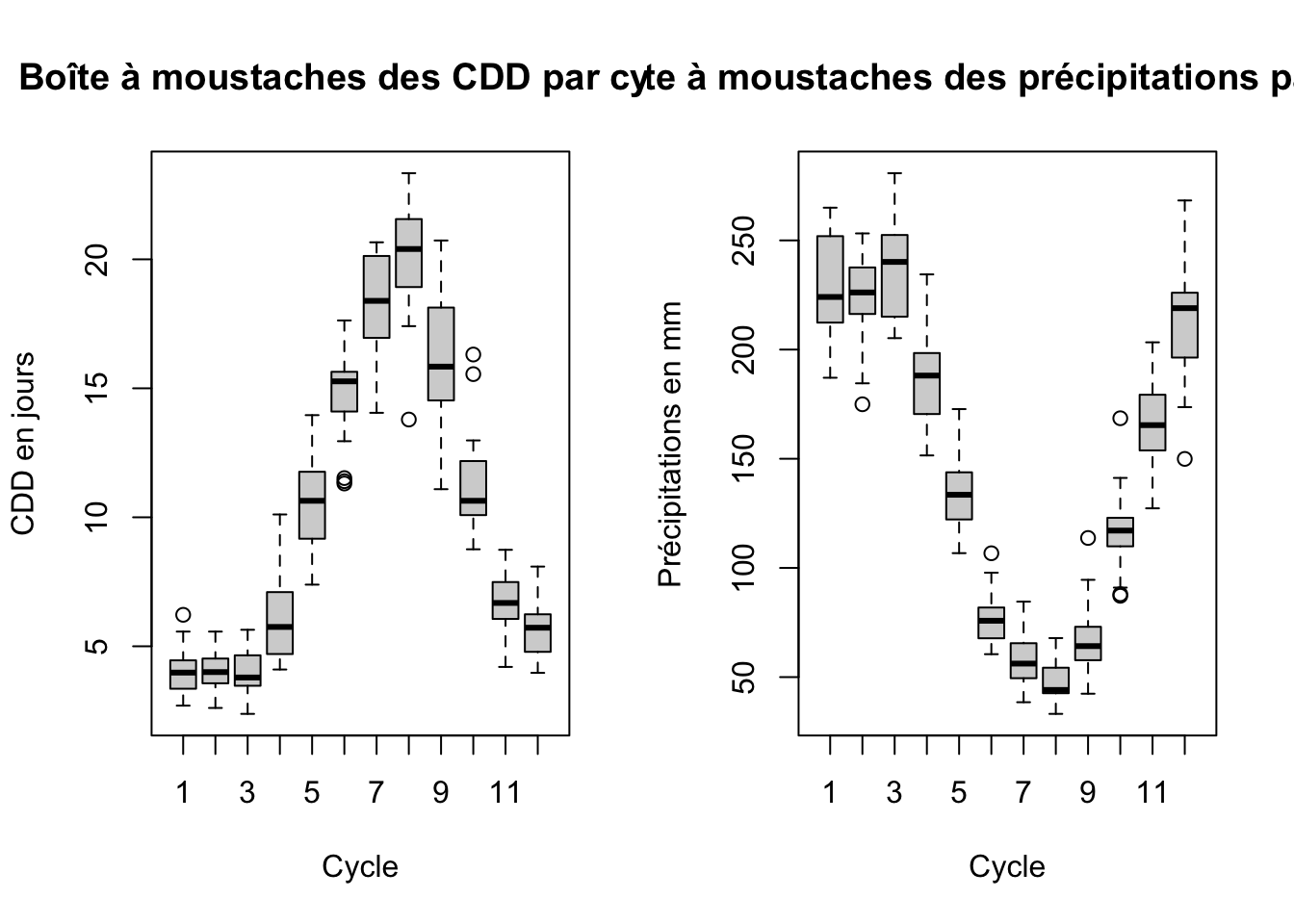

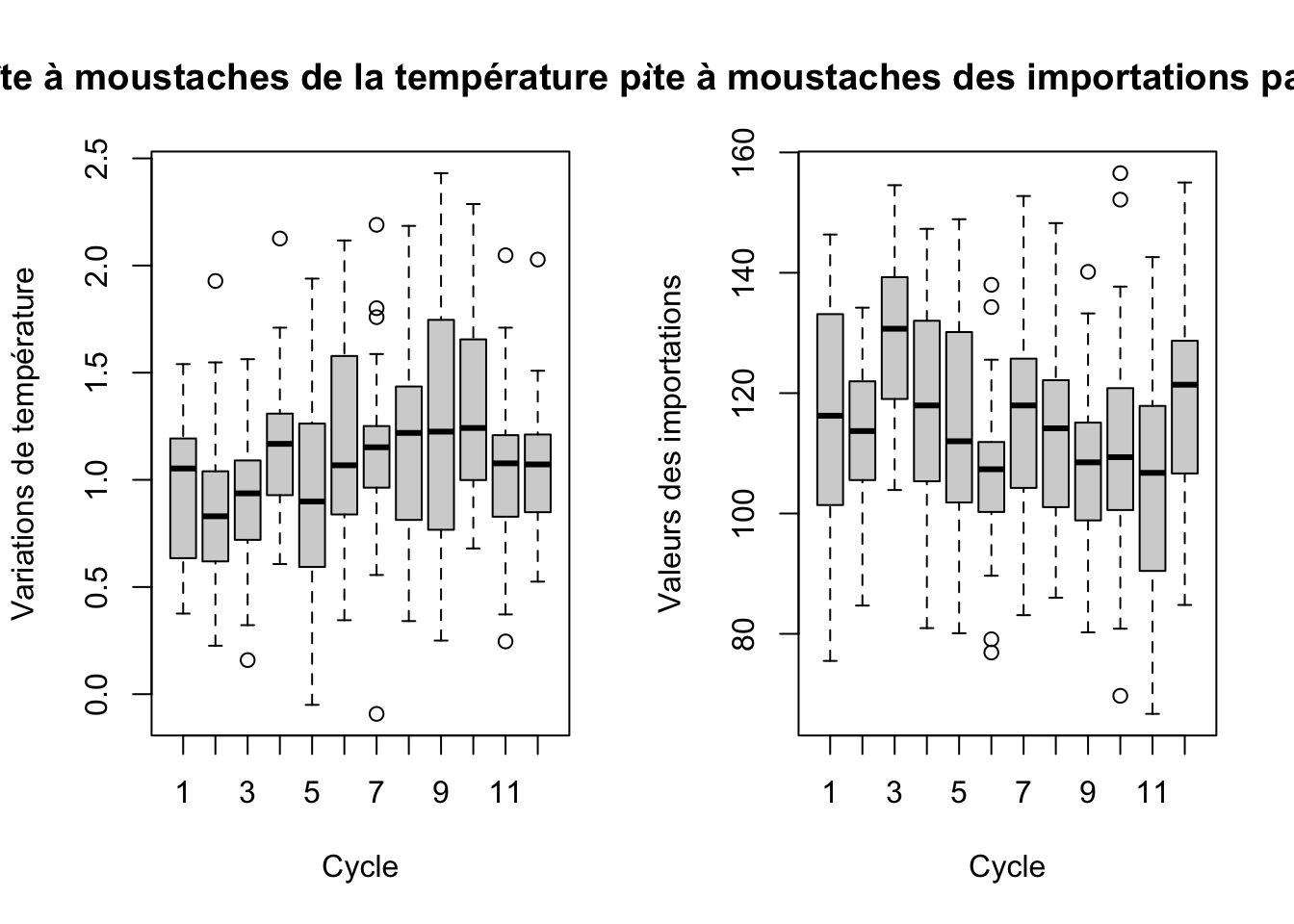

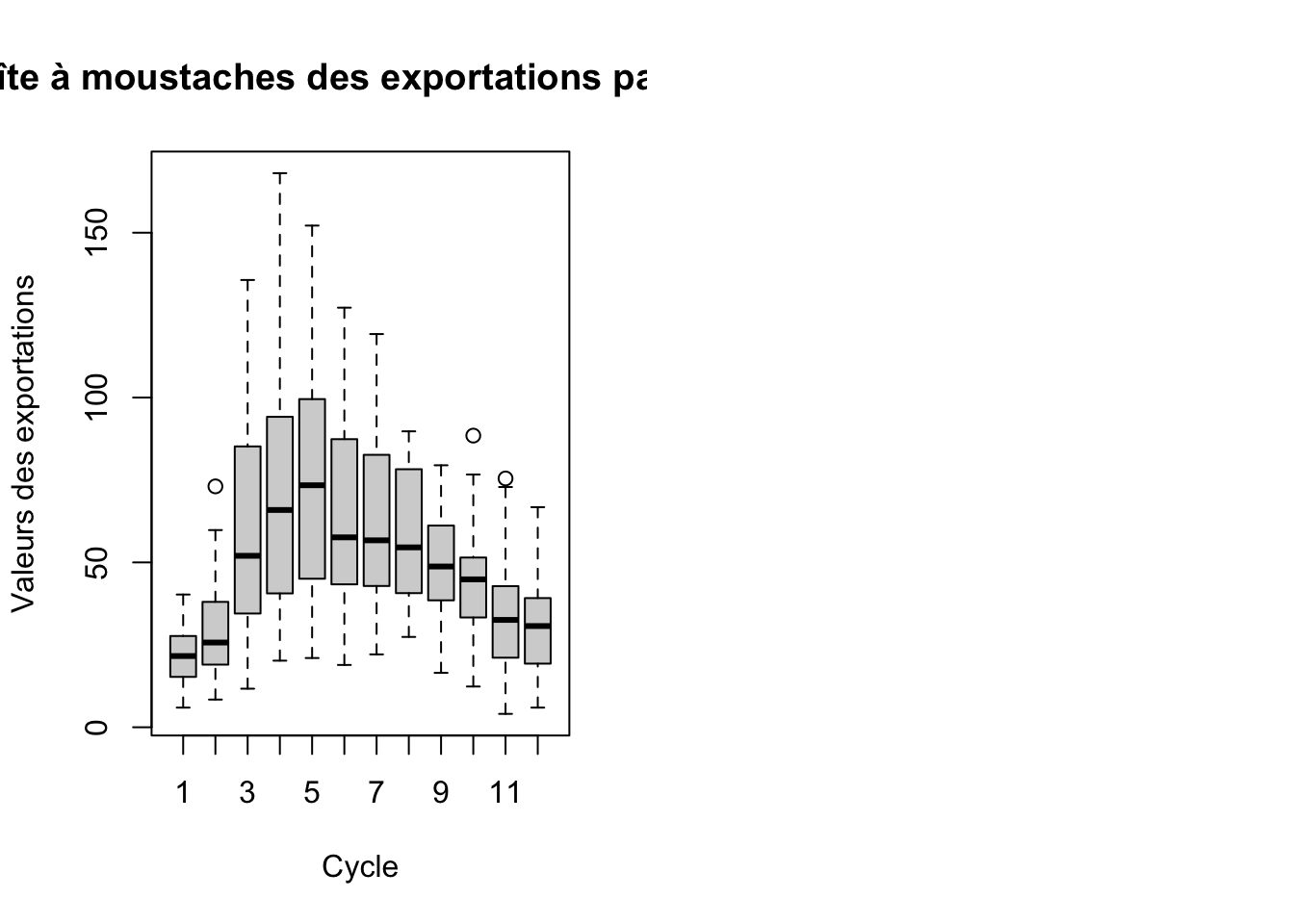

Test statistic: 4.35

P-value: 5.416069e-06Les variables pressentant une saisonnalité d’après les tests sont CDD, importations, Exportations, Précipitation et température

Le code ci-dessous et similaire à celui que nous avons fait precedement pour transformer les variables en time series, on a besoin si nous téléchargeons le fichier data.adj

# Boucle pour convertir chaque colonne en ts et les stocker comme variables séparées

for(column_name in names(data_adj)[-1]) { # Exclure la colonne de date

# Créer une série temporelle pour la colonne actuelle

ts_list <- ts(data_adj[[column_name]], start = c(2000, 1), frequency = 12)

# variable dans l'environnement global avec un nom dynamique

assign(paste0("ts_", column_name), ts_list)

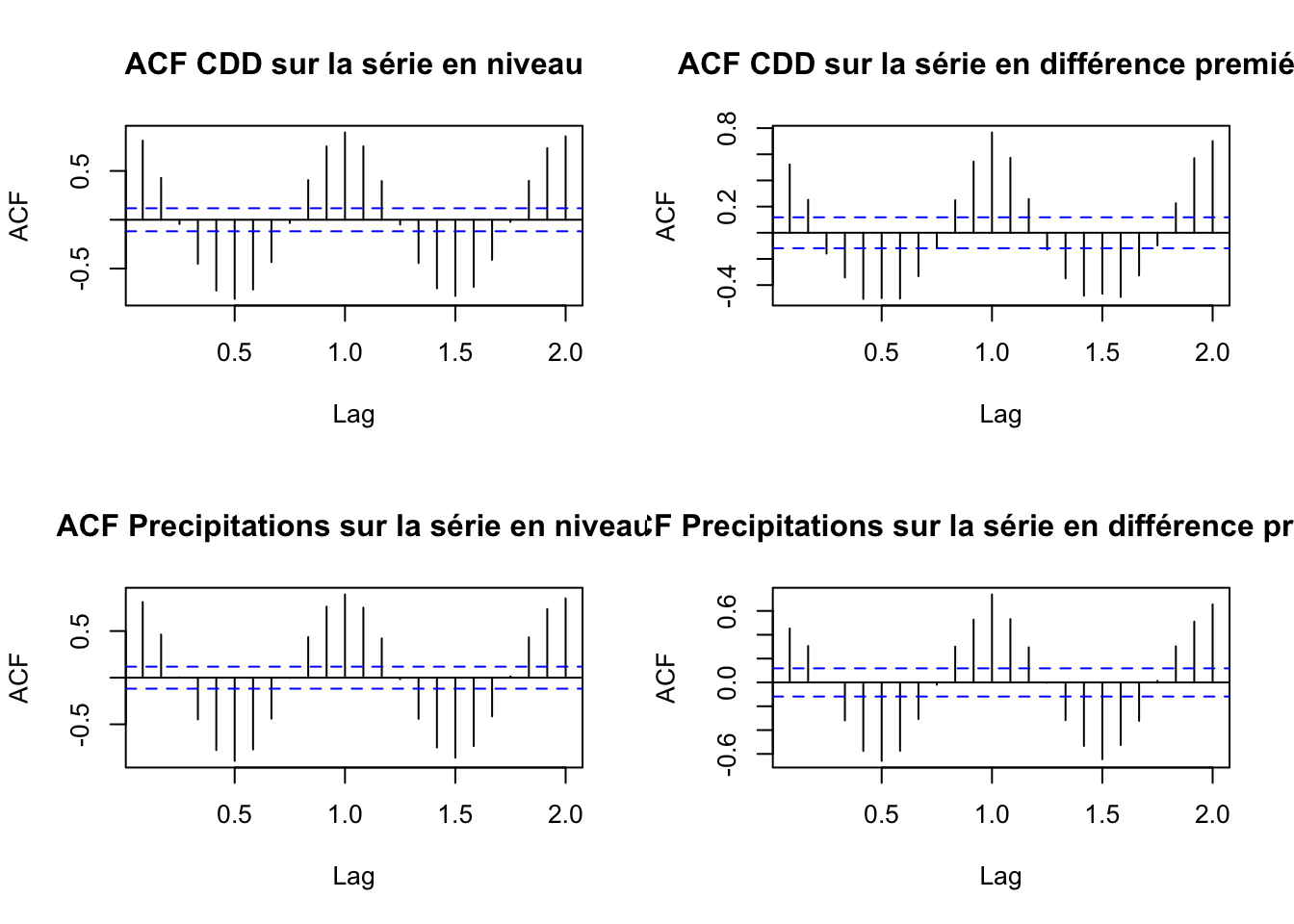

}Correlogramme des variables saisonnières

par(mfrow=c(2,2))

# ACF pour les variables presentant une saisonalité

# CDD

acf(ts_CDD, main = "ACF CDD sur la série en niveau")

acf(diff(ts_CDD,differences = 1), main = "ACF CDD sur la série en différence premiére")

# Précipitation

acf(ts_precipitation, main = "ACF Precipitations sur la série en niveau")

acf(diff(ts_precipitation,differences = 1), main = "ACF Precipitations sur la série en différence premiére")

# Témperature

acf(ts_temperature, main = "ACF Témperature sur la série en niveau ")

acf(diff(ts_temperature,differences = 1), main = "ACF Témperature sur la série en différence premiére")

# Importations

acf(ts_importations, main = "ACF Importations sur la série en niveau")

acf(diff(ts_importations, differences = 1),main = "ACF Importations sur la série en différence premiére")

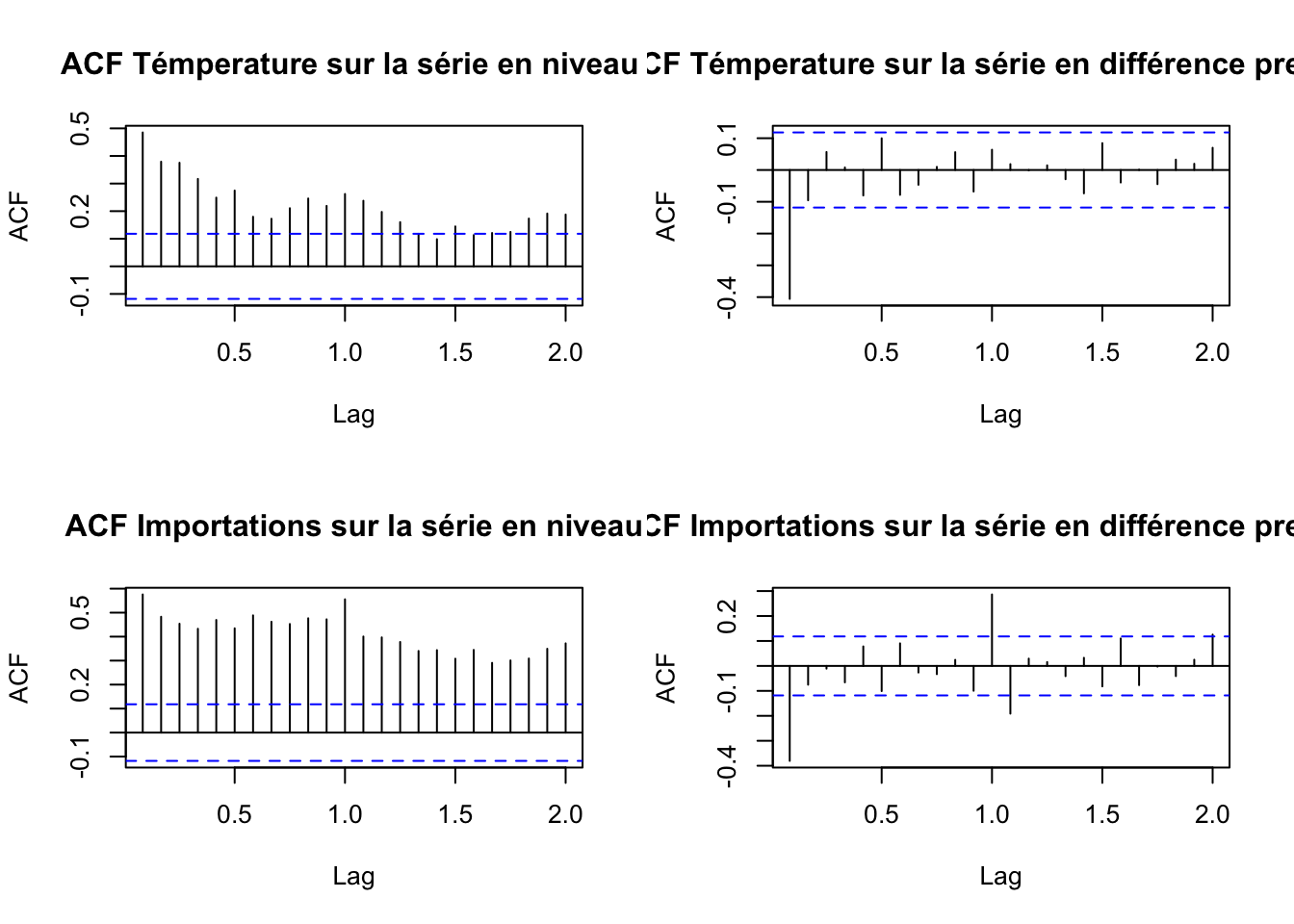

# Exportations

acf(ts_exportations, main = "ACF Exportations sur la série en niveau")

acf(diff(ts_exportations,differences = 1), main = "ACF Exportations sur la série en différence premiére")

