suppressPackageStartupMessages({

library(readxl)

library(tsoutliers)

library(TSA)

library(seastests)

library(forecast)

library(seasonal)

library(RJDemetra)

library(ggplot2)

library(EnvStats)

library(tseries)

library(smooth)

library(timeSeries)

library(plotly)

library(dplyr)

library(tidyr)

library(Kendall)

library(here)

})Techniques de prévision et conjoncture

Évolution de l’indice des prix d’achat des moyens de production agricole en France

Janvier 2005 – Décembre 2023

Résumé

L’indice des Prix d’Achat des Moyens de Production Agricole (IPAMPA) joue un rôle très important dans l’économie agricole en offrant un aperçu des coûts auxquels les agriculteurs sont confrontés. En 2023, les agriculteurs européens en Pologne, Roumanie, Slovaquie, Hongrie, Bulgarie, ainsi qu’en France, ont été confrontés à des défis marqués par des conditions climatiques extrêmes et une forte concurrence due aux importations à bas prix en provenance de l’Ukraine, considérées comme une « concurrence déloyale ». Ces tensions surviennent après une année 2022 difficile, marquée par des réserves en eau basses et des perturbations climatiques qui ont fortement impacté les rendements agricoles.

Dans ce contexte, comprendre l’évolution de l’IPAMPA ne concerne pas uniquement les acteurs du secteur agricole. En effet, les variations de cet indice ont également des répercussions sur les prix à la consommation. Tout changement dans les coûts de production se répercute, après un certain délai, sur les prix finaux, influençant ainsi le coût de la vie générale. Face à cette complexité, notre projet s’est concentré sur la prévision de l’IPAMPA à l’aide de plusieurs modèles de prévision statistique. Nous avons exploré diverses approches pour identifier le modèle le plus performant en fonction des spécificités de nos données.

L’objectif principal de notre étude a été de confronter ces modèles aux données réelles afin d’évaluer leur capacité à prédire précisément les fluctuations de l’IPAMPA. Ce processus nous permet non seulement de comprendre les défis associés à la prévision de cet indice, mais aussi d’appréhender les difficultés à développer un outil prédictif fiable.

Vous avez la possibilité de télécharger le document ici :) 📥 Télécharger le fichier PDF

Présentation du code

Je vous présente ci-dessous, le code utilisé pour mener à bien ce projet, avec les étapes et explications correspondantes.

Analyse exploratoire

Librairies

Récupération des données

ipampa1 <- read_excel(here("data", "serie_ipampa.xlsx"), sheet = 'complete')

ipampa <- read_excel(here("data", "serie_ipampa.xlsx"))

str(ipampa)tibble [216 × 2] (S3: tbl_df/tbl/data.frame)

$ Période: chr [1:216] "2022-12" "2022-11" "2022-10" "2022-09" ...

$ IPAMPA : num [1:216] 140 141 142 140 139 ...ipampa <- ipampa[nrow(ipampa):1,]

ipampa <- ipampa[, 2]

ipampa# A tibble: 216 × 1

IPAMPA

<dbl>

1 78.2

2 78.5

3 79.1

4 79.3

5 78.9

6 79.4

7 79.8

8 80

9 80.5

10 80.7

# ℹ 206 more rowsCréation de la série temporelle

ipampa <- ts(data = ipampa, start = c(2005, 01), frequency=12) Visualisation

show(ipampa) Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2005 78.2 78.5 79.1 79.3 78.9 79.4 79.8 80.0 80.5 80.7 80.3 80.4

2006 80.8 81.1 81.3 81.8 81.8 81.8 81.9 82.1 81.9 82.1 82.3 82.5

2007 82.6 83.1 83.8 84.5 84.8 85.1 85.8 86.6 88.1 89.5 91.1 91.9

2008 93.2 94.4 95.7 96.9 98.8 100.2 101.3 100.6 100.6 99.5 97.7 95.8

2009 95.4 94.8 93.9 93.5 92.7 92.2 90.8 90.7 90.1 89.7 89.4 89.3

2010 89.5 89.8 90.4 91.0 91.2 91.4 91.3 92.1 93.7 95.0 95.6 96.6

2011 98.0 99.4 100.6 101.0 100.4 100.6 101.0 100.9 101.3 101.3 101.2 101.0

2012 100.6 101.2 101.9 102.3 102.3 101.8 103.1 105.1 106.0 106.5 106.4 106.3

2013 106.4 106.8 106.4 105.7 105.4 105.0 104.6 104.2 103.7 103.0 102.7 102.7

2014 102.9 103.0 103.1 103.3 103.3 103.1 102.5 102.1 101.6 101.0 100.4 99.5

2015 99.1 100.5 100.7 101.1 101.3 100.6 100.2 99.7 99.6 99.5 99.3 98.3

2016 97.8 97.5 97.6 97.4 97.9 97.8 97.3 96.9 97.0 97.4 97.2 98.3

2017 98.6 99.0 98.9 99.1 98.7 98.1 97.9 98.0 98.4 98.9 99.2 99.3

2018 100.1 100.1 100.4 101.1 102.0 101.9 102.2 102.7 103.6 104.6 104.5 103.8

2019 103.6 104.1 104.4 104.6 104.4 103.8 103.7 103.3 103.7 103.6 103.3 103.5

2020 103.6 103.4 102.3 101.7 101.7 101.8 101.8 101.8 101.5 102.1 102.6 103.1

2021 104.5 106.4 107.6 107.9 108.5 109.6 110.9 111.6 113.2 117.5 119.5 120.5

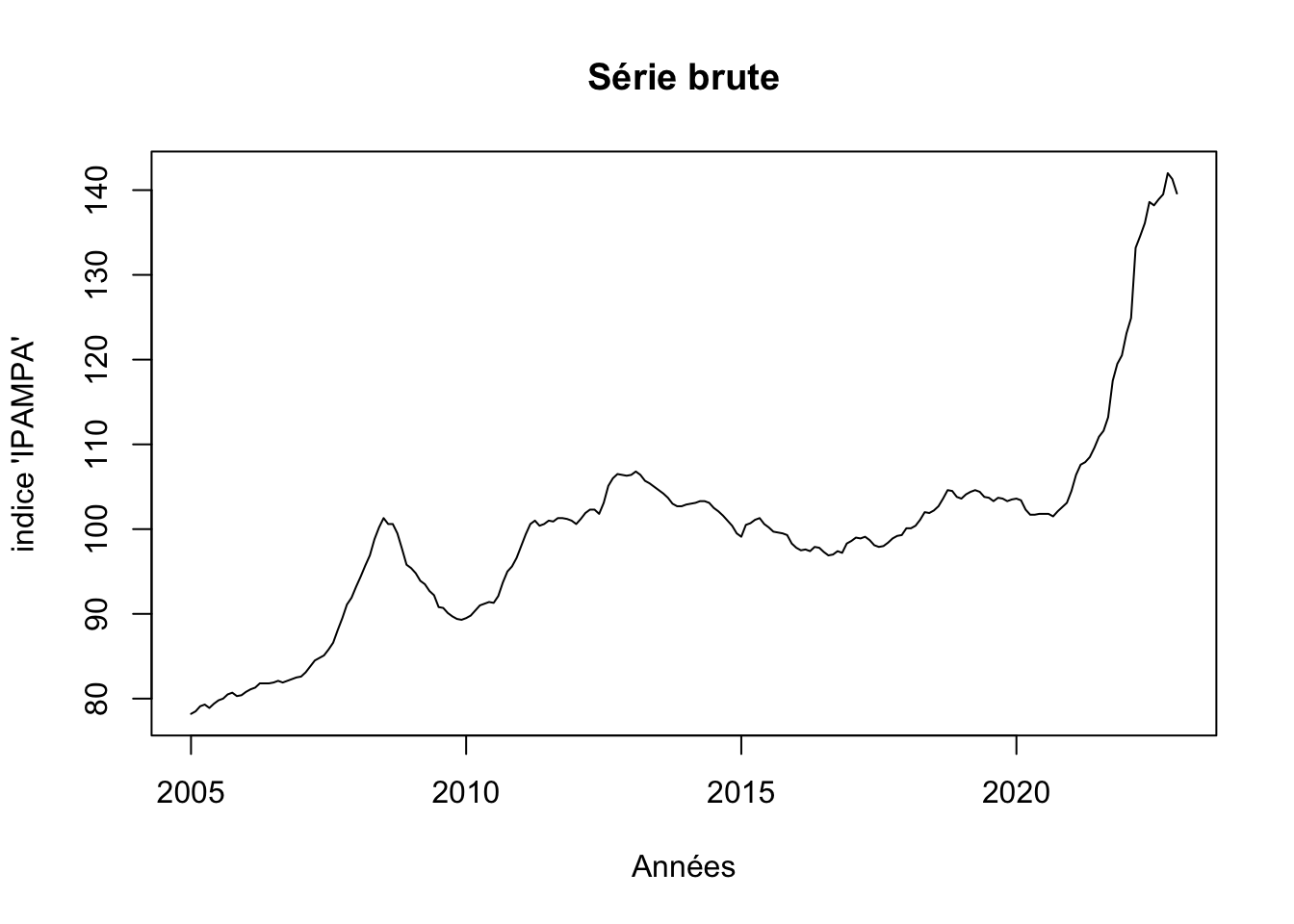

2022 123.1 124.9 133.2 134.6 136.1 138.6 138.2 138.9 139.5 142.0 141.3 139.6plot(ipampa, xlab = "Années", ylab ="indice 'IPAMPA'", main= "Série brute")

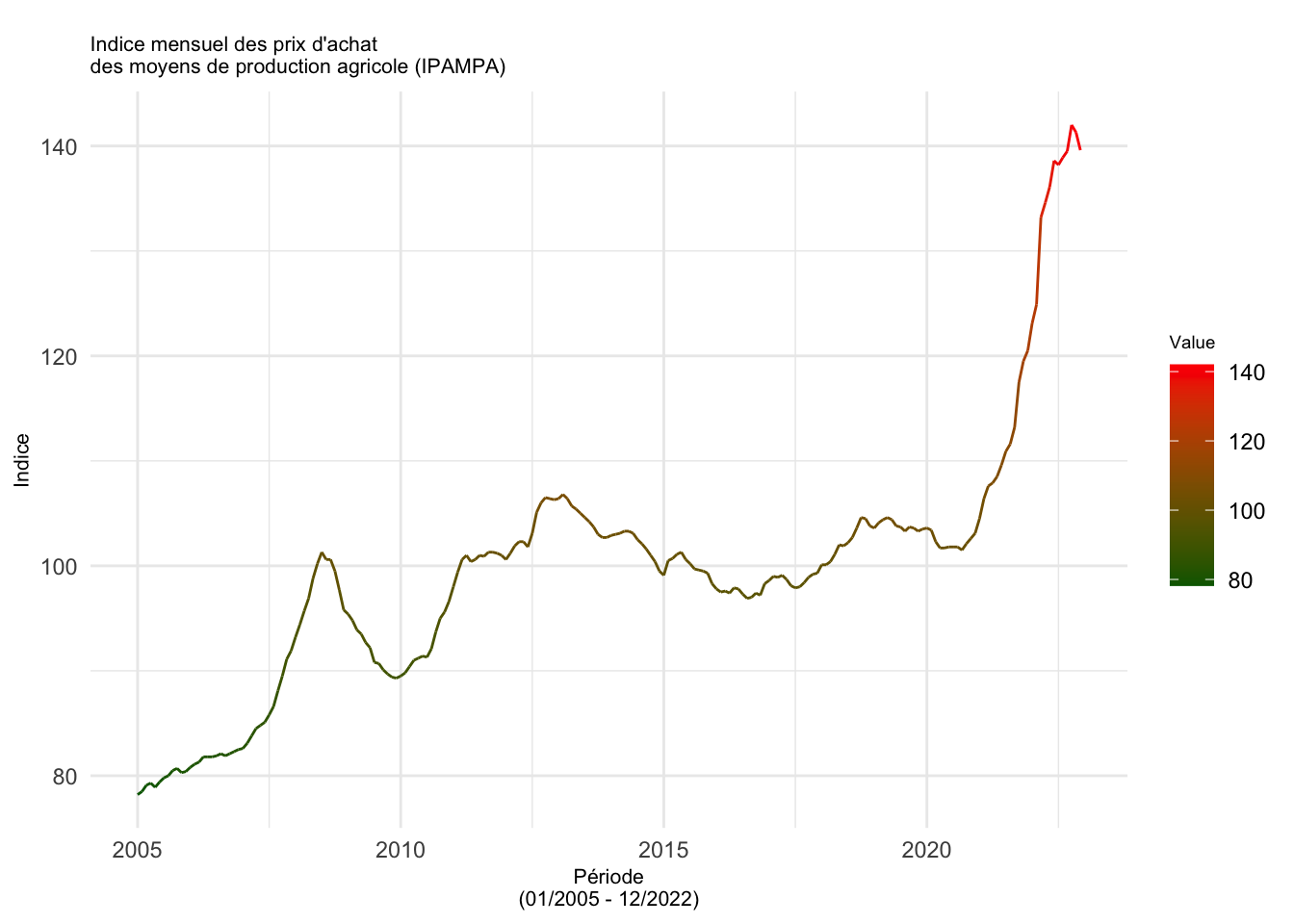

Graphique avec ggplot

ts_df <- data.frame(Date = time(ipampa), Value = as.numeric(ipampa))

# graphique ggplot

ggplot(data = ts_df, aes(x = Date, y = Value)) +

geom_line(aes(color = Value)) +

scale_color_gradient(low = "darkgreen", high = "red") +

labs(title = "

Indice mensuel des prix d'achat

des moyens de production agricole (IPAMPA)",

x = "Période\n(01/2005 - 12/2022)", y = "Indice") +

theme_minimal() +

theme(legend.position = "right",

plot.title = element_text(size = 8),

axis.title.x = element_text(size = 8),

axis.title.y = element_text(size = 8),

legend.title = element_text(size = 7)) Don't know how to automatically pick scale for object of type <ts>. Defaulting

to continuous.

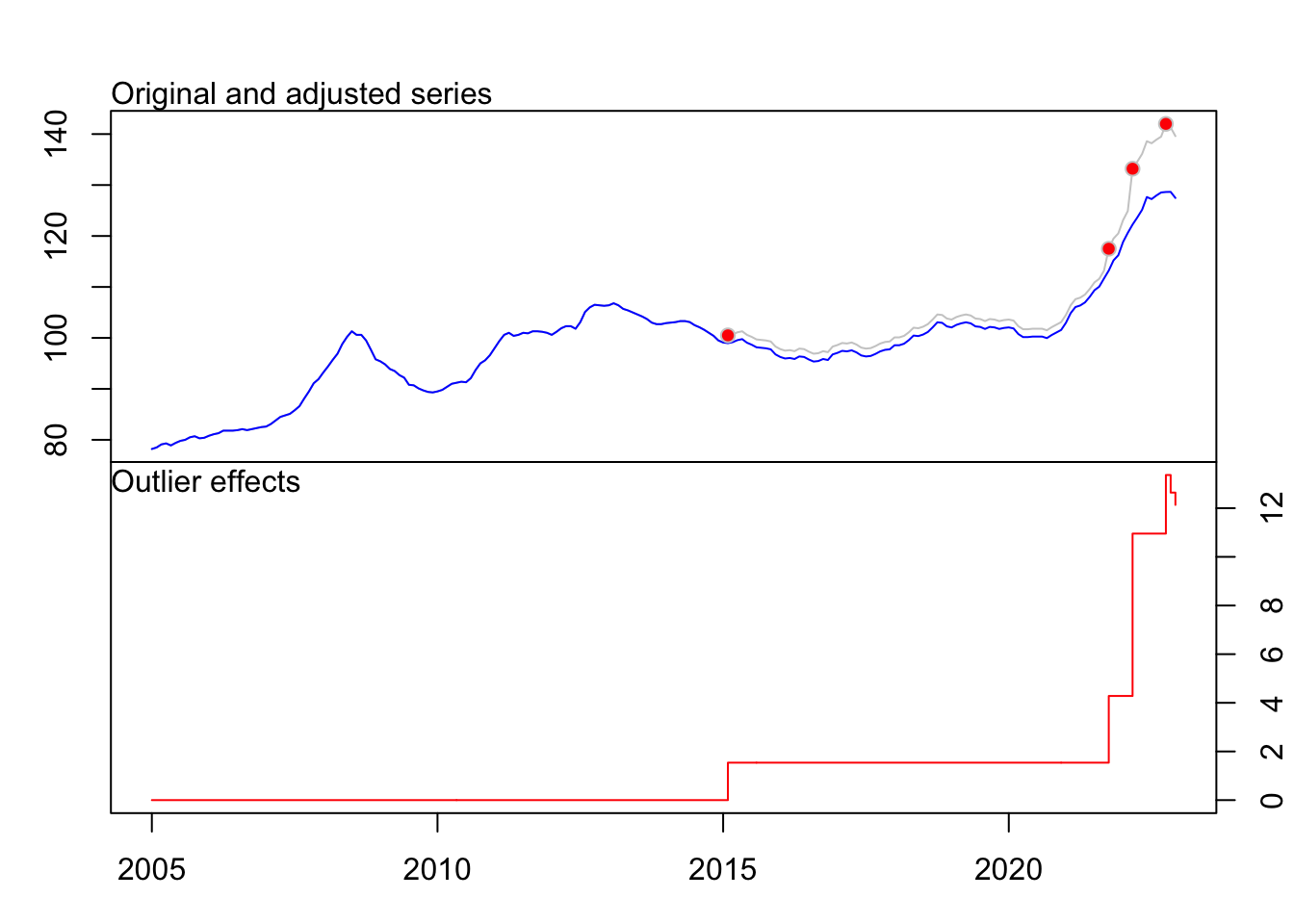

Détection outliers

# Automatic Procedure for Detection of Outliers

tso(ipampa)Series: ipampa

Regression with ARIMA(1,1,1) errors

Coefficients:

ar1 ma1 LS122 LS202 LS207 TC214

0.8434 -0.2691 1.5395 2.7421 6.6747 2.4083

s.e. 0.0531 0.1062 0.4497 0.4520 0.4505 0.3936

sigma^2 = 0.2814: log likelihood = -166.1

AIC=346.2 AICc=346.74 BIC=369.79

Outliers:

type ind time coefhat tstat

1 LS 122 2015:02 1.539 3.423

2 LS 202 2021:10 2.742 6.067

3 LS 207 2022:03 6.675 14.817

4 TC 214 2022:10 2.408 6.119fit <- tso(ipampa)

plot(fit)

show(fit)Series: ipampa

Regression with ARIMA(1,1,1) errors

Coefficients:

ar1 ma1 LS122 LS202 LS207 TC214

0.8434 -0.2691 1.5395 2.7421 6.6747 2.4083

s.e. 0.0531 0.1062 0.4497 0.4520 0.4505 0.3936

sigma^2 = 0.2814: log likelihood = -166.1

AIC=346.2 AICc=346.74 BIC=369.79

Outliers:

type ind time coefhat tstat

1 LS 122 2015:02 1.539 3.423

2 LS 202 2021:10 2.742 6.067

3 LS 207 2022:03 6.675 14.817

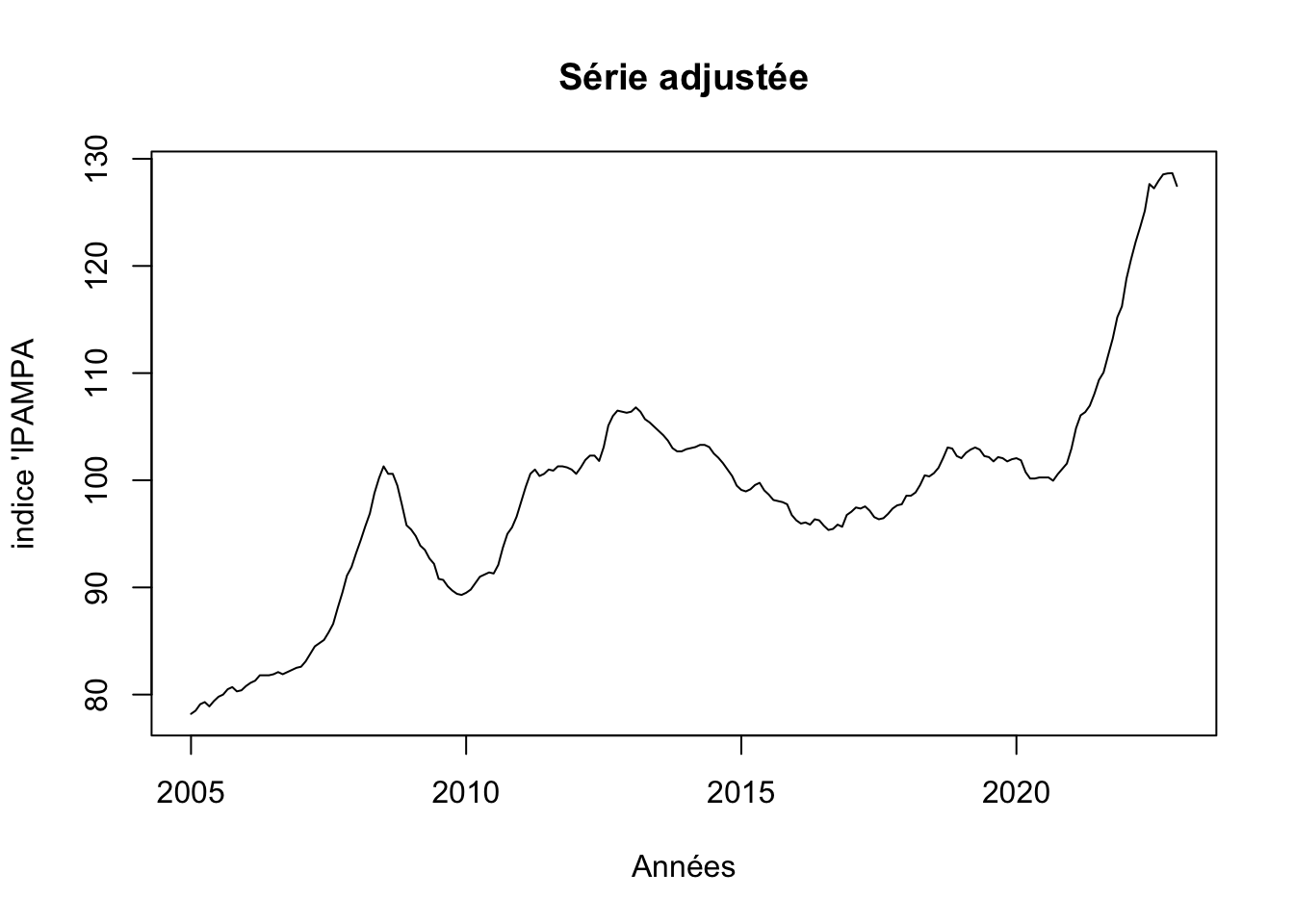

4 TC 214 2022:10 2.408 6.119Série corrigée

par(mfrow=c(1,1))

# outlier-adjusted series

ipampa <- fit$yadj

plot(ipampa, main= "Série adjustée", xlab= "Années", ylab ="indice 'IPAMPA")