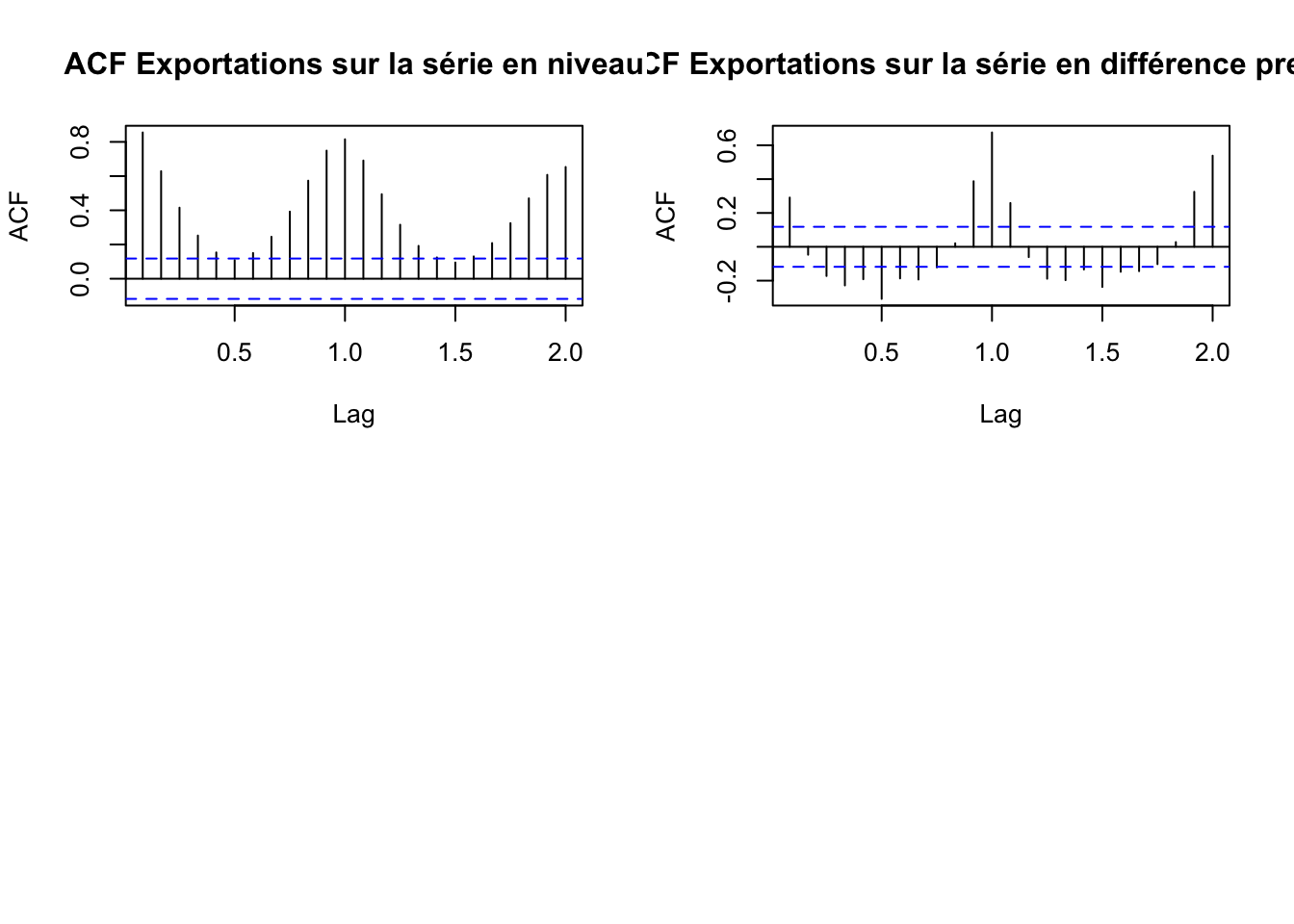

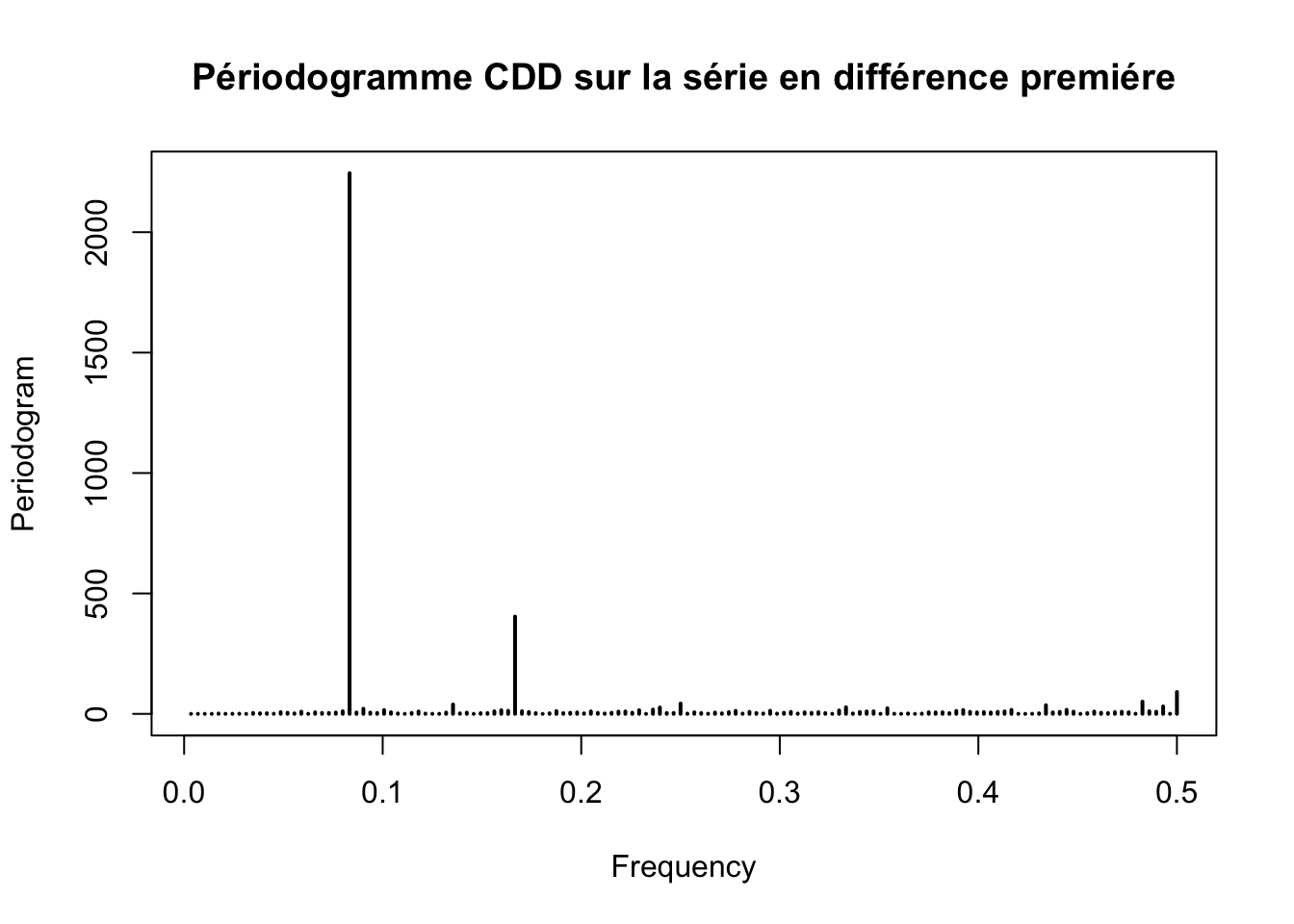

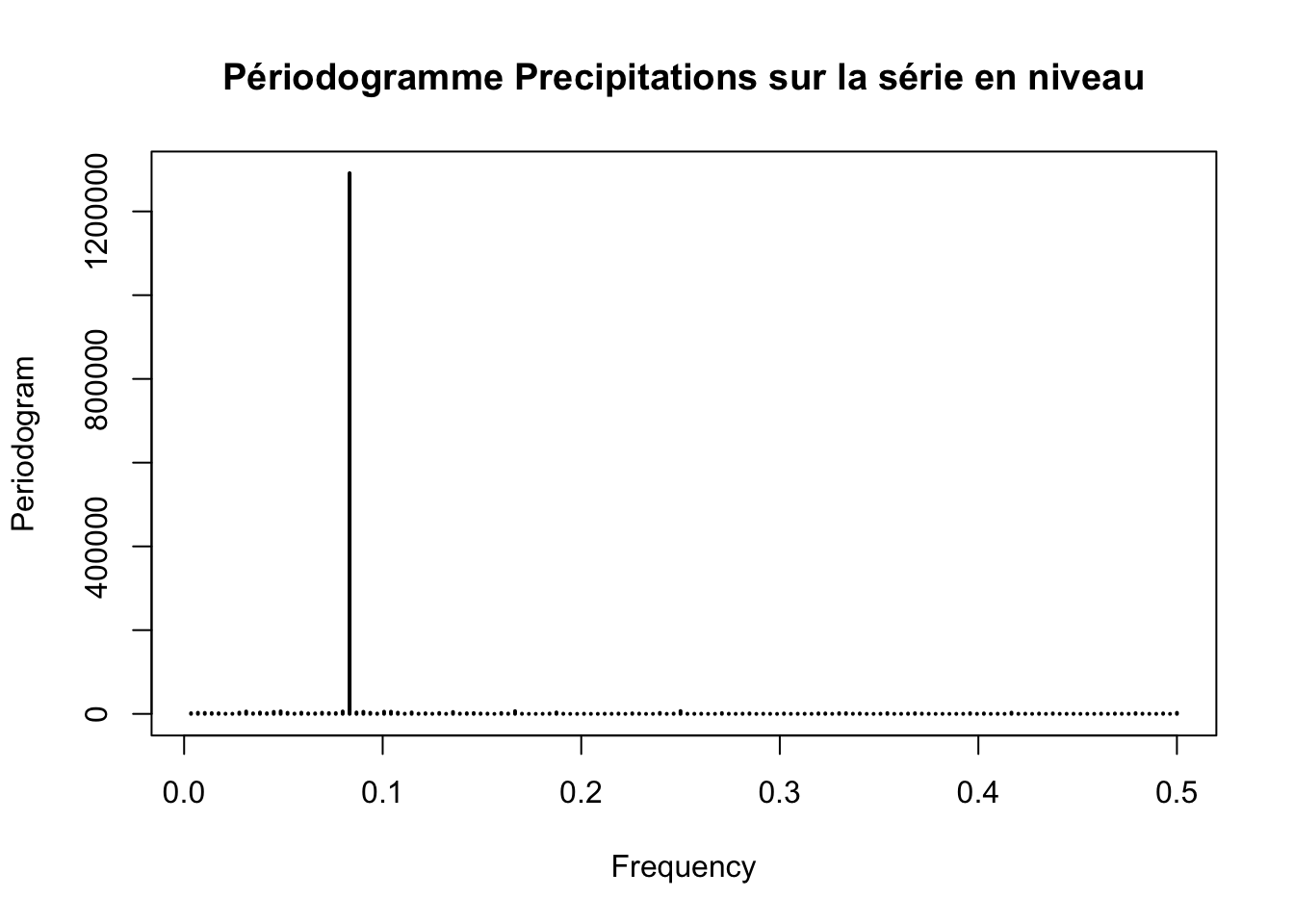

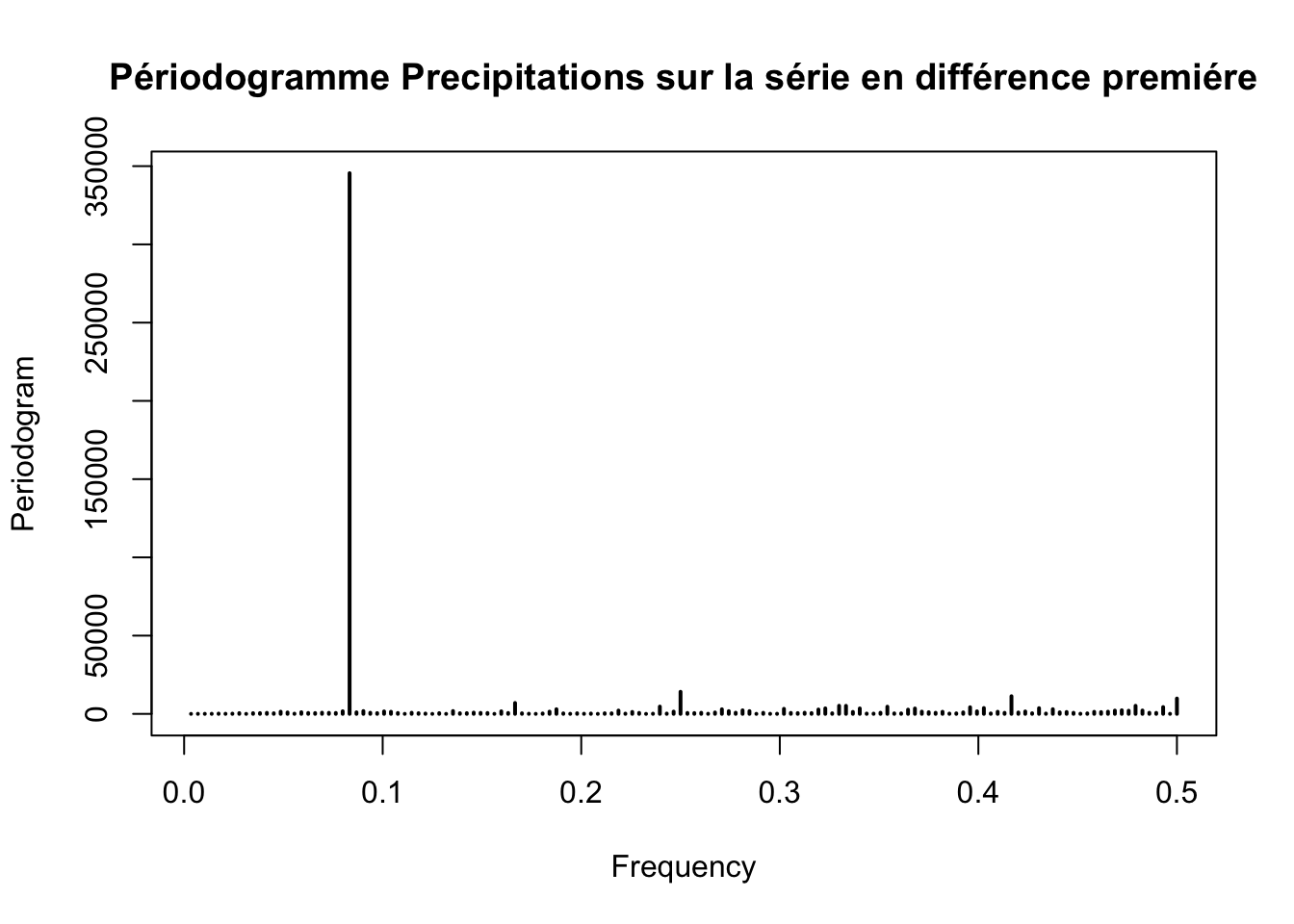

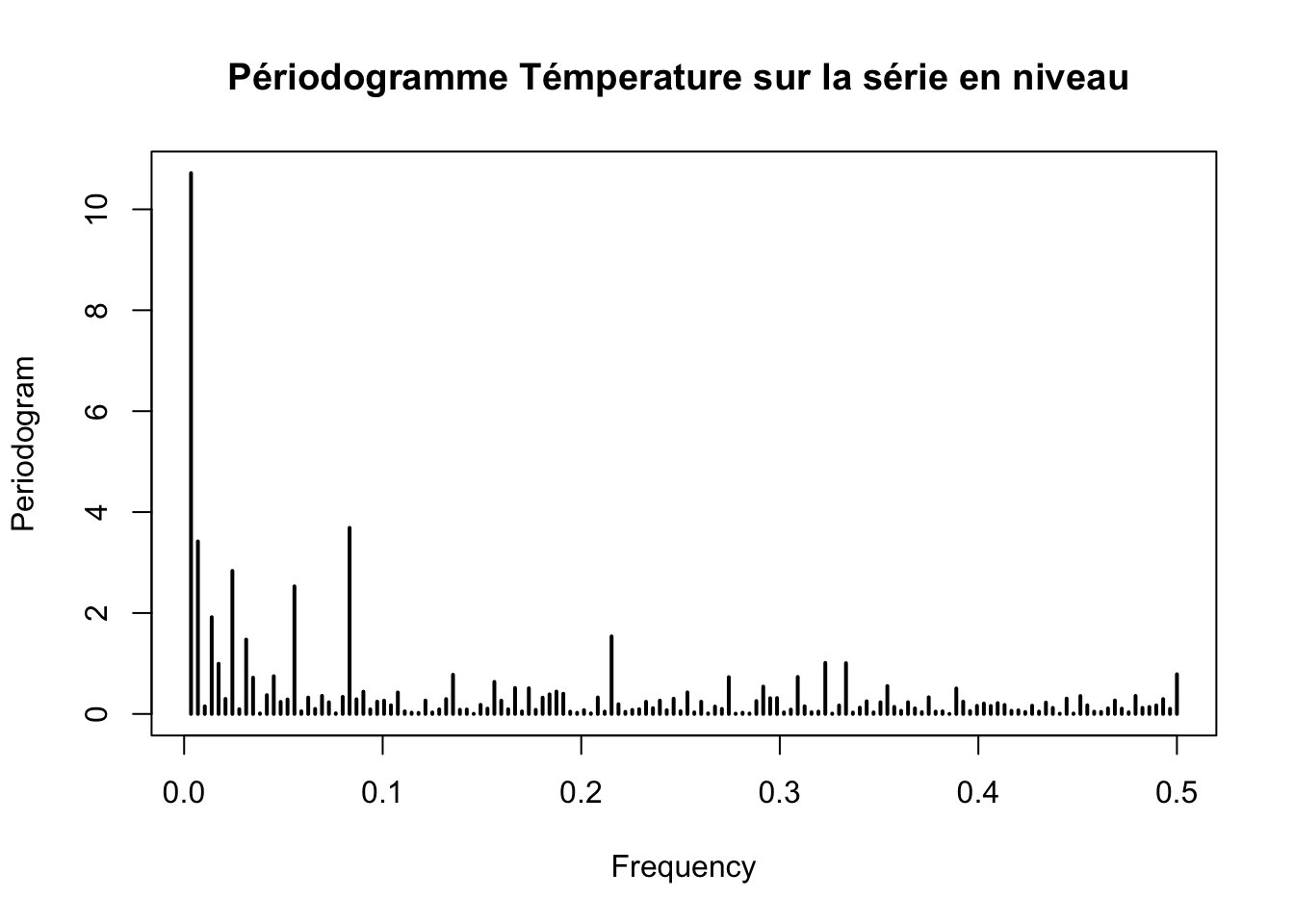

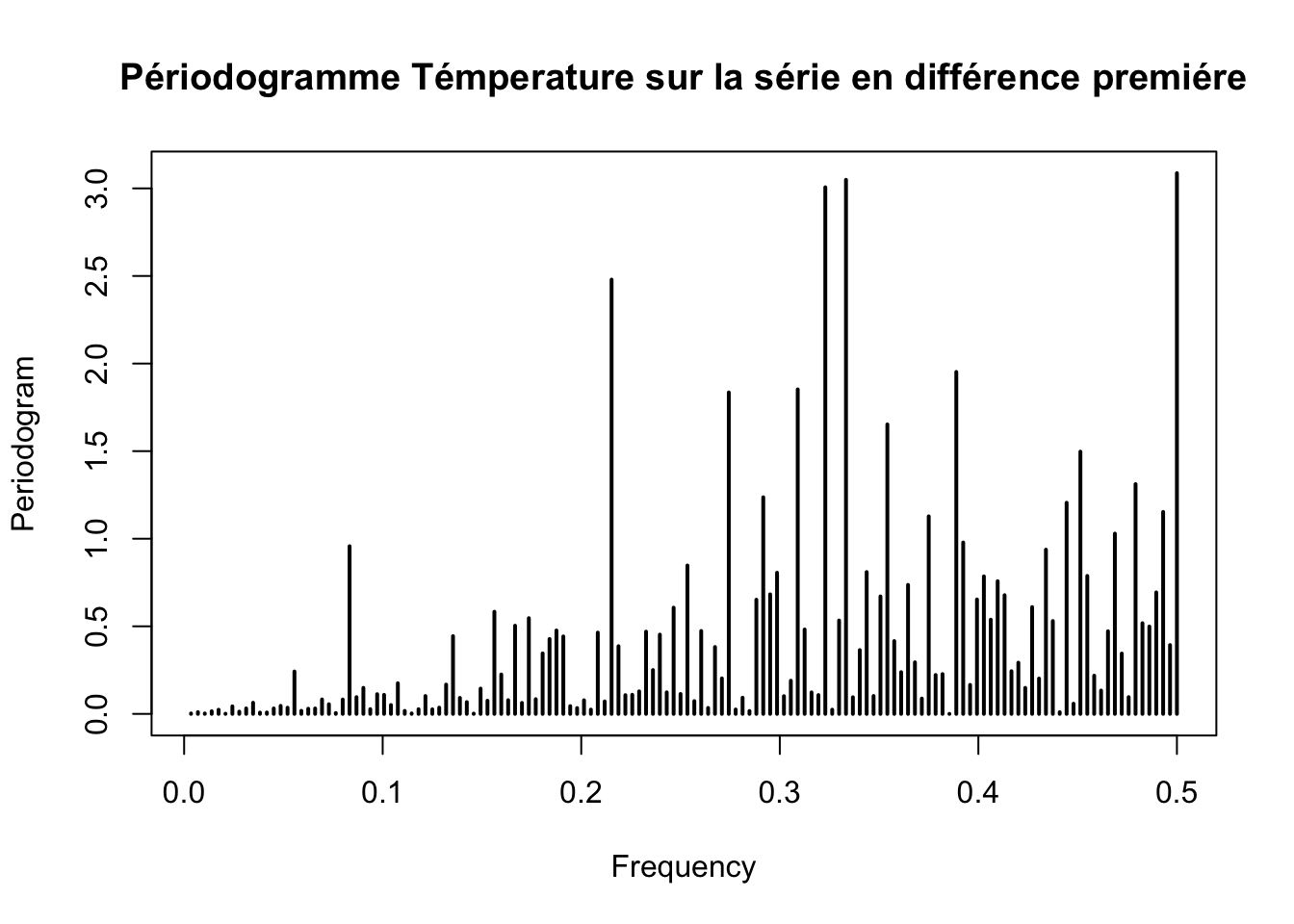

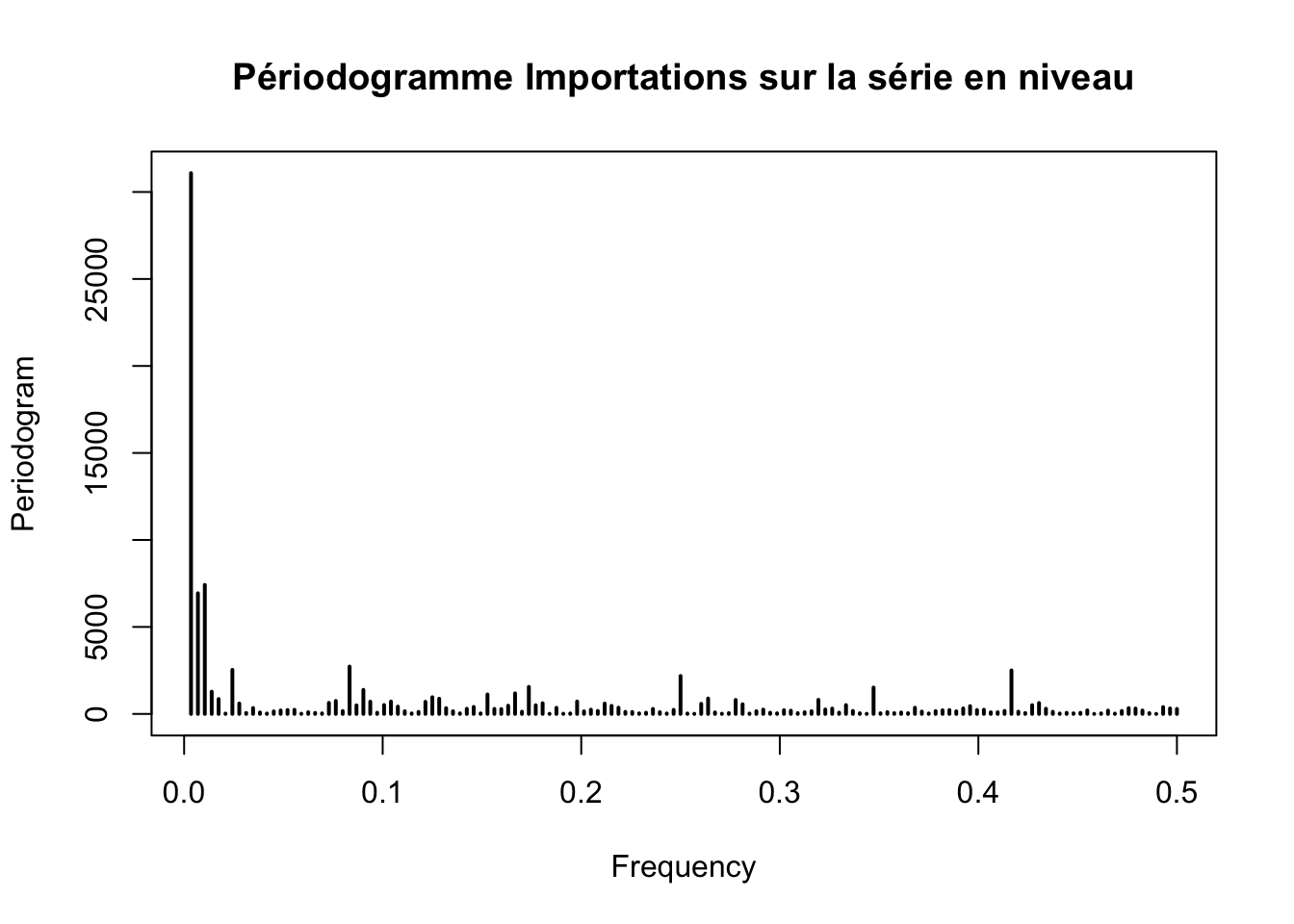

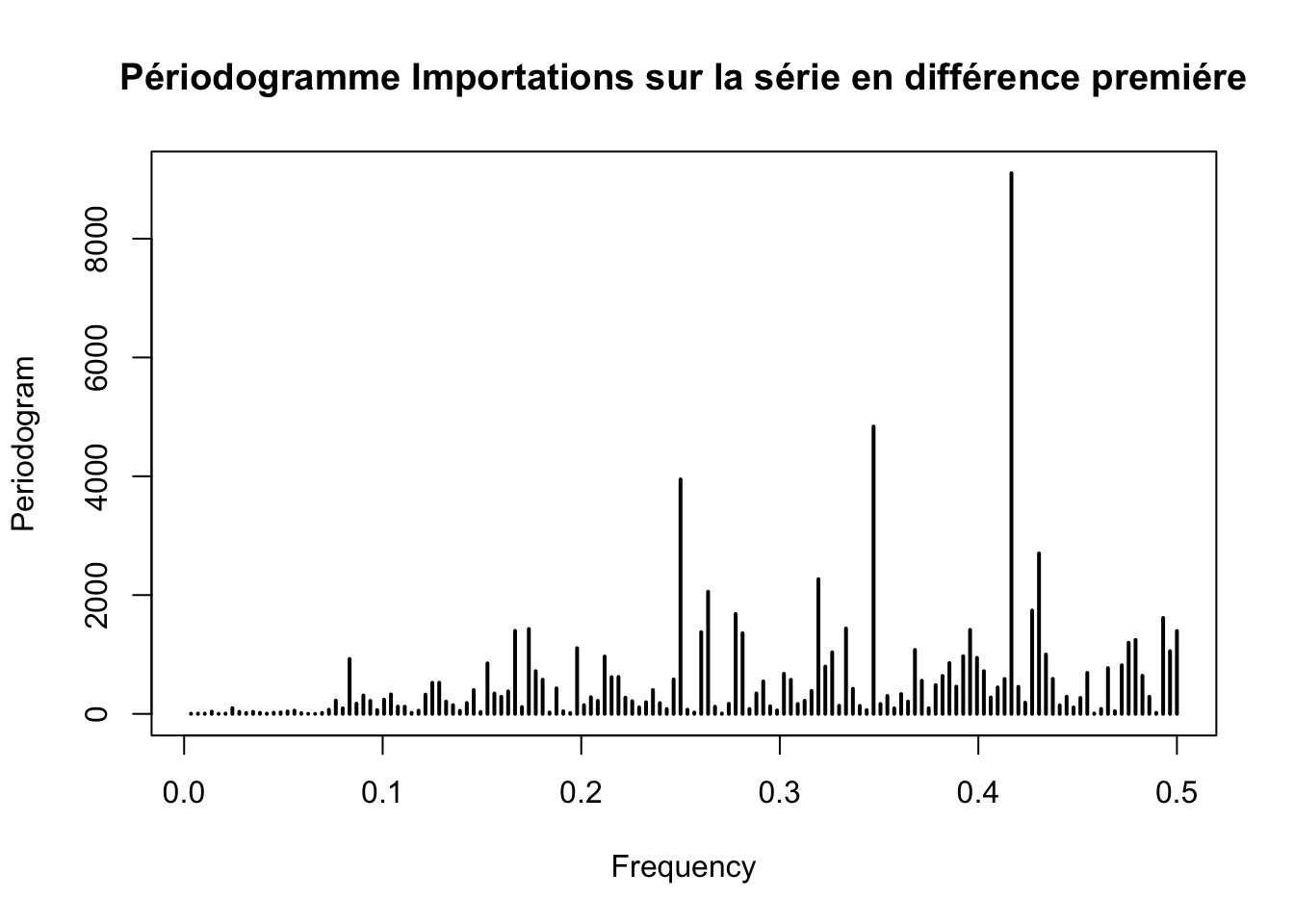

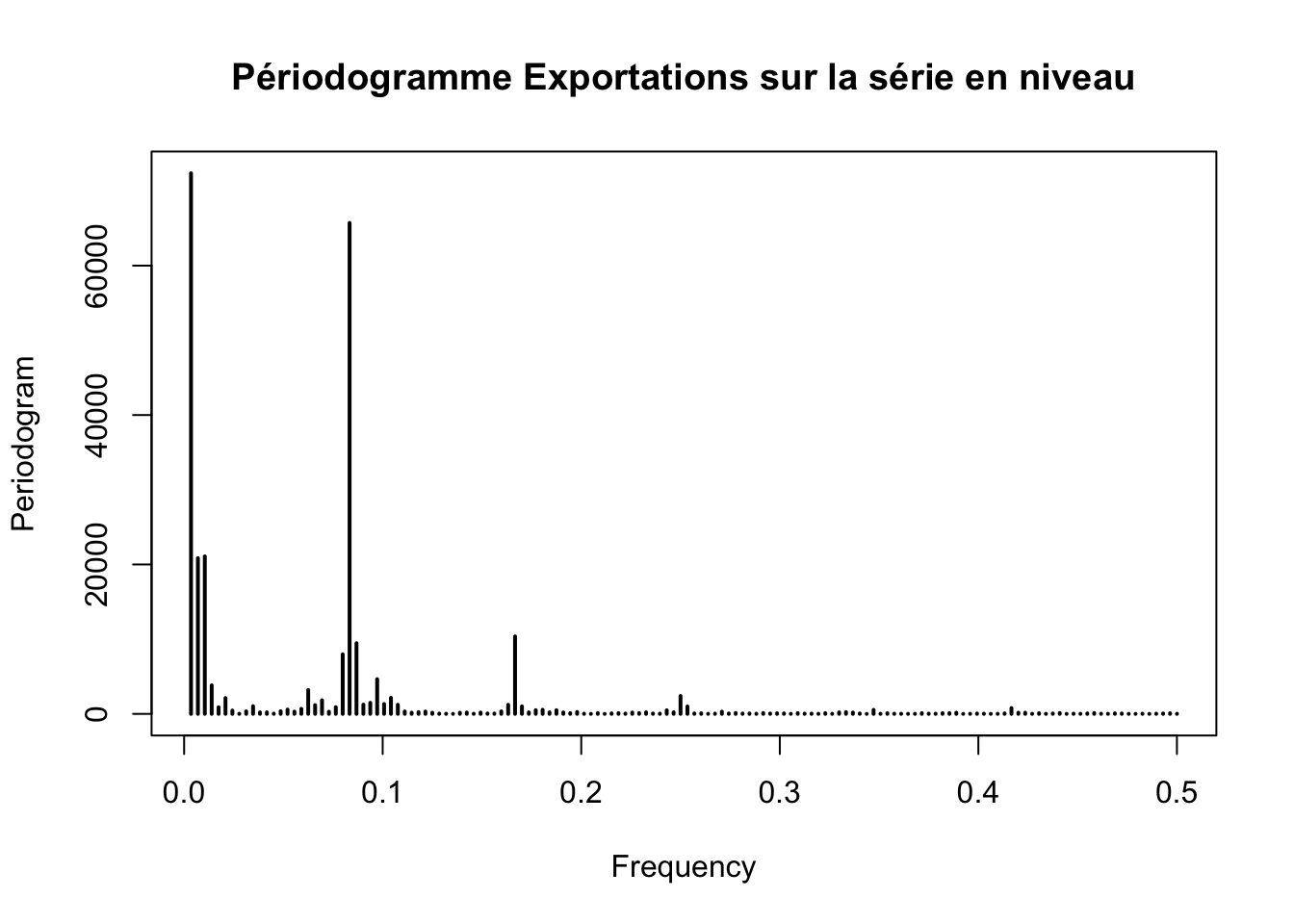

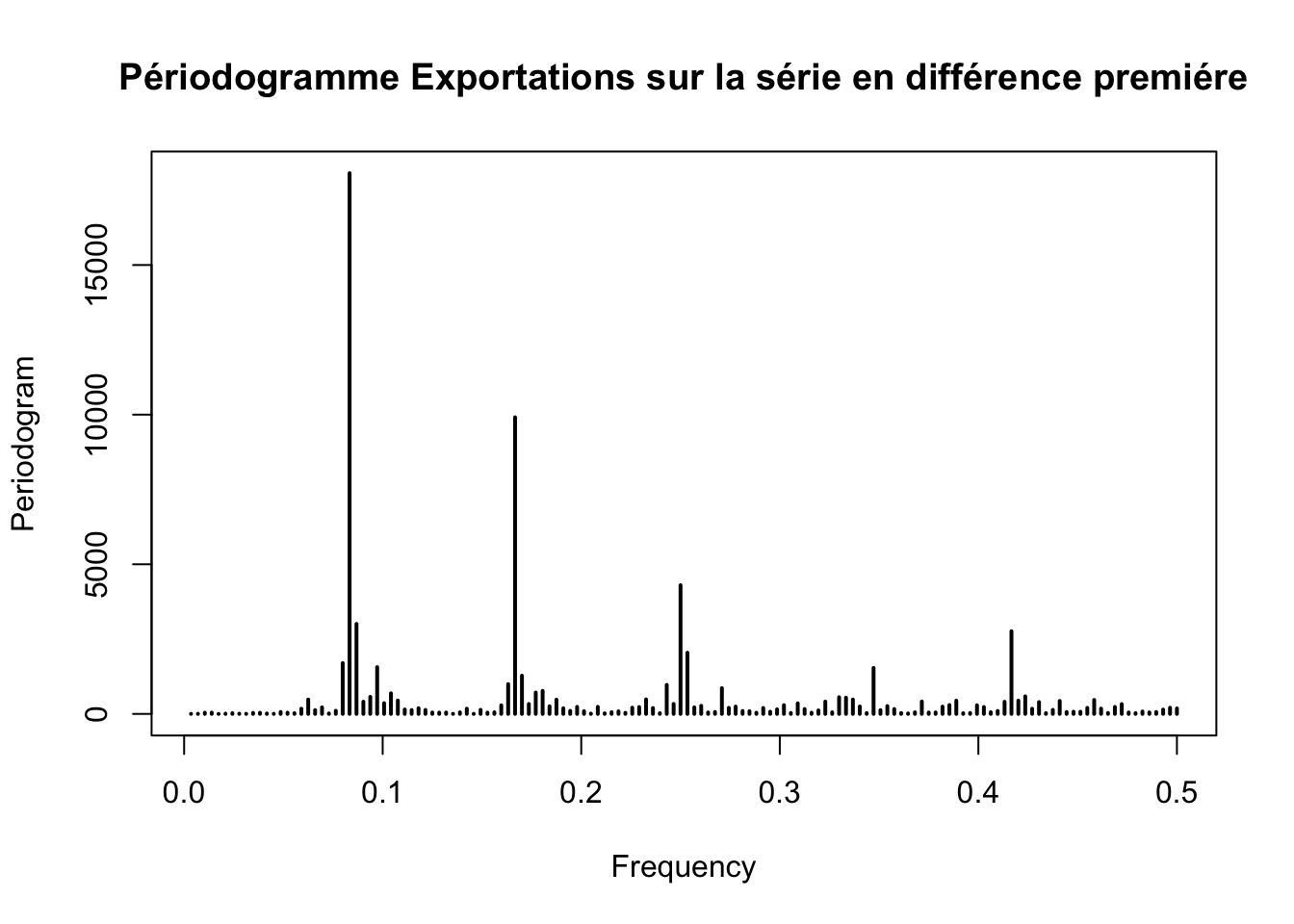

Périodogramme

# Périodogramme ou filtre spectra pour les sérires presentant une saisonalité

# CDD

periodogram(ts_CDD, main = "Périodogramme CDD sur la série en niveau")

periodogram(diff(ts_CDD,differences = 1), main = "Périodogramme CDD sur la série en différence premiére")

# Precipitations

periodogram(ts_precipitation, main = "Périodogramme Precipitations sur la série en niveau")

periodogram(diff(ts_precipitation,differences = 1), main = "Périodogramme Precipitations sur la série en différence premiére")

# Temperature

periodogram(ts_temperature, main = "Périodogramme Témperature sur la série en niveau ")

periodogram(diff(ts_temperature,differences = 1), main = "Périodogramme Témperature sur la série en différence premiére")

# Importations

periodogram(ts_importations, main = "Périodogramme Importations sur la série en niveau")

periodogram(diff(ts_importations, differences = 1),main = "Périodogramme Importations sur la série en différence premiére")

# Exportations

periodogram(ts_exportations, main = "Périodogramme Exportations sur la série en niveau")

periodogram(diff(ts_exportations,differences = 1), main = "Périodogramme Exportations sur la série en différence premiére")

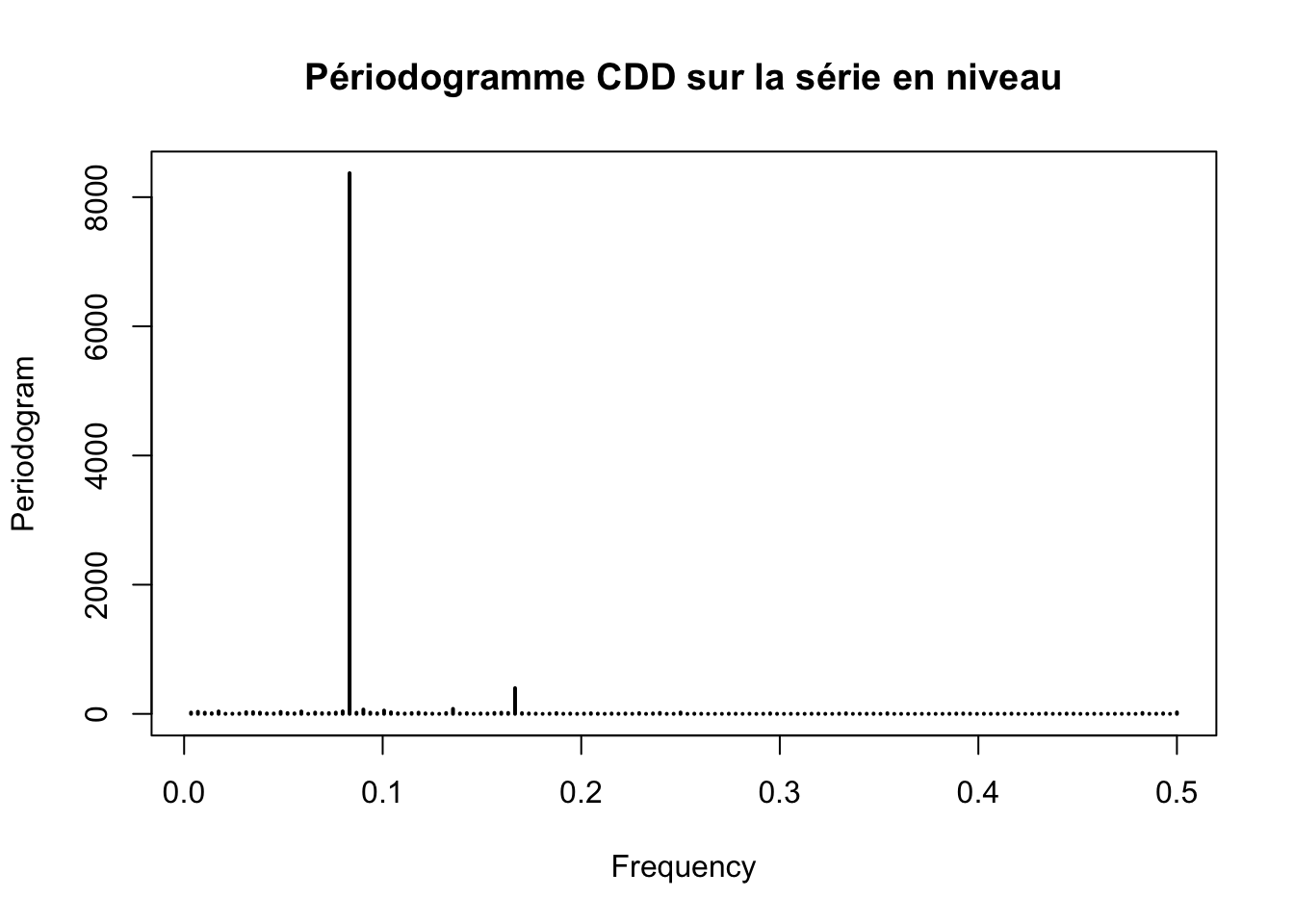

par(mfrow=c(1,2))

# Boxplots pour les variables climatiques avec les cycles correspondants à chaque série

boxplot(ts_CDD ~ cycle(ts_CDD), main = "Boîte à moustaches des CDD par cycle", xlab = "Cycle", ylab = "CDD en jours")

boxplot(ts_precipitation ~ cycle(ts_precipitation), main = "Boîte à moustaches des précipitations par cycle", xlab = "Cycle", ylab = "Précipitations en mm")

boxplot(ts_temperature ~ cycle(ts_temperature), main = "Boîte à moustaches de la température par cycle", xlab = "Cycle", ylab = "Variations de température")

# Variables export - importation

boxplot(ts_importations ~ cycle(ts_importations), main = "Boîte à moustaches des importations par cycle", xlab = "Cycle", ylab = "Valeurs des importations")

boxplot(ts_exportations ~ cycle(ts_exportations), main = "Boîte à moustaches des exportations par cycle", xlab = "Cycle", ylab = "Valeurs des exportations")

Test ADF

#|warning: false

#|message: false

# test ADF

lapply(data_adj[variables], function(x) {

adf.test(x, alternative = "stationary")

})Warning in adf.test(x, alternative = "stationary"): p-value smaller than

printed p-value

Warning in adf.test(x, alternative = "stationary"): p-value smaller than

printed p-value

Warning in adf.test(x, alternative = "stationary"): p-value smaller than

printed p-value

Warning in adf.test(x, alternative = "stationary"): p-value smaller than

printed p-value

Warning in adf.test(x, alternative = "stationary"): p-value smaller than

printed p-value$IPA

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -2.0623, Lag order = 6, p-value = 0.5498

alternative hypothesis: stationary

$CDD

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -15.661, Lag order = 6, p-value = 0.01

alternative hypothesis: stationary

$precipitation

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -12.168, Lag order = 6, p-value = 0.01

alternative hypothesis: stationary

$temperature

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -4.9028, Lag order = 6, p-value = 0.01

alternative hypothesis: stationary

$exportations

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -8.6625, Lag order = 6, p-value = 0.01

alternative hypothesis: stationary

$importations

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -3.7022, Lag order = 6, p-value = 0.02434

alternative hypothesis: stationary

$taux_change

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -1.4862, Lag order = 6, p-value = 0.7925

alternative hypothesis: stationary

$SMIC

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -6.0839, Lag order = 6, p-value = 0.01

alternative hypothesis: stationary

$petrole

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -2.178, Lag order = 6, p-value = 0.5011

alternative hypothesis: stationaryGraphiques des variables non stationnaires Test ADF

# Graphique pour la série IPA

ggplot(data = data_adj, aes(x = Date, y = IPA)) +

geom_line(color = "blue", size = 0.5) +

stat_smooth(color = "red", fill = "red", method = "loess", show.legend = TRUE, size = 0.2) +

ggtitle("Analyse de la tendance de l'IPA-DI sur la période 01/2000 - 12/2022") +

xlab("Date") +

ylab("IPA Value") Warning: Using `size` aesthetic for lines was deprecated in ggplot2 3.4.0.

ℹ Please use `linewidth` instead.Don't know how to automatically pick scale for object of type <ts>. Defaulting

to continuous.

`geom_smooth()` using formula = 'y ~ x'

# Graphique pour la série petrole

ggplot(data = data_adj, aes(x = Date, y = petrole)) +

geom_line(color = "blue", size = 0.5) +

stat_smooth(color = "red", fill = "red", method = "loess", show.legend = TRUE, size = 0.2) +

ggtitle("Analyse de la tendance du prix du pétrole sur la période 01/2000 - 12/2022") +

xlab("Date") +

ylab("Petrole Value") Don't know how to automatically pick scale for object of type <ts>. Defaulting

to continuous.

`geom_smooth()` using formula = 'y ~ x'

# Graphique pour la série taux de change

ggplot(data = data_adj, aes(x = Date, y = taux_change)) +

geom_line(color = "blue", size = 0.5) +

stat_smooth(color = "red", fill = "red", method = "loess", show.legend = TRUE, size = 0.2) +

ggtitle("Analyse de la tendance du taux de change sur la période 01/2000 - 12/2022") +

xlab("Date") +

ylab("Taux de change") Don't know how to automatically pick scale for object of type <ts>. Defaulting

to continuous.

`geom_smooth()` using formula = 'y ~ x'

La fonction stat_smooth(method = “loess”) ajoute une courbe de lissage aux données, utilisant la méthode LOESS (Locally Estimated Scatterplot Smoothing). Cette courbe est utile pour visualiser une tendance centrale plus lisse dans les données, ce qui peut être particulièrement bénéfique dans les cas où les données sont bruyantes ou volatiles

Test KPSS

#|warning: false

#|message: false

## Trend

for (i in 1:ncol(ts_data)) {

nom_var <- colnames(ts_data)[i]

result <- kpss.test(ts_data[, i], null = "Trend")

cat("\nTest KPSS: ", nom_var, ":\n")

print(result)

}Warning in kpss.test(ts_data[, i], null = "Trend"): p-value smaller than

printed p-value

Test KPSS: IPA :

KPSS Test for Trend Stationarity

data: ts_data[, i]

KPSS Trend = 0.59792, Truncation lag parameter = 5, p-value = 0.01Warning in kpss.test(ts_data[, i], null = "Trend"): p-value greater than

printed p-value

Test KPSS: CDD :

KPSS Test for Trend Stationarity

data: ts_data[, i]

KPSS Trend = 0.0099421, Truncation lag parameter = 5, p-value = 0.1Warning in kpss.test(ts_data[, i], null = "Trend"): p-value smaller than

printed p-value

Test KPSS: importations :

KPSS Test for Trend Stationarity

data: ts_data[, i]

KPSS Trend = 0.37607, Truncation lag parameter = 5, p-value = 0.01Warning in kpss.test(ts_data[, i], null = "Trend"): p-value greater than

printed p-value

Test KPSS: exportations :

KPSS Test for Trend Stationarity

data: ts_data[, i]

KPSS Trend = 0.034185, Truncation lag parameter = 5, p-value = 0.1Warning in kpss.test(ts_data[, i], null = "Trend"): p-value smaller than

printed p-value

Test KPSS: petrole :

KPSS Test for Trend Stationarity

data: ts_data[, i]

KPSS Trend = 0.63433, Truncation lag parameter = 5, p-value = 0.01Warning in kpss.test(ts_data[, i], null = "Trend"): p-value smaller than

printed p-value

Test KPSS: taux_change :

KPSS Test for Trend Stationarity

data: ts_data[, i]

KPSS Trend = 0.94899, Truncation lag parameter = 5, p-value = 0.01Warning in kpss.test(ts_data[, i], null = "Trend"): p-value greater than

printed p-value

Test KPSS: SMIC :

KPSS Test for Trend Stationarity

data: ts_data[, i]

KPSS Trend = 0.018996, Truncation lag parameter = 5, p-value = 0.1Warning in kpss.test(ts_data[, i], null = "Trend"): p-value greater than

printed p-value

Test KPSS: precipitation :

KPSS Test for Trend Stationarity

data: ts_data[, i]

KPSS Trend = 0.010157, Truncation lag parameter = 5, p-value = 0.1

Test KPSS: temperature :

KPSS Test for Trend Stationarity

data: ts_data[, i]

KPSS Trend = 0.13529, Truncation lag parameter = 5, p-value = 0.06984## Level

for (i in 1:ncol(ts_data)) {

nom_var <- colnames(ts_data)[i]

result <- kpss.test(ts_data[, i], null = "Level")

cat("\nTest KPSS: ", nom_var, ":\n")

print(result)

}Warning in kpss.test(ts_data[, i], null = "Level"): p-value smaller than

printed p-value

Test KPSS: IPA :

KPSS Test for Level Stationarity

data: ts_data[, i]

KPSS Level = 3.5331, Truncation lag parameter = 5, p-value = 0.01Warning in kpss.test(ts_data[, i], null = "Level"): p-value greater than

printed p-value

Test KPSS: CDD :

KPSS Test for Level Stationarity

data: ts_data[, i]

KPSS Level = 0.089483, Truncation lag parameter = 5, p-value = 0.1Warning in kpss.test(ts_data[, i], null = "Level"): p-value smaller than

printed p-value

Test KPSS: importations :

KPSS Test for Level Stationarity

data: ts_data[, i]

KPSS Level = 2.666, Truncation lag parameter = 5, p-value = 0.01Warning in kpss.test(ts_data[, i], null = "Level"): p-value smaller than

printed p-value

Test KPSS: exportations :

KPSS Test for Level Stationarity

data: ts_data[, i]

KPSS Level = 3.1023, Truncation lag parameter = 5, p-value = 0.01Warning in kpss.test(ts_data[, i], null = "Level"): p-value smaller than

printed p-value

Test KPSS: petrole :

KPSS Test for Level Stationarity

data: ts_data[, i]

KPSS Level = 1.2759, Truncation lag parameter = 5, p-value = 0.01Warning in kpss.test(ts_data[, i], null = "Level"): p-value smaller than

printed p-value

Test KPSS: taux_change :

KPSS Test for Level Stationarity

data: ts_data[, i]

KPSS Level = 2.6251, Truncation lag parameter = 5, p-value = 0.01Warning in kpss.test(ts_data[, i], null = "Level"): p-value greater than

printed p-value

Test KPSS: SMIC :

KPSS Test for Level Stationarity

data: ts_data[, i]

KPSS Level = 0.020247, Truncation lag parameter = 5, p-value = 0.1Warning in kpss.test(ts_data[, i], null = "Level"): p-value greater than

printed p-value

Test KPSS: precipitation :

KPSS Test for Level Stationarity

data: ts_data[, i]

KPSS Level = 0.030274, Truncation lag parameter = 5, p-value = 0.1Warning in kpss.test(ts_data[, i], null = "Level"): p-value smaller than

printed p-value

Test KPSS: temperature :

KPSS Test for Level Stationarity

data: ts_data[, i]

KPSS Level = 1.7517, Truncation lag parameter = 5, p-value = 0.01Correction

Nous allons maintenant déterminer le type de schéma des séries, multiplicatif ou addif

# Approche Graphique

plot(ts_CDD)

plot(ts_precipitation)

plot(ts_temperature)

plot(ts_importations)

plot(ts_exportations)

# Test log-level

regx13_CDD <- regarima_x13(ts_CDD, spec ="RG5c")

s_transform(regx13_CDD) tfunction adjust aicdiff

Auto None -2regx13_precipitation <- regarima_x13(ts_precipitation, spec ="RG5c")

s_transform(regx13_precipitation) tfunction adjust aicdiff

Auto None -2regx13_temperature <- regarima_x13(ts_temperature, spec ="RG5c")

s_transform(regx13_temperature) tfunction adjust aicdiff

Auto None -2regx13_importations <- regarima_x13(ts_importations, spec ="RG5c")

s_transform(regx13_importations) tfunction adjust aicdiff

Auto None -2regx13_exportations <- regarima_x13(ts_exportations, spec ="RG5c")

s_transform(regx13_exportations) tfunction adjust aicdiff

Auto None -2Ce test est spécifiquement conçu pour décider si une transformation logarithmique des données est appropriée