Existence de 4 outliers 3 type LS et un type TC

Tests de saisonnalité

# Friedman test

ft <- fried(ipampa)

show(ft)Test used: Friedman rank

Test statistic: 15.81

P-value: 0.1485093# Testing the seasonality of series

# a boolean value is returned : TRUE or FALSE

is <- isSeasonal(ipampa, test="wo")

show(is)[1] FALSE# Kruskal-Wallis test

kwt <- kw(ipampa)

show(kwt)Test used: Kruskall Wallis

Test statistic: 10.94

P-value: 0.4482418# Seasonal dummies

# impotant

sd <- seasdum(ipampa)

show(sd)Test used: SeasonalDummies

Test statistic: 0.86

P-value: 0.5759353# Webel-Ollech test

# Webel-Ollech test - new version of seastests (2021-09)

# impotant

wot <- combined_test(ipampa)

show(wot)Test used: WO

Test statistic: 0

P-value: 1 1 0.03397038Les tests confirment la non saisonnalité de la série IPAMPA

Graphique

# Trace une série chronologique avec son acf et soit son pacf, son nuage de points décalé ou son spectre

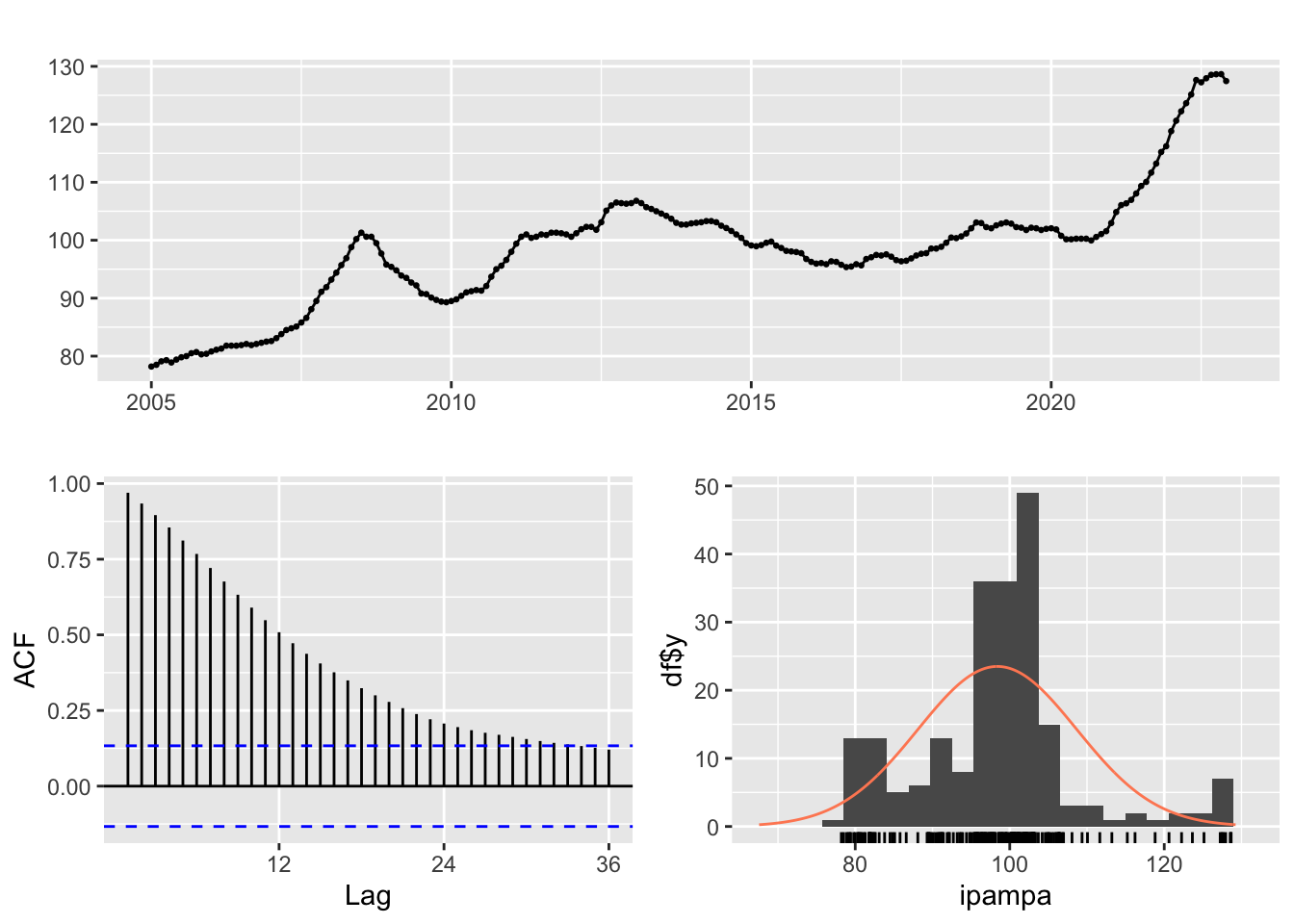

ggtsdisplay(ipampa, plot.type="histogram")

# Trace un graphique saisonnier où les données sont comparées aux saisons d'années distinctes

# ggseasonplot(ipampa_ts, col=rainbow(12), year.labels=TRUE)Vérification de la stationnarité

stationnarité de ipampa

adf.test(ipampa)

Augmented Dickey-Fuller Test

data: ipampa

Dickey-Fuller = -3.1388, Lag order = 5, p-value = 0.09931

alternative hypothesis: stationaryLa série n’est pas stationnaire car le test ADF > 0.05

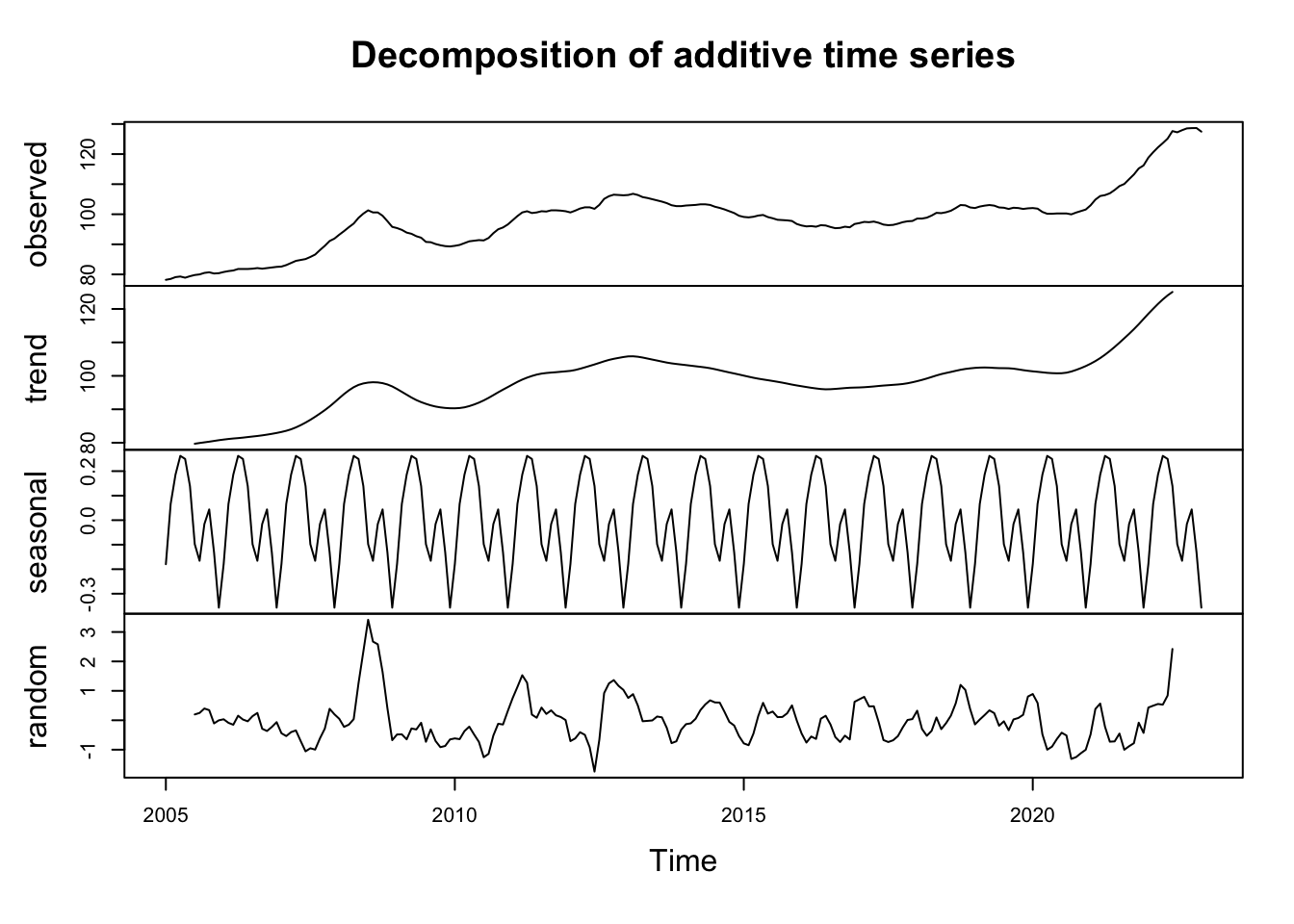

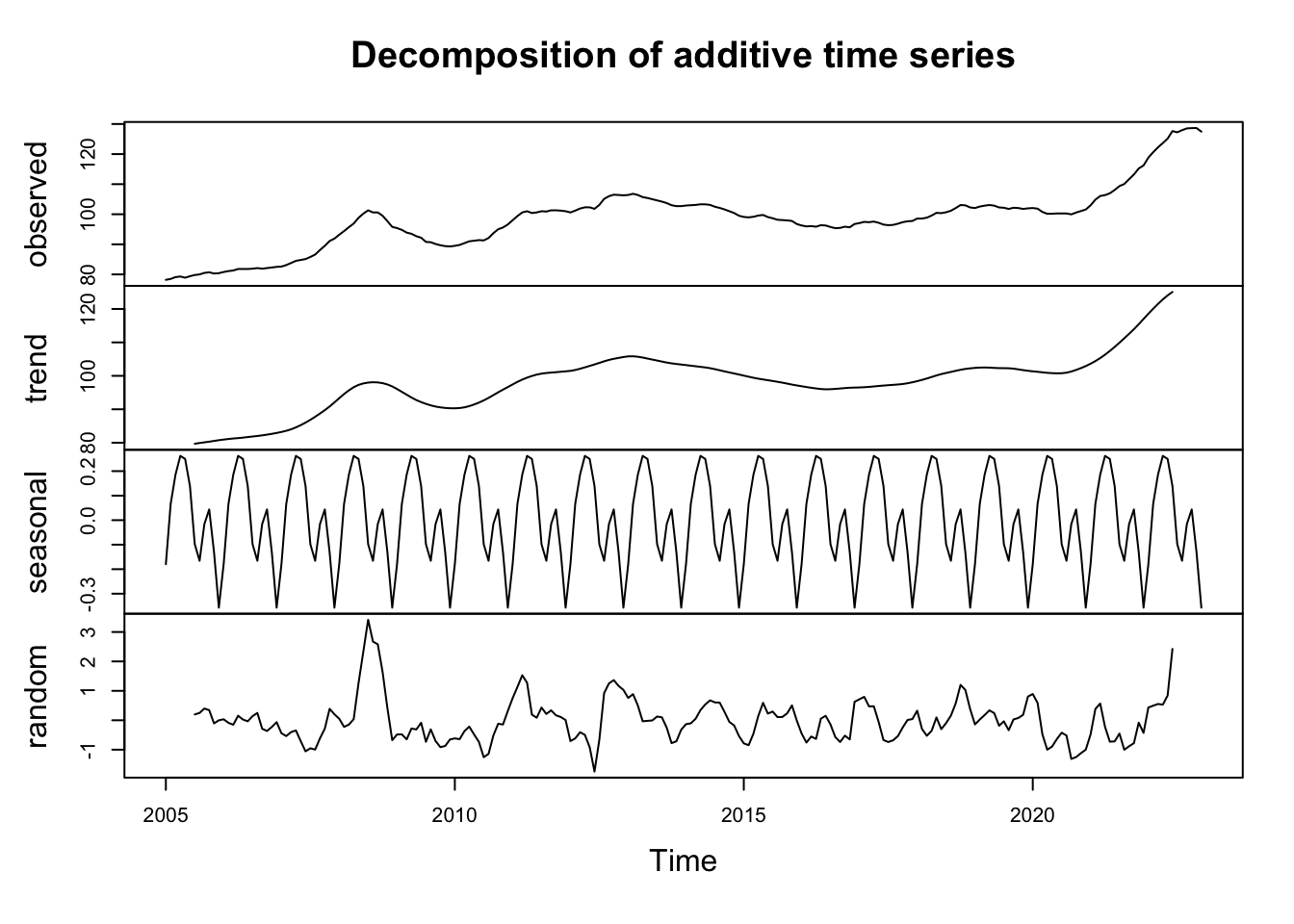

Vu que notre série ne presente pas de saisonalité, nous allons faire un analyse sur la tendance

decomp <- decompose(ipampa)

plot(decomp)

Tendance

# test de tendence serie niveau

MannKendall(ipampa)tau = 0.568, 2-sided pvalue =< 2.22e-16Dans notre cas, τ = 0.568 suggère une tendance croissante modérément forte dans la série temporelle à niveau, avec un p_value inférieur à 0,05 on peut dire que la série initial presente bien une tendance

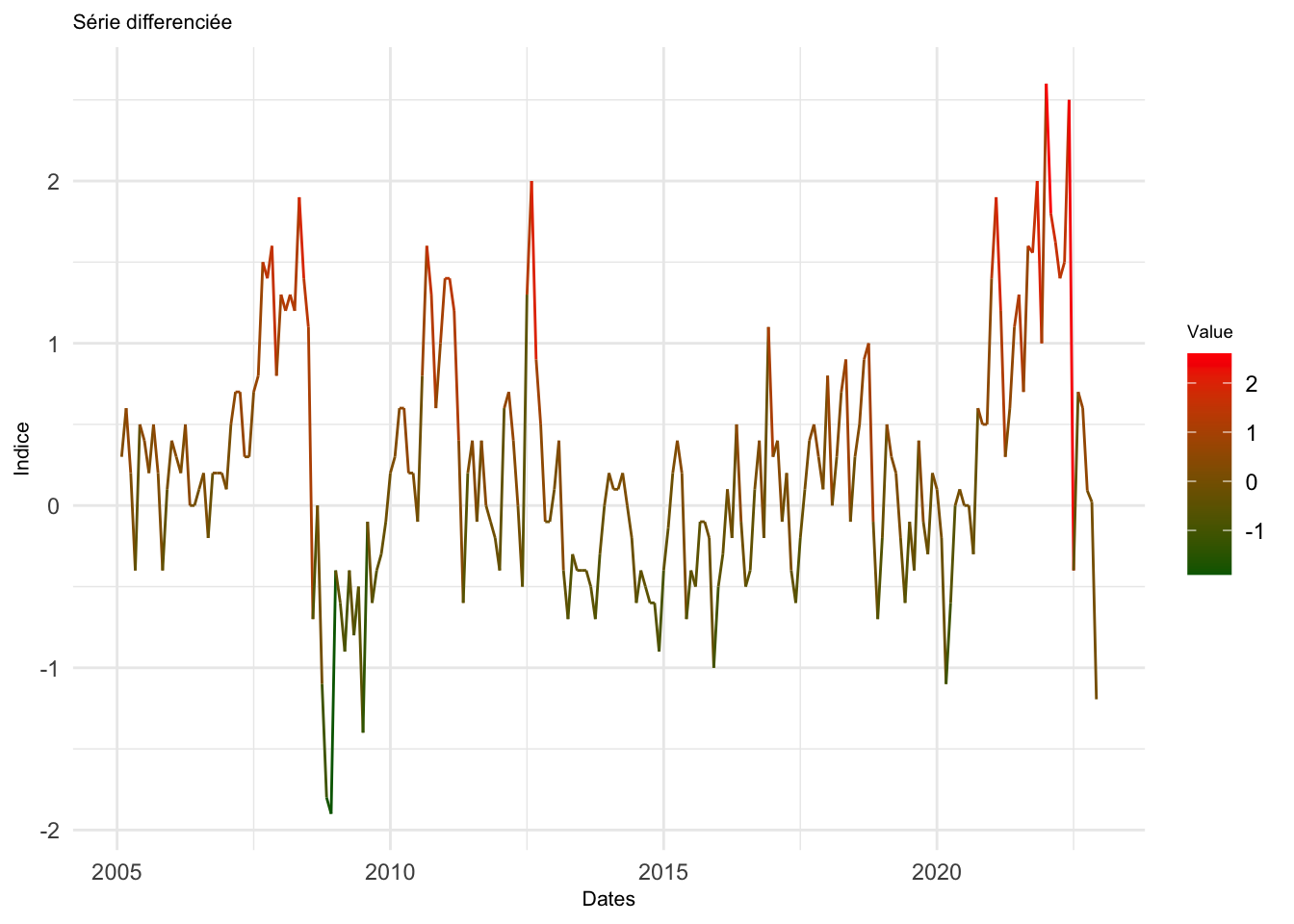

differentiation de la série

d_ipampa <- diff(ipampa, differences = 1)# graphique ggplot

df <- data.frame(Date = time(d_ipampa), Value = as.numeric(d_ipampa))

# graphique ggplot

ggplot(data = df, aes(x = Date, y = Value)) +

geom_line(aes(color = Value)) +

scale_color_gradient(low = "darkgreen", high = "red") +

labs(title = "Série differenciée",

x = "Dates", y = "Indice") +

theme_minimal() +

theme(legend.position = "right",

plot.title = element_text(size = 8),

axis.title.x = element_text(size = 8),

axis.title.y = element_text(size = 8),

legend.title = element_text(size = 7)) Don't know how to automatically pick scale for object of type <ts>. Defaulting

to continuous.

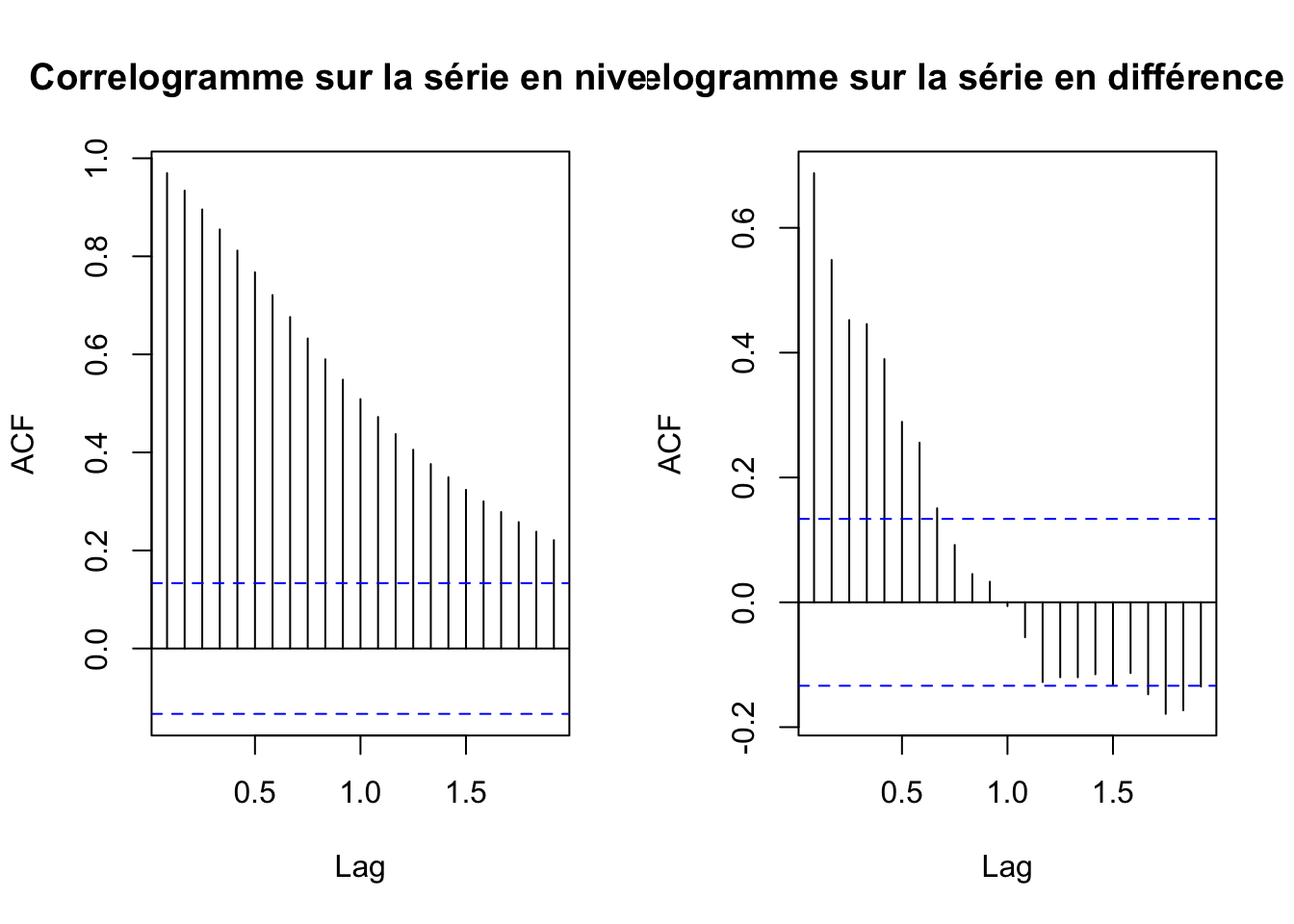

Correlogramme série brute et série differencié

par(mfrow=c(1,2))

acf(ipampa, main="Correlogramme sur la série en niveau")

acf(d_ipampa, main="Correlogramme sur la série en différence première")