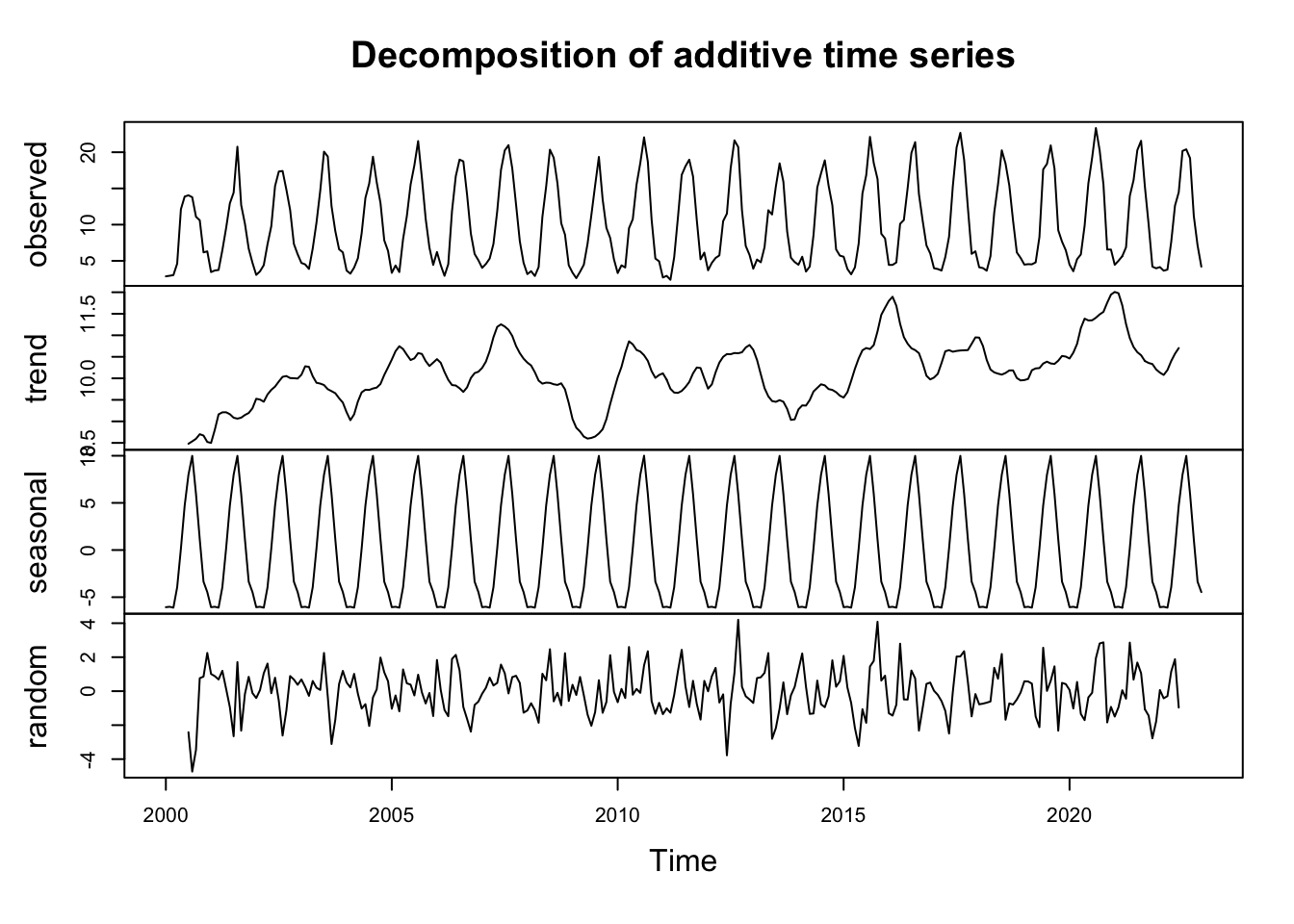

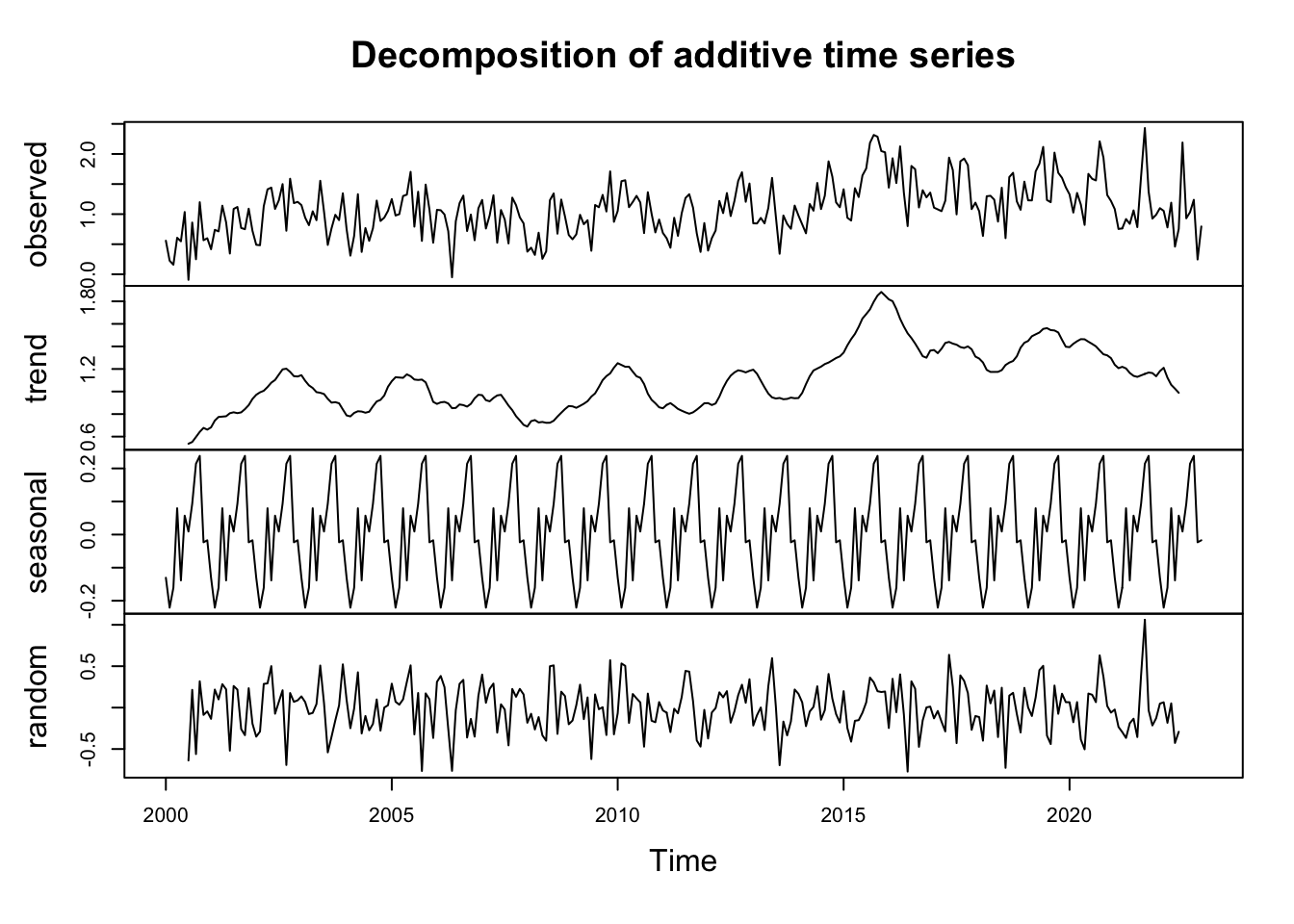

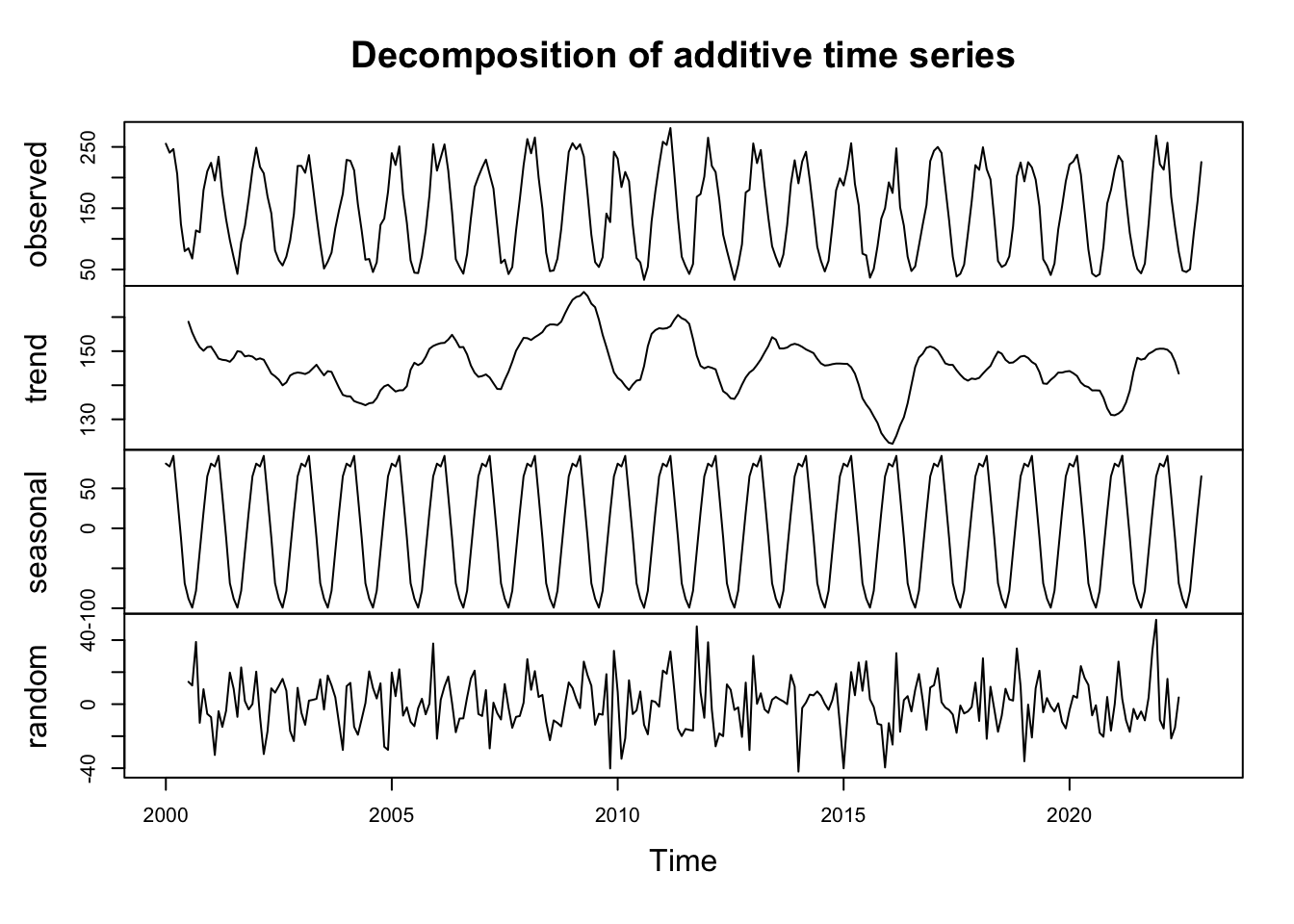

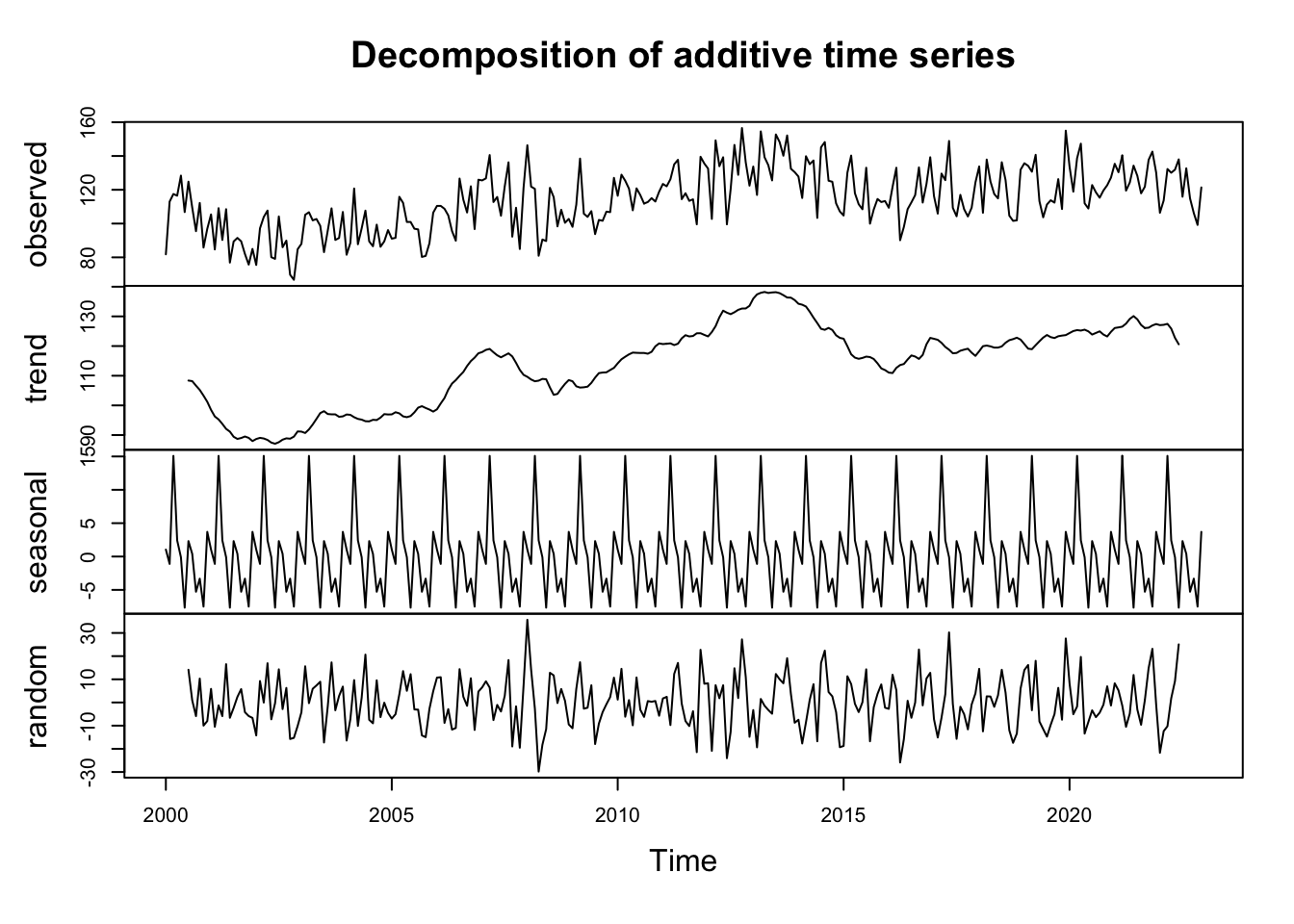

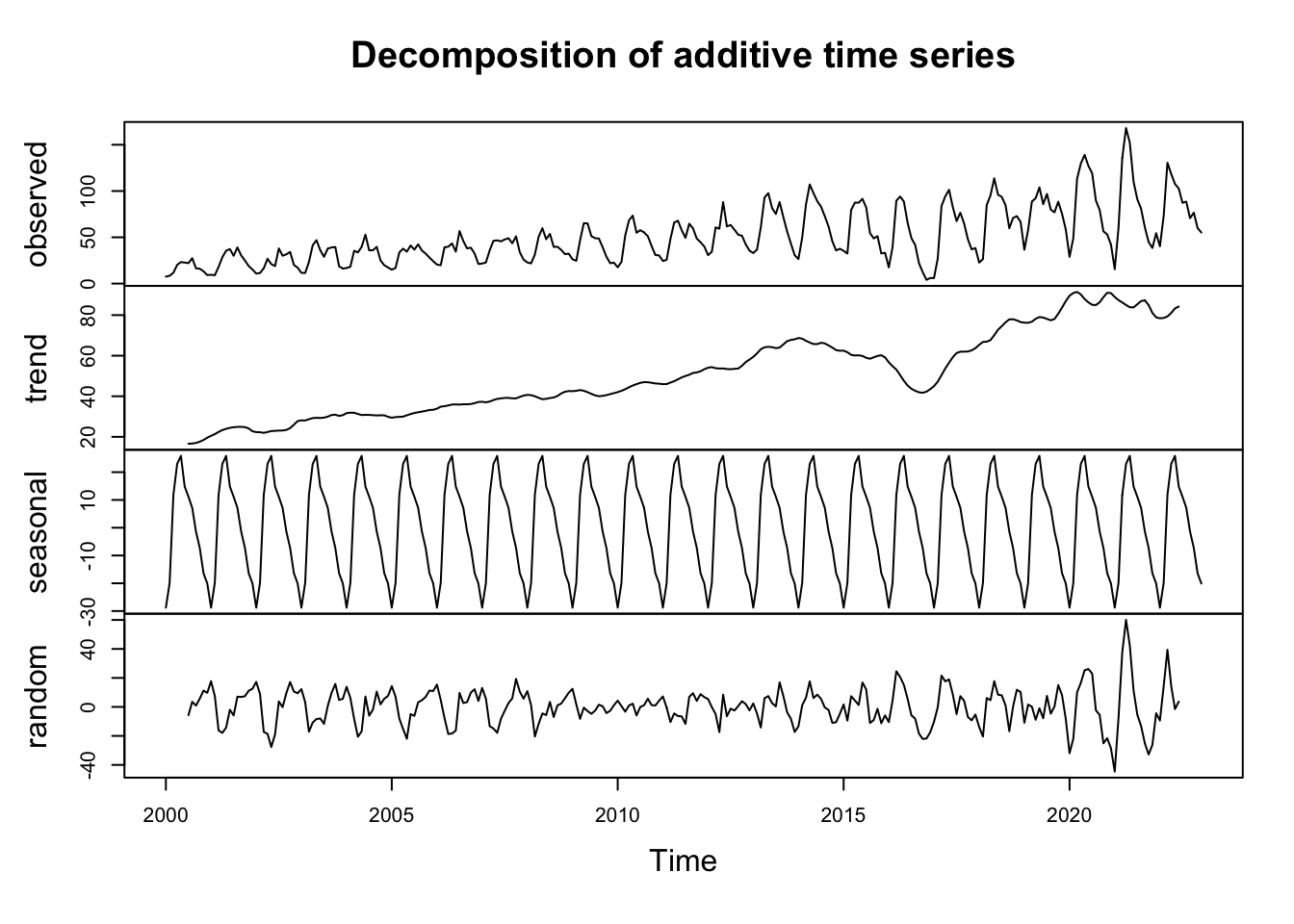

Décomposition

Utilisation de decompose pour une décomposition additive

# Décomposition

decom_CDD <- decompose(ts_CDD, type="additive")

decom_precipitations<- decompose(ts_precipitation, type="additive")

decom_temperature <- decompose(ts_temperature, type="additive")

decom_importations <- decompose(ts_importations, type="additive")

decom_importations <- decompose(ts_importations, type="additive")

decom_exportations <- decompose(ts_exportations, type = "additive")

# Plot

plot(decom_CDD)

plot(decom_temperature)

plot(decom_precipitations)

plot(decom_importations)

plot(decom_exportations)

Chacune de nos variables saisonnières est décomposé en ‘trend’, ‘seasonl’, ‘random’

Désaisonalitation

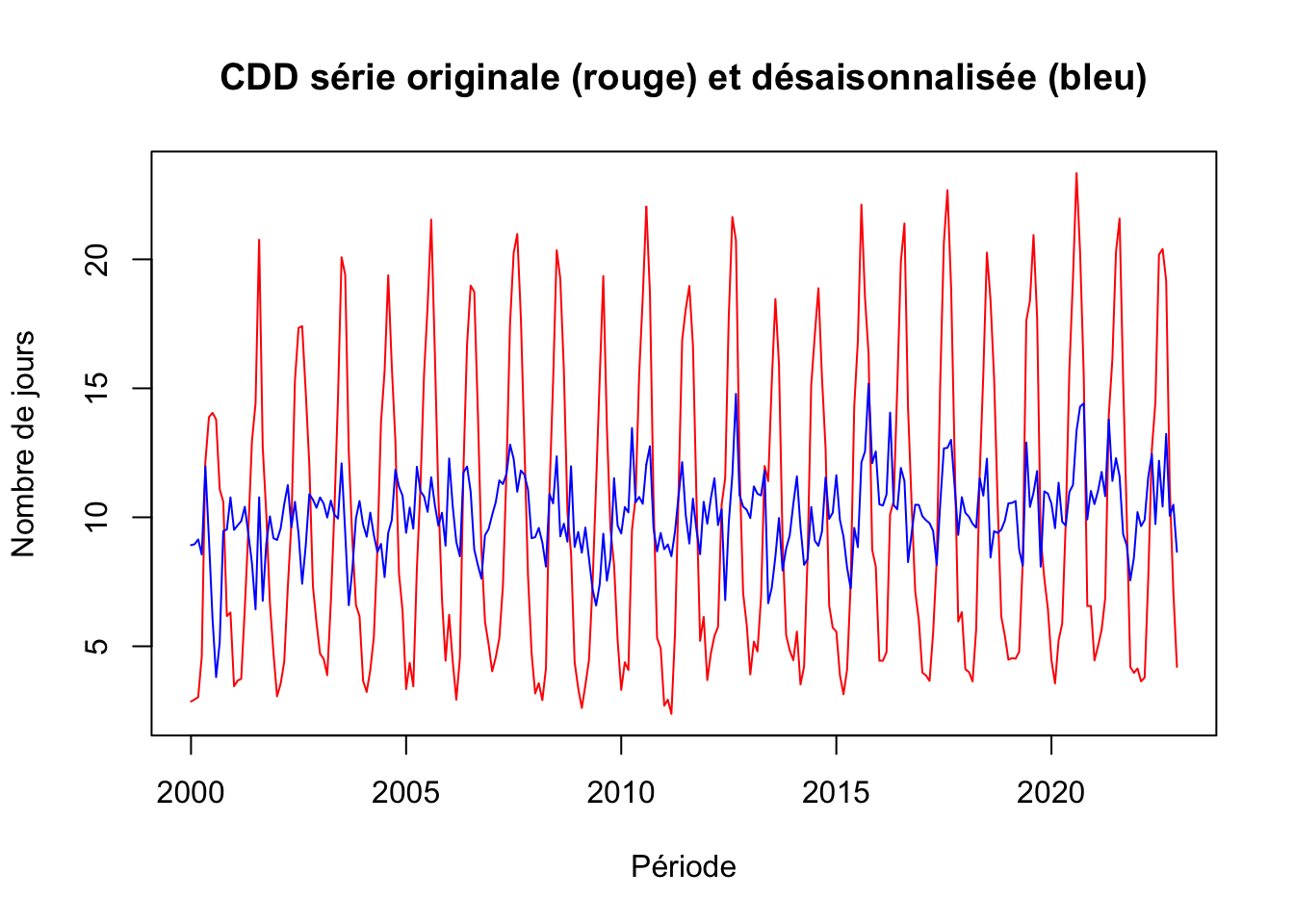

CDD

CDD_deseason <- ts_CDD - decom_CDD$seasonal

cdd <- ts.intersect(ts_CDD, CDD_deseason)

# Graphique

plot.ts(cdd,

plot.type = "single",

col = c("red", "blue"),

main = "CDD série originale (rouge) et désaisonnalisée (bleu)",

xlab = "Période",

ylab= "Nombre de jours")

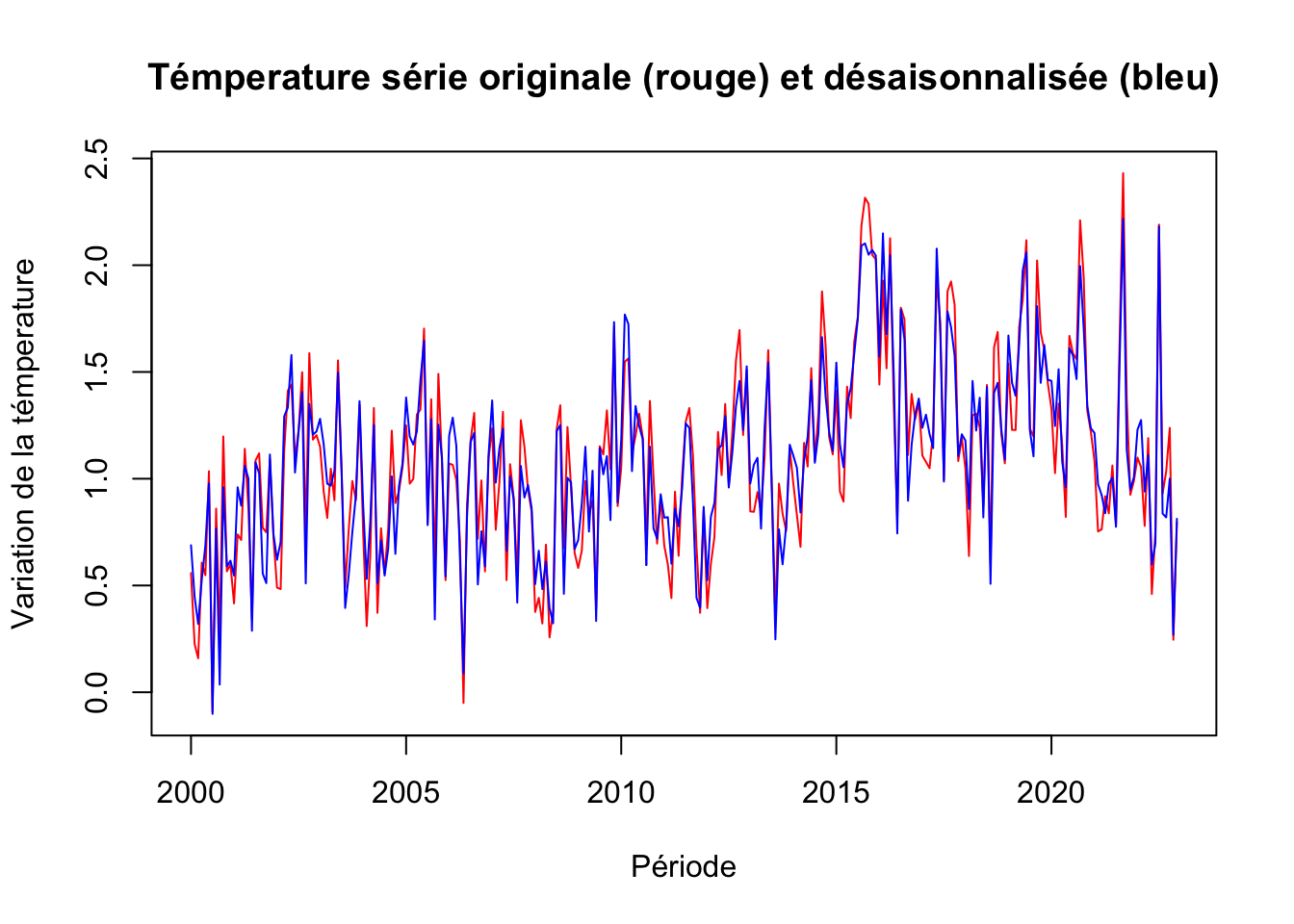

Température

temperature_deseason <- ts_temperature - decom_temperature$seasonal

temperature <- ts.intersect(ts_temperature, temperature_deseason)

# Graphique

plot.ts(temperature,

plot.type = "single",

col = c("red", "blue"),

main = "Témperature série originale (rouge) et désaisonnalisée (bleu)",

xlab = "Période",

ylab= "Variation de la témperature")

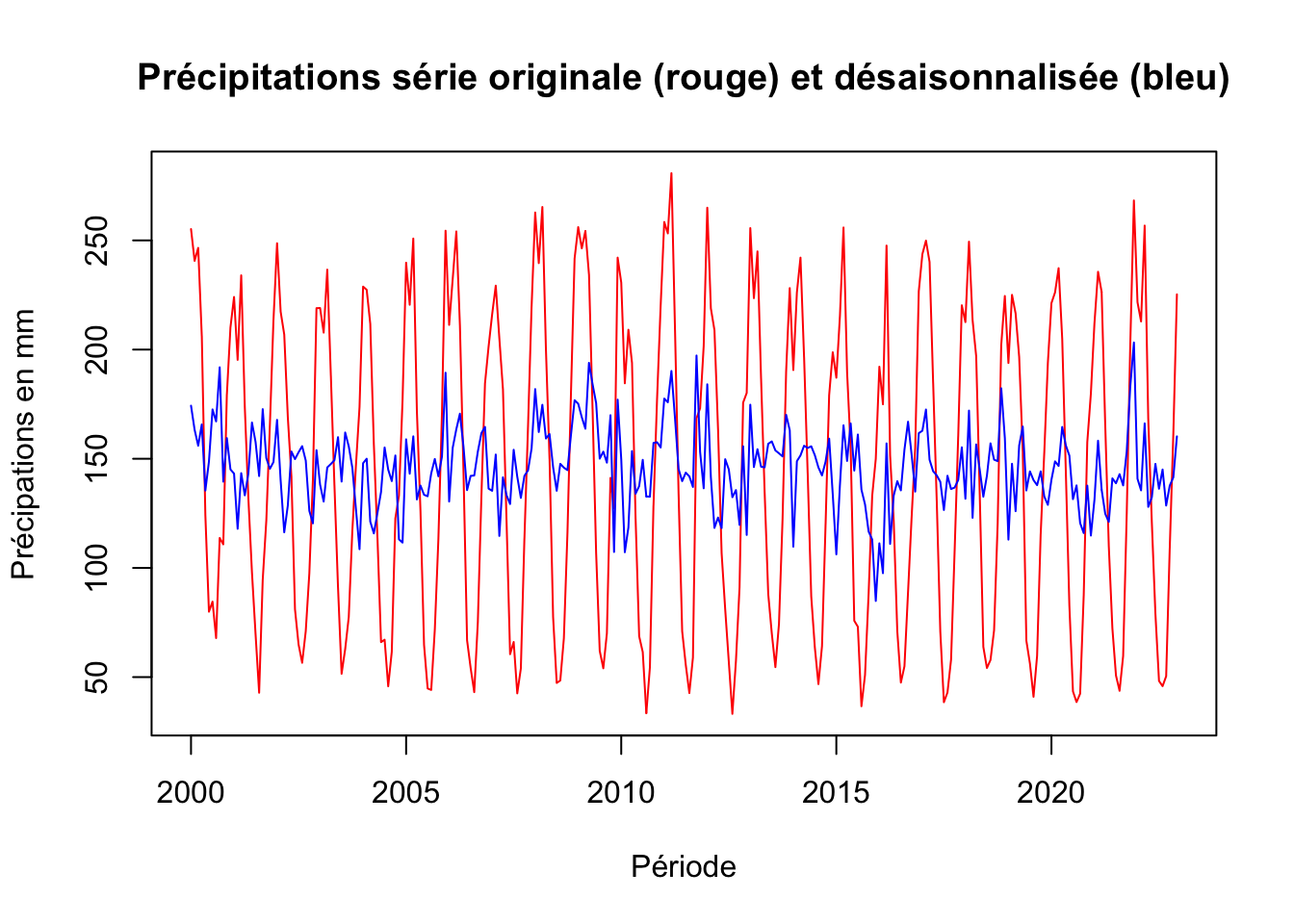

Précipitations

precipitations_deseason <- ts_precipitation - decom_precipitations$seasonal

precipitations <- ts.intersect(ts_precipitation, precipitations_deseason)

# Graphique

plot.ts(precipitations,

plot.type = "single",

col = c("red", "blue"),

main = "Précipitations série originale (rouge) et désaisonnalisée (bleu)",

xlab = "Période",

ylab= "Précipations en mm")

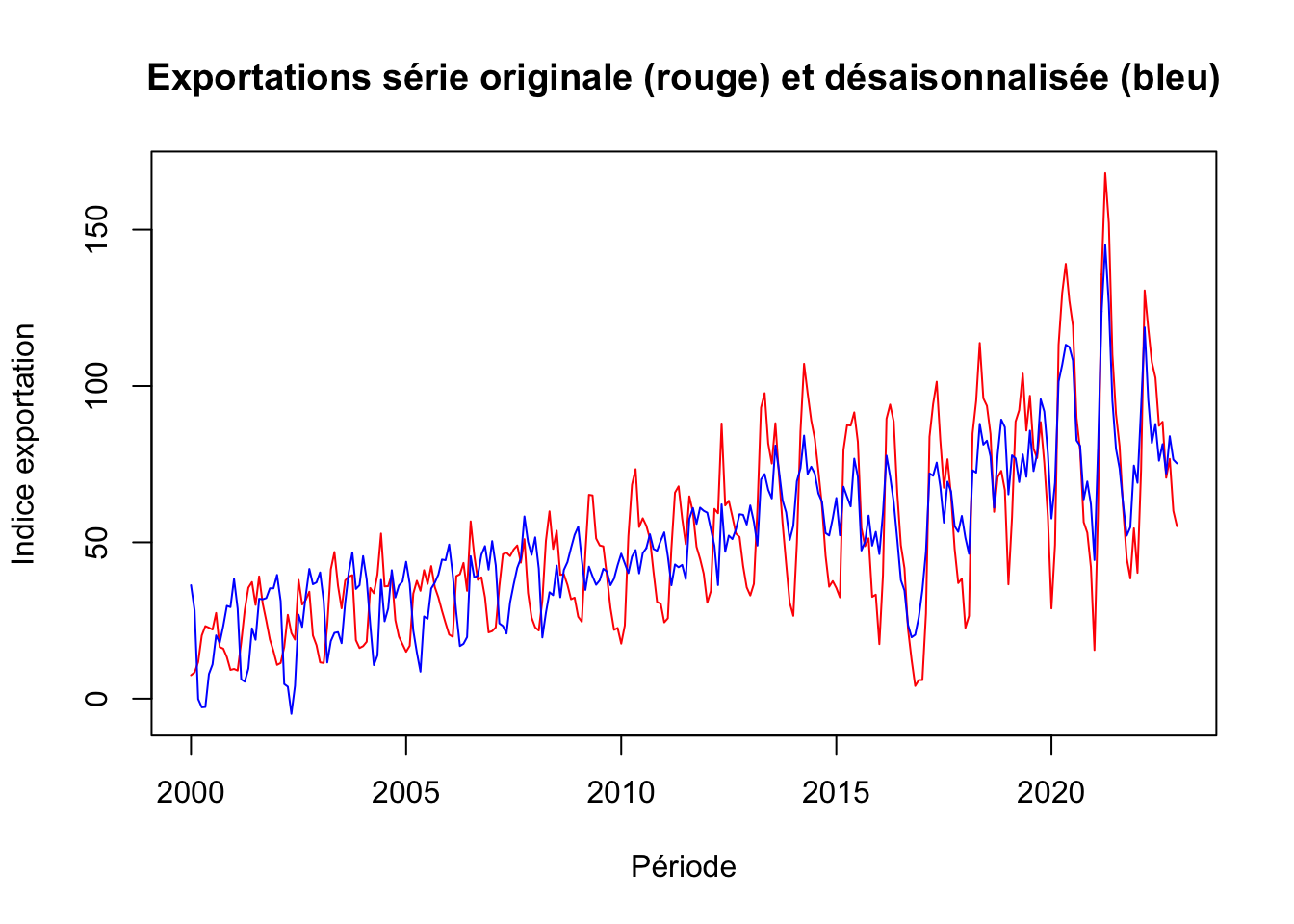

Exportation

exportations_deseason <- ts_exportations - decom_exportations$seasonal

exportations <- ts.intersect(ts_exportations, exportations_deseason)

# Graphique

plot.ts(exportations,

plot.type = "single",

col = c("red", "blue"),

main = "Exportations série originale (rouge) et désaisonnalisée (bleu)",

xlab = "Période",

ylab= "Indice exportation")

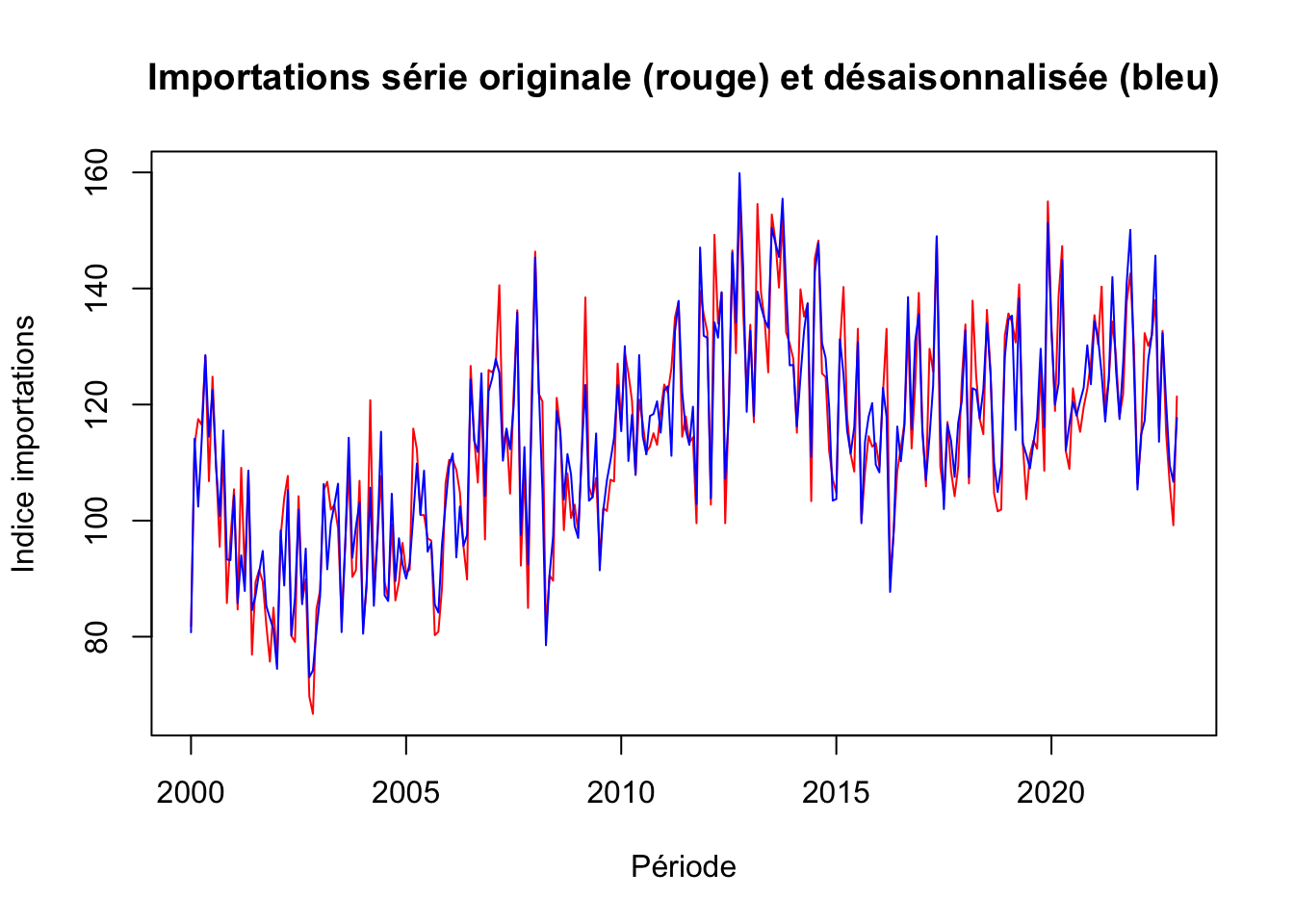

Importation

importations_deseason <- ts_importations - decom_importations$seasonal

importations <- ts.intersect(ts_importations, importations_deseason)

# Graphique

plot.ts(importations,

plot.type = "single",

col = c("red", "blue"),

main = "Importations série originale (rouge) et désaisonnalisée (bleu)",

xlab = "Période",

ylab= "Indice importations")

# CDD

adf.test(CDD_deseason, alternative = "stationary")Warning in adf.test(CDD_deseason, alternative = "stationary"): p-value smaller

than printed p-value

Augmented Dickey-Fuller Test

data: CDD_deseason

Dickey-Fuller = -6.1831, Lag order = 6, p-value = 0.01

alternative hypothesis: stationarykpss.test(CDD_deseason, null = "Trend")Warning in kpss.test(CDD_deseason, null = "Trend"): p-value greater than

printed p-value

KPSS Test for Trend Stationarity

data: CDD_deseason

KPSS Trend = 0.053447, Truncation lag parameter = 5, p-value = 0.1kpss.test(CDD_deseason, null = "Level")Warning in kpss.test(CDD_deseason, null = "Level"): p-value smaller than

printed p-value

KPSS Test for Level Stationarity

data: CDD_deseason

KPSS Level = 0.85893, Truncation lag parameter = 5, p-value = 0.01# temperature

adf.test(temperature_deseason, alternative = "stationary")

Augmented Dickey-Fuller Test

data: temperature_deseason

Dickey-Fuller = -3.9825, Lag order = 6, p-value = 0.01032

alternative hypothesis: stationarykpss.test(temperature_deseason, null = "Trend")

KPSS Test for Trend Stationarity

data: temperature_deseason

KPSS Trend = 0.14896, Truncation lag parameter = 5, p-value = 0.04753kpss.test(temperature_deseason, null = "Level")Warning in kpss.test(temperature_deseason, null = "Level"): p-value smaller

than printed p-value

KPSS Test for Level Stationarity

data: temperature_deseason

KPSS Level = 1.7965, Truncation lag parameter = 5, p-value = 0.01# precipitation

adf.test(precipitations_deseason, alternative = "stationary")Warning in adf.test(precipitations_deseason, alternative = "stationary"):

p-value smaller than printed p-value

Augmented Dickey-Fuller Test

data: precipitations_deseason

Dickey-Fuller = -5.8362, Lag order = 6, p-value = 0.01

alternative hypothesis: stationarykpss.test(precipitations_deseason, null = "Trend")Warning in kpss.test(precipitations_deseason, null = "Trend"): p-value greater

than printed p-value

KPSS Test for Trend Stationarity

data: precipitations_deseason

KPSS Trend = 0.078174, Truncation lag parameter = 5, p-value = 0.1kpss.test(precipitations_deseason, null = "Level")Warning in kpss.test(precipitations_deseason, null = "Level"): p-value greater

than printed p-value

KPSS Test for Level Stationarity

data: precipitations_deseason

KPSS Level = 0.22839, Truncation lag parameter = 5, p-value = 0.1# Importations

adf.test(importations_deseason, alternative = "stationary")

Augmented Dickey-Fuller Test

data: importations_deseason

Dickey-Fuller = -3.3037, Lag order = 6, p-value = 0.07096

alternative hypothesis: stationarykpss.test(importations_deseason, null = "Trend")Warning in kpss.test(importations_deseason, null = "Trend"): p-value smaller

than printed p-value

KPSS Test for Trend Stationarity

data: importations_deseason

KPSS Trend = 0.39913, Truncation lag parameter = 5, p-value = 0.01kpss.test(importations_deseason, null = "Level")Warning in kpss.test(importations_deseason, null = "Level"): p-value smaller

than printed p-value

KPSS Test for Level Stationarity

data: importations_deseason

KPSS Level = 2.7696, Truncation lag parameter = 5, p-value = 0.01# Differenciaiton

importation_diff <- diff(importations_deseason, differences = 1)

adf.test(importation_diff, alternative = "stationary")Warning in adf.test(importation_diff, alternative = "stationary"): p-value

smaller than printed p-value

Augmented Dickey-Fuller Test

data: importation_diff

Dickey-Fuller = -10.305, Lag order = 6, p-value = 0.01

alternative hypothesis: stationarykpss.test(importation_diff, null = "Trend")Warning in kpss.test(importation_diff, null = "Trend"): p-value greater than

printed p-value

KPSS Test for Trend Stationarity

data: importation_diff

KPSS Trend = 0.014578, Truncation lag parameter = 5, p-value = 0.1kpss.test(importation_diff, null = "Level")Warning in kpss.test(importation_diff, null = "Level"): p-value greater than

printed p-value

KPSS Test for Level Stationarity

data: importation_diff

KPSS Level = 0.031579, Truncation lag parameter = 5, p-value = 0.1# Exportations

adf.test(exportations_deseason, alternative = "stationary")Warning in adf.test(exportations_deseason, alternative = "stationary"): p-value

smaller than printed p-value

Augmented Dickey-Fuller Test

data: exportations_deseason

Dickey-Fuller = -6.2104, Lag order = 6, p-value = 0.01

alternative hypothesis: stationarykpss.test(exportations_deseason, null = "Trend")Warning in kpss.test(exportations_deseason, null = "Trend"): p-value greater

than printed p-value

KPSS Test for Trend Stationarity

data: exportations_deseason

KPSS Trend = 0.067186, Truncation lag parameter = 5, p-value = 0.1kpss.test(exportations_deseason, null = "Level")Warning in kpss.test(exportations_deseason, null = "Level"): p-value smaller

than printed p-value

KPSS Test for Level Stationarity

data: exportations_deseason

KPSS Level = 3.7622, Truncation lag parameter = 5, p-value = 0.01Différenciation des séries non stationnaires par la tendance stochastique

Tests après corrections

#|warning: false

#|message: false

# Differenciation

ipa_diff <- diff(ts_data[, "IPA"])

taux_change_diff <- diff(ts_data[, "taux_change"])

petrole_diff <- diff(ts_data[, "petrole"])

# TESTS FINAL ADF ET KPSS

#IPA

adf.test(ipa_diff, alternative = "stationary")

Augmented Dickey-Fuller Test

data: ipa_diff

Dickey-Fuller = -3.9389, Lag order = 6, p-value = 0.01251

alternative hypothesis: stationarykpss.test(ipa_diff, null = "Trend")

KPSS Test for Trend Stationarity

data: ipa_diff

KPSS Trend = 0.12657, Truncation lag parameter = 5, p-value = 0.08599kpss.test(ipa_diff, null = "Level")

KPSS Test for Level Stationarity

data: ipa_diff

KPSS Level = 0.58846, Truncation lag parameter = 5, p-value = 0.02369# Taux de change

adf.test(taux_change_diff, alternative = "stationary")Warning in adf.test(taux_change_diff, alternative = "stationary"): p-value

smaller than printed p-value

Augmented Dickey-Fuller Test

data: taux_change_diff

Dickey-Fuller = -6.4556, Lag order = 6, p-value = 0.01

alternative hypothesis: stationarykpss.test(taux_change_diff, null = "Trend")Warning in kpss.test(taux_change_diff, null = "Trend"): p-value greater than

printed p-value

KPSS Test for Trend Stationarity

data: taux_change_diff

KPSS Trend = 0.070678, Truncation lag parameter = 5, p-value = 0.1kpss.test(taux_change_diff, null = "Level")Warning in kpss.test(taux_change_diff, null = "Level"): p-value greater than

printed p-value

KPSS Test for Level Stationarity

data: taux_change_diff

KPSS Level = 0.17753, Truncation lag parameter = 5, p-value = 0.1# Pétrole

adf.test(petrole_diff, alternative = "stationary")Warning in adf.test(petrole_diff, alternative = "stationary"): p-value smaller

than printed p-value

Augmented Dickey-Fuller Test

data: petrole_diff

Dickey-Fuller = -6.3498, Lag order = 6, p-value = 0.01

alternative hypothesis: stationarykpss.test(petrole_diff, null = "Trend")Warning in kpss.test(petrole_diff, null = "Trend"): p-value greater than

printed p-value

KPSS Test for Trend Stationarity

data: petrole_diff

KPSS Trend = 0.038075, Truncation lag parameter = 5, p-value = 0.1kpss.test(petrole_diff, null = "Level")Warning in kpss.test(petrole_diff, null = "Level"): p-value greater than

printed p-value

KPSS Test for Level Stationarity

data: petrole_diff

KPSS Level = 0.055257, Truncation lag parameter = 5, p-value = 0.1# smic

adf.test(ts_SMIC, alternative = "stationary")Warning in adf.test(ts_SMIC, alternative = "stationary"): p-value smaller than

printed p-value

Augmented Dickey-Fuller Test

data: ts_SMIC

Dickey-Fuller = -6.0839, Lag order = 6, p-value = 0.01

alternative hypothesis: stationarykpss.test(ts_SMIC, null = "Trend")Warning in kpss.test(ts_SMIC, null = "Trend"): p-value greater than printed

p-value

KPSS Test for Trend Stationarity

data: ts_SMIC

KPSS Trend = 0.018996, Truncation lag parameter = 5, p-value = 0.1kpss.test(ts_SMIC, null = "Level")Warning in kpss.test(ts_SMIC, null = "Level"): p-value greater than printed

p-value

KPSS Test for Level Stationarity

data: ts_SMIC

KPSS Level = 0.020247, Truncation lag parameter = 5, p-value = 0.1Data frame avec les variables stationnaires

Maintenant que nos séries ont été rendues stationnaires, nous allons créer un nouveau dataframe avec ces variables. Cependant, du fait que la différenciation entraîne la perte de la première observation, nous devrons également supprimer la première observation des séries qui étaient déjà stationnaires. Ainsi, nous ajusterons toutes les séries pour aligner leurs longueurs.