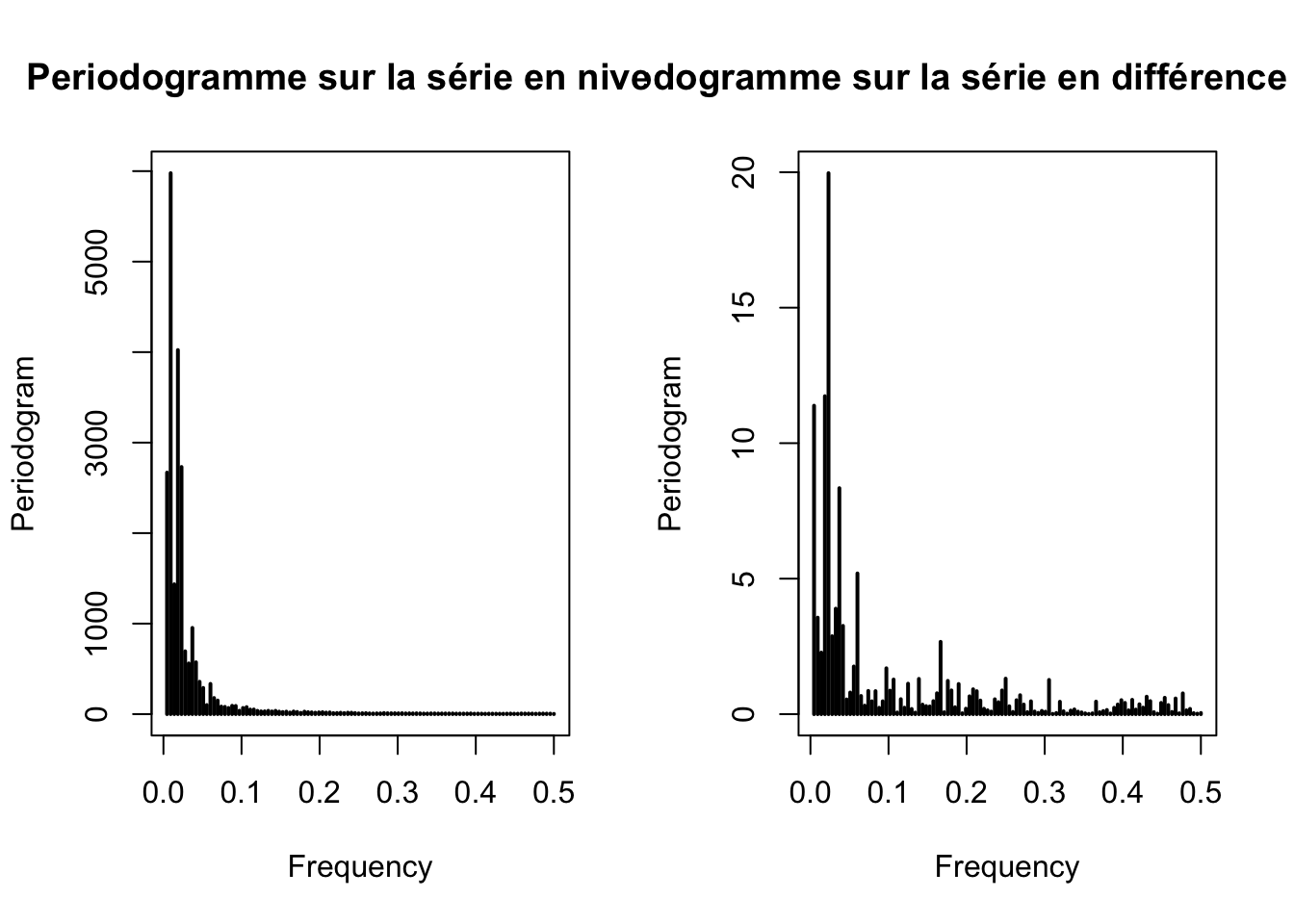

Periodogramme

# Periodogramme

par(mfrow=c(1,2))

periodogram(ipampa, main="Periodogramme sur la série en niveau")

periodogram(d_ipampa, main="Periodogramme sur la série en différence première")

Test de stationnarité de la série différencié ipampa

adf.test(d_ipampa)

Augmented Dickey-Fuller Test

data: d_ipampa

Dickey-Fuller = -3.564, Lag order = 5, p-value = 0.0378

alternative hypothesis: stationaryApres la différentiation la série devient bien stationnaire

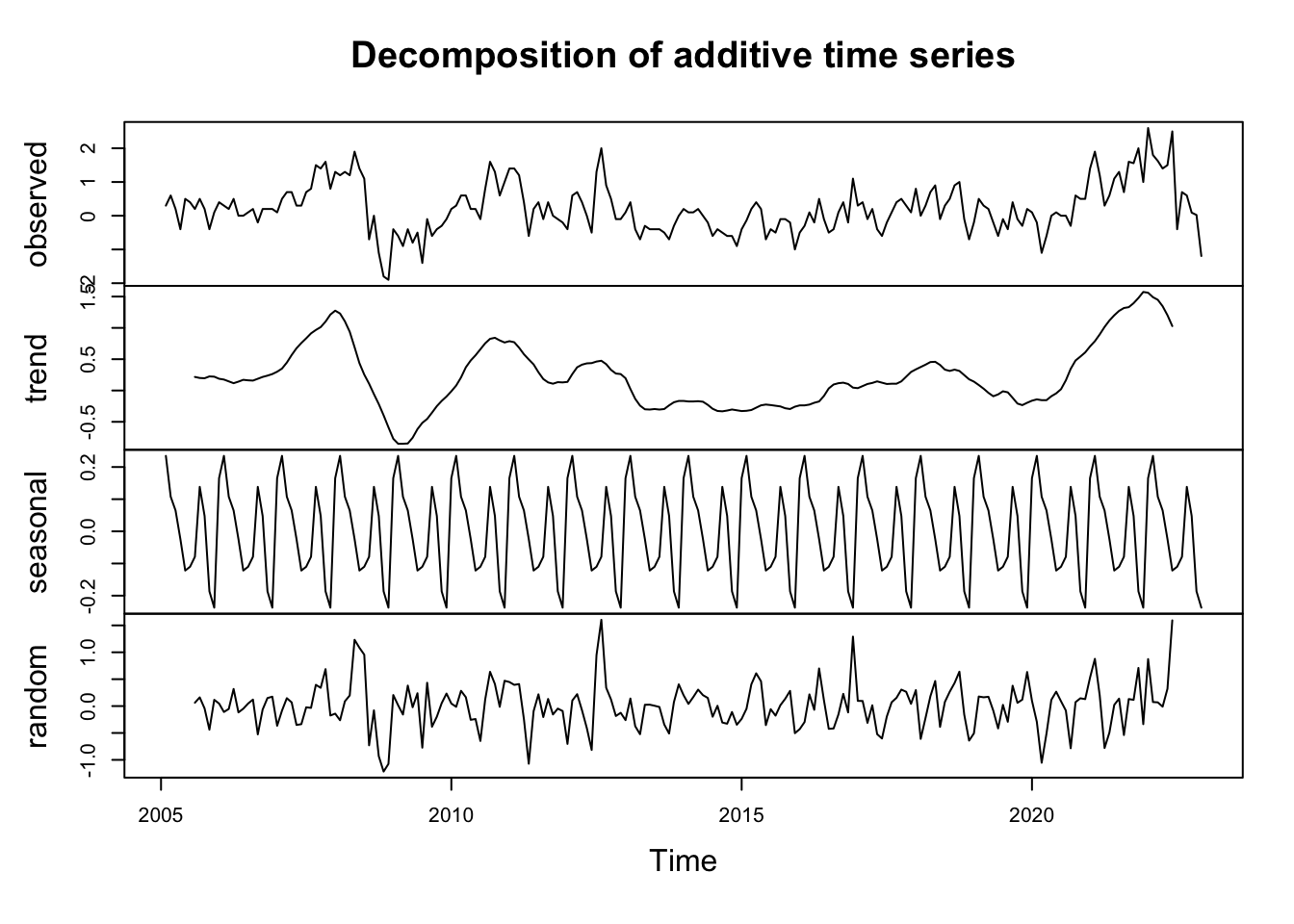

decomp <- decompose(ipampa)

decomp_d <- decompose(d_ipampa)

graph1 <- plot(decomp)

graph2 <- plot(decomp_d)

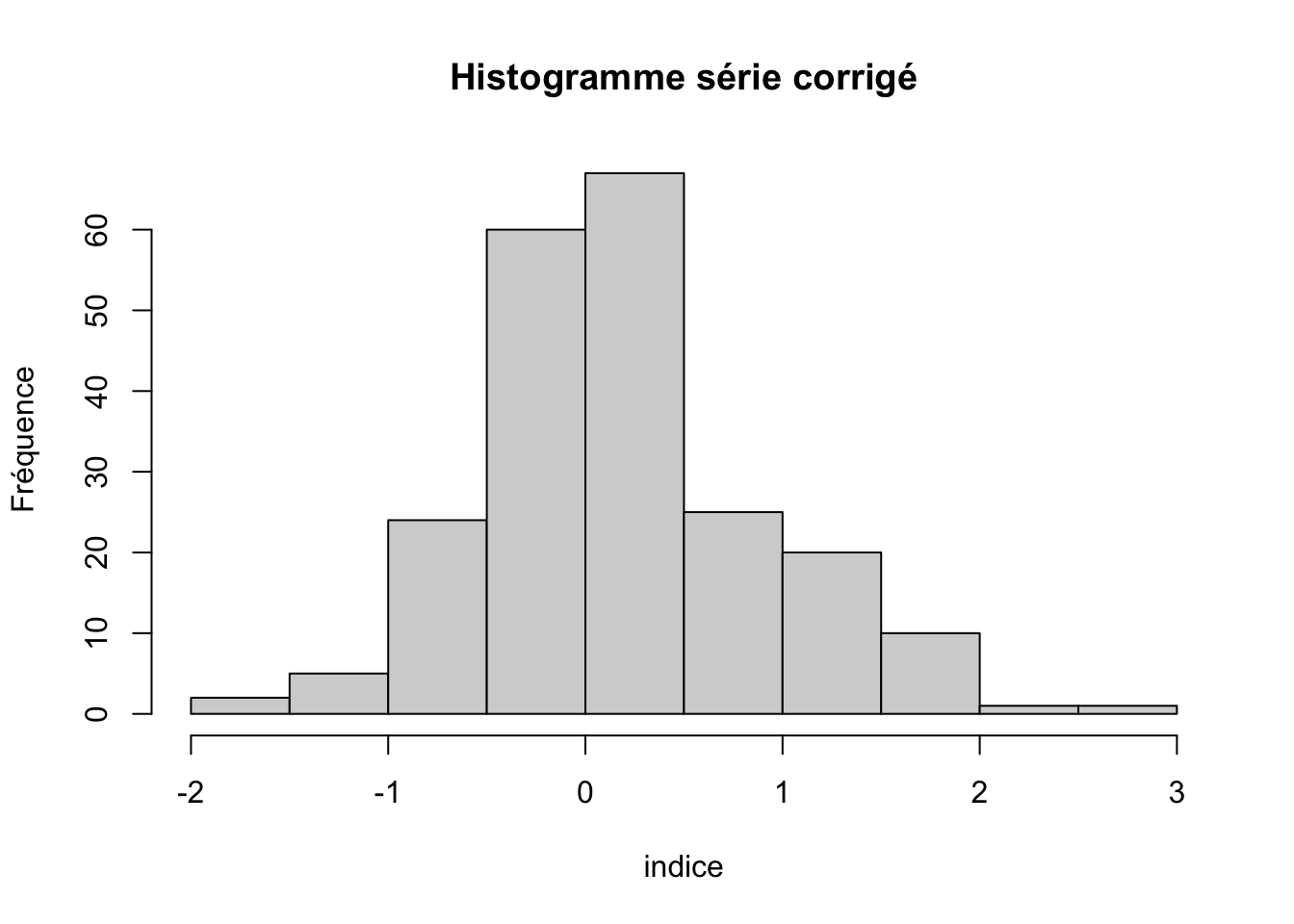

Statistiques descriptives

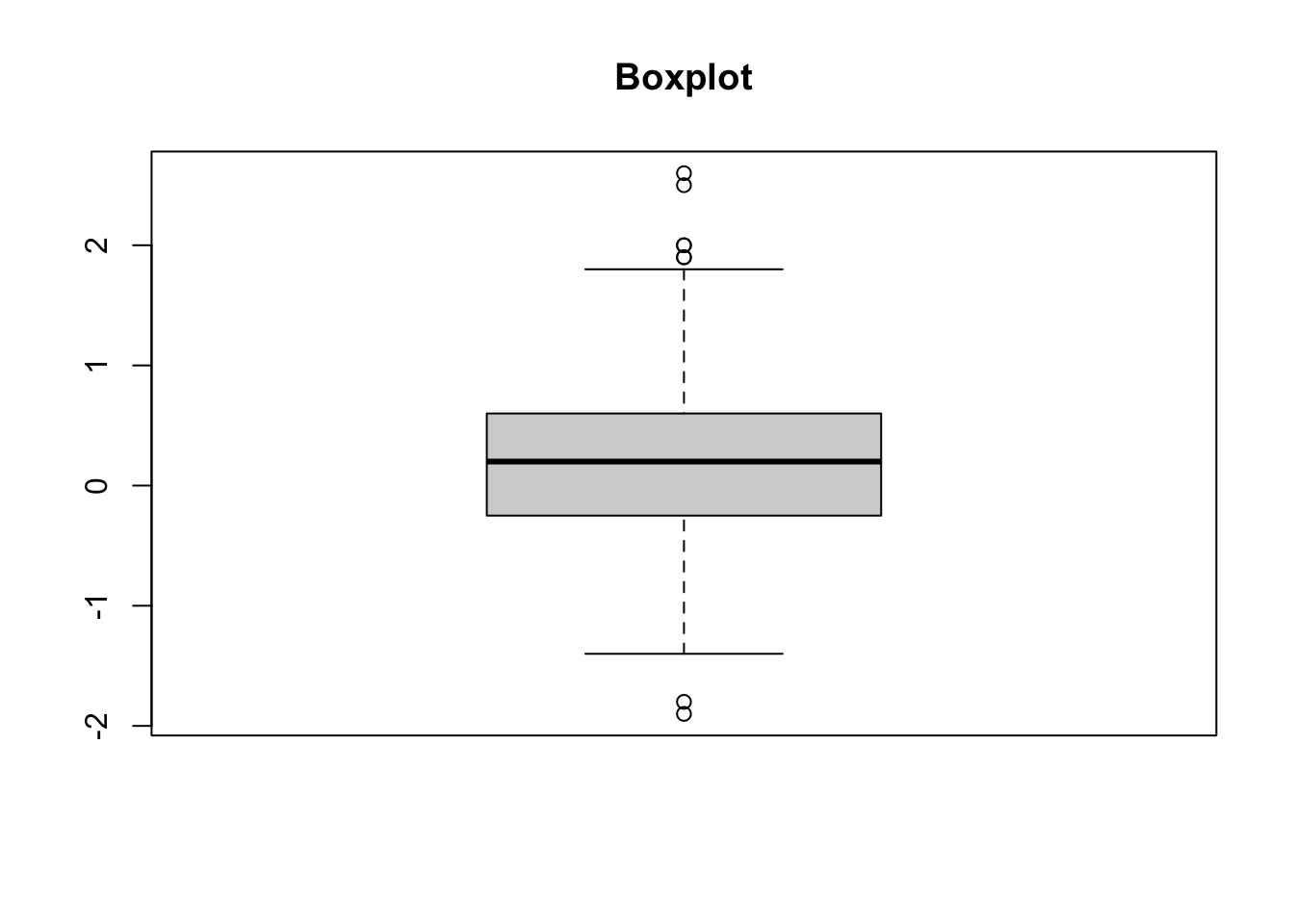

summary(d_ipampa) y

Min. :-1.9000

1st Qu.:-0.2500

Median : 0.2000

Mean : 0.2291

3rd Qu.: 0.6000

Max. : 2.6000 #histogramme

hist(d_ipampa, main= "Histogramme série corrigé", ylab=" Fréquence", xlab="indice")

#skewness

PerformanceAnalytics::skewness(d_ipampa)[1] 0.4496658#kurtosis

PerformanceAnalytics::kurtosis(d_ipampa)[1] 0.6254732e1071::kurtosis(d_ipampa)[1] 0.5918263#normalité

stats::shapiro.test(d_ipampa)

Shapiro-Wilk normality test

data: d_ipampa

W = 0.97467, p-value = 0.0006498#boxplot

boxplot(d_ipampa, main="Boxplot")

#test outliers

rosnerTest(d_ipampa, k=10)

Results of Outlier Test

-------------------------

Test Method: Rosner's Test for Outliers

Hypothesized Distribution: Normal

Data: d_ipampa

Sample Size: 215

Test Statistics: R.1 = 3.233268

R.2 = 3.183835

R.3 = 3.006058

R.4 = 2.934315

R.5 = 2.627525

R.6 = 2.678351

R.7 = 2.579619

R.8 = 2.628374

R.9 = 2.522953

R.10 = 2.523867

Test Statistic Parameter: k = 10

Alternative Hypothesis: Up to 10 observations are not

from the same Distribution.

Type I Error: 5%

Number of Outliers Detected: 0

i Mean.i SD.i Value Obs.Num R.i+1 lambda.i+1 Outlier

1 0 0.2291333 0.7332725 2.6 204 3.233268 3.627118 FALSE

2 1 0.2180544 0.7167286 2.5 209 3.183835 3.625734 FALSE

3 2 0.2073411 0.7010315 -1.9 47 3.006058 3.624342 FALSE

4 3 0.2172814 0.6874795 -1.8 46 2.934315 3.622942 FALSE

5 4 0.2268419 0.6748397 2.0 91 2.627525 3.621535 FALSE

6 5 0.2183983 0.6651861 2.0 202 2.678351 3.620120 FALSE

7 6 0.2098739 0.6551844 1.9 193 2.579619 3.618697 FALSE

8 7 0.2017483 0.6461226 1.9 40 2.628374 3.617266 FALSE

9 8 0.1935442 0.6367363 1.8 205 2.522953 3.615828 FALSE

10 9 0.1857459 0.6283000 -1.4 54 2.523867 3.614381 FALSELe test de shapiro, indique que notre série ne suit pas une loi normal

Le box plot nous indique des possibles outliers. La vérification avec le test de rosner nous indique que finalement il n’y pas

Estimation des modèles linéaires

Modèles AR(1), AR(p) et ARIMA(p,d,q) et de la méthode LED Holt-Winters, ADAM ETS, ADAM ETS SARIMA, SSARIMA et CES

Modèle AR(1)

# Parametres modele AR(1)

ar1 <- auto.arima(d_ipampa, max.p=1, max.q=0, d=0, stationary = TRUE, seasonal = FALSE, ic = "aic", stepwise = TRUE, trace = TRUE)

Fitting models using approximations to speed things up...

ARIMA(1,0,0) with non-zero mean : 341.619

ARIMA(0,0,0) with non-zero mean : 479.739

ARIMA(1,0,0) with non-zero mean : 341.619

ARIMA(0,0,0) with zero mean : 497.859

ARIMA(1,0,0) with zero mean : 342.4367

Now re-fitting the best model(s) without approximations...

ARIMA(1,0,0) with non-zero mean : 341.299

Best model: ARIMA(1,0,0) with non-zero mean # Estimation

summary(ar1)Series: d_ipampa

ARIMA(1,0,0) with non-zero mean

Coefficients:

ar1 mean

0.6966 0.2150

s.e. 0.0492 0.1172

sigma^2 = 0.2802: log likelihood = -167.65

AIC=341.3 AICc=341.41 BIC=351.41

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

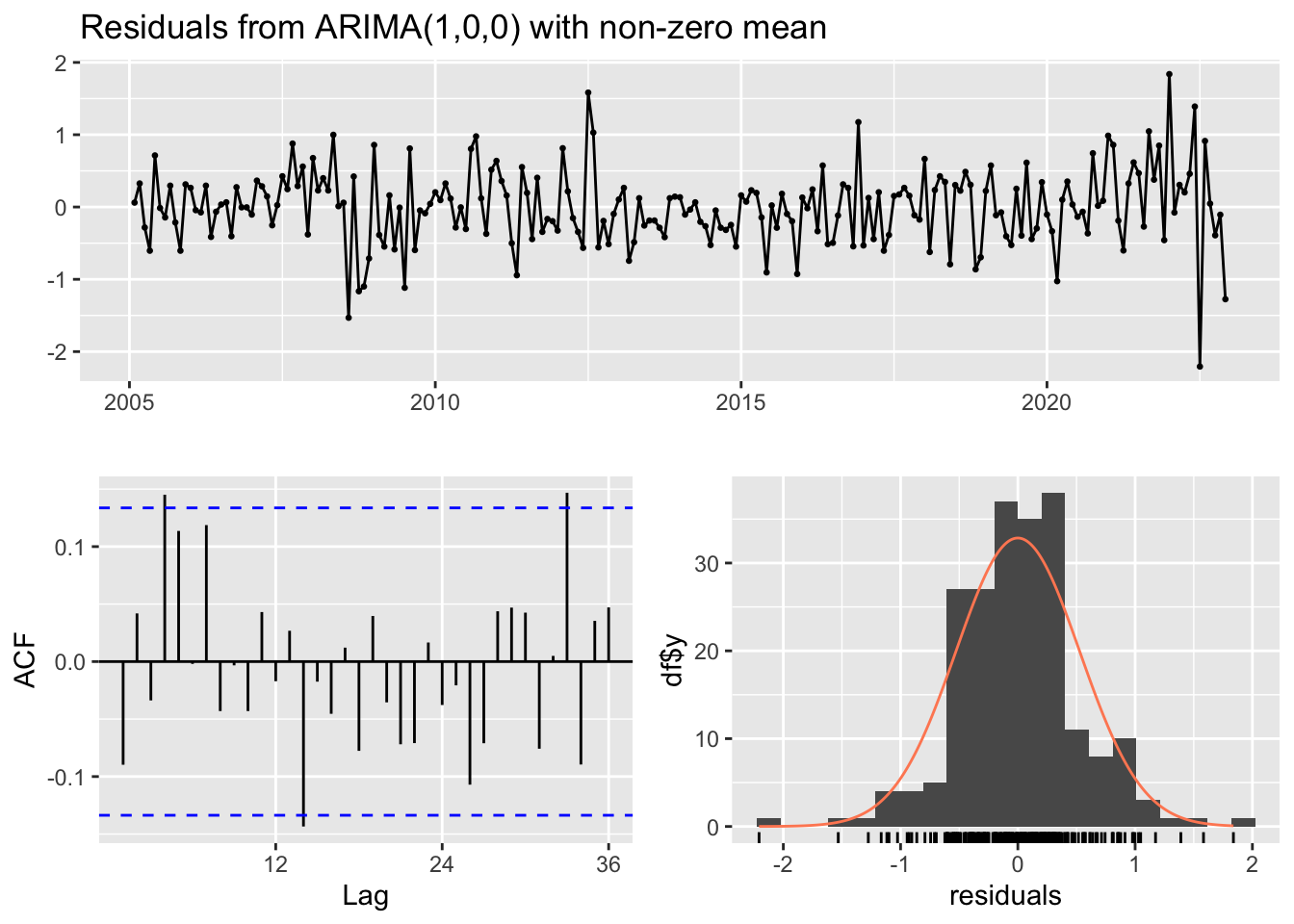

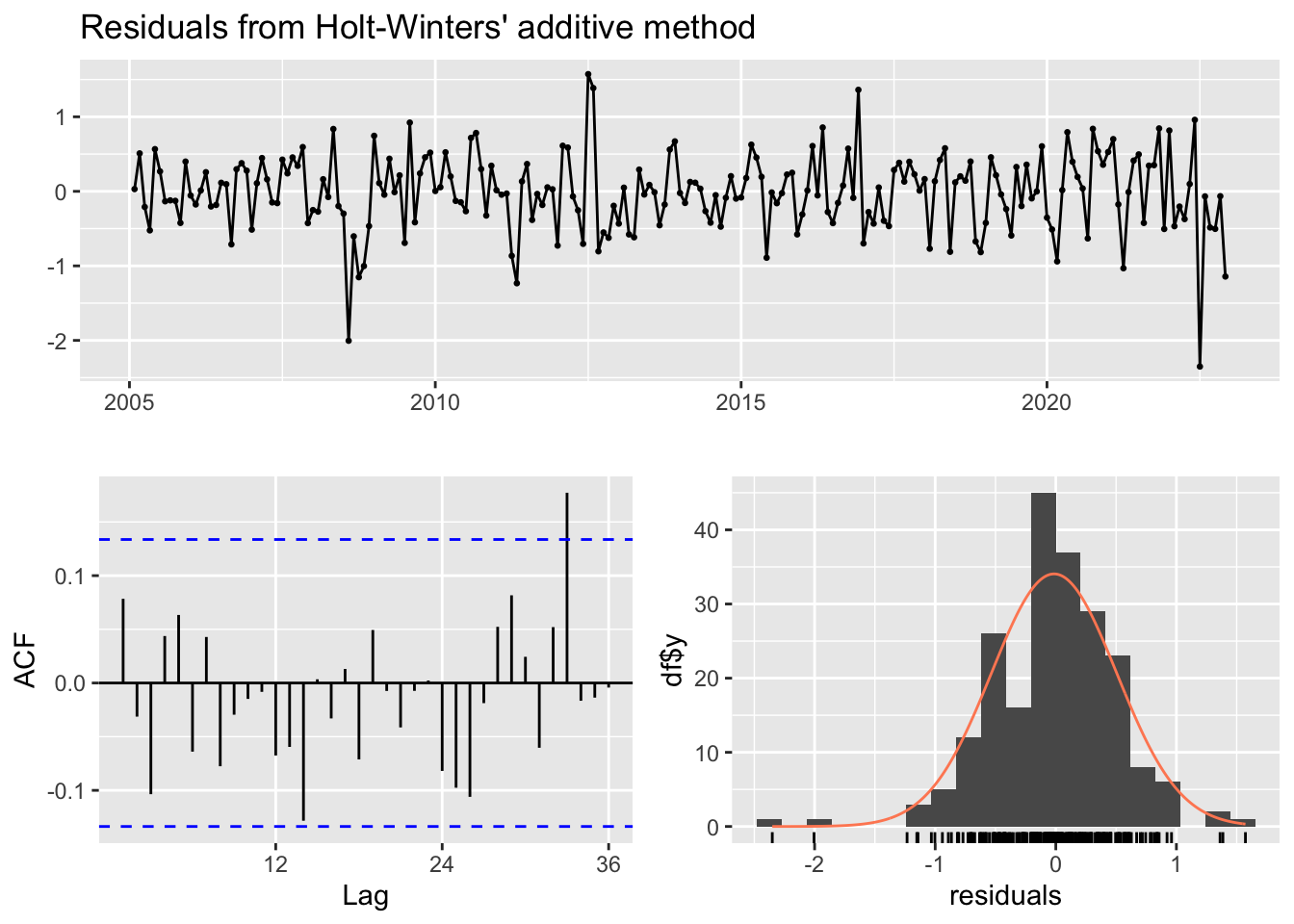

Training set -0.000387161 0.526914 0.3958932 NaN Inf 0.5050639 -0.08971407checkresiduals(ar1)

Ljung-Box test

data: Residuals from ARIMA(1,0,0) with non-zero mean

Q* = 24.914, df = 23, p-value = 0.3548

Model df: 1. Total lags used: 24Nombre de retards pour le test Ljung-BOx: 24, ce test permet de vérifier si les résidus de notre modèle sont effectivement du bruit blanc (c’est-à-dire non corrélés et avec une moyenne constante et une variance constante). Ici la P_value est de 0,354 donc > 0,05 ; Il n’y a pas suffisamment de preuves pour rejeter l’hypothèse selon laquelle les résidus du modèle ARIMA(1,0,0) sont indépendants. Les résidus du modèle ne présentent pas d’autocorrélation significative à aucun des décalages testés.