#|warning: false

#|message: false

# Suppression de la première observation des séries non différenciées

# dataframe avec des longueurs alignées

stationnaire_data <- data.frame(

Date = data_adj$Date[-1],

IPA = ipa_diff,

CDD = CDD_deseason[-1],

importations = importation_diff,

exportations = exportations_deseason[-1],

petrole = petrole_diff,

taux_change = taux_change_diff,

SMIC = ts_SMIC[-1],

precipitation = precipitations_deseason[-1],

temperature = temperature_deseason[-1]

)#|warning: false

#|message: false

# Re vérification du test ADF

lapply(stationnaire_data[variables], function(x) {

adf.test(x, alternative = "stationary")

})Warning in adf.test(x, alternative = "stationary"): p-value smaller than

printed p-value

Warning in adf.test(x, alternative = "stationary"): p-value smaller than

printed p-value

Warning in adf.test(x, alternative = "stationary"): p-value smaller than

printed p-value

Warning in adf.test(x, alternative = "stationary"): p-value smaller than

printed p-value

Warning in adf.test(x, alternative = "stationary"): p-value smaller than

printed p-value

Warning in adf.test(x, alternative = "stationary"): p-value smaller than

printed p-value

Warning in adf.test(x, alternative = "stationary"): p-value smaller than

printed p-value$IPA

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -3.9389, Lag order = 6, p-value = 0.01251

alternative hypothesis: stationary

$CDD

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -6.4265, Lag order = 6, p-value = 0.01

alternative hypothesis: stationary

$precipitation

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -5.8847, Lag order = 6, p-value = 0.01

alternative hypothesis: stationary

$temperature

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -3.9132, Lag order = 6, p-value = 0.01379

alternative hypothesis: stationary

$exportations

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -6.2011, Lag order = 6, p-value = 0.01

alternative hypothesis: stationary

$importations

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -10.305, Lag order = 6, p-value = 0.01

alternative hypothesis: stationary

$taux_change

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -6.4556, Lag order = 6, p-value = 0.01

alternative hypothesis: stationary

$SMIC

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -6.0722, Lag order = 6, p-value = 0.01

alternative hypothesis: stationary

$petrole

Augmented Dickey-Fuller Test

data: x

Dickey-Fuller = -6.3498, Lag order = 6, p-value = 0.01

alternative hypothesis: stationary# test kpss

lapply(stationnaire_data[variables], function(x) {

kpss.test(x, null = "Trend")

})Warning in kpss.test(x, null = "Trend"): p-value greater than printed p-valueWarning in kpss.test(x, null = "Trend"): p-value greater than printed p-value

Warning in kpss.test(x, null = "Trend"): p-value greater than printed p-value

Warning in kpss.test(x, null = "Trend"): p-value greater than printed p-value

Warning in kpss.test(x, null = "Trend"): p-value greater than printed p-value

Warning in kpss.test(x, null = "Trend"): p-value greater than printed p-value

Warning in kpss.test(x, null = "Trend"): p-value greater than printed p-value$IPA

KPSS Test for Trend Stationarity

data: x

KPSS Trend = 0.12657, Truncation lag parameter = 5, p-value = 0.08599

$CDD

KPSS Test for Trend Stationarity

data: x

KPSS Trend = 0.052585, Truncation lag parameter = 5, p-value = 0.1

$precipitation

KPSS Test for Trend Stationarity

data: x

KPSS Trend = 0.081222, Truncation lag parameter = 5, p-value = 0.1

$temperature

KPSS Test for Trend Stationarity

data: x

KPSS Trend = 0.14976, Truncation lag parameter = 5, p-value = 0.04686

$exportations

KPSS Test for Trend Stationarity

data: x

KPSS Trend = 0.066037, Truncation lag parameter = 5, p-value = 0.1

$importations

KPSS Test for Trend Stationarity

data: x

KPSS Trend = 0.014578, Truncation lag parameter = 5, p-value = 0.1

$taux_change

KPSS Test for Trend Stationarity

data: x

KPSS Trend = 0.070678, Truncation lag parameter = 5, p-value = 0.1

$SMIC

KPSS Test for Trend Stationarity

data: x

KPSS Trend = 0.019059, Truncation lag parameter = 5, p-value = 0.1

$petrole

KPSS Test for Trend Stationarity

data: x

KPSS Trend = 0.038075, Truncation lag parameter = 5, p-value = 0.1# test kpss

lapply(stationnaire_data[variables], function(x) {

kpss.test(x, null = "Level")

})Warning in kpss.test(x, null = "Level"): p-value smaller than printed p-valueWarning in kpss.test(x, null = "Level"): p-value greater than printed p-valueWarning in kpss.test(x, null = "Level"): p-value smaller than printed p-value

Warning in kpss.test(x, null = "Level"): p-value smaller than printed p-valueWarning in kpss.test(x, null = "Level"): p-value greater than printed p-value

Warning in kpss.test(x, null = "Level"): p-value greater than printed p-value

Warning in kpss.test(x, null = "Level"): p-value greater than printed p-value

Warning in kpss.test(x, null = "Level"): p-value greater than printed p-value$IPA

KPSS Test for Level Stationarity

data: x

KPSS Level = 0.58846, Truncation lag parameter = 5, p-value = 0.02369

$CDD

KPSS Test for Level Stationarity

data: x

KPSS Level = 0.83849, Truncation lag parameter = 5, p-value = 0.01

$precipitation

KPSS Test for Level Stationarity

data: x

KPSS Level = 0.21186, Truncation lag parameter = 5, p-value = 0.1

$temperature

KPSS Test for Level Stationarity

data: x

KPSS Level = 1.7803, Truncation lag parameter = 5, p-value = 0.01

$exportations

KPSS Test for Level Stationarity

data: x

KPSS Level = 3.7628, Truncation lag parameter = 5, p-value = 0.01

$importations

KPSS Test for Level Stationarity

data: x

KPSS Level = 0.031579, Truncation lag parameter = 5, p-value = 0.1

$taux_change

KPSS Test for Level Stationarity

data: x

KPSS Level = 0.17753, Truncation lag parameter = 5, p-value = 0.1

$SMIC

KPSS Test for Level Stationarity

data: x

KPSS Level = 0.019994, Truncation lag parameter = 5, p-value = 0.1

$petrole

KPSS Test for Level Stationarity

data: x

KPSS Level = 0.055257, Truncation lag parameter = 5, p-value = 0.1Sélection des variables

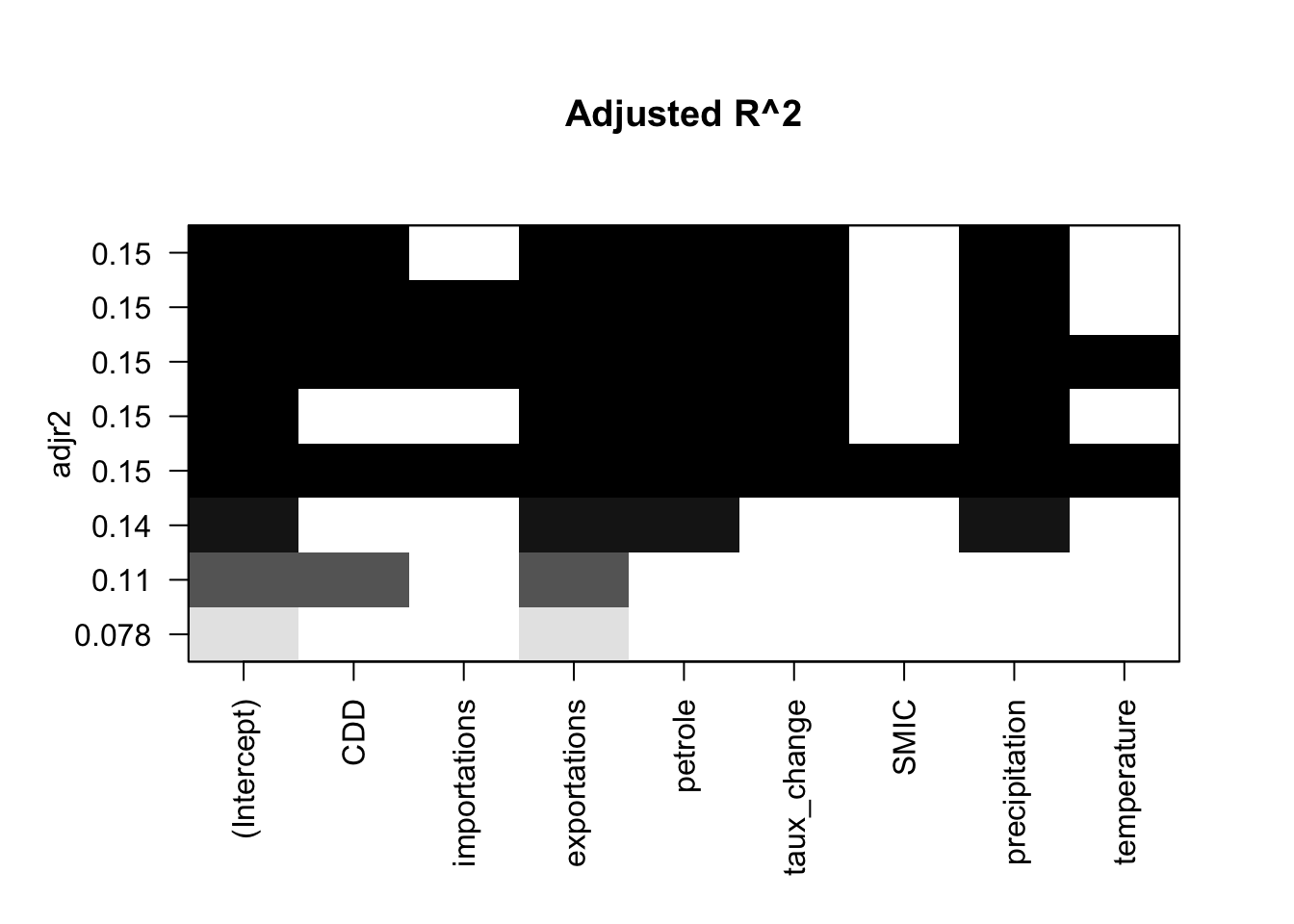

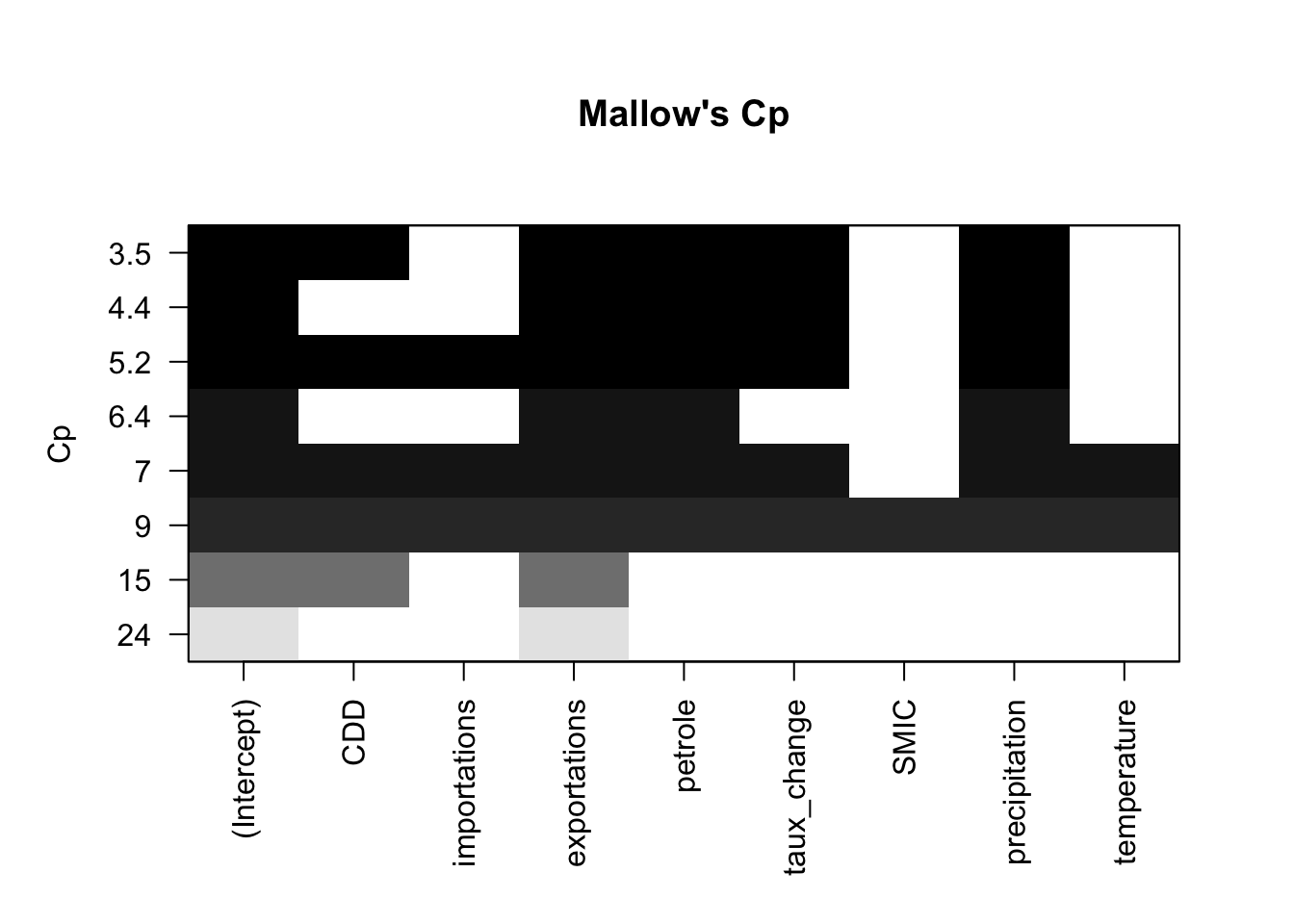

1er méthode

leaps <- regsubsets(IPA ~ CDD + importations + exportations + petrole + taux_change + SMIC + precipitation + temperature, data=stationnaire_data, nbest=1, method=c("exhaustive"))

summary(leaps)Subset selection object

Call: regsubsets.formula(IPA ~ CDD + importations + exportations +

petrole + taux_change + SMIC + precipitation + temperature,

data = stationnaire_data, nbest = 1, method = c("exhaustive"))

8 Variables (and intercept)

Forced in Forced out

CDD FALSE FALSE

importations FALSE FALSE

exportations FALSE FALSE

petrole FALSE FALSE

taux_change FALSE FALSE

SMIC FALSE FALSE

precipitation FALSE FALSE

temperature FALSE FALSE

1 subsets of each size up to 8

Selection Algorithm: exhaustive

CDD importations exportations petrole taux_change SMIC precipitation

1 ( 1 ) " " " " "*" " " " " " " " "

2 ( 1 ) "*" " " "*" " " " " " " " "

3 ( 1 ) " " " " "*" "*" " " " " "*"

4 ( 1 ) " " " " "*" "*" "*" " " "*"

5 ( 1 ) "*" " " "*" "*" "*" " " "*"

6 ( 1 ) "*" "*" "*" "*" "*" " " "*"

7 ( 1 ) "*" "*" "*" "*" "*" " " "*"

8 ( 1 ) "*" "*" "*" "*" "*" "*" "*"

temperature

1 ( 1 ) " "

2 ( 1 ) " "

3 ( 1 ) " "

4 ( 1 ) " "

5 ( 1 ) " "

6 ( 1 ) " "

7 ( 1 ) "*"

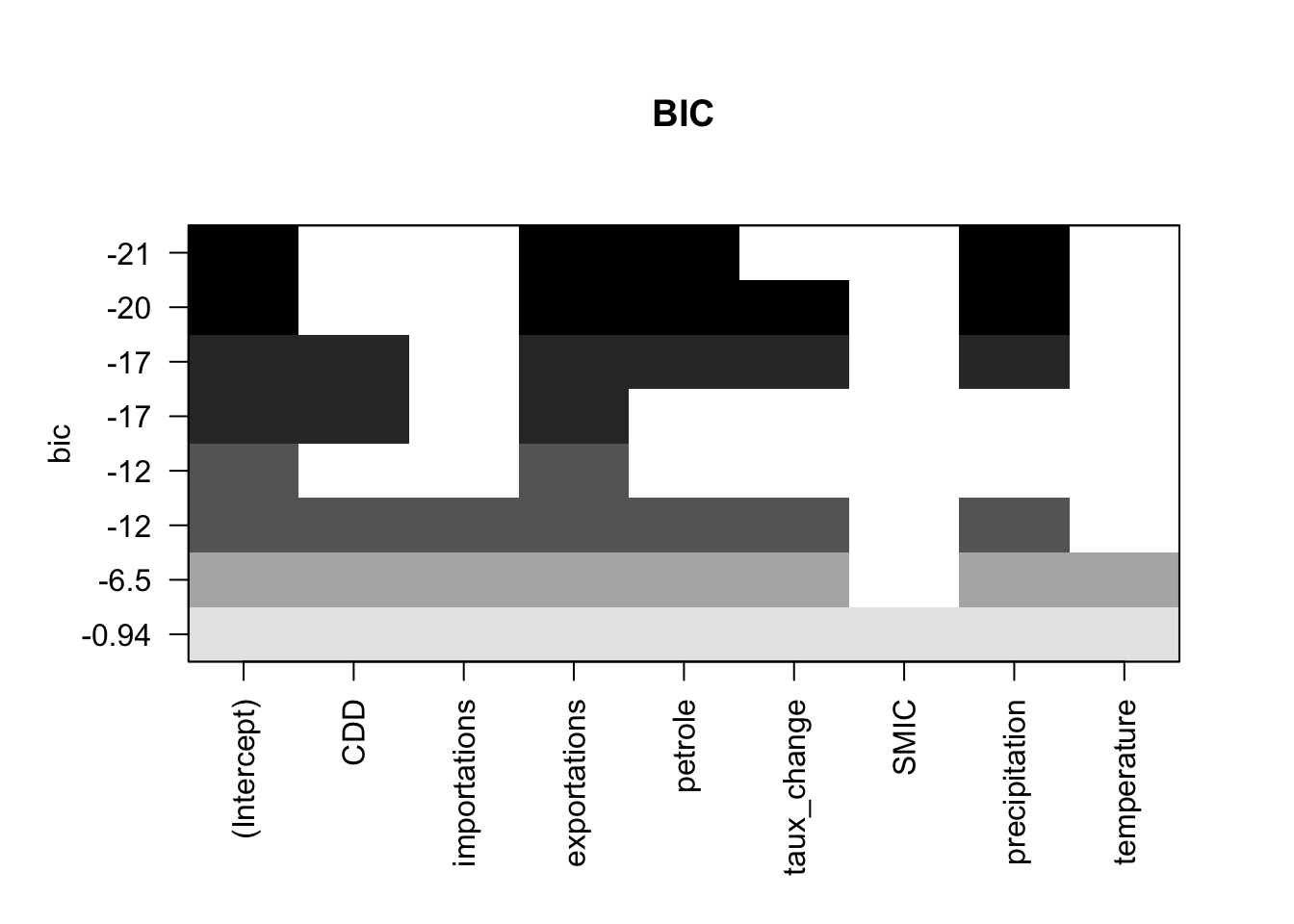

8 ( 1 ) "*" # Résumé des critères pour choisir le modèle optimal

res.sum <- summary(leaps)

optimal_model <- data.frame(

Adj.R2 = which.max(res.sum$adjr2),

CP = which.min(res.sum$cp),

BIC = which.min(res.sum$bic)

)

# Affichage des résultats

print(optimal_model) Adj.R2 CP BIC

1 5 5 3print(res.sum)Subset selection object

Call: regsubsets.formula(IPA ~ CDD + importations + exportations +

petrole + taux_change + SMIC + precipitation + temperature,

data = stationnaire_data, nbest = 1, method = c("exhaustive"))

8 Variables (and intercept)

Forced in Forced out

CDD FALSE FALSE

importations FALSE FALSE

exportations FALSE FALSE

petrole FALSE FALSE

taux_change FALSE FALSE

SMIC FALSE FALSE

precipitation FALSE FALSE

temperature FALSE FALSE

1 subsets of each size up to 8

Selection Algorithm: exhaustive

CDD importations exportations petrole taux_change SMIC precipitation

1 ( 1 ) " " " " "*" " " " " " " " "

2 ( 1 ) "*" " " "*" " " " " " " " "

3 ( 1 ) " " " " "*" "*" " " " " "*"

4 ( 1 ) " " " " "*" "*" "*" " " "*"

5 ( 1 ) "*" " " "*" "*" "*" " " "*"

6 ( 1 ) "*" "*" "*" "*" "*" " " "*"

7 ( 1 ) "*" "*" "*" "*" "*" " " "*"

8 ( 1 ) "*" "*" "*" "*" "*" "*" "*"

temperature

1 ( 1 ) " "

2 ( 1 ) " "

3 ( 1 ) " "

4 ( 1 ) " "

5 ( 1 ) " "

6 ( 1 ) " "

7 ( 1 ) "*"

8 ( 1 ) "*" # plot a table of models showing variables in each model.

# models are ordered by the selection statistic

# Other options for plot( ) are bic, Cp, and adjr2

par(mfrow=c(1,1))

plot(leaps, scale="adjr2", main = "Adjusted R^2")

plot(leaps, scale="Cp", main = "Mallow's Cp")

plot(leaps, scale="bic", main = "BIC")

Deuxième approche de sélection

# Modele avec toutes les variables, ne sera pas utilisé dans notre analyse - voir méthode STEP

modele1 <- lm(IPA ~ CDD + importations + exportations + petrole + taux_change + SMIC + precipitation + temperature, data=stationnaire_data)

summary(modele1)

Call:

lm(formula = IPA ~ CDD + importations + exportations + petrole +

taux_change + SMIC + precipitation + temperature, data = stationnaire_data)

Residuals:

Min 1Q Median 3Q Max

-63.082 -9.647 -1.660 7.512 114.297

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 3.50014 21.25705 0.165 0.869338

CDD 1.67054 0.95321 1.753 0.080834 .

importations 0.04751 0.08371 0.568 0.570832

exportations 0.23078 0.05235 4.409 1.51e-05 ***

petrole 0.75790 0.21168 3.580 0.000408 ***

taux_change 21.03398 10.31384 2.039 0.042399 *

SMIC 0.00493 0.05341 0.092 0.926529

precipitation -0.16864 0.08630 -1.954 0.051731 .

temperature -1.30279 3.41350 -0.382 0.703021

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 20.1 on 266 degrees of freedom

Multiple R-squared: 0.1708, Adjusted R-squared: 0.1458

F-statistic: 6.847 on 8 and 266 DF, p-value: 3.489e-08# Step : Sélection des variables explicatives significatives (modèle linéaire = modele1 )

modele0 <- lm(IPA~1,data=stationnaire_data)

summary(modele0)

Call:

lm(formula = IPA ~ 1, data = stationnaire_data)

Residuals:

Min 1Q Median 3Q Max

-60.985 -10.203 -3.965 5.489 132.912

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 7.146 1.311 5.449 1.13e-07 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 21.75 on 274 degrees of freedom### Méthode ascendante

step1 <- step(modele0, scope=list(lower=modele0, upper=modele1), data=stationnaire_data, direction="forward")Start: AIC=1694.75

IPA ~ 1

Df Sum of Sq RSS AIC

+ exportations 1 10514.2 119087 1673.5

+ CDD 1 7482.6 122118 1680.4

+ precipitation 1 5178.7 124422 1685.5

+ petrole 1 3258.2 126343 1689.8

+ temperature 1 2522.9 127078 1691.3

<none> 129601 1694.8

+ taux_change 1 396.9 129204 1695.9

+ importations 1 388.0 129213 1695.9

+ SMIC 1 4.3 129597 1696.7

Step: AIC=1673.48

IPA ~ exportations

Df Sum of Sq RSS AIC

+ CDD 1 4509.8 114577 1664.9

+ precipitation 1 4286.2 114801 1665.4

+ petrole 1 3708.8 115378 1666.8

<none> 119087 1673.5

+ temperature 1 526.8 118560 1674.3

+ taux_change 1 294.5 118792 1674.8

+ importations 1 277.5 118809 1674.8

+ SMIC 1 36.9 119050 1675.4

Step: AIC=1664.86

IPA ~ exportations + CDD

Df Sum of Sq RSS AIC

+ petrole 1 3654.2 110923 1658.0

+ precipitation 1 1121.9 113455 1664.2

<none> 114577 1664.9

+ taux_change 1 394.5 114182 1665.9

+ importations 1 341.6 114235 1666.0

+ SMIC 1 13.6 114563 1666.8

+ temperature 1 0.1 114577 1666.9

Step: AIC=1657.95

IPA ~ exportations + CDD + petrole

Df Sum of Sq RSS AIC

+ taux_change 1 1630.73 109292 1655.9

+ precipitation 1 1545.06 109378 1656.1

<none> 110923 1658.0

+ importations 1 220.08 110703 1659.4

+ temperature 1 33.87 110889 1659.9

+ SMIC 1 27.01 110896 1659.9

Step: AIC=1655.88

IPA ~ exportations + CDD + petrole + taux_change

Df Sum of Sq RSS AIC

+ precipitation 1 1608.85 107683 1653.8

<none> 109292 1655.9

+ importations 1 239.66 109052 1657.3

+ temperature 1 26.53 109265 1657.8

+ SMIC 1 0.14 109292 1657.9

Step: AIC=1653.8

IPA ~ exportations + CDD + petrole + taux_change + precipitation

Df Sum of Sq RSS AIC

<none> 107683 1653.8

+ importations 1 150.885 107532 1655.4

+ temperature 1 77.809 107605 1655.6

+ SMIC 1 3.351 107680 1655.8### Méthode descendante

step2 <- step(modele1,data=stationnaire_data,direction="backward")Start: AIC=1659.26

IPA ~ CDD + importations + exportations + petrole + taux_change +

SMIC + precipitation + temperature

Df Sum of Sq RSS AIC

- SMIC 1 3.4 107474 1657.3

- temperature 1 58.9 107530 1657.4

- importations 1 130.1 107601 1657.6

<none> 107471 1659.3

- CDD 1 1240.9 108712 1660.4

- precipitation 1 1542.9 109014 1661.2

- taux_change 1 1680.4 109151 1661.5

- petrole 1 5179.2 112650 1670.2

- exportations 1 7852.3 115323 1676.7

Step: AIC=1657.26

IPA ~ CDD + importations + exportations + petrole + taux_change +

precipitation + temperature

Df Sum of Sq RSS AIC

- temperature 1 58.0 107532 1655.4

- importations 1 131.1 107605 1655.6

<none> 107474 1657.3

- CDD 1 1240.1 108714 1658.4

- precipitation 1 1539.4 109014 1659.2

- taux_change 1 1722.5 109197 1659.6

- petrole 1 5182.5 112657 1668.2

- exportations 1 7890.1 115364 1674.8

Step: AIC=1655.41

IPA ~ CDD + importations + exportations + petrole + taux_change +

precipitation

Df Sum of Sq RSS AIC

- importations 1 150.9 107683 1653.8

<none> 107532 1655.4

- CDD 1 1194.3 108727 1656.5

- precipitation 1 1520.1 109052 1657.3

- taux_change 1 1708.8 109241 1657.8

- petrole 1 5262.3 112795 1666.5

- exportations 1 8068.0 115600 1673.3

Step: AIC=1653.8

IPA ~ CDD + exportations + petrole + taux_change + precipitation

Df Sum of Sq RSS AIC

<none> 107683 1653.8

- CDD 1 1142.0 108825 1654.7

- precipitation 1 1608.9 109292 1655.9

- taux_change 1 1694.5 109378 1656.1

- petrole 1 5390.6 113074 1665.2

- exportations 1 8176.7 115860 1671.9### Méthode double

#méthode dans les 2 sens

step3 <- step(modele0,scope=list(upper=modele1),data=stationnaire_data,direction="both")Start: AIC=1694.75

IPA ~ 1

Df Sum of Sq RSS AIC

+ exportations 1 10514.2 119087 1673.5

+ CDD 1 7482.6 122118 1680.4

+ precipitation 1 5178.7 124422 1685.5

+ petrole 1 3258.2 126343 1689.8

+ temperature 1 2522.9 127078 1691.3

<none> 129601 1694.8

+ taux_change 1 396.9 129204 1695.9

+ importations 1 388.0 129213 1695.9

+ SMIC 1 4.3 129597 1696.7

Step: AIC=1673.48

IPA ~ exportations

Df Sum of Sq RSS AIC

+ CDD 1 4509.8 114577 1664.9

+ precipitation 1 4286.2 114801 1665.4

+ petrole 1 3708.8 115378 1666.8

<none> 119087 1673.5

+ temperature 1 526.8 118560 1674.3

+ taux_change 1 294.5 118792 1674.8

+ importations 1 277.5 118809 1674.8

+ SMIC 1 36.9 119050 1675.4

- exportations 1 10514.2 129601 1694.8

Step: AIC=1664.86

IPA ~ exportations + CDD

Df Sum of Sq RSS AIC

+ petrole 1 3654.2 110923 1658.0

+ precipitation 1 1121.9 113455 1664.2

<none> 114577 1664.9

+ taux_change 1 394.5 114182 1665.9

+ importations 1 341.6 114235 1666.0

+ SMIC 1 13.6 114563 1666.8

+ temperature 1 0.1 114577 1666.9

- CDD 1 4509.8 119087 1673.5

- exportations 1 7541.5 122118 1680.4

Step: AIC=1657.95

IPA ~ exportations + CDD + petrole

Df Sum of Sq RSS AIC

+ taux_change 1 1630.7 109292 1655.9

+ precipitation 1 1545.1 109378 1656.1

<none> 110923 1658.0

+ importations 1 220.1 110703 1659.4

+ temperature 1 33.9 110889 1659.9

+ SMIC 1 27.0 110896 1659.9

- petrole 1 3654.2 114577 1664.9

- CDD 1 4455.3 115378 1666.8

- exportations 1 7928.8 118852 1674.9

Step: AIC=1655.88

IPA ~ exportations + CDD + petrole + taux_change

Df Sum of Sq RSS AIC

+ precipitation 1 1608.9 107683 1653.8

<none> 109292 1655.9

+ importations 1 239.7 109052 1657.3

+ temperature 1 26.5 109265 1657.8

+ SMIC 1 0.1 109292 1657.9

- taux_change 1 1630.7 110923 1658.0

- CDD 1 4665.5 113958 1665.4

- petrole 1 4890.5 114182 1665.9

- exportations 1 7751.2 117043 1672.7

Step: AIC=1653.8

IPA ~ exportations + CDD + petrole + taux_change + precipitation

Df Sum of Sq RSS AIC

<none> 107683 1653.8

- CDD 1 1142.0 108825 1654.7

+ importations 1 150.9 107532 1655.4

+ temperature 1 77.8 107605 1655.6

+ SMIC 1 3.4 107680 1655.8

- precipitation 1 1608.9 109292 1655.9

- taux_change 1 1694.5 109378 1656.1

- petrole 1 5390.6 113074 1665.2

- exportations 1 8176.7 115860 1671.9MODELES

Après les méthodes de sélections les variables IPA ~ exportations + CDD + petrole + taux_change + precipitation

1. Modèle

1 retenue

lm_model1 <- lm(IPA ~ exportations + CDD + petrole + taux_change + precipitation, data=stationnaire_data)

summary(lm_model1)

Call:

lm(formula = IPA ~ exportations + CDD + petrole + taux_change +

precipitation, data = stationnaire_data)

Residuals:

Min 1Q Median 3Q Max

-62.049 -9.874 -1.524 7.272 114.365

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 2.78407 18.61192 0.150 0.881204

exportations 0.22733 0.05030 4.520 9.29e-06 ***

CDD 1.57990 0.93540 1.689 0.092376 .

petrole 0.77049 0.20997 3.670 0.000293 ***

taux_change 20.96618 10.19045 2.057 0.040608 *

precipitation -0.16106 0.08034 -2.005 0.045992 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 20.01 on 269 degrees of freedom

Multiple R-squared: 0.1691, Adjusted R-squared: 0.1537

F-statistic: 10.95 on 5 and 269 DF, p-value: 1.316e-09Hypothèses

Test de normalité des résidus

# Résidus

# Test de normalité des résidus

residus <- residuals(lm_model1)

# Test de normalité des résidus

ks.test(residus, "pnorm", mean = mean(residus), sd = sd(residus))

Asymptotic one-sample Kolmogorov-Smirnov test

data: residus

D = 0.11327, p-value = 0.001723

alternative hypothesis: two-sidedp-value = 0.001723, Refus de l’hypothèse de normalité des résidus au seuil de risque de 5%

Test d’homoscédasticité des résidus

# Test de Breusch-Pagan pour l'hétéroscédasticité

bptest(lm_model1)

studentized Breusch-Pagan test

data: lm_model1

BP = 26.02, df = 5, p-value = 8.844e-05p-value = 8.844e-05, Refus de l’hypothèse d’homoscédacticité des résidus au seuil de risque de 5%

Forme fonctionnelle

# Test RESET

reset(lm_model1)

RESET test

data: lm_model1

RESET = 6.6669, df1 = 2, df2 = 267, p-value = 0.001495p-value = 0.001495; Forme fonctionnelle linéaire du modèle spécifié acceptée au seuil de 5%

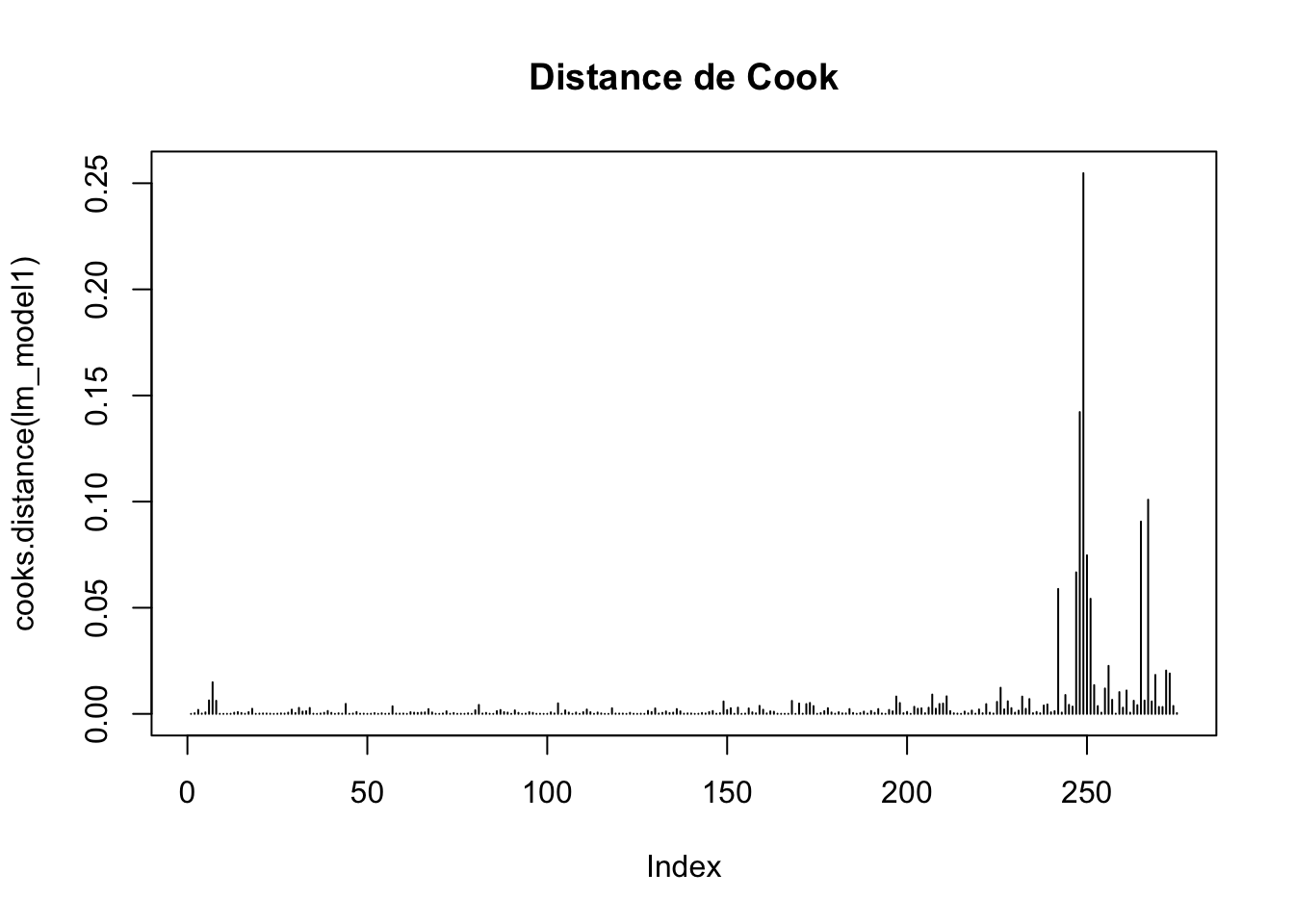

Analyse des observations influençant l’estimation

# Distance de Cook pour identifier les points influents

plot(cooks.distance(lm_model1), type = "h", main = "Distance de Cook")