Modèle AR(p)

# Parametres modele AR(p)

arp <- auto.arima(d_ipampa, max.q=0, d=0, stationary = TRUE, seasonal = FALSE, ic = "aic", stepwise = TRUE, trace = TRUE)

Fitting models using approximations to speed things up...

ARIMA(2,0,0) with non-zero mean : 340.2507

ARIMA(0,0,0) with non-zero mean : 479.739

ARIMA(1,0,0) with non-zero mean : 341.619

ARIMA(0,0,0) with zero mean : 497.859

ARIMA(3,0,0) with non-zero mean : 342.3594

ARIMA(2,0,0) with zero mean : 340.1487

ARIMA(1,0,0) with zero mean : 342.4367

ARIMA(3,0,0) with zero mean : 342.0625

Now re-fitting the best model(s) without approximations...

ARIMA(2,0,0) with zero mean : 339.5992

Best model: ARIMA(2,0,0) with zero mean # Estimation

summary(arp)Series: d_ipampa

ARIMA(2,0,0) with zero mean

Coefficients:

ar1 ar2

0.6144 0.1489

s.e. 0.0680 0.0680

sigma^2 = 0.2779: log likelihood = -166.8

AIC=339.6 AICc=339.71 BIC=349.71

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

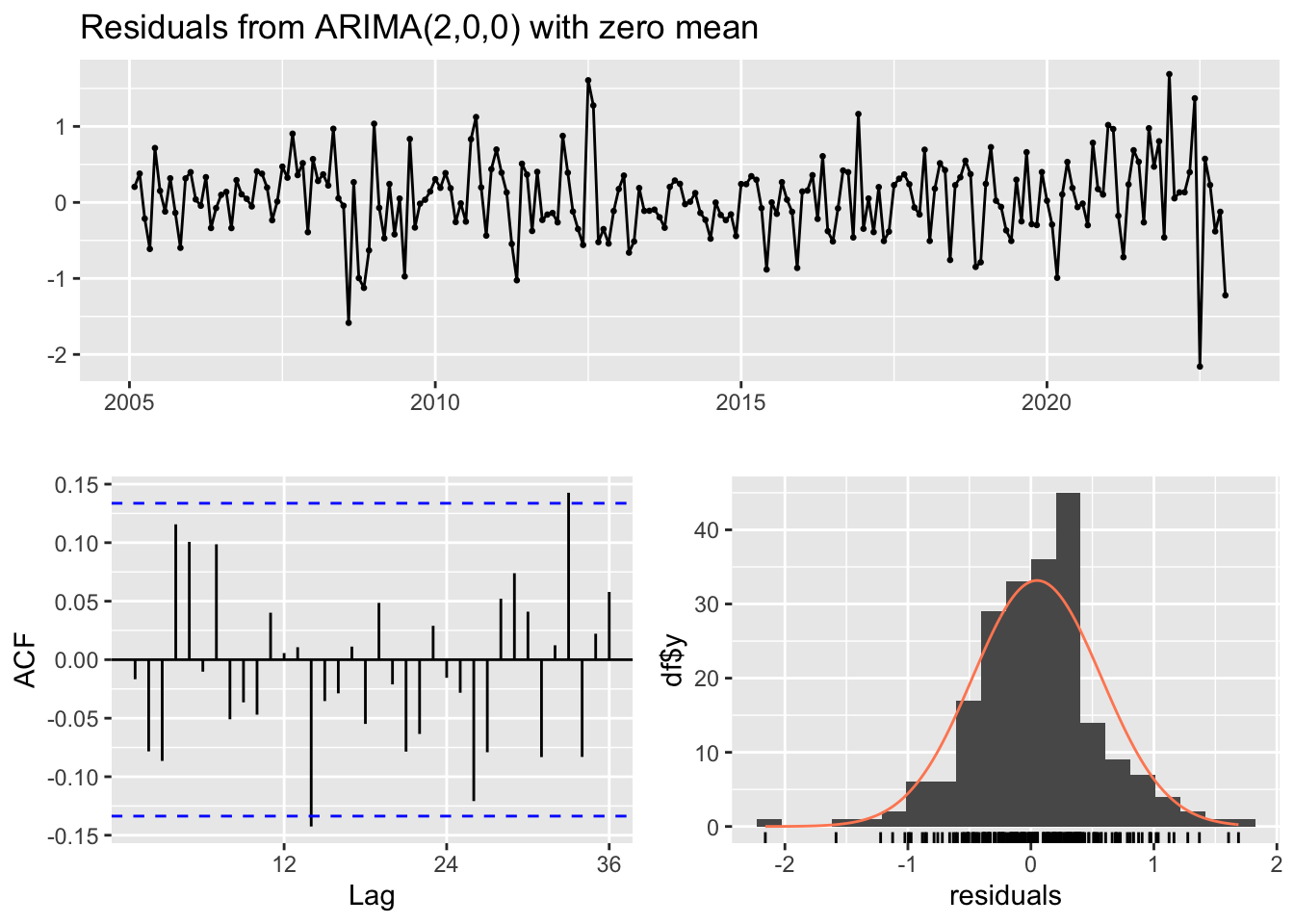

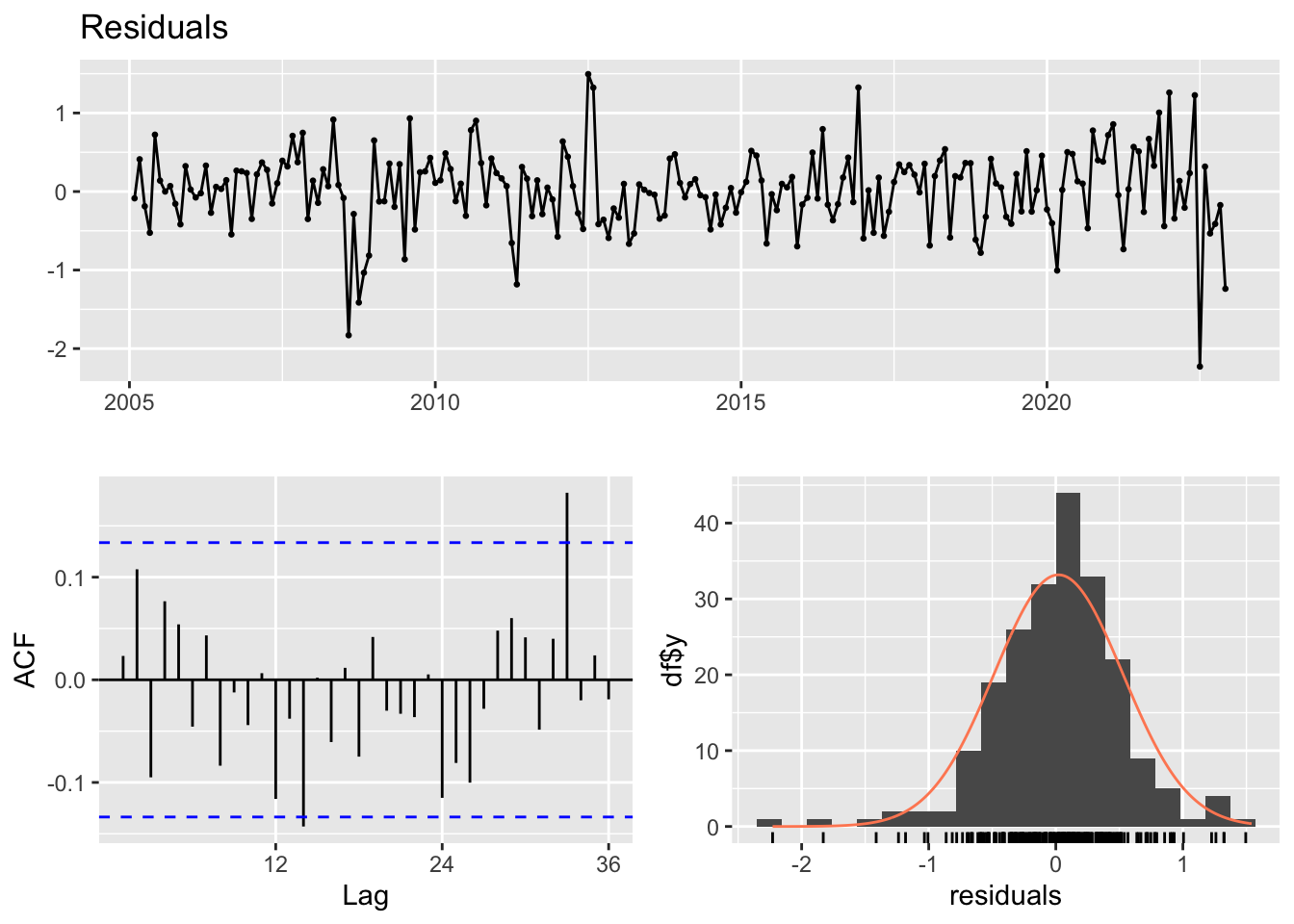

Training set 0.04941427 0.5246927 0.3970709 NaN Inf 0.5065663 -0.01668794checkresiduals(arp)

Ljung-Box test

data: Residuals from ARIMA(2,0,0) with zero mean

Q* = 21.585, df = 22, p-value = 0.4849

Model df: 2. Total lags used: 24Modèle ARIMA(p,d,q)

# Parametres modele AR(p,d,q)

arima <- auto.arima(d_ipampa, stationary = TRUE, seasonal = FALSE, ic = "aic", stepwise = TRUE, trace = TRUE)

Fitting models using approximations to speed things up...

ARIMA(2,0,2) with non-zero mean : 342.5512

ARIMA(0,0,0) with non-zero mean : 479.739

ARIMA(1,0,0) with non-zero mean : 341.619

ARIMA(0,0,1) with non-zero mean : 397.5533

ARIMA(0,0,0) with zero mean : 497.859

ARIMA(2,0,0) with non-zero mean : 340.2507

ARIMA(3,0,0) with non-zero mean : 342.3594

ARIMA(2,0,1) with non-zero mean : 340.767

ARIMA(1,0,1) with non-zero mean : 338.5836

ARIMA(1,0,2) with non-zero mean : 339.5905

ARIMA(0,0,2) with non-zero mean : 360.2773

ARIMA(1,0,1) with zero mean : 338.1744

ARIMA(0,0,1) with zero mean : 408.3375

ARIMA(1,0,0) with zero mean : 342.4367

ARIMA(2,0,1) with zero mean : 340.0586

ARIMA(1,0,2) with zero mean : 338.9206

ARIMA(0,0,2) with zero mean : 366.344

ARIMA(2,0,0) with zero mean : 340.1487

ARIMA(2,0,2) with zero mean : 341.8261

Now re-fitting the best model(s) without approximations...

ARIMA(1,0,1) with zero mean : 338.1988

Best model: ARIMA(1,0,1) with zero mean # Estimation

summary(arima)Series: d_ipampa

ARIMA(1,0,1) with zero mean

Coefficients:

ar1 ma1

0.8434 -0.2691

s.e. 0.0527 0.1045

sigma^2 = 0.2761: log likelihood = -166.1

AIC=338.2 AICc=338.31 BIC=348.31

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set 0.04405366 0.5229599 0.3932828 NaN Inf 0.5017336 0.01465994Modèle Holt-Winter

# un lissage exponentiel double (Holt-Winters sans composante saisonnière)

# premier modele

holtw_model <- HoltWinters(d_ipampa,gamma=FALSE)

holtw_modelHolt-Winters exponential smoothing with trend and without seasonal component.

Call:

HoltWinters(x = d_ipampa, gamma = FALSE)

Smoothing parameters:

alpha: 0.6535009

beta : 0.05000744

gamma: FALSE

Coefficients:

[,1]

a -0.76012345

b -0.07822051summary(holtw_model) Length Class Mode

fitted 639 mts numeric

x 215 ts numeric

alpha 1 -none- numeric

beta 1 -none- numeric

gamma 1 -none- logical

coefficients 2 -none- numeric

seasonal 1 -none- character

SSE 1 -none- numeric

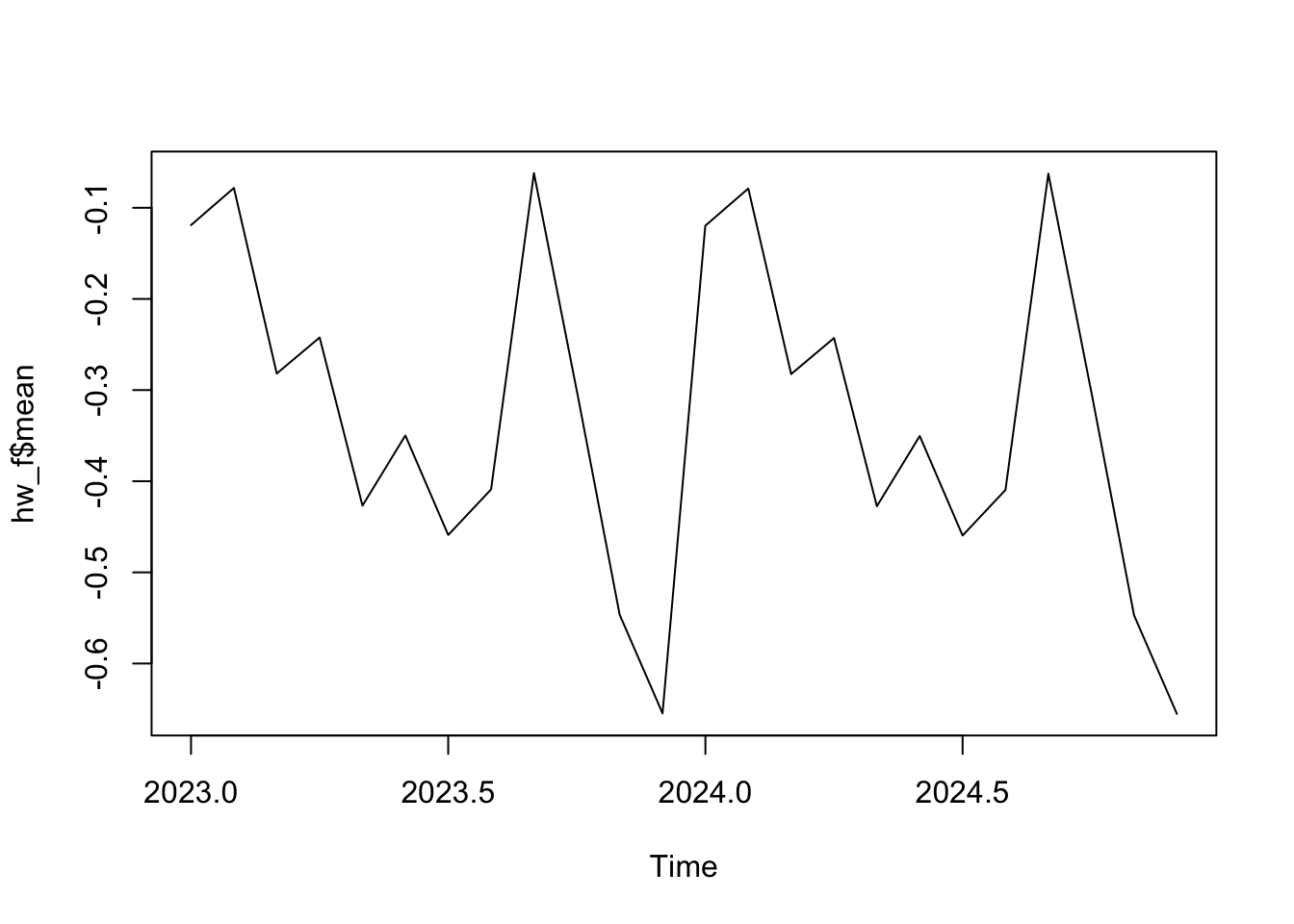

call 3 -none- call # modèle Holt-Winters package forecaste - deuxieme modele

hw_f <- hw(d_ipampa, seasonal = NULL)

summary(hw_f)

Forecast method: Holt-Winters' additive method

Model Information:

Holt-Winters' additive method

Call:

hw(y = d_ipampa, seasonal = NULL)

Smoothing parameters:

alpha = 0.5271

beta = 0.0028

gamma = 3e-04

Initial states:

l = 0.0125

b = 0.0087

s = 0.2086 -0.327 -0.2191 0.0265 0.2662 -0.0816

-0.1315 -0.0219 -0.0996 0.0853 0.045 0.249

sigma: 0.5395

AIC AICc BIC

906.7153 909.8219 964.0161

Error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set -0.01440269 0.5190534 0.3883465 NaN Inf 0.4954361 0.07842208

Forecasts:

Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

Jan 2023 -0.11899046 -0.8104086 0.5724277 -1.176423 0.9384424

Feb 2023 -0.07826328 -0.8607539 0.7042273 -1.274979 1.1184528

Mar 2023 -0.28184860 -1.1466923 0.5829951 -1.604513 1.0408158

Apr 2023 -0.24232723 -1.1831015 0.6984470 -1.681117 1.1964628

May 2023 -0.42684394 -1.4385769 0.5848890 -1.974156 1.1204681

Jun 2023 -0.34980408 -1.4285091 0.7289009 -1.999541 1.2999329

Jul 2023 -0.45898101 -1.6013761 0.6834141 -2.206123 1.2881615

Aug 2023 -0.40898321 -1.6123107 0.7943443 -2.249314 1.4313474

Sep 2023 -0.06201067 -1.3239156 1.1998942 -1.991928 1.8679064

Oct 2023 -0.30085375 -1.6192978 1.0175903 -2.317240 1.7155325

Nov 2023 -0.54649791 -1.9196974 0.8267016 -2.646625 1.5536295

Dec 2023 -0.65465763 -2.0810370 0.7717217 -2.836117 1.5268013

Jan 2024 -0.11958951 -1.5977911 1.3586121 -2.380304 2.1411248

Feb 2024 -0.07886233 -1.6075814 1.4498567 -2.416836 2.2591117

Mar 2024 -0.28244765 -1.8605495 1.2956542 -2.695946 2.1310509

Apr 2024 -0.24292628 -1.8693821 1.3835296 -2.730376 2.2445233

May 2024 -0.42744299 -2.1013153 1.2464293 -2.987410 2.1325238

Jun 2024 -0.35040313 -2.0708342 1.3700279 -2.981575 2.2807691

Jul 2024 -0.45958006 -2.2257820 1.3066219 -3.160753 2.2415928

Aug 2024 -0.40958226 -2.2208293 1.4016647 -3.179645 2.3604810

Sep 2024 -0.06260973 -1.9182307 1.7930112 -2.900537 2.7753176

Oct 2024 -0.30145280 -2.2008257 1.5979201 -3.206293 2.6033874

Nov 2024 -0.54709696 -2.4896438 1.3954499 -3.517966 2.4237721

Dec 2024 -0.65525668 -2.6404390 1.3299257 -3.691331 2.3808177hw_ff <- forecast(hw_f, h=12)

plot(hw_f$mean)

checkresiduals(hw_ff)

Ljung-Box test

data: Residuals from Holt-Winters' additive method

Q* = 18.017, df = 24, p-value = 0.8022

Model df: 0. Total lags used: 24Modèle Holt - nous testons un troisième modele, avec la fonction Holt de forecast

# Ajustement du modèle de Holt

#holtW <- holt(d_ipampa, h=12)

#summary(holtW)

# résidus

#checkresiduals(holtW)Modèle ADAM ETS

# 1er ADAM ETS

adam_ets <- auto.adam(d_ipampa, model="ZZN", lags=c(1,12),

select=TRUE, ic = "AIC")Warning: The data is not strictly positive, so not all the distributions make

sense. Dropping dlnorm, dinvgauss, dgamma.Warning: Only additive models are allowed for your data. Changing the selection

mechanism.

Warning: Only additive models are allowed for your data. Changing the selection

mechanism.

Warning: Only additive models are allowed for your data. Changing the selection

mechanism.

Warning: Only additive models are allowed for your data. Changing the selection

mechanism.# Message d'avertissement

"Warning messages:

1: The data is not strictly positive, so not all the distributions make sense. Dropping dlnorm, dinvgauss, dgamma.

2: Only additive models are allowed for your data. Changing the selection mechanism"[1] "Warning messages:\n1: The data is not strictly positive, so not all the distributions make sense. Dropping dlnorm, dinvgauss, dgamma. \n2: Only additive models are allowed for your data. Changing the selection mechanism"# estimation

summary(adam_ets)Warning: Observed Fisher Information is not positive semi-definite, which means

that the likelihood was not maximised properly. Consider reestimating the

model, tuning the optimiser or using bootstrap via bootstrap=TRUE.

Model estimated using auto.adam() function: ETS(ANN)+ARIMA(3,0,0)

Response variable: y

Distribution used in the estimation: Generalised Normal with shape=1.2895

Loss function type: likelihood; Loss function value: 158.6382

Coefficients:

Estimate Std. Error Lower 2.5% Upper 97.5%

alpha 0.0003 0.0607 0.0000 0.1199

phi1[1] 0.5854 0.0335 0.5195 0.6513 *

phi2[1] 0.0926 0.0040 0.0848 0.1005 *

phi3[1] 0.0918 0.0157 0.0608 0.1228 *

level 0.2758 0.1074 0.0641 0.4875 *

ARIMAState1 -0.0004 0.7456 -1.4705 1.4689

ARIMAState2 0.0038 2.3852 -4.6990 4.7041

ARIMAState3 0.0001 2.9640 -5.8437 5.8408

other 1.2895 0.1638 0.9665 1.6124 *

Error standard deviation: 0.5494

Sample size: 215

Number of estimated parameters: 10

Number of degrees of freedom: 205

Information criteria:

AIC AICc BIC BICc

337.2764 338.3548 370.9828 373.8787 # deuxieme adam_ets pour eviter le message d'avertissement

adam_ets <- auto.adam(d_ipampa, model="AAN", select=TRUE, ic = "AIC", distribution = c("dnorm"), bootstrap=TRUE, control=list(maxit=1000, trace=TRUE),orders=list(ar=c(0), i = c(0), ma = c(0)))

summary(adam_ets)Warning: Observed Fisher Information is not positive semi-definite, which means

that the likelihood was not maximised properly. Consider reestimating the

model, tuning the optimiser or using bootstrap via bootstrap=TRUE.

Model estimated using auto.adam() function: ETS(AAN)

Response variable: y

Distribution used in the estimation: Normal

Loss function type: likelihood; Loss function value: 172.4178

Coefficients:

Estimate Std. Error Lower 2.5% Upper 97.5%

alpha 0.5797 0.0661 0.4494 0.7099 *

beta 0.0001 0.0145 0.0000 0.0287

level 0.3396 0.4910 -0.6284 1.3073

trend -0.0044 0.0217 -0.0472 0.0384

Error standard deviation: 0.5608

Sample size: 215

Number of estimated parameters: 5

Number of degrees of freedom: 210

Information criteria:

AIC AICc BIC BICc

354.8355 355.1226 371.6887 372.4596 "Warning message:

Observed Fisher Information is not positive semi-definite, which means that the likelihood was not maximised properly. Consider reestimating the model, tuning the optimiser or using bootstrap via bootstrap=TRUE."[1] "Warning message:\nObserved Fisher Information is not positive semi-definite, which means that the likelihood was not maximised properly. Consider reestimating the model, tuning the optimiser or using bootstrap via bootstrap=TRUE."# troicieme adam_ets modèle ADAM sans saisonnalité

# adam_ets <-auto.adam(d_ipampa, model="ANN", select=TRUE, ic="AIC", bootstrap=TRUE, distribution = c("dnorm", "dlaplace"), control=list(maxit=1000, trace=TRUE))

#summary(adam_ets)Modèle ADAM ETS ARIMA

# premier test model ADAM ETS SARIMA

adam_ets_sa <- auto.adam(d_ipampa, model="ZZN", lags=c(1,1,12), orders=list(ar=c(3,3), i=c(0), ma=c(3,3), select=TRUE))Warning: The data is not strictly positive, so not all the distributions make

sense. Dropping dlnorm, dinvgauss, dgamma.Warning: Only additive models are allowed for your data. Changing the selection

mechanism.

Warning: Only additive models are allowed for your data. Changing the selection

mechanism.

Warning: Only additive models are allowed for your data. Changing the selection

mechanism.

Warning: Only additive models are allowed for your data. Changing the selection

mechanism.summary(adam_ets_sa)Warning: Observed Fisher Information is not positive semi-definite, which means

that the likelihood was not maximised properly. Consider reestimating the

model, tuning the optimiser or using bootstrap via bootstrap=TRUE.

Model estimated using auto.adam() function: ETS(ANN)+ARIMA(3,0,0)

Response variable: y

Distribution used in the estimation: Generalised Normal with shape=1.2895

Loss function type: likelihood; Loss function value: 158.6382

Coefficients:

Estimate Std. Error Lower 2.5% Upper 97.5%

alpha 0.0003 0.0607 0.0000 0.1199

phi1[1] 0.5854 0.0335 0.5195 0.6513 *

phi2[1] 0.0926 0.0040 0.0848 0.1005 *

phi3[1] 0.0918 0.0157 0.0608 0.1228 *

level 0.2758 0.1074 0.0641 0.4875 *

ARIMAState1 -0.0004 0.7456 -1.4705 1.4689

ARIMAState2 0.0038 2.3852 -4.6990 4.7041

ARIMAState3 0.0001 2.9640 -5.8437 5.8408

other 1.2895 0.1638 0.9665 1.6124 *

Error standard deviation: 0.5494

Sample size: 215

Number of estimated parameters: 10

Number of degrees of freedom: 205

Information criteria:

AIC AICc BIC BICc

337.2764 338.3548 370.9828 373.8787 "Warning messages:

1: The data is not strictly positive, so not all the distributions make sense. Dropping dlnorm, dinvgauss, dgamma.

2: Only additive models are allowed for your data. Changing the selection mechanism. "[1] "Warning messages:\n1: The data is not strictly positive, so not all the distributions make sense. Dropping dlnorm, dinvgauss, dgamma. \n2: Only additive models are allowed for your data. Changing the selection mechanism. "# apres modification pour éviter les message d'avertisment

adam_ets_sa <- auto.adam(d_ipampa, model="AAN", lags=c(1,1,12), orders=list(ar=c(3,3), i=c(0), ma=c(3,3), select=TRUE), distribution = c("dnorm", "dlaplace"))

summary(adam_ets_sa)Warning: Observed Fisher Information is not positive semi-definite, which means

that the likelihood was not maximised properly. Consider reestimating the

model, tuning the optimiser or using bootstrap via bootstrap=TRUE.

Model estimated using auto.adam() function: ETS(AAN)

Response variable: y

Distribution used in the estimation: Laplace

Loss function type: likelihood; Loss function value: 166.9445

Coefficients:

Estimate Std. Error Lower 2.5% Upper 97.5%

alpha 0.5671 0.0061 0.5550 0.5791 *

beta 0.0000 0.0022 0.0000 0.0043

level 0.2844 7.3964 -14.2962 14.8613

trend 0.0158 0.0079 0.0003 0.0314 *

Error standard deviation: 0.5621

Sample size: 215

Number of estimated parameters: 5

Number of degrees of freedom: 210

Information criteria:

AIC AICc BIC BICc

343.8889 344.1760 360.7421 361.5130 "Warning message:

Observed Fisher Information is not positive semi-definite, which means that the likelihood was not maximised properly. Consider reestimating the model, tuning the optimiser or using bootstrap via bootstrap=TRUE. "[1] "Warning message:\nObserved Fisher Information is not positive semi-definite, which means that the likelihood was not maximised properly. Consider reestimating the model, tuning the optimiser or using bootstrap via bootstrap=TRUE. "# Modele choisi

adam_ets_sa <- auto.adam(d_ipampa, model="ANN", lags=c(1,1,12), orders=list(ar=c(3,3), i=c(0), ma=c(3,3), select=TRUE), distribution=c("dnorm", "dlaplace"), bootstrap=TRUE,control=list(maxit=3000))

summary(adam_ets_sa)Warning: Observed Fisher Information is not positive semi-definite, which means

that the likelihood was not maximised properly. Consider reestimating the

model, tuning the optimiser or using bootstrap via bootstrap=TRUE.

Model estimated using auto.adam() function: ETS(ANN)+ARIMA(3,0,0)

Response variable: y

Distribution used in the estimation: Laplace

Loss function type: likelihood; Loss function value: 160.6124

Coefficients:

Estimate Std. Error Lower 2.5% Upper 97.5%

alpha 0.0036 0.0050 0.0000 0.0135

phi1[1] 0.5864 0.0520 0.4839 0.6889 *

phi2[1] 0.0559 0.0008 0.0543 0.0574 *

phi3[1] 0.1051 0.0125 0.0804 0.1298 *

level 0.2951 0.3738 -0.4419 1.0317

ARIMAState1 0.0007 0.0844 -0.1657 0.1669

ARIMAState2 0.0000 0.0794 -0.1565 0.1564

ARIMAState3 0.0024 2.2856 -4.5038 4.5065

Error standard deviation: 0.5488

Sample size: 215

Number of estimated parameters: 9

Number of degrees of freedom: 206

Information criteria:

AIC AICc BIC BICc

339.2248 340.1028 369.5605 371.9184 summary(adam_ets_sa)Warning: Observed Fisher Information is not positive semi-definite, which means

that the likelihood was not maximised properly. Consider reestimating the

model, tuning the optimiser or using bootstrap via bootstrap=TRUE.

Model estimated using auto.adam() function: ETS(ANN)+ARIMA(3,0,0)

Response variable: y

Distribution used in the estimation: Laplace

Loss function type: likelihood; Loss function value: 160.6124

Coefficients:

Estimate Std. Error Lower 2.5% Upper 97.5%

alpha 0.0036 0.0050 0.0000 0.0135

phi1[1] 0.5864 0.0520 0.4839 0.6889 *

phi2[1] 0.0559 0.0008 0.0543 0.0574 *

phi3[1] 0.1051 0.0125 0.0804 0.1298 *

level 0.2951 0.3738 -0.4419 1.0317

ARIMAState1 0.0007 0.0844 -0.1657 0.1669

ARIMAState2 0.0000 0.0794 -0.1565 0.1564

ARIMAState3 0.0024 2.2856 -4.5038 4.5065

Error standard deviation: 0.5488

Sample size: 215

Number of estimated parameters: 9

Number of degrees of freedom: 206

Information criteria:

AIC AICc BIC BICc

339.2248 340.1028 369.5605 371.9184 forecast(adam_ets_sa, h=12) Jan Feb Mar Apr May Jun

2023 -0.62258914 -0.35958468 -0.30092313 -0.19125026 -0.09602462 -0.02789313

Jul Aug Sep Oct Nov Dec

2023 0.02890327 0.07602108 0.11398312 0.14484443 0.17001336 0.19048551# meme apres avoir reduit la complexité du modele cela donne l'avertissement

#adam_ets_sa_Test <- auto.adam(d_ipampa, model="ANN", lags=c(1,12), orders=list(ar=c(1,1), i=c(0), ma=c(1,1),select=TRUE), distribution=c("dnorm", "dlaplace"), bootstrap=TRUE, bootstrap=TRUE, control=list(maxit=3000))

#forecast(adam_ets_sa_Test, h=12)

#?auto.adam()si l’on veut éviter l’avertissement il faut mettre model = ‘ANN’, mais cela implique que les prévision sont toutes égales. sur le graphique cela donne une ligne droite

forecast(adam_ets_sa_Test, h=12) Jan Feb Mar Apr May 2023 -0.588298 -0.588298 -0.588298 -0.588298 -0.588298 Jun Jul Aug Sep Oct 2023 -0.588298 -0.588298 -0.588298 -0.588298 -0.588298 Nov Dec 2023 -0.588298 -0.588298

On continue avec l’avertissement …

Modèle SSARIMA

# SSARIMA

ssarima <- auto.ssarima(d_ipampa, lags=c(1,12), orders=list(ar=c(3,3), i=(0), ma=c(3,3), select=TRUE), ic="AICc")

ssarima Time elapsed: 0.92 seconds

Model estimated: ARIMA(3,0,3)

Matrix of AR terms:

Lag 1

AR(1) 0.1719

AR(2) 0.0180

AR(3) 0.5445

Matrix of MA terms:

Lag 1

MA(1) 0.4367

MA(2) 0.3575

MA(3) -0.3599

Initial values were produced using backcasting.

Loss function type: likelihood; Loss function value: 161.0136

Error standard deviation: 0.5202

Sample size: 215

Number of estimated parameters: 7

Number of degrees of freedom: 208

Information criteria:

AIC AICc BIC BICc

336.0272 336.5682 359.6216 361.0746 summary(ssarima)Time elapsed: 0.92 seconds

Model estimated: ARIMA(3,0,3)

Matrix of AR terms:

Lag 1

AR(1) 0.1719

AR(2) 0.0180

AR(3) 0.5445

Matrix of MA terms:

Lag 1

MA(1) 0.4367

MA(2) 0.3575

MA(3) -0.3599

Initial values were produced using backcasting.

Loss function type: likelihood; Loss function value: 161.0136

Error standard deviation: 0.5202

Sample size: 215

Number of estimated parameters: 7

Number of degrees of freedom: 208

Information criteria:

AIC AICc BIC BICc

336.0272 336.5682 359.6216 361.0746 ?auto.ssarima()Modèle CES

# auto

ces <- auto.ces(d_ipampa, models=c("n", "s", "p", "f"), ic="AICc") # tester plusieurs types de modèles

summary(ces)Time elapsed: 0.89 seconds

Model estimated: CES(f)

a0 + ia1: 1.4655+0.9264i

b0 + ib1: 0.995+0.9989i

Initial values were produced using backcasting.

Loss function type: likelihood; Loss function value: 158.5716

Error standard deviation: 0.5119

Sample size: 215

Number of estimated parameters: 5

Number of degrees of freedom: 210

Information criteria:

AIC AICc BIC BICc

327.1431 327.4302 343.9963 344.7672 cesTime elapsed: 0.89 seconds

Model estimated: CES(f)

a0 + ia1: 1.4655+0.9264i

b0 + ib1: 0.995+0.9989i

Initial values were produced using backcasting.

Loss function type: likelihood; Loss function value: 158.5716

Error standard deviation: 0.5119

Sample size: 215

Number of estimated parameters: 5

Number of degrees of freedom: 210

Information criteria:

AIC AICc BIC BICc

327.1431 327.4302 343.9963 344.7672 checkresiduals(ces)

Ljung-Box test

data: Residuals

Q* = 24.373, df = 24, p-value = 0.4405

Model df: 0. Total lags used: 24#?auto.ces()Modèle Naïf

naive <- naive(d_ipampa, h=12)

summary(naive)

Forecast method: Naive method

Model Information:

Call: naive(y = d_ipampa, h = 12)

Residual sd: 0.5714

Error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set -0.006982548 0.5714192 0.4232642 NaN Inf 0.5399827 -0.2612091

Forecasts:

Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

Jan 2023 -1.194265 -1.926568 -0.46196213 -2.314226 -0.07430425

Feb 2023 -1.194265 -2.229898 -0.15863223 -2.778129 0.38959880

Mar 2023 -1.194265 -2.462652 0.07412099 -3.134095 0.74556413

Apr 2023 -1.194265 -2.658872 0.27034103 -3.434187 1.04565679

May 2023 -1.194265 -2.831745 0.44321436 -3.698574 1.31004373

Jun 2023 -1.194265 -2.988034 0.59950379 -3.937598 1.54906779

Jul 2023 -1.194265 -3.131757 0.74322676 -4.157404 1.76887310

Aug 2023 -1.194265 -3.265531 0.87700084 -4.361993 1.97346289

Sep 2023 -1.194265 -3.391175 1.00264420 -4.554148 2.16561783

Oct 2023 -1.194265 -3.510011 1.12148064 -4.735893 2.34736248

Nov 2023 -1.194265 -3.623040 1.23450953 -4.908756 2.52022526

Dec 2023 -1.194265 -3.731038 1.34250728 -5.073924 2.68539355Prévisions

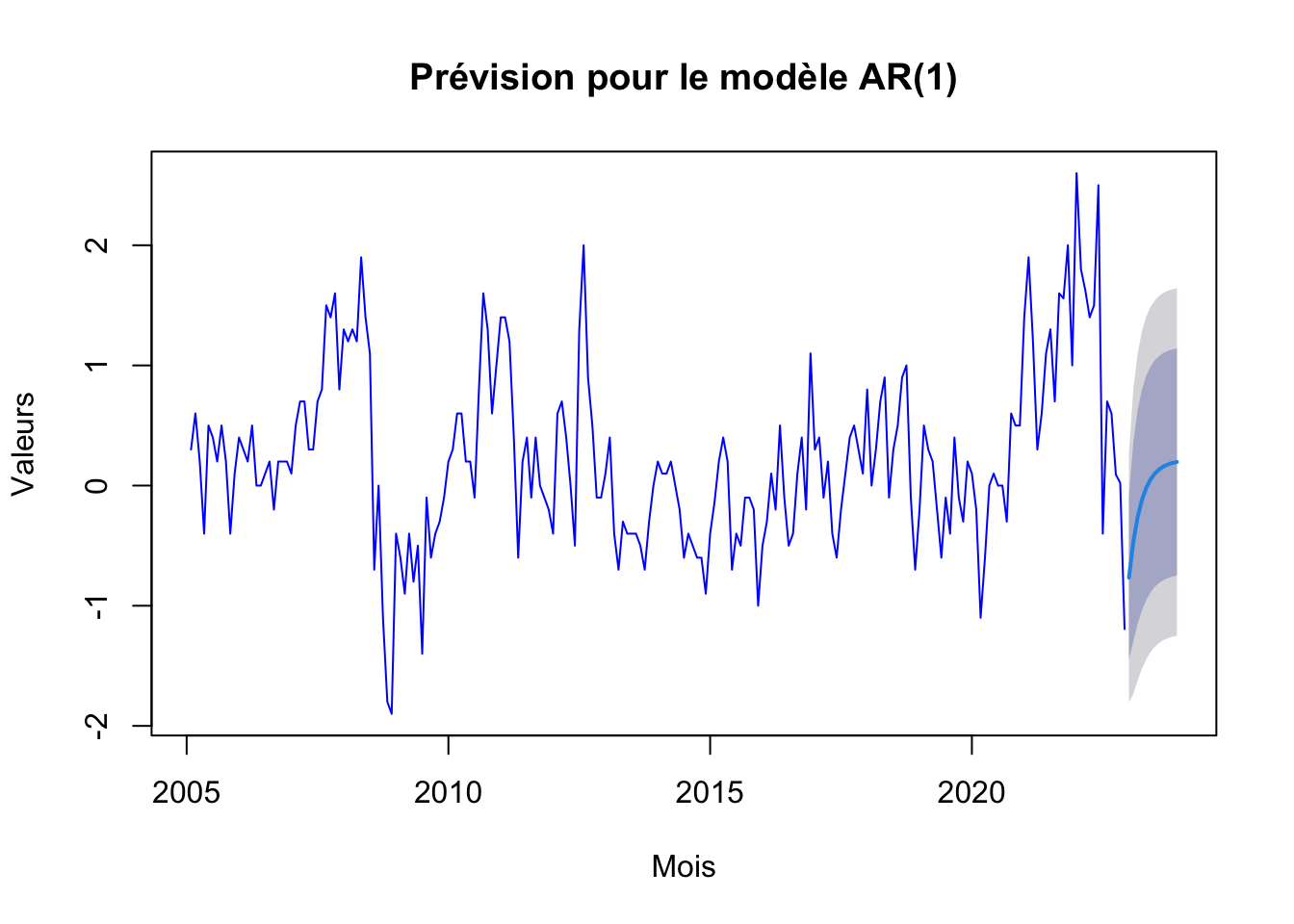

# Prévision et tracé pour le modèle AR(1)

ar1_forecast <- forecast(ar1, h=12)

plot(ar1_forecast, main="Prévision pour le modèle AR(1)", xlab="Mois", ylab="Valeurs", col="blue")

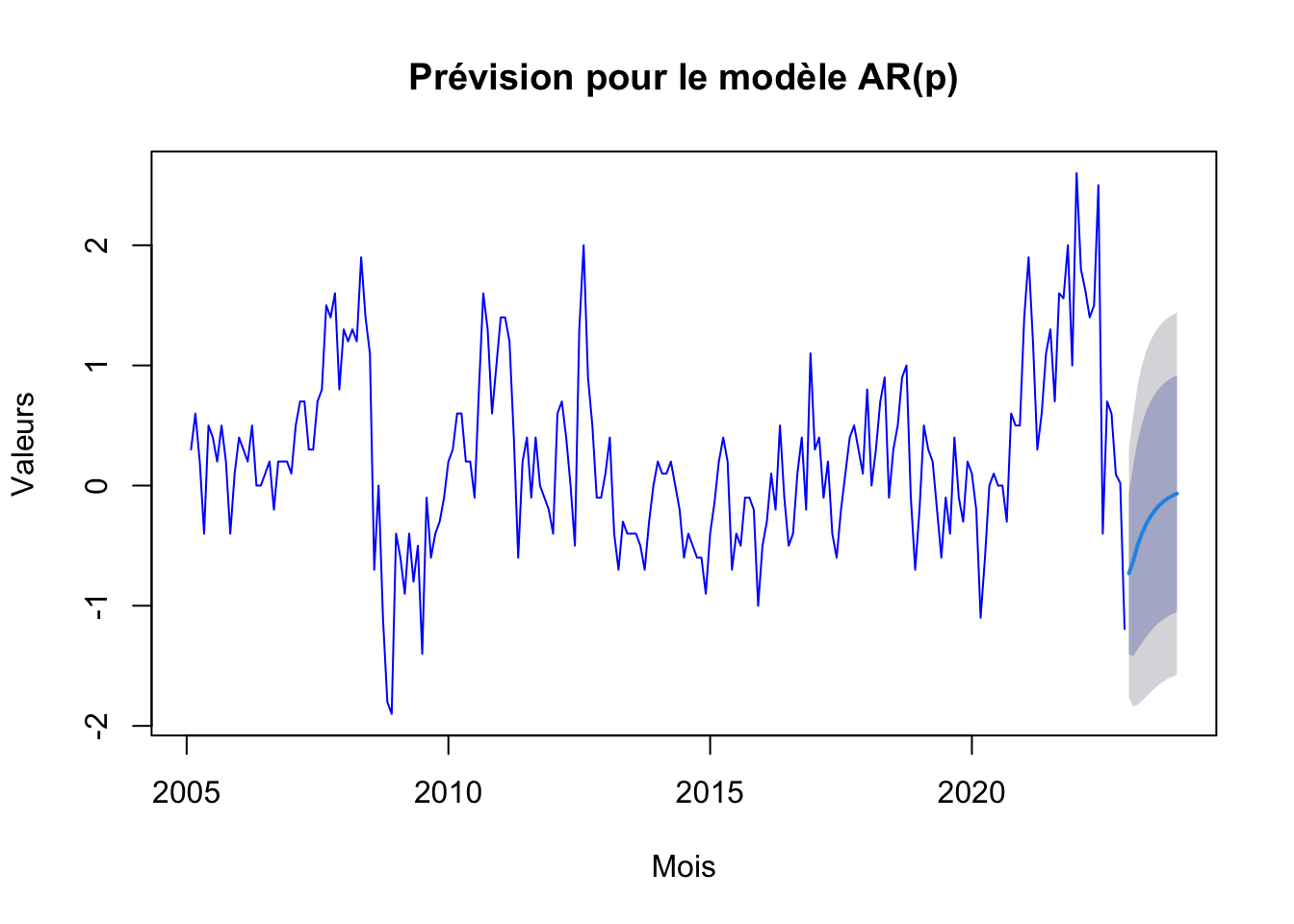

# Prévision et tracé pour le modèle AR(p)

arp_forecast <- forecast(arp, h=12)

plot(arp_forecast, main="Prévision pour le modèle AR(p)", xlab="Mois", ylab="Valeurs", col="blue")