multicollinéarité

vif(lm_model1) exportations CDD petrole taux_change precipitation

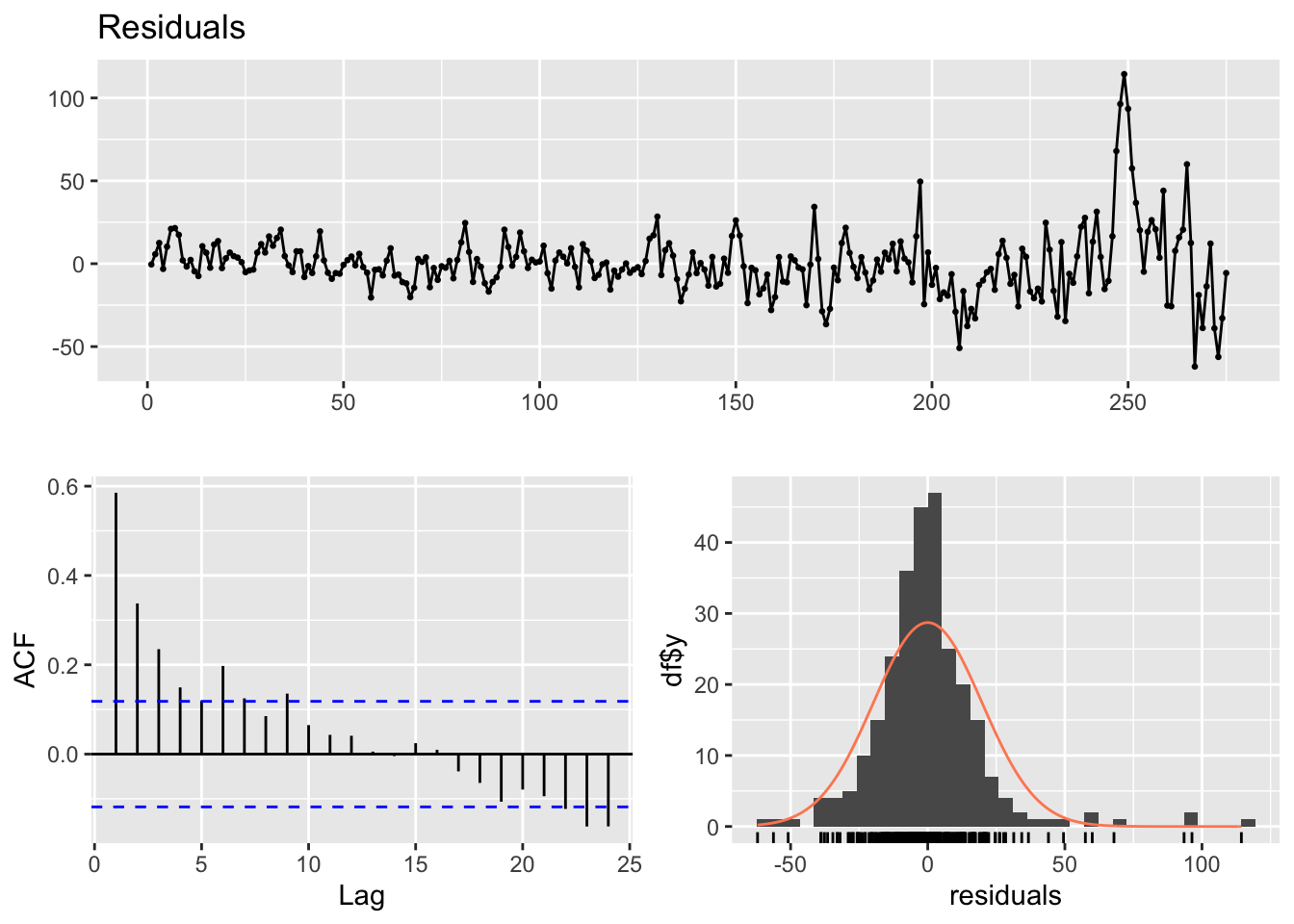

1.048992 1.531173 1.115762 1.107182 1.482521 Autocorrelation de résidus

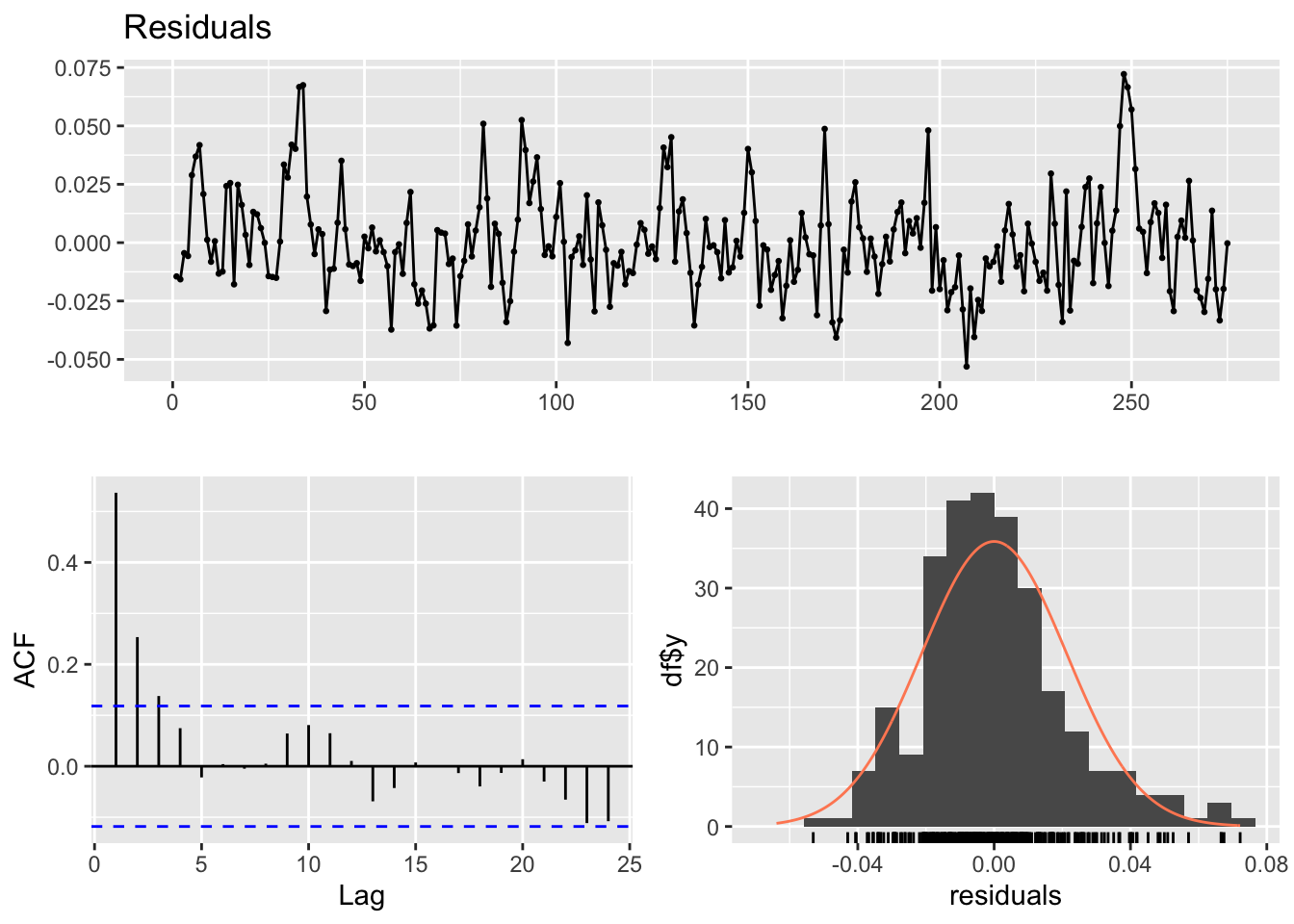

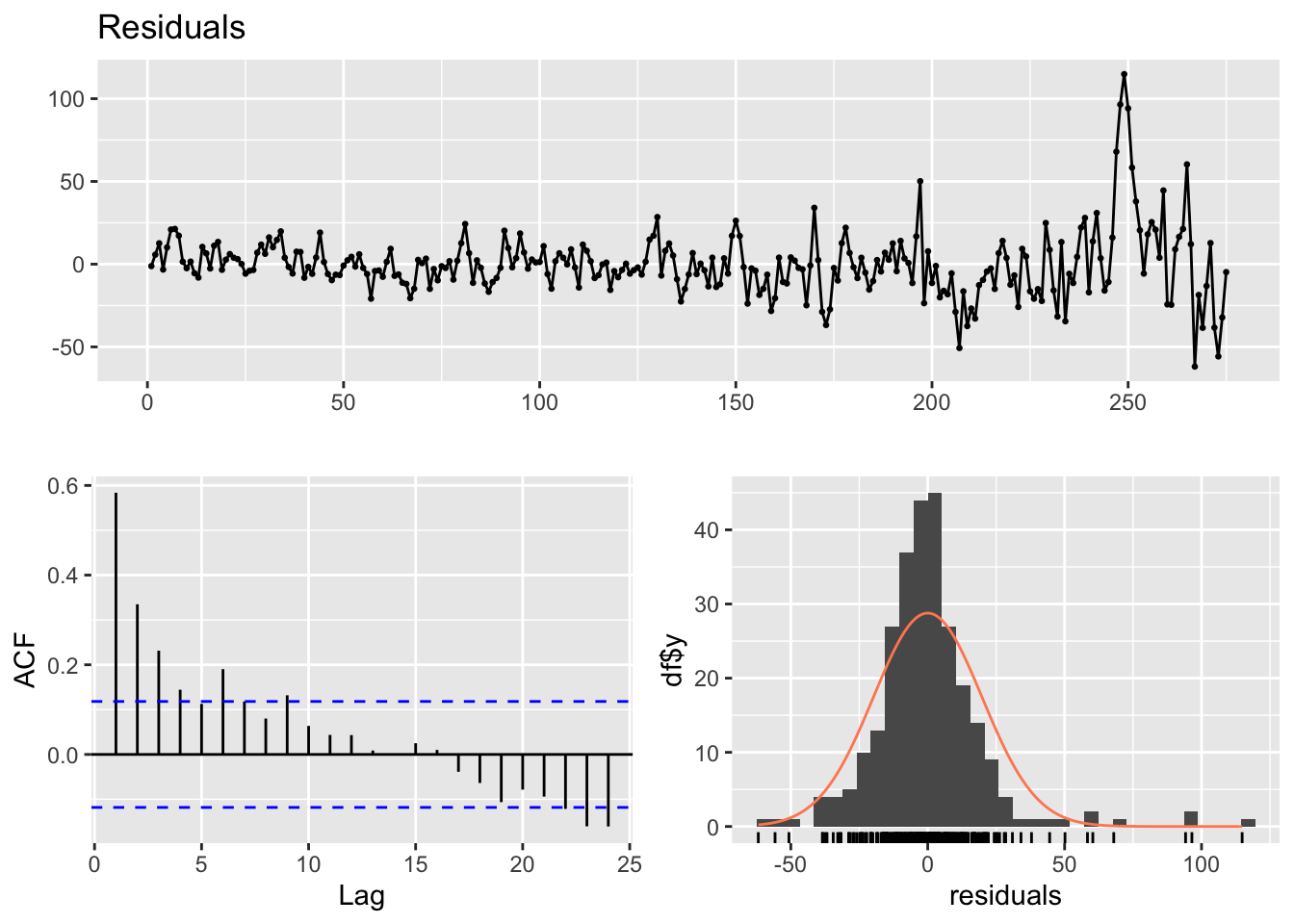

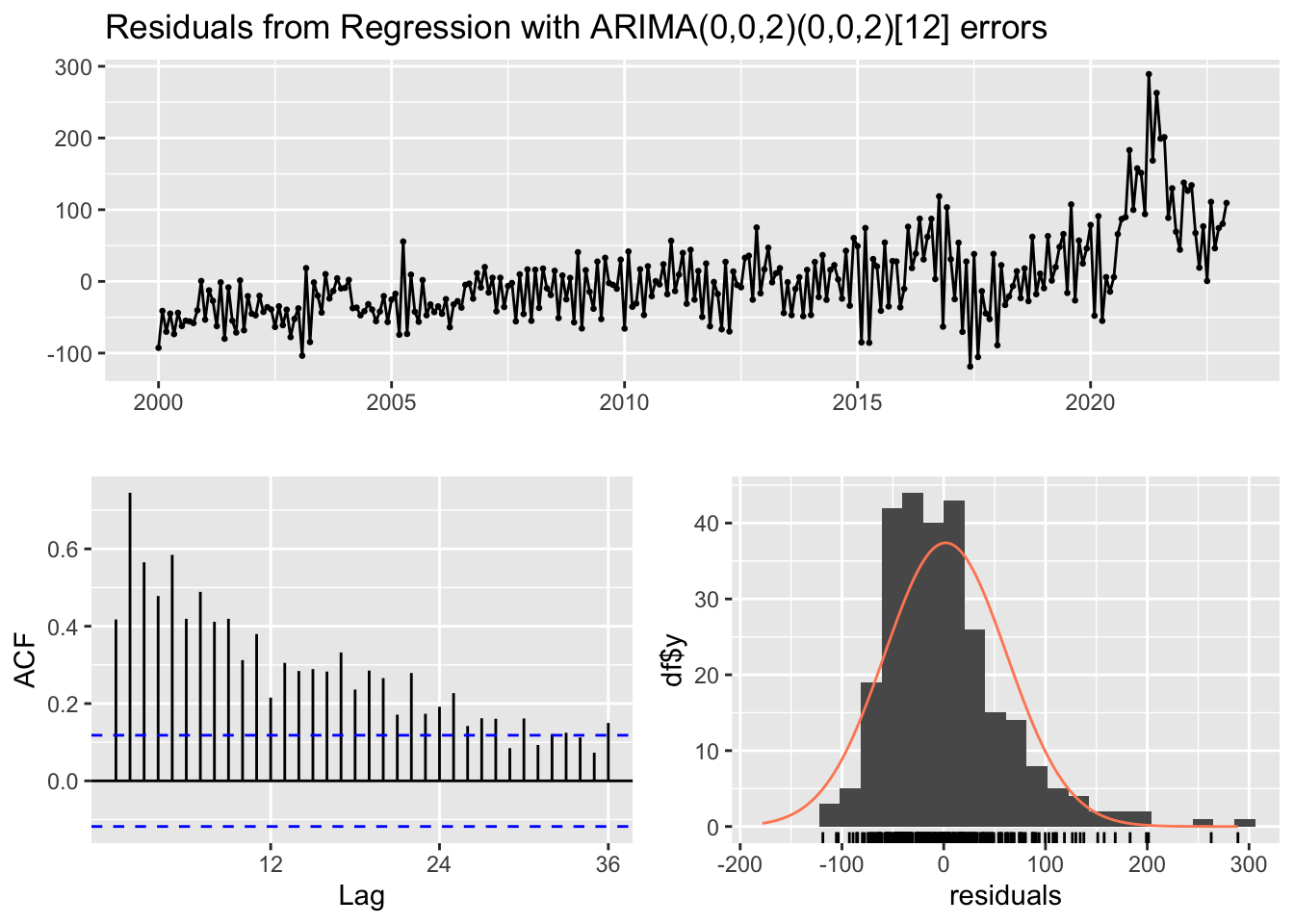

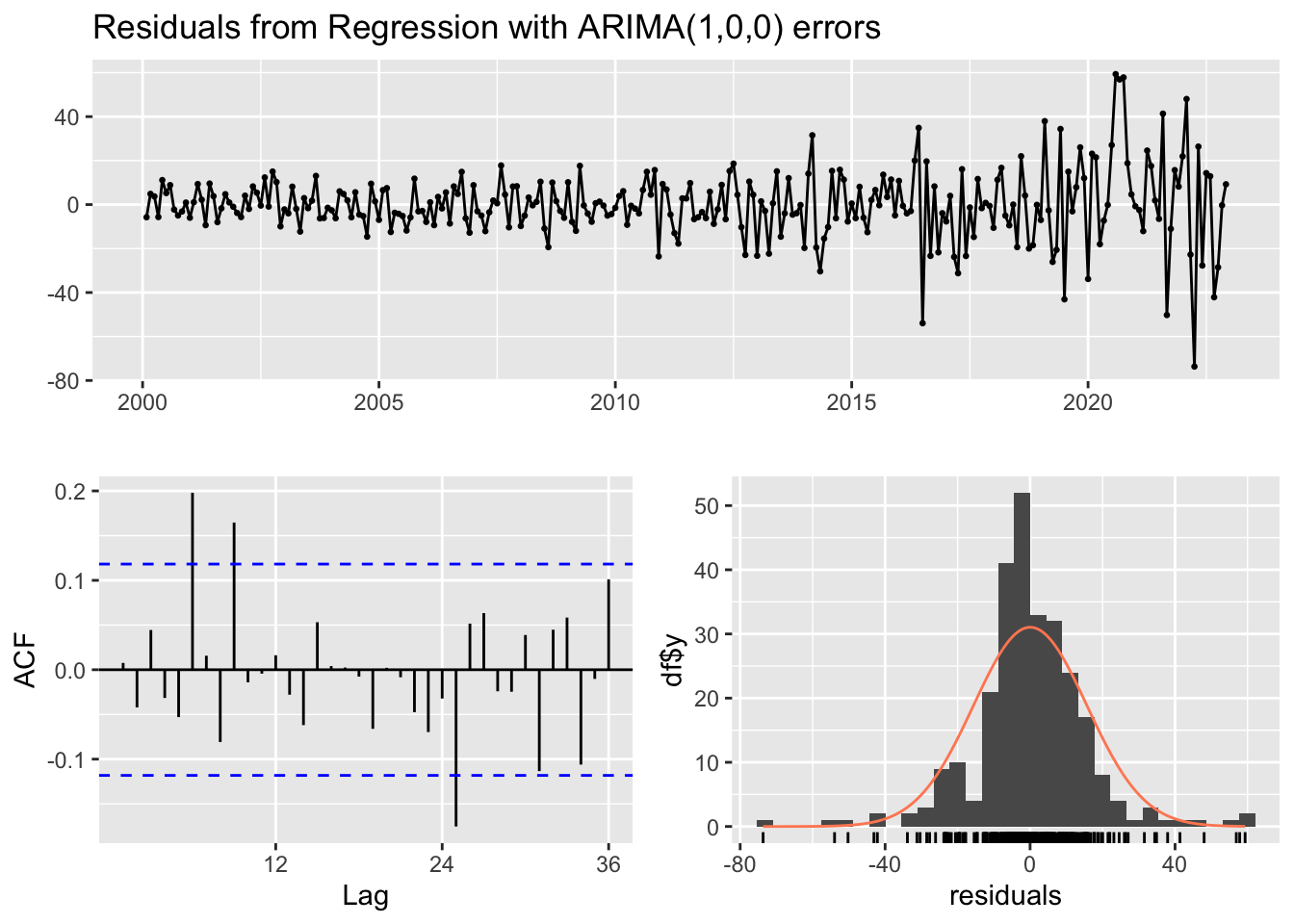

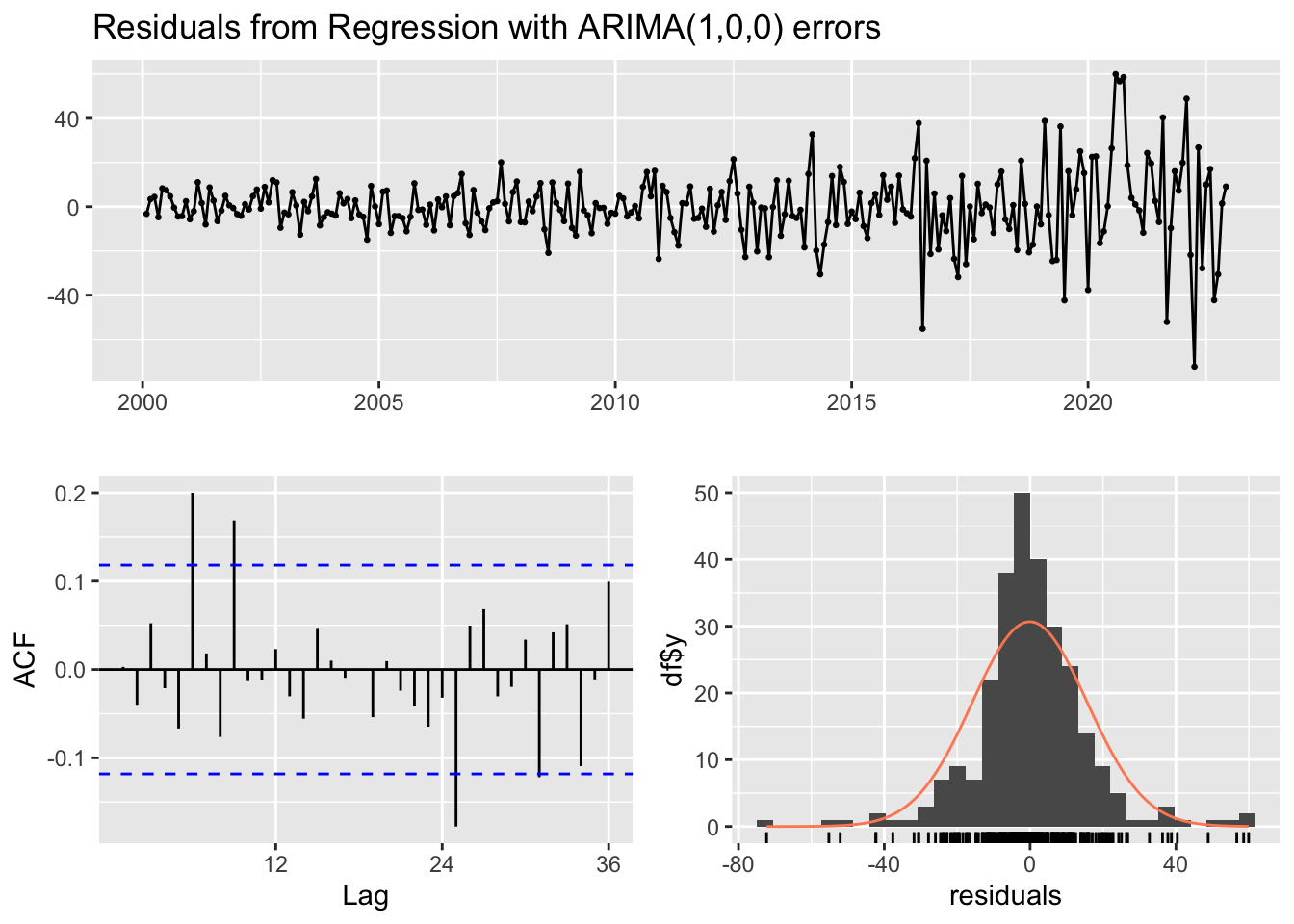

checkresiduals(lm_model1)

Breusch-Godfrey test for serial correlation of order up to 10

data: Residuals

LM test = 109.93, df = 10, p-value < 2.2e-16p-value < 2.2e-16. il existe des preuves significatives d’auto-corrélation résiduelle dans les données.

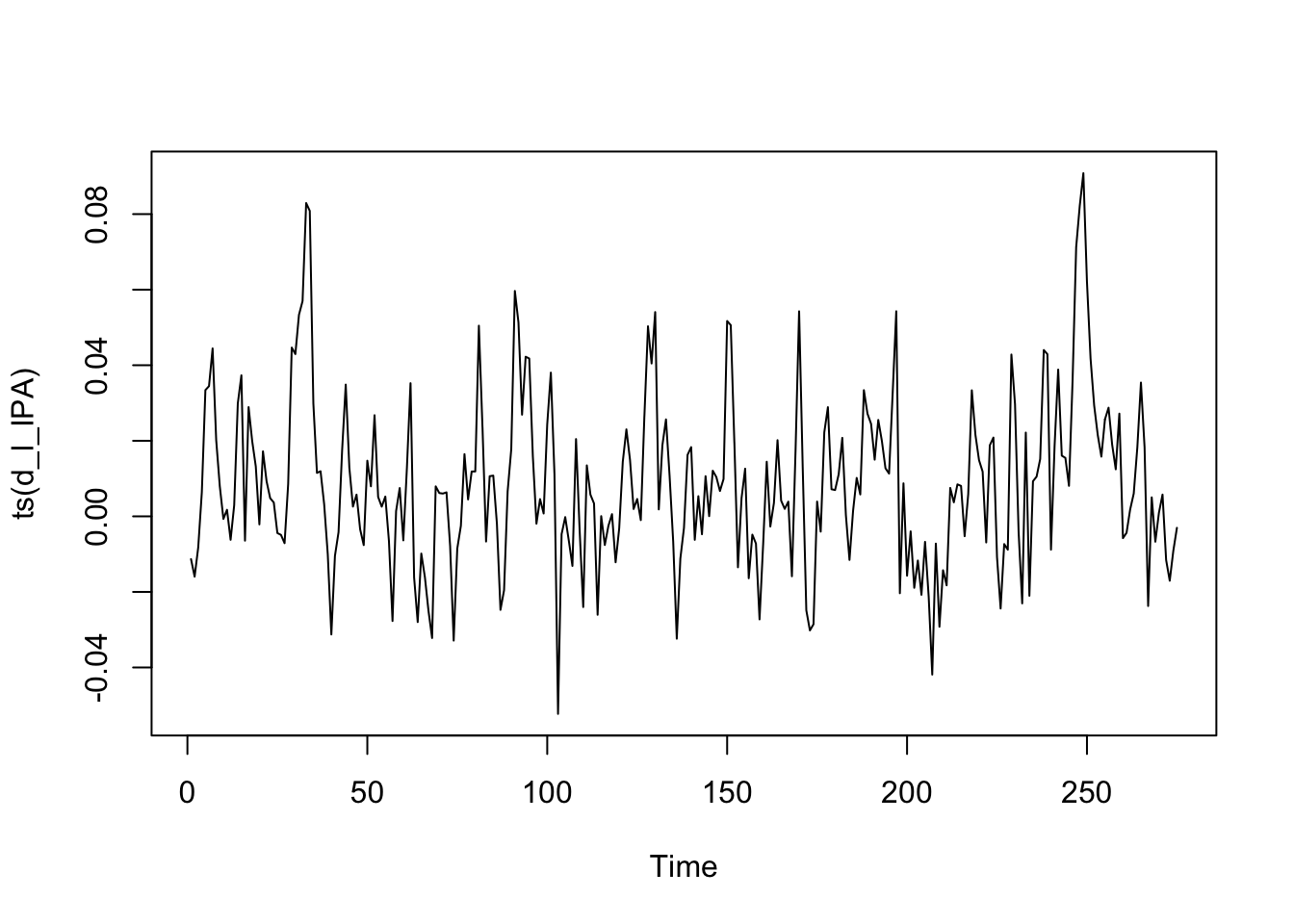

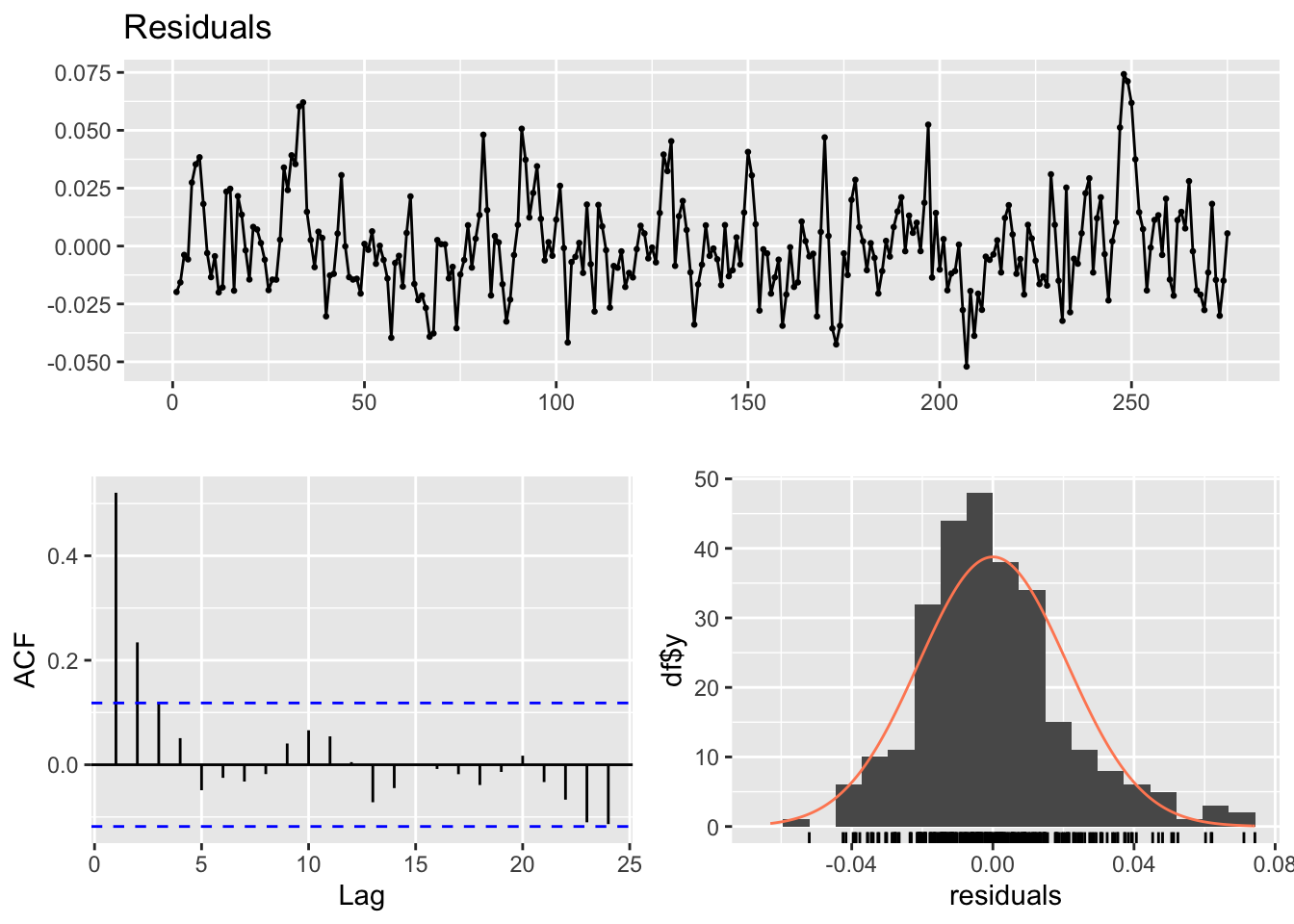

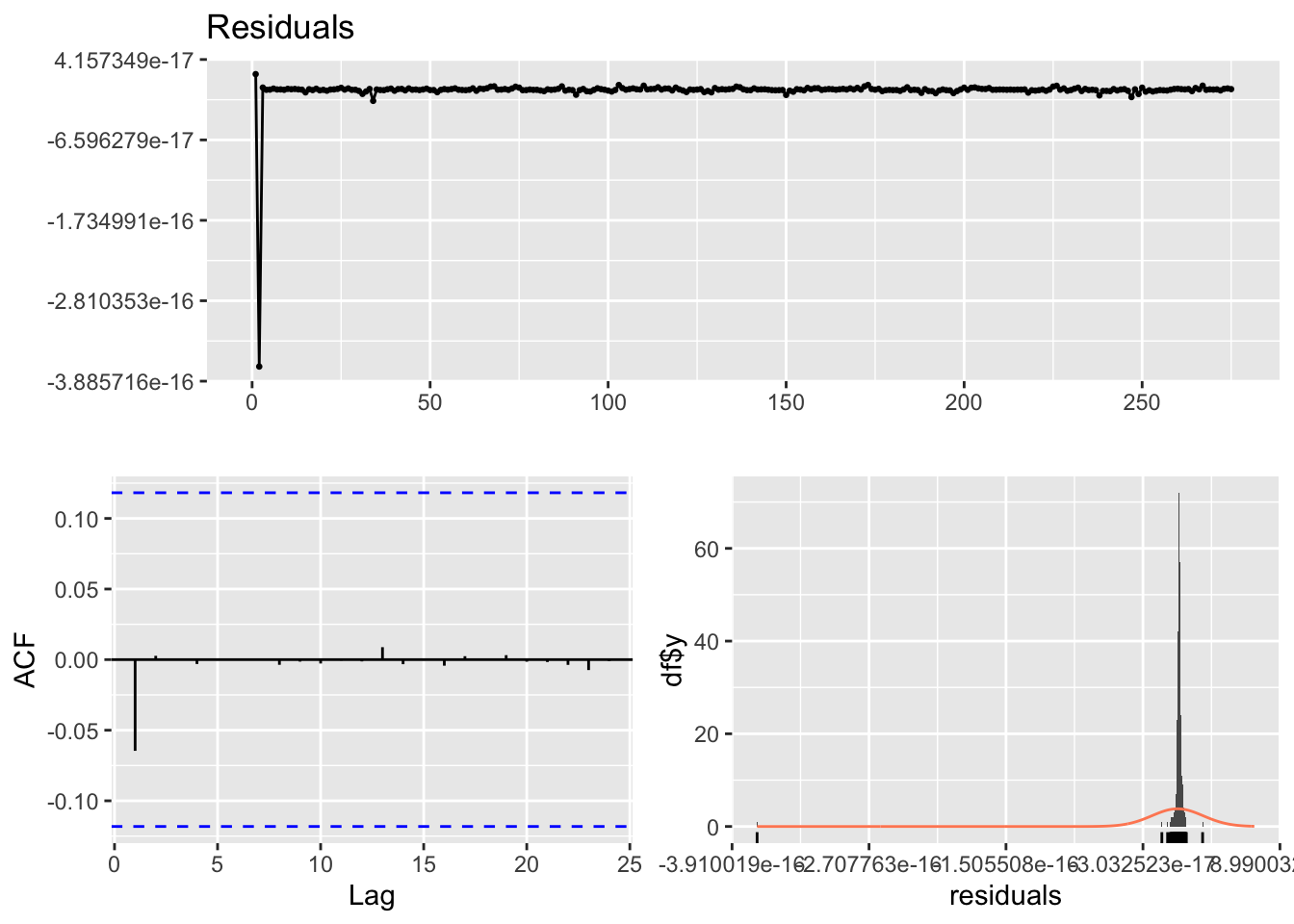

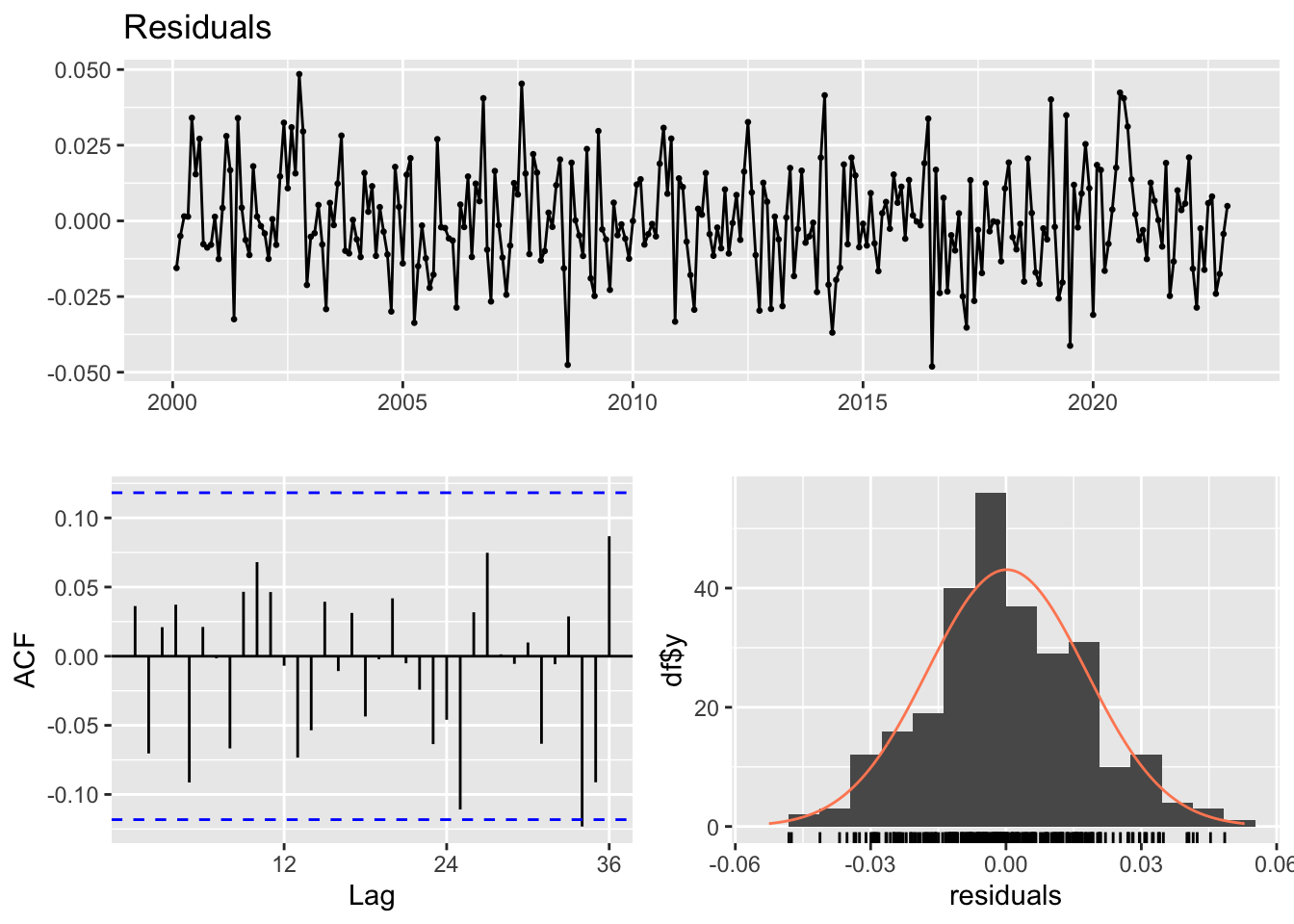

2. Modèle 2: différencié - logarithmique

Dans ce model nous appliquons le logarithme avant la différenciation p

d_l_IPA <- diff(log(data_adj$IPA), differences = 1)

plot(ts(d_l_IPA))

adf.test(d_l_IPA) # on verifie stationnarité Warning in adf.test(d_l_IPA): p-value smaller than printed p-value

Augmented Dickey-Fuller Test

data: d_l_IPA

Dickey-Fuller = -5.2389, Lag order = 6, p-value = 0.01

alternative hypothesis: stationary# creation df avec la dif du log de ipa

st2_data <- data.frame(

Date = data_adj$Date[-1],

IPA = d_l_IPA,

CDD = CDD_deseason[-1],

importations = importation_diff,

exportations = exportations_deseason[-1],

petrole = petrole_diff,

taux_change = taux_change_diff,

SMIC = ts_SMIC[-1],

precipitation = precipitations_deseason[-1],

temperature = temperature_deseason[-1]

)

# estimation modele avec ipa differencié et log

modele1_2 <- lm(IPA ~ CDD + importations + exportations + petrole + taux_change + SMIC + precipitation + temperature, data=st2_data)

summary(modele1_2)

Call:

lm(formula = IPA ~ CDD + importations + exportations + petrole +

taux_change + SMIC + precipitation + temperature, data = st2_data)

Residuals:

Min 1Q Median 3Q Max

-0.053209 -0.013832 -0.001854 0.010430 0.074676

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 4.582e-02 2.275e-02 2.014 0.045005 *

CDD 7.037e-05 1.020e-03 0.069 0.945062

importations 5.464e-05 8.959e-05 0.610 0.542481

exportations 1.068e-04 5.603e-05 1.907 0.057611 .

petrole 8.162e-04 2.266e-04 3.602 0.000376 ***

taux_change 4.257e-02 1.104e-02 3.856 0.000144 ***

SMIC -3.741e-05 5.717e-05 -0.654 0.513451