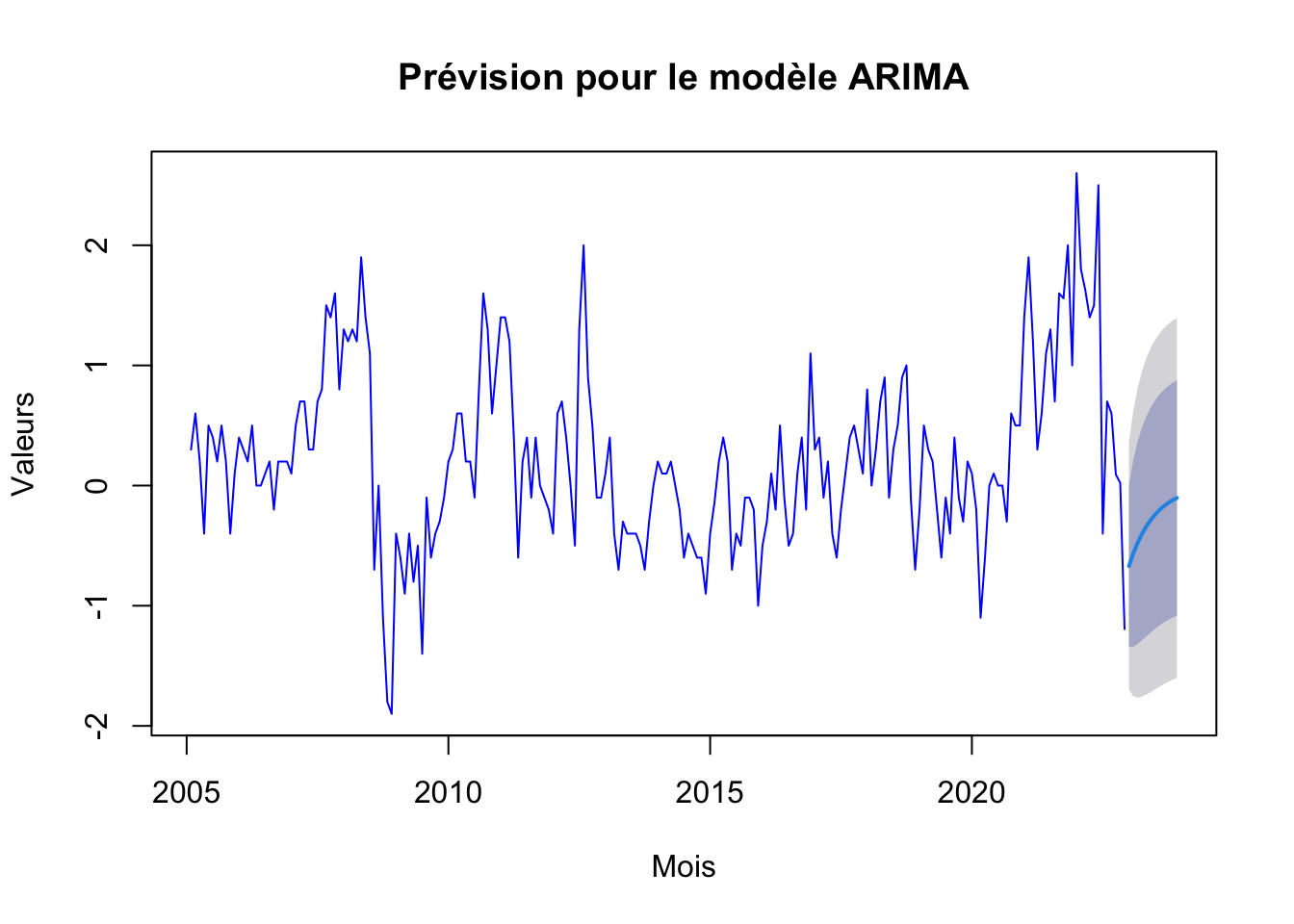

# Prévision et tracé pour le modèle ARIMA

arima_forecast <- forecast(arima, h=12)

plot(arima_forecast, main="Prévision pour le modèle ARIMA", xlab="Mois", ylab="Valeurs", col="blue")

# Prévision et tracé pour le modèle Holt (LED Holt sans saisonnalité)

#holt_forecast <- forecast(holtw_model, h=12, interval="confidence", level = 0.90)

#plot(holt_forecast, main="Prévision pour le modèle Holt", xlab="Mois", ylab="Valeurs", col="purple")

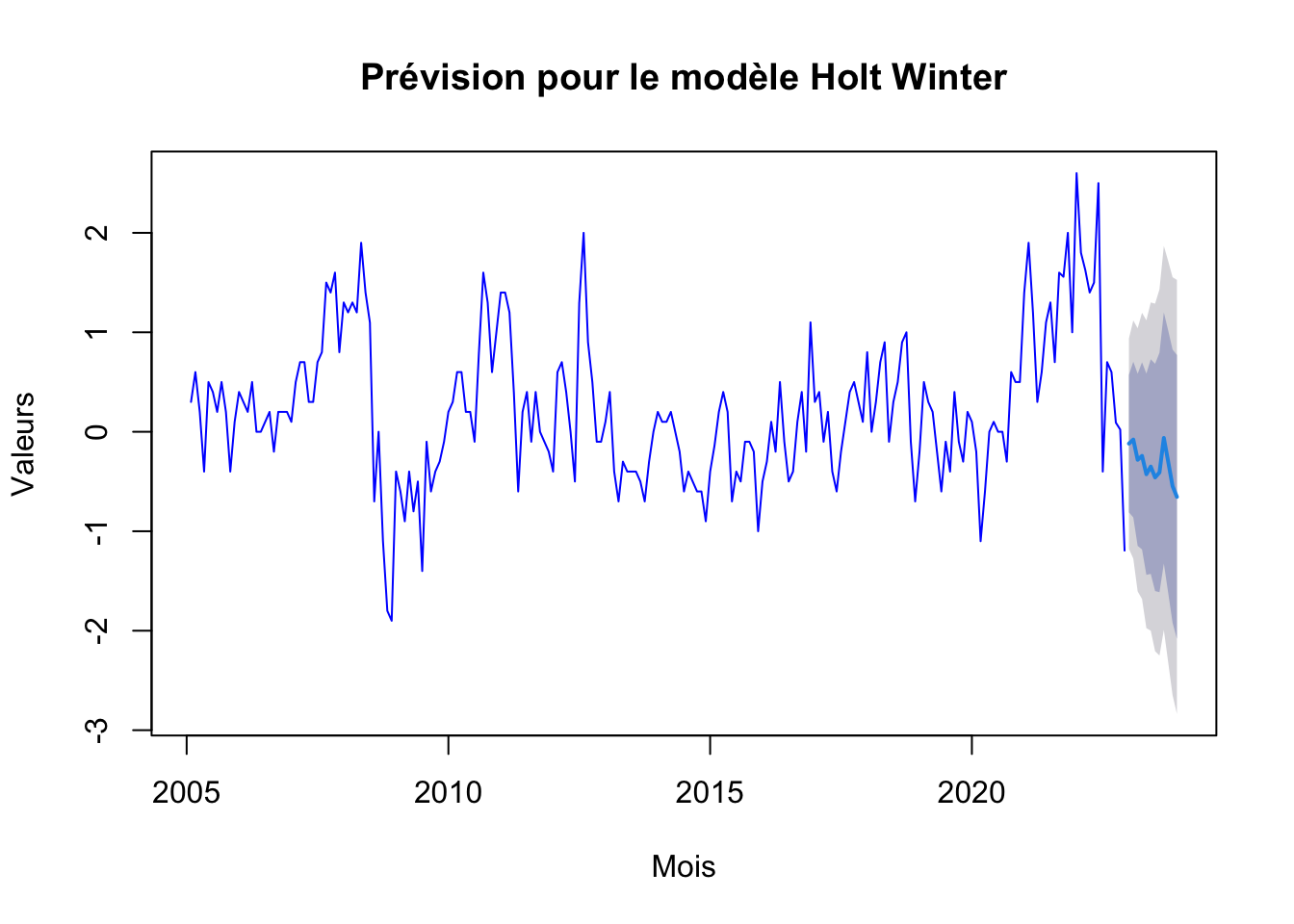

hw_forecast <- forecast(hw_f, h=12)

plot(hw_forecast, main="Prévision pour le modèle Holt Winter", xlab="Mois", ylab="Valeurs", col="blue")

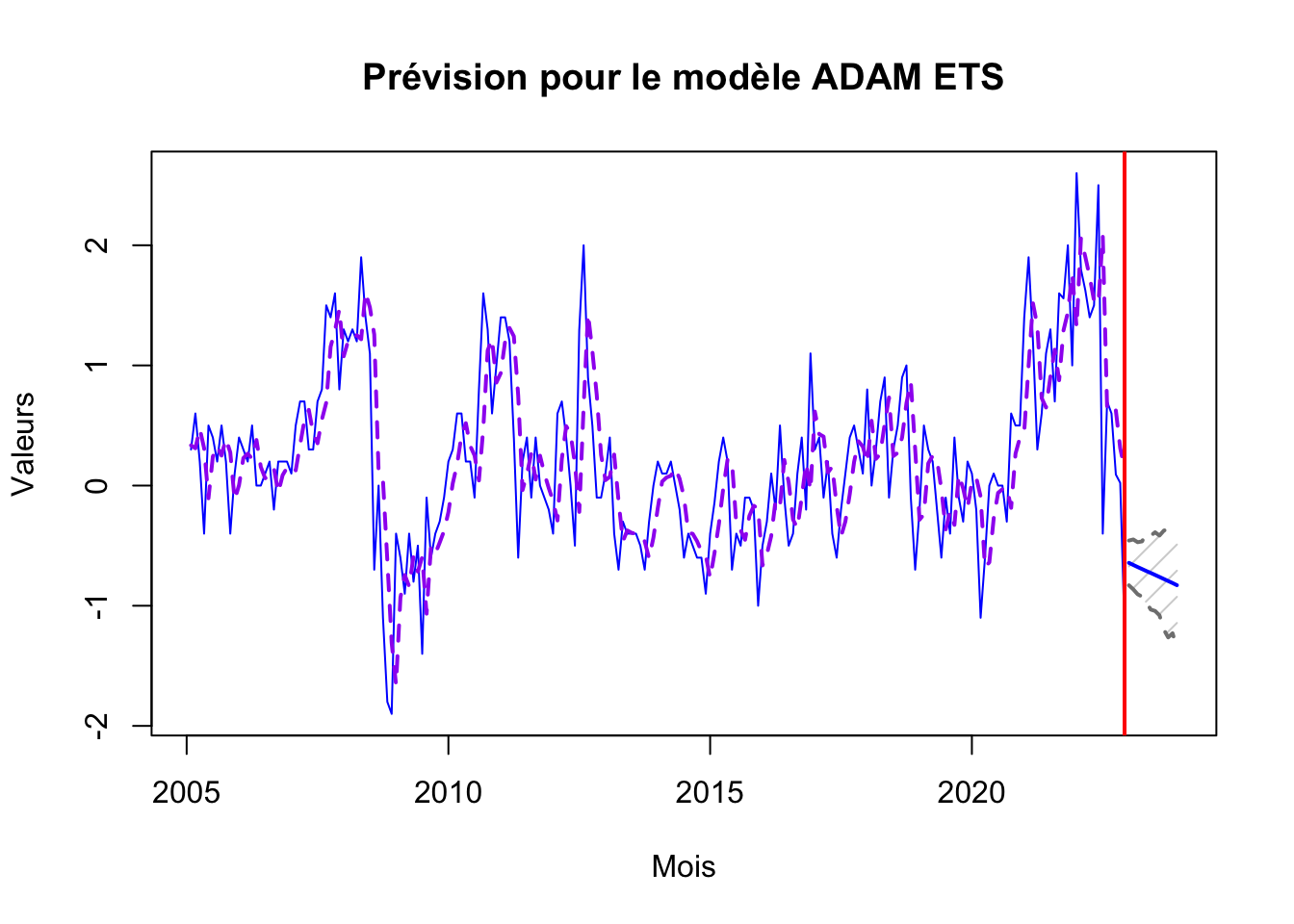

# Prévision et tracé pour le modèle ADAM ETS

adam_ets_forecast <- forecast(adam_ets, h=12, interval="confidence", level = 0.90)

plot(adam_ets_forecast, main="Prévision pour le modèle ADAM ETS", xlab="Mois", ylab="Valeurs", col="blue")

# Prévision et tracé pour le modèle ADAM ES

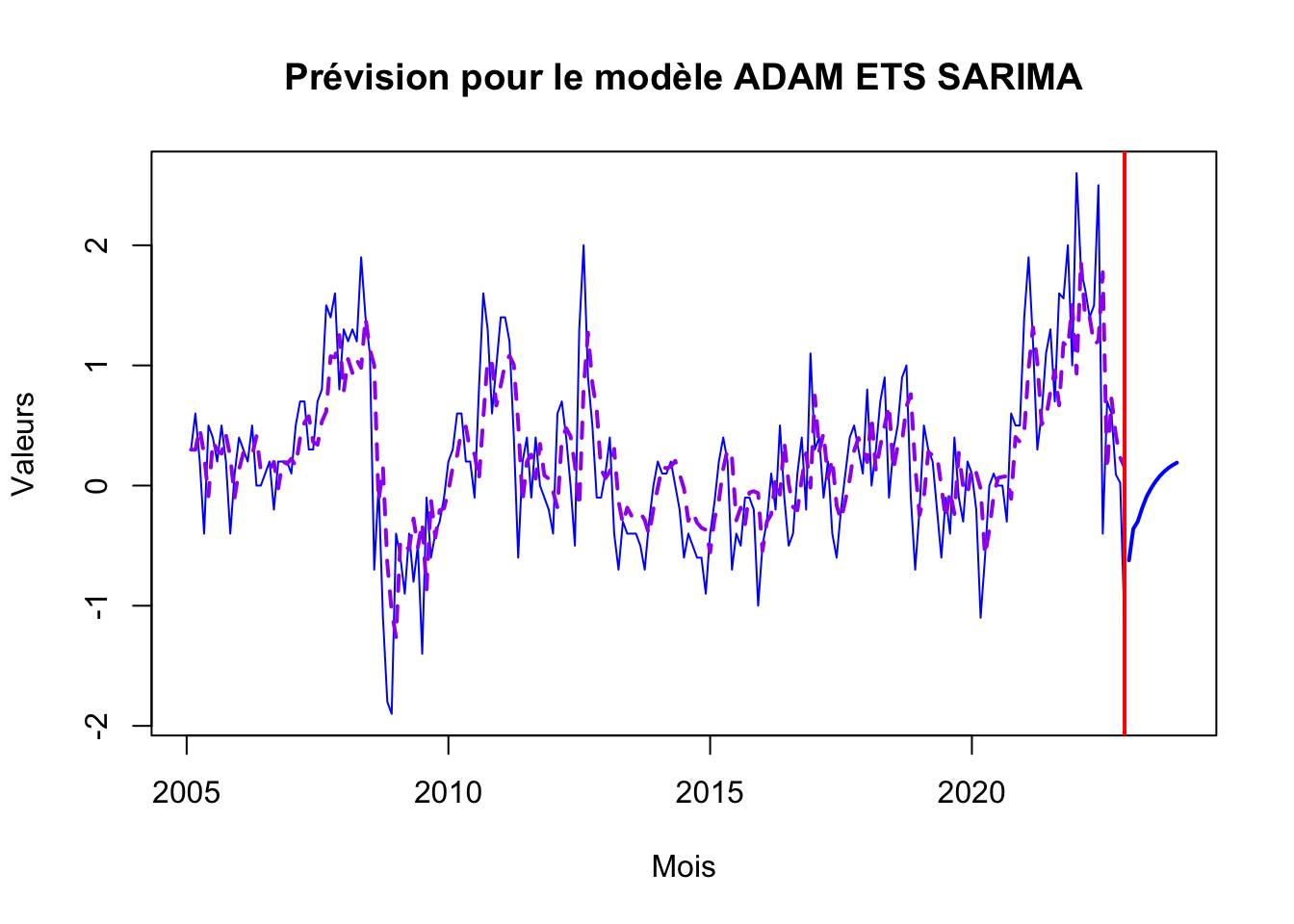

adamES_forecast <- forecast(adam_ets_sa, h=12, level = 0.90)

plot(adamES_forecast, main="Prévision pour le modèle ADAM ETS SARIMA", xlab="Mois", ylab="Valeurs", col="blue")

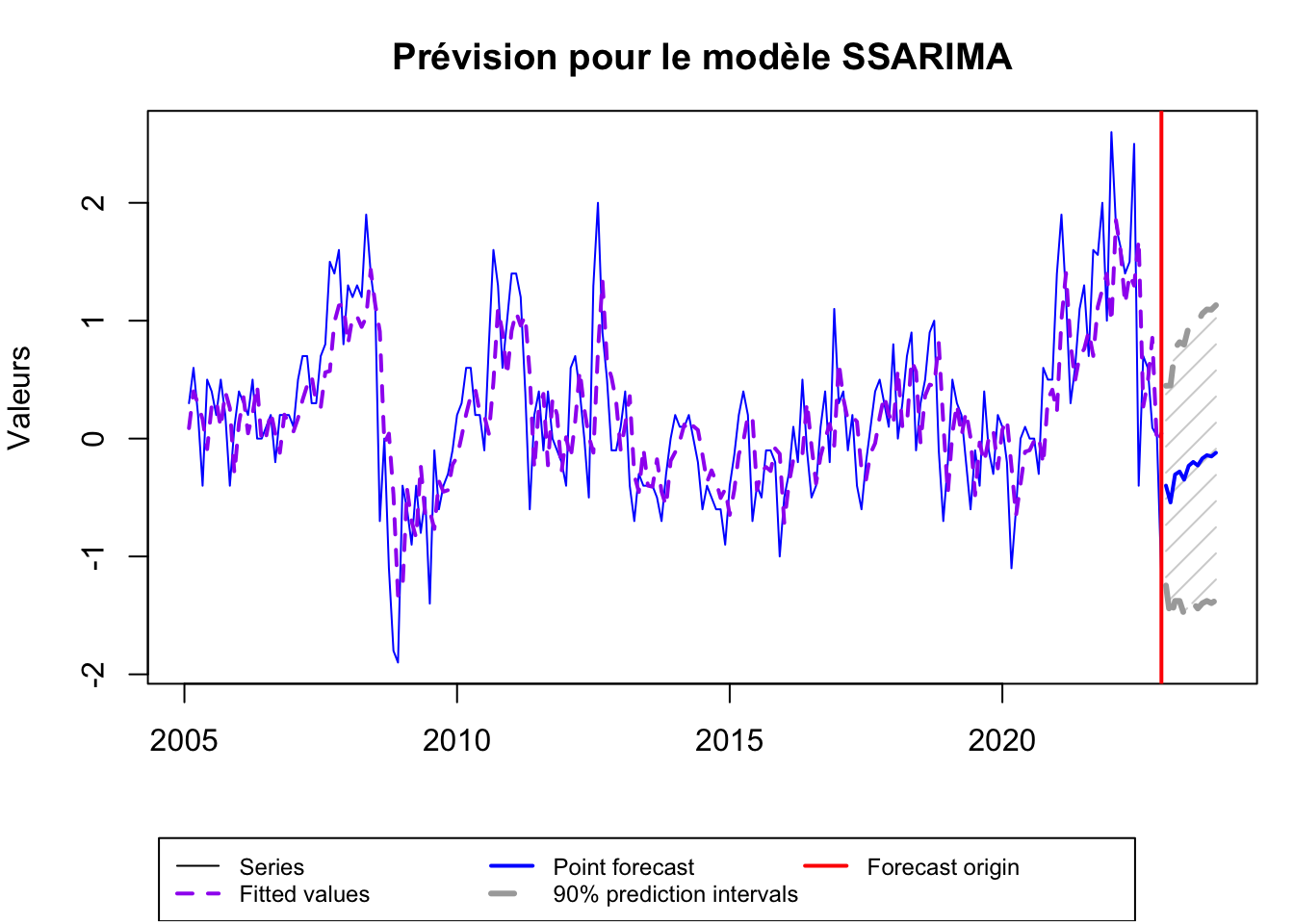

# Prévision et tracé pour le modèle SSARIMA - State Space ARIMA

ssarima_forecast <- forecast(ssarima, h=12, level = 0.90)

plot(ssarima_forecast, main="Prévision pour le modèle SSARIMA", xlab="Mois", ylab="Valeurs", col="blue")

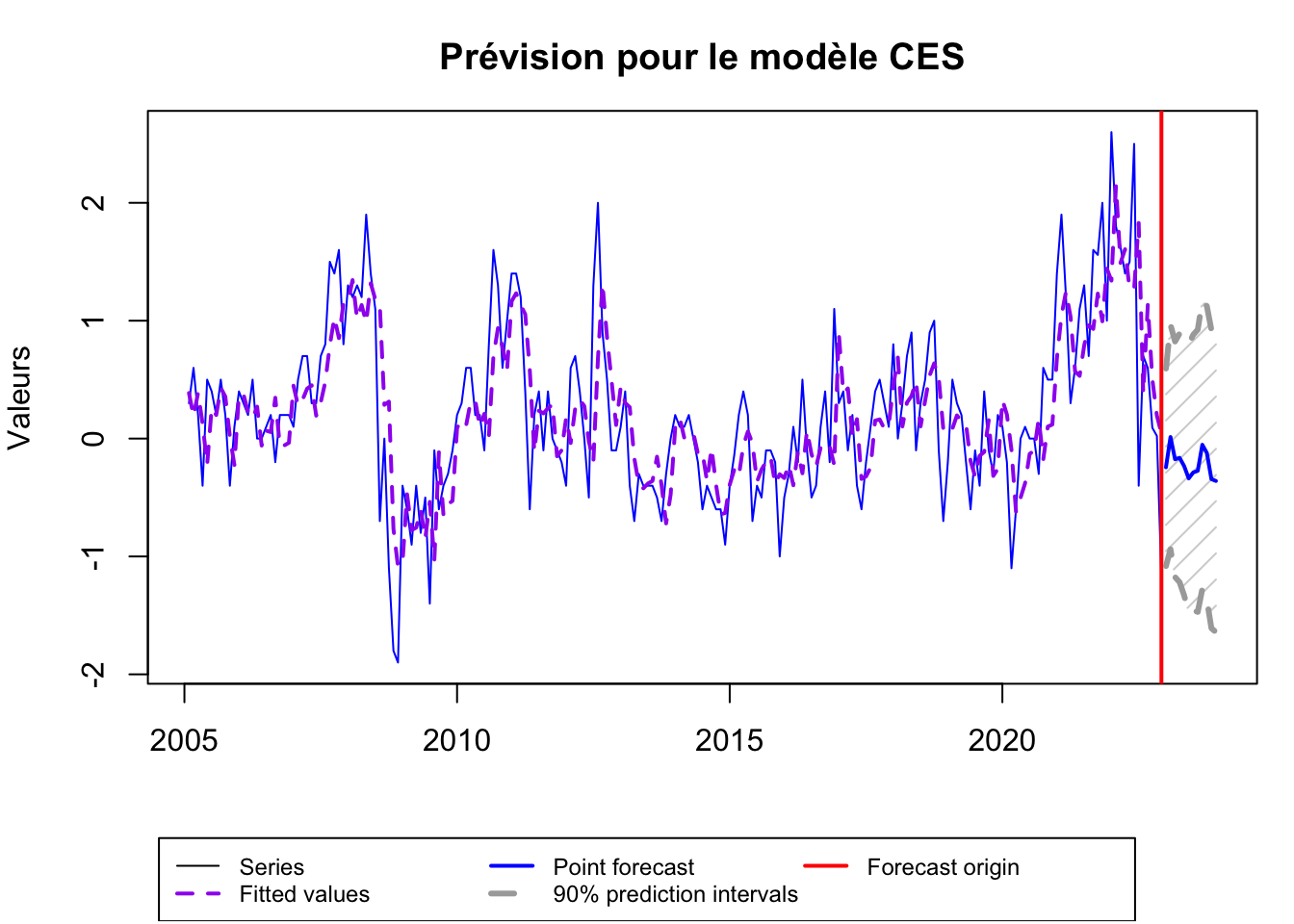

# Prévision et tracé pour le modèle CES

ces_forecast <- forecast(ces, h=12, level = 0.90)

plot(ces_forecast, main="Prévision pour le modèle CES", xlab="Mois", ylab="Valeurs", col="blue")

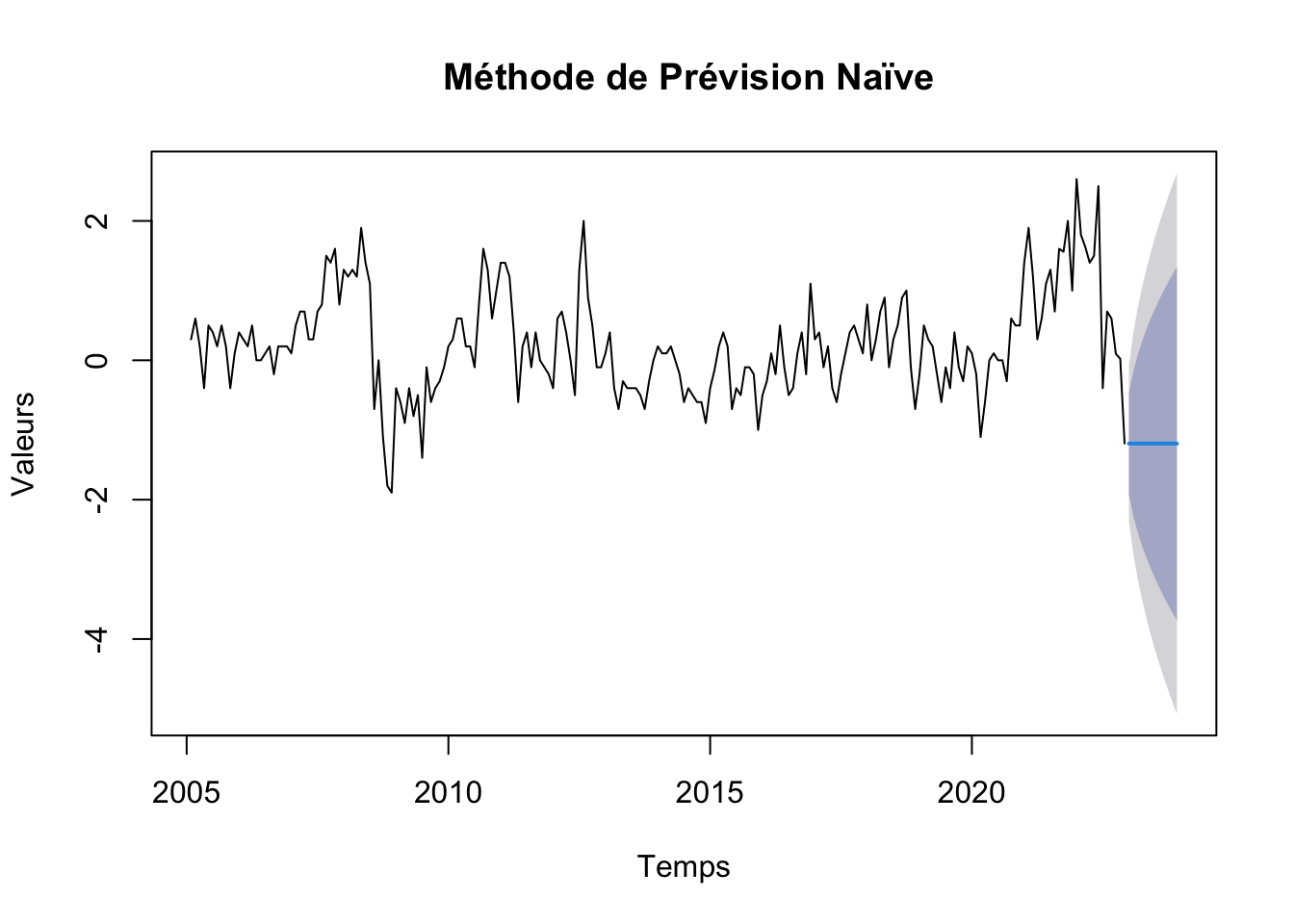

# Graphique prévsion modele naive

plot(naive, main=" Méthode de Prévision Naïve", xlab="Temps", ylab="Valeurs")

Récupération des “points forecastes” dans un seul dataframe

start_date <- as.Date("2023-01-01") # La date de début des prévisions

forecast_horizon <- 12 # Le nombre de mois à prévoir

# séquence de dates pour les prévisions

forecast_dates <- seq(start_date, by = "month", length.out = forecast_horizon)

# data frames avec les dates et les previsions

df <- data.frame(

Date = forecast_dates,

AR1 = as.numeric(ar1_forecast$mean),

ARP = as.numeric(arp_forecast$mean),

ARIMA =as.numeric(arima_forecast$mean),

HOLT = as.numeric(hw_forecast$mean),

ADAM_ETS = as.numeric(adam_ets_forecast$mean),

ADAM_ETS_SARIMA = as.numeric(adamES_forecast$mean),

SSARIMA = as.numeric(ssarima_forecast$mean),

CES = as.numeric(ces_forecast$mean),

NAIVE = as.numeric(naive$mean)

)

df Date AR1 ARP ARIMA HOLT ADAM_ETS

1 2023-01-01 -0.76672710 -0.73037881 -0.6694243 -0.11899046 -0.6432482

2 2023-02-01 -0.46889491 -0.62651673 -0.5646122 -0.07826328 -0.6606814

3 2023-03-01 -0.26141868 -0.49364745 -0.4762105 -0.28184860 -0.6779770

4 2023-04-01 -0.11688633 -0.39655404 -0.4016499 -0.24232723 -0.6945137

5 2023-05-01 -0.01620203 -0.31712205 -0.3387634 -0.42684394 -0.7112971

6 2023-06-01 0.05393680 -0.25386675 -0.2857230 -0.34980408 -0.7270746

7 2023-07-01 0.10279699 -0.20317926 -0.2409872 -0.45898101 -0.7437233

8 2023-08-01 0.13683404 -0.16262133 -0.2032557 -0.40898321 -0.7604755

9 2023-09-01 0.16054497 -0.13015772 -0.1714318 -0.06201067 -0.7774719

10 2023-10-01 0.17706251 -0.10417504 -0.1445906 -0.30085375 -0.7944000

11 2023-11-01 0.18856898 -0.08337908 -0.1219520 -0.54649791 -0.8110963

12 2023-12-01 0.19658463 -0.06673454 -0.1028579 -0.65465763 -0.8290626

ADAM_ETS_SARIMA SSARIMA CES NAIVE

1 -0.62258914 -0.3992712 -0.24360607 -1.194265

2 -0.35958468 -0.5418099 0.01295041 -1.194265

3 -0.30092313 -0.3051800 -0.17555379 -1.194265

4 -0.19125026 -0.2796120 -0.16331942 -1.194265

5 -0.09602462 -0.3485568 -0.23342431 -1.194265

6 -0.02789313 -0.2311090 -0.33789275 -1.194265

7 0.02890327 -0.1982459 -0.28771617 -1.194265

8 0.07602108 -0.2280172 -0.27307246 -1.194265

9 0.11398312 -0.1685953 -0.05269430 -1.194265

10 0.14484443 -0.1410267 -0.12204586 -1.194265

11 0.17001336 -0.1514261 -0.34386009 -1.194265

12 0.19048551 -0.1203632 -0.35952800 -1.194265Recuperation des données 2023

Lors du Téléchargement de notre jeu de données nous nous sommes arrêtés au mois de décembre 2022 et mis de coté les données pour l’année 2023, on récupère les données pour les comparer aux modèles

real <- read_excel(here("data", "serie_ipampa.xlsx"), sheet = 'complete')

real <- real[nrow(real):1,]

real <- real[, 2]

real <- ts(data = real, start = c(2005, 01), frequency=12)

real_2023 <- window(real, start = c(2023, 1), end = c(2023, 12))

real_2023 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

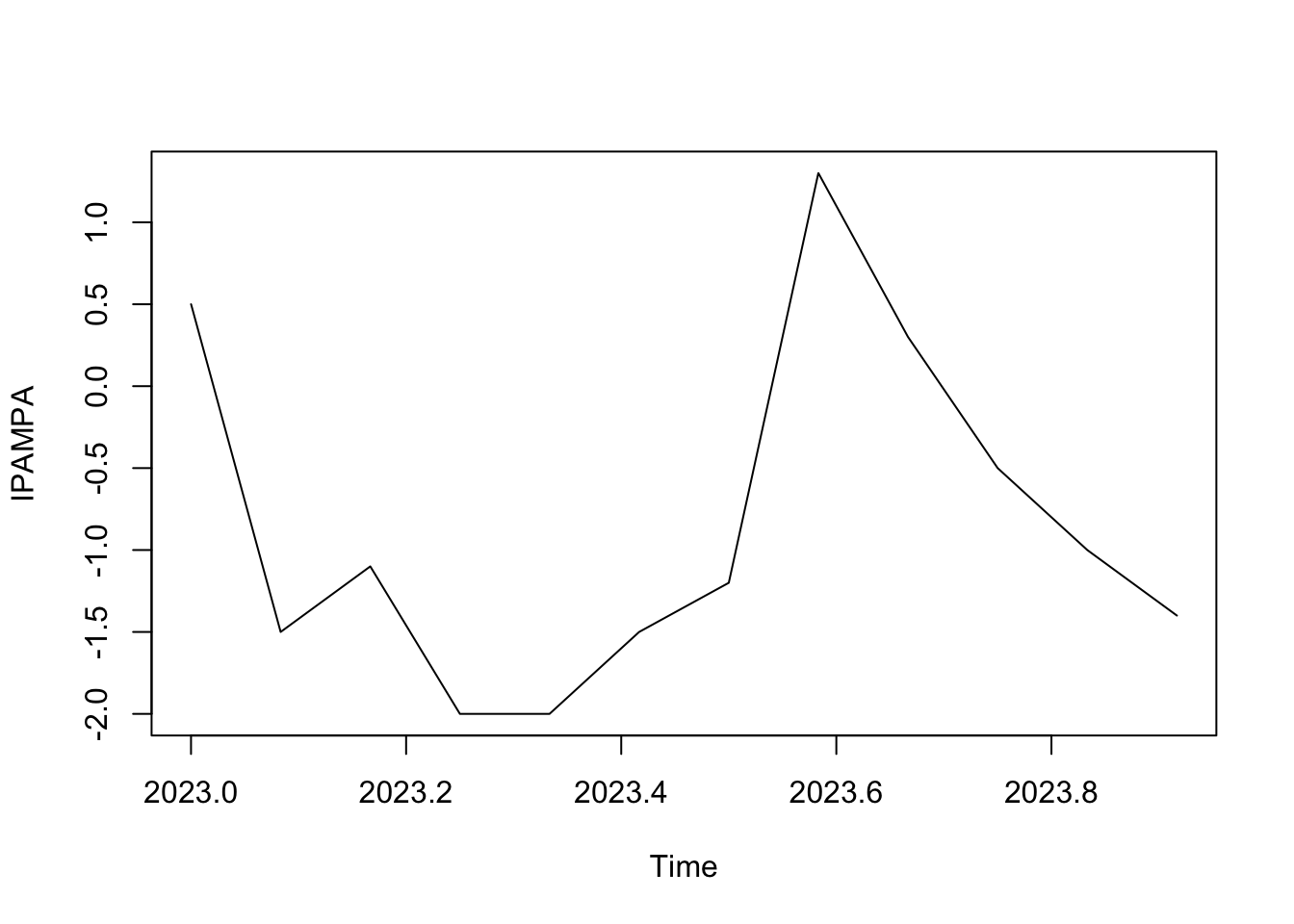

2023 140.1 138.6 137.5 135.5 133.5 132.0 130.8 132.1 132.4 131.9 130.9 129.5real_d <- diff(real, differences = 1)

real_d <- window(real_d, start = c(2023, 1), end = c(2023, 12))

plot(real_d)

real_d <- as.numeric(real_d)

df$Real = real_d

df Date AR1 ARP ARIMA HOLT ADAM_ETS

1 2023-01-01 -0.76672710 -0.73037881 -0.6694243 -0.11899046 -0.6432482

2 2023-02-01 -0.46889491 -0.62651673 -0.5646122 -0.07826328 -0.6606814

3 2023-03-01 -0.26141868 -0.49364745 -0.4762105 -0.28184860 -0.6779770

4 2023-04-01 -0.11688633 -0.39655404 -0.4016499 -0.24232723 -0.6945137

5 2023-05-01 -0.01620203 -0.31712205 -0.3387634 -0.42684394 -0.7112971

6 2023-06-01 0.05393680 -0.25386675 -0.2857230 -0.34980408 -0.7270746

7 2023-07-01 0.10279699 -0.20317926 -0.2409872 -0.45898101 -0.7437233

8 2023-08-01 0.13683404 -0.16262133 -0.2032557 -0.40898321 -0.7604755

9 2023-09-01 0.16054497 -0.13015772 -0.1714318 -0.06201067 -0.7774719

10 2023-10-01 0.17706251 -0.10417504 -0.1445906 -0.30085375 -0.7944000

11 2023-11-01 0.18856898 -0.08337908 -0.1219520 -0.54649791 -0.8110963

12 2023-12-01 0.19658463 -0.06673454 -0.1028579 -0.65465763 -0.8290626

ADAM_ETS_SARIMA SSARIMA CES NAIVE Real

1 -0.62258914 -0.3992712 -0.24360607 -1.194265 0.5

2 -0.35958468 -0.5418099 0.01295041 -1.194265 -1.5

3 -0.30092313 -0.3051800 -0.17555379 -1.194265 -1.1

4 -0.19125026 -0.2796120 -0.16331942 -1.194265 -2.0

5 -0.09602462 -0.3485568 -0.23342431 -1.194265 -2.0

6 -0.02789313 -0.2311090 -0.33789275 -1.194265 -1.5

7 0.02890327 -0.1982459 -0.28771617 -1.194265 -1.2

8 0.07602108 -0.2280172 -0.27307246 -1.194265 1.3

9 0.11398312 -0.1685953 -0.05269430 -1.194265 0.3

10 0.14484443 -0.1410267 -0.12204586 -1.194265 -0.5

11 0.17001336 -0.1514261 -0.34386009 -1.194265 -1.0

12 0.19048551 -0.1203632 -0.35952800 -1.194265 -1.4names (df) # on verifie que real fait bien partie du data frame [1] "Date" "AR1" "ARP" "ARIMA"

[5] "HOLT" "ADAM_ETS" "ADAM_ETS_SARIMA" "SSARIMA"

[9] "CES" "NAIVE" "Real" Graphique de comparaison

# Transformer les données en format long

df_long <- pivot_longer(df, cols = -Date, names_to = "Model", values_to = "Value")

# graphique plotly

p <- ggplot(df_long, aes(x = Date, y = Value, color = Model)) +

geom_line() +

theme_minimal() +

labs(title = "Comparaison des prévisions des modèles avec les données réelles

Jan 2023 à Déc 2023 - série differencié",

x = "Date",

y = "Valeur",

color = "Modèle") +

theme(legend.position = "bottom")

ggplotly(p)Réintégration

Nous pouvons reintegrer les prévisions aux données pour avoir le graphique au niveau

dec_2022 <- 139.6

df_real <- data.frame(

Date = forecast_dates,

AR1 = dec_2022 + cumsum(df$AR1),

ARP = dec_2022 + cumsum(df$ARP),

ARIMA = dec_2022 + cumsum(df$ARIMA),

HOLT = dec_2022 + cumsum(df$HOLT),

ADAM_ETS = dec_2022 + cumsum(df$ADAM_ETS),

ADAM_ETS_SARIMA = dec_2022 + cumsum(df$ADAM_ETS_SARIMA),

SSARIMA = dec_2022 + cumsum(df$SSARIMA),

CES = dec_2022 + cumsum(df$CES)

)

real_2023 <- as.numeric(real_2023)

df_real$Real = real_2023

df_real Date AR1 ARP ARIMA HOLT ADAM_ETS ADAM_ETS_SARIMA

1 2023-01-01 138.8333 138.8696 138.9306 139.4810 138.9568 138.9774

2 2023-02-01 138.3644 138.2431 138.3660 139.4027 138.2961 138.6178

3 2023-03-01 138.1030 137.7495 137.8898 139.1209 137.6181 138.3169

4 2023-04-01 137.9861 137.3529 137.4881 138.8786 136.9236 138.1257

5 2023-05-01 137.9699 137.0358 137.1493 138.4517 136.2123 138.0296

6 2023-06-01 138.0238 136.7819 136.8636 138.1019 135.4852 138.0017

7 2023-07-01 138.1266 136.5787 136.6226 137.6429 134.7415 138.0306

8 2023-08-01 138.2634 136.4161 136.4194 137.2340 133.9810 138.1067

9 2023-09-01 138.4240 136.2860 136.2479 137.1719 133.2035 138.2206

10 2023-10-01 138.6010 136.1818 136.1034 136.8711 132.4091 138.3655

11 2023-11-01 138.7896 136.0984 135.9814 136.3246 131.5980 138.5355

12 2023-12-01 138.9862 136.0317 135.8785 135.6699 130.7690 138.7260

SSARIMA CES Real

1 139.2007 139.3564 140.1

2 138.6589 139.3693 138.6

3 138.3537 139.1938 137.5

4 138.0741 139.0305 135.5

5 137.7256 138.7970 133.5

6 137.4945 138.4592 132.0

7 137.2962 138.1714 130.8

8 137.0682 137.8984 132.1

9 136.8996 137.8457 132.4

10 136.7586 137.7236 131.9

11 136.6072 137.3798 130.9

12 136.4868 137.0202 129.5# Transformer les données en format long

df_real_long <- pivot_longer(df_real, cols = -Date, names_to = "Model", values_to = "Value")

# graphique plotly

r <- ggplot(df_real_long, aes(x = Date, y = Value, color = Model)) +

geom_line() +

theme_minimal() +

labs(title = "Comparaison des prévisions des modèles avec les données réelles

Jan 2023 à Déc 2023",

x = "Date",

y = "Valeur",

color = "Modèle") +

theme(legend.position = "bottom")

ggplotly(r)Qualité de prévision

# Erreur de prévision , comparatif entre la valeur predicte de chaque modele et la valeur real

models <- names(df)[-which(names(df) == "Date" | names(df) == "Real")]

# Calculer l'erreur pour chaque modèle

errors_df <- data.frame(Date = df$Date) # nouveau dataframe pour stocker les erreurs

for (model in models) {

errors_df[[model]] <- df[[model]] - df$Real

}

errors_df Date AR1 ARP ARIMA HOLT ADAM_ETS

1 2023-01-01 -1.2667271 -1.2303788 -1.1694243 -0.6189905 -1.1432482

2 2023-02-01 1.0311051 0.8734833 0.9353878 1.4217367 0.8393186

3 2023-03-01 0.8385813 0.6063525 0.6237895 0.8181514 0.4220230

4 2023-04-01 1.8831137 1.6034460 1.5983501 1.7576728 1.3054863

5 2023-05-01 1.9837980 1.6828780 1.6612366 1.5731561 1.2887029

6 2023-06-01 1.5539368 1.2461333 1.2142770 1.1501959 0.7729254

7 2023-07-01 1.3027970 0.9968207 0.9590128 0.7410190 0.4562767

8 2023-08-01 -1.1631660 -1.4626213 -1.5032557 -1.7089832 -2.0604755

9 2023-09-01 -0.1394550 -0.4301577 -0.4714318 -0.3620107 -1.0774719

10 2023-10-01 0.6770625 0.3958250 0.3554094 0.1991463 -0.2944000

11 2023-11-01 1.1885690 0.9166209 0.8780480 0.4535021 0.1889037

12 2023-12-01 1.5965846 1.3332655 1.2971421 0.7453424 0.5709374

ADAM_ETS_SARIMA SSARIMA CES NAIVE

1 -1.1225891 -0.8992712 -0.7436061 -1.69426529

2 1.1404153 0.9581901 1.5129504 0.30573471

3 0.7990769 0.7948200 0.9244462 -0.09426529

4 1.8087497 1.7203880 1.8366806 0.80573471

5 1.9039754 1.6514432 1.7665757 0.80573471

6 1.4721069 1.2688910 1.1621073 0.30573471

7 1.2289033 1.0017541 0.9122838 0.00573471

8 -1.2239789 -1.5280172 -1.5730725 -2.49426529

9 -0.1860169 -0.4685953 -0.3526943 -1.49426529

10 0.6448444 0.3589733 0.3779541 -0.69426529

11 1.1700134 0.8485739 0.6561399 -0.19426529

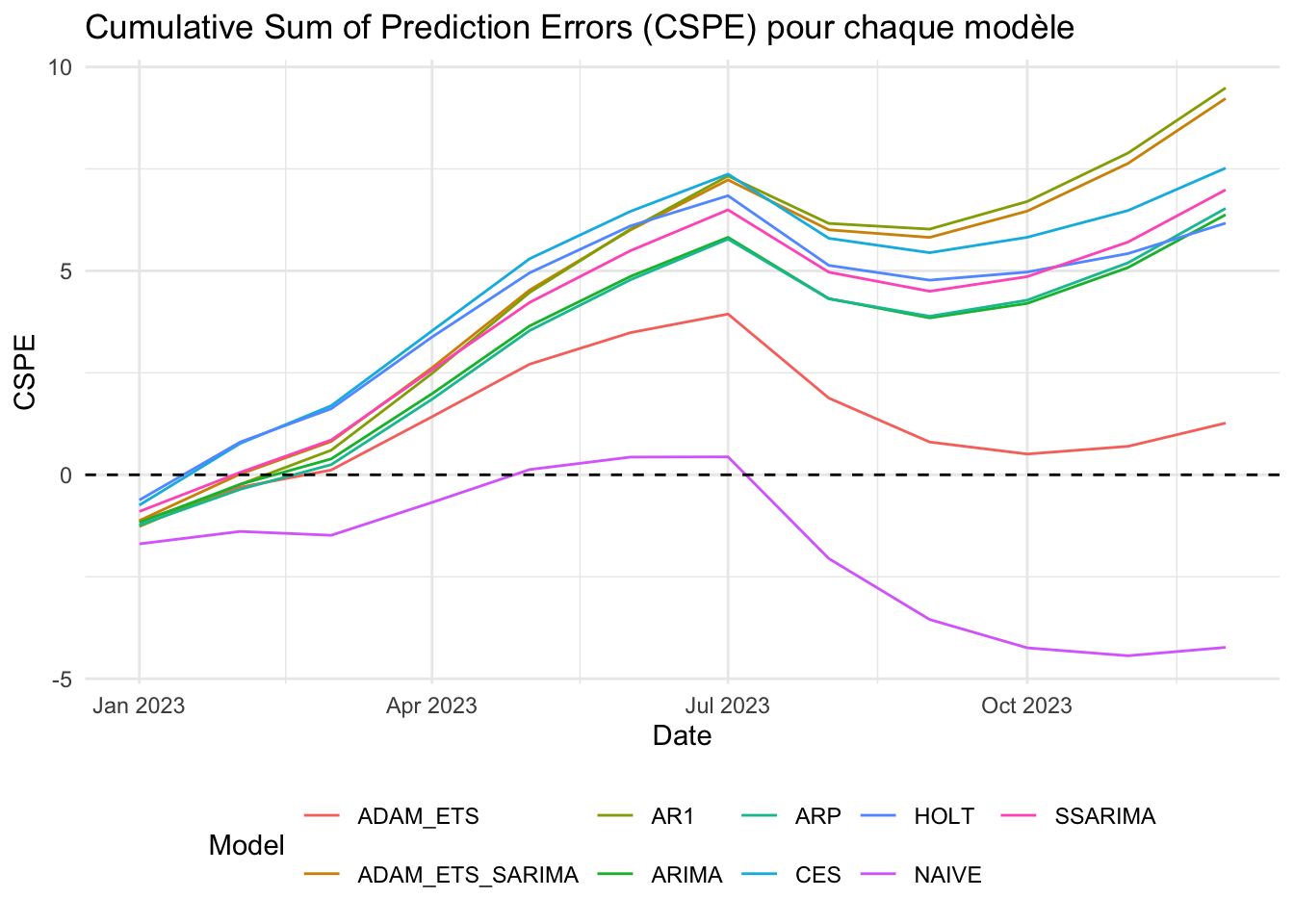

12 1.5904855 1.2796368 1.0404720 0.20573471CSPE somme cumulative des erreurs pour chaque modèle et graphique

# errors_df contienne déjà les erreurs pour chaque modèle calculées comme précédemment

cspe_df <- data.frame(Date = df$Date) # nouveau dataframe pour stocker le CSPE

for (model in models) {

cspe_df[[model]] <- cumsum(errors_df[[model]]) # Calcul du CSPE

}

cspe_df Date AR1 ARP ARIMA HOLT ADAM_ETS

1 2023-01-01 -1.2667271 -1.2303788 -1.1694243 -0.6189905 -1.1432482

2 2023-02-01 -0.2356220 -0.3568955 -0.2340365 0.8027463 -0.3039295

3 2023-03-01 0.6029593 0.2494570 0.3897530 1.6208977 0.1180935

4 2023-04-01 2.4860730 1.8529030 1.9881031 3.3785704 1.4235798

5 2023-05-01 4.4698709 3.5357809 3.6493397 4.9517265 2.7122827

6 2023-06-01 6.0238077 4.7819142 4.8636168 6.1019224 3.4852081

7 2023-07-01 7.3266047 5.7787349 5.8226296 6.8429414 3.9414848

8 2023-08-01 6.1634388 4.3161136 4.3193739 5.1339582 1.8810093

9 2023-09-01 6.0239837 3.8859559 3.8479421 4.7719475 0.8035374

10 2023-10-01 6.7010463 4.2817808 4.2033515 4.9710938 0.5091373

11 2023-11-01 7.8896152 5.1984018 5.0813995 5.4245959 0.6980410

12 2023-12-01 9.4861999 6.5316672 6.3785416 6.1699382 1.2689784

ADAM_ETS_SARIMA SSARIMA CES NAIVE

1 -1.12258914 -0.89927118 -0.7436061 -1.6942653

2 0.01782618 0.05891892 0.7693443 -1.3885306

3 0.81690305 0.85373893 1.6937906 -1.4827959

4 2.62565279 2.57412690 3.5304711 -0.6770612

5 4.52962817 4.22557013 5.2970468 0.1286735

6 6.00173504 5.49446116 6.4591541 0.4344083

7 7.23063831 6.49621530 7.3714379 0.4401430

8 6.00665939 4.96819810 5.7983654 -2.0541223

9 5.82064251 4.49960279 5.4456711 -3.5483876

10 6.46548693 4.85857613 5.8236253 -4.2426529

11 7.63550029 5.70715006 6.4797652 -4.4369182

12 9.22598580 6.98678690 7.5202372 -4.2311835# on pivot cspe_df pour l'utiliser avec ggplot2

cspe_long <- tidyr::pivot_longer(cspe_df, cols = -Date, names_to = "Model", values_to = "CSPE")

ggplot(cspe_long, aes(x = Date, y = CSPE, color = Model)) +

geom_line() +

geom_hline(yintercept = 0, linetype = "dashed", color = "black") +

labs(title = "Cumulative Sum of Prediction Errors (CSPE) pour chaque modèle",

x = "Date",

y = "CSPE") +

theme_minimal() +

theme(legend.position = "bottom")

Calcul du R2OOS pour chaque modèle

calculate_r2oos <- function(actual, predicted, naive_predictions) {

ss_res <- sum((actual - predicted)^2) # Somme des carrés des erreurs de prédiction

ss_tot <- sum((actual - naive_predictions)^2) # Somme des carrés des erreurs du modèle naïf

r2_oos <- 1 - ss_res / ss_tot

return(r2_oos)

}

# DataFrame pour stocker le R^2 OOS de chaque modèle

r2oos_df <- data.frame(Model = character(), R2OOS = numeric())

# R^2 OOS pour chaque modèle, avec modèle naïf comme référence

models <- setdiff(names(df), c("Date", "Real", "NAIVE")) # Exclure Date, Real, et NAIVE de la liste des modèles

for (model in models) {

r2oos_value <- calculate_r2oos(df$Real, df[[model]], df$NAIVE)

r2oos_df <- rbind(r2oos_df, data.frame(Model = model, R2OOS = r2oos_value))

}

r2oos_df Model R2OOS

1 AR1 -0.55123249

2 ARP -0.17276444

3 ARIMA -0.15103662

4 HOLT -0.07335788

5 ADAM_ETS 0.08713937

6 ADAM_ETS_SARIMA -0.46627994

7 SSARIMA -0.17329720

8 CES -0.24268116Calcul du MSE pour chaque modèle

# dataFrame pour stocker le MSE de chaque modèle

mse_df <- data.frame(Model = character(), MSE = numeric())

for (model in models) {

mse_value <- mean((errors_df[[model]])^2) # Calcul du MSE

mse_df <- rbind(mse_df, data.frame(Model = model, MSE = mse_value))

}

mse_df Model MSE

1 AR1 1.729763

2 ARP 1.307738

3 ARIMA 1.283509

4 HOLT 1.196890

5 ADAM_ETS 1.017921

6 ADAM_ETS_SARIMA 1.635034

7 SSARIMA 1.308332

8 CES 1.385701DM test

# DataFrame pour stocker les résultats du

dm_results <- data.frame(Model = character(), DM_Statistic = numeric(), P_Value = numeric(), stringsAsFactors = FALSE)

# DM test pour chaque modèle comparé au modèle naïf

for (model in setdiff(models, "NAIVE")) {

dm_test_result <- dm.test(errors_df$NAIVE, errors_df[[model]], alternative = "less")

# résultats

dm_results <- rbind(dm_results, data.frame(Model = model, DM_Statistic = dm_test_result$statistic, P_Value = dm_test_result$p.value))}

dm_results Model DM_Statistic P_Value

DM AR1 -0.8916720 0.1958281

DM1 ARP -0.3582740 0.3634595

DM2 ARIMA -0.3198306 0.3775446

DM3 HOLT -0.1541724 0.4401330

DM4 ADAM_ETS 0.3452391 0.6317870

DM5 ADAM_ETS_SARIMA -0.7802244 0.2258607

DM6 SSARIMA -0.3504809 0.3662986

DM7 CES -0.4600823 0.3272090?dm.test()Accuracy

# dataframe pour stocker les résultats d'accuracy

accuracy_results <- data.frame(Model = character(),

ME = numeric(),

RMSE = numeric(),

MAE = numeric(),

MPE = numeric(),

MAPE = numeric())

models <- setdiff(names(df), c("Real", "Date"))

# Calcul de l'accuracy pour chaque modèle

for (model in models) { acc <- accuracy(df[[model]], df$Real)

# résultats au dataframe des résultats

accuracy_results <- rbind(accuracy_results, data.frame(Model = model,ME = acc[1, "ME"], RMSE = acc[1, "RMSE"],MAE = acc[1, "MAE"], MPE = acc[1, "MPE"], APE = acc[1, "MAPE"]))

}

accuracy_results Model ME RMSE MAE MPE APE

1 AR1 -0.7905167 1.315205 1.2187413 109.00822 109.00822

2 ARP -0.5443056 1.143564 1.0648319 100.98722 100.98722

3 ARIMA -0.5315451 1.132921 1.0555638 100.09331 100.09331

4 HOLT -0.5141615 1.094025 0.9624922 82.37328 82.37328

5 ADAM_ETS -0.1057482 1.008921 0.8683475 88.38982 98.20315

6 ADAM_ETS_SARIMA -0.7688322 1.278684 1.1909296 106.25903 106.25903

7 SSARIMA -0.5822322 1.143823 1.0648795 97.87055 97.87055

8 CES -0.6266864 1.177158 1.0715819 93.44833 93.44833

9 NAIVE 0.3525986 1.055978 0.7583333 83.20585 111.01404Estimation de modeles série corrigé (non stationnaire)

#lissage exponentiel double (Holt-Winters sans composante saisonnière)

hw2 <- HoltWinters(ipampa, gamma = FALSE)

forecast_hw2 <- forecast(hw2, h=12)

# ADAM ETS

ae2 <- auto.adam(ipampa, model="ZZN", lags=c(1,12), select=TRUE)

forecast_ae2 <- forecast(ae2, h=12)

forecast_ae2 Jan Feb Mar Apr May Jun Jul Aug

2023 126.7827 126.2061 125.7241 125.3410 125.0289 124.7638 124.5520 124.3797

Sep Oct Nov Dec

2023 124.2318 124.1225 124.0340 123.9569# ADAM ETS+ARIMA

aea2 <- auto.adam(ipampa, model="ZZN", lags=c(1,12), orders=list(ar=c(3,3), i=(2), ma=c(3,3), select=TRUE))

forecast_aea2 <- forecast(aea2 , h=12)

forecast_aea2 Jan Feb Mar Apr May Jun Jul Aug

2023 126.7636 126.1681 125.6880 125.2948 124.9711 124.7042 124.4836 124.3059

Sep Oct Nov Dec

2023 124.1553 124.0212 123.9137 123.8230# SSARIMA

ssarima2 <- auto.ssarima(ipampa, lags=c(1,12), orders=list(ar=c(3,3), i=(2), ma=c(3,3), select=TRUE))

forecast_ssarima2 <- forecast(ssarima2 , h=12)

forecast_ssarima2 Point forecast Lower bound (2.5%) Upper bound (97.5%)

Jan 2023 126.8350 125.7776 127.8923

Feb 2023 126.3923 124.3689 128.4157

Mar 2023 125.9496 122.9206 128.9786

Apr 2023 125.5069 121.3936 129.6203

May 2023 125.0643 119.7833 130.3452

Jun 2023 124.6216 118.0916 131.1516

Jul 2023 124.1789 116.3217 132.0361

Aug 2023 123.7362 114.4770 132.9955

Sep 2023 123.2935 112.5607 134.0264

Oct 2023 122.8508 110.5759 135.1258

Nov 2023 122.4082 108.5252 136.2912

Dec 2023 121.9655 106.4110 137.5199#ces

ces2 <- auto.ces(ipampa, models=c("n", "s", "p", "f"), ic="AICc")

forecast_ces2 <- forecast(ces2 , h=12)

forecast_ces2 Point forecast Lower bound (2.5%) Upper bound (97.5%)

Jan 2023 128.0169 126.6153 129.4185

Feb 2023 128.4711 126.4840 130.4581

Mar 2023 128.9841 126.5364 131.4319

Apr 2023 129.2816 126.4542 132.1091

May 2023 129.6860 126.5145 132.8574

Jun 2023 129.7981 126.3225 133.2738

Jul 2023 129.9620 126.1984 133.7255

Aug 2023 130.1308 126.1051 134.1564

Sep 2023 130.6903 126.4112 134.9694

Oct 2023 130.9689 126.4554 135.4824

Nov 2023 131.2151 126.4719 135.9583

Dec 2023 131.2254 126.2677 136.1830# Naive model

forecast_naive2 <- naive(ipampa,h=12)

forecast_naive2 Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

Jan 2023 127.4637 126.4812 128.4461 125.9611 128.9662

Feb 2023 127.4637 126.0743 128.8530 125.3388 129.5885

Mar 2023 127.4637 125.7620 129.1653 124.8612 130.0661

Apr 2023 127.4637 125.4988 129.4285 124.4586 130.4687

May 2023 127.4637 125.2668 129.6605 124.1039 130.8234

Jun 2023 127.4637 125.0572 129.8702 123.7832 131.1441

Jul 2023 127.4637 124.8643 130.0630 123.4883 131.4390

Aug 2023 127.4637 124.6849 130.2424 123.2139 131.7134

Sep 2023 127.4637 124.5163 130.4110 122.9561 131.9712

Oct 2023 127.4637 124.3569 130.5704 122.7122 132.2151

Nov 2023 127.4637 124.2052 130.7221 122.4803 132.4470

Dec 2023 127.4637 124.0603 130.8670 122.2587 132.6686ipampa Jan Feb Mar Apr May Jun Jul Aug

2005 78.2000 78.5000 79.1000 79.3000 78.9000 79.4000 79.8000 80.0000

2006 80.8000 81.1000 81.3000 81.8000 81.8000 81.8000 81.9000 82.1000

2007 82.6000 83.1000 83.8000 84.5000 84.8000 85.1000 85.8000 86.6000

2008 93.2000 94.4000 95.7000 96.9000 98.8000 100.2000 101.3000 100.6000

2009 95.4000 94.8000 93.9000 93.5000 92.7000 92.2000 90.8000 90.7000

2010 89.5000 89.8000 90.4000 91.0000 91.2000 91.4000 91.3000 92.1000

2011 98.0000 99.4000 100.6000 101.0000 100.4000 100.6000 101.0000 100.9000

2012 100.6000 101.2000 101.9000 102.3000 102.3000 101.8000 103.1000 105.1000

2013 106.4000 106.8000 106.4000 105.7000 105.4000 105.0000 104.6000 104.2000

2014 102.9000 103.0000 103.1000 103.3000 103.3000 103.1000 102.5000 102.1000

2015 99.1000 98.9605 99.1605 99.5605 99.7605 99.0605 98.6605 98.1605

2016 96.2605 95.9605 96.0605 95.8605 96.3605 96.2605 95.7605 95.3605

2017 97.0605 97.4605 97.3605 97.5605 97.1605 96.5605 96.3605 96.4605

2018 98.5605 98.5605 98.8605 99.5605 100.4605 100.3605 100.6605 101.1605

2019 102.0605 102.5605 102.8605 103.0605 102.8605 102.2605 102.1605 101.7605

2020 102.0605 101.8605 100.7605 100.1605 100.1605 100.2605 100.2605 100.2605

2021 102.9605 104.8605 106.0605 106.3605 106.9605 108.0605 109.3605 110.0605

2022 118.8184 120.6184 122.2437 123.6437 125.1437 127.6437 127.2437 127.9437

Sep Oct Nov Dec

2005 80.5000 80.7000 80.3000 80.4000

2006 81.9000 82.1000 82.3000 82.5000

2007 88.1000 89.5000 91.1000 91.9000

2008 100.6000 99.5000 97.7000 95.8000

2009 90.1000 89.7000 89.4000 89.3000

2010 93.7000 95.0000 95.6000 96.6000

2011 101.3000 101.3000 101.2000 101.0000

2012 106.0000 106.5000 106.4000 106.3000

2013 103.7000 103.0000 102.7000 102.7000

2014 101.6000 101.0000 100.4000 99.5000

2015 98.0605 97.9605 97.7605 96.7605

2016 95.4605 95.8605 95.6605 96.7605

2017 96.8605 97.3605 97.6605 97.7605

2018 102.0605 103.0605 102.9605 102.2605

2019 102.1605 102.0605 101.7605 101.9605

2020 99.9605 100.5605 101.0605 101.5605

2021 111.6605 113.2184 115.2184 116.2184

2022 128.5437 128.6354 128.6579 127.4637Récuperation des previsions

## Récupération des "points forecastes" dans un seul dataframe

start_date <- as.Date("2023-01-01") # La date de début des prévisions

forecast_horizon <- 12 # Le nombre de mois à prévoir

# séquence de dates pour les prévisions

forecast_dates <- seq(start_date, by = "month", length.out = forecast_horizon)

# data frames avec les dates et les previsions

df2 <- data.frame(

Date = forecast_dates,

AR1 = dec_2022 + cumsum(df$AR1),

ARP = dec_2022 + cumsum(df$ARP),

ARIMA = dec_2022 + cumsum(df$ARIMA),

HOLT_WINTER = as.numeric(forecast_hw2$mean),

ADAM_ETS = as.numeric(forecast_ae2$mean),

ADAM_ETS_SARIMA = as.numeric(forecast_aea2$mean),

SSARIMA = as.numeric(forecast_ssarima2$mean),

CES = as.numeric(forecast_ces2$mean),

NAIVE = as.numeric(forecast_naive2$mean)

)

df2$Real = real_2023

# Transformer les données en format long

df_long2 <- pivot_longer(df2, cols = -Date, names_to = "Model", values_to = "Value")

# graphique plotly

p <- ggplot(df_long2, aes(x = Date, y = Value, color = Model)) +

geom_line() +

theme_minimal() +

labs(title = "Comparaison des prévisions des modèles avec les données réelles

Jan 2023 à Déc 2023 - série corrigée",

x = "Date",

y = "Valeur",

color = "Modèle") +

theme(legend.position = "bottom")

ggplotly(p)Récupération des données completes de janvier 2005 à décembre 2023

ip <- ipampa1[nrow(ipampa1):1,]

ip <- ip[, 2]

ip <- ts(data = ip, start = c(2005, 01), frequency=12)

ip Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2005 78.2 78.5 79.1 79.3 78.9 79.4 79.8 80.0 80.5 80.7 80.3 80.4

2006 80.8 81.1 81.3 81.8 81.8 81.8 81.9 82.1 81.9 82.1 82.3 82.5

2007 82.6 83.1 83.8 84.5 84.8 85.1 85.8 86.6 88.1 89.5 91.1 91.9

2008 93.2 94.4 95.7 96.9 98.8 100.2 101.3 100.6 100.6 99.5 97.7 95.8

2009 95.4 94.8 93.9 93.5 92.7 92.2 90.8 90.7 90.1 89.7 89.4 89.3

2010 89.5 89.8 90.4 91.0 91.2 91.4 91.3 92.1 93.7 95.0 95.6 96.6

2011 98.0 99.4 100.6 101.0 100.4 100.6 101.0 100.9 101.3 101.3 101.2 101.0

2012 100.6 101.2 101.9 102.3 102.3 101.8 103.1 105.1 106.0 106.5 106.4 106.3

2013 106.4 106.8 106.4 105.7 105.4 105.0 104.6 104.2 103.7 103.0 102.7 102.7

2014 102.9 103.0 103.1 103.3 103.3 103.1 102.5 102.1 101.6 101.0 100.4 99.5

2015 99.1 100.5 100.7 101.1 101.3 100.6 100.2 99.7 99.6 99.5 99.3 98.3

2016 97.8 97.5 97.6 97.4 97.9 97.8 97.3 96.9 97.0 97.4 97.2 98.3

2017 98.6 99.0 98.9 99.1 98.7 98.1 97.9 98.0 98.4 98.9 99.2 99.3

2018 100.1 100.1 100.4 101.1 102.0 101.9 102.2 102.7 103.6 104.6 104.5 103.8

2019 103.6 104.1 104.4 104.6 104.4 103.8 103.7 103.3 103.7 103.6 103.3 103.5

2020 103.6 103.4 102.3 101.7 101.7 101.8 101.8 101.8 101.5 102.1 102.6 103.1

2021 104.5 106.4 107.6 107.9 108.5 109.6 110.9 111.6 113.2 117.5 119.5 120.5

2022 123.1 124.9 133.2 134.6 136.1 138.6 138.2 138.9 139.5 142.0 141.3 139.6

2023 140.1 138.6 137.5 135.5 133.5 132.0 130.8 132.1 132.4 131.9 130.9 129.5Série complete corrigée

# Automatic Procedure for Detection of Outliers

tso(ip)Series: ip

Regression with ARIMA(1,1,1) errors

Coefficients:

ar1 ma1 LS202 LS207 TC214

0.8275 -0.2803 2.7628 6.6897 2.3709

s.e. 0.0557 0.1008 0.5046 0.5038 0.4368

sigma^2 = 0.3418: log likelihood = -198.09

AIC=408.17 AICc=408.56 BIC=428.72

Outliers:

type ind time coefhat tstat

1 LS 202 2021:10 2.763 5.475

2 LS 207 2022:03 6.690 13.278

3 TC 214 2022:10 2.371 5.429fit_ip <- tso(ip)

# outlier-adjusted series

ip_corrige <- fit_ip$yadj

ip_corrige Jan Feb Mar Apr May Jun Jul Aug

2005 78.2000 78.5000 79.1000 79.3000 78.9000 79.4000 79.8000 80.0000

2006 80.8000 81.1000 81.3000 81.8000 81.8000 81.8000 81.9000 82.1000

2007 82.6000 83.1000 83.8000 84.5000 84.8000 85.1000 85.8000 86.6000

2008 93.2000 94.4000 95.7000 96.9000 98.8000 100.2000 101.3000 100.6000

2009 95.4000 94.8000 93.9000 93.5000 92.7000 92.2000 90.8000 90.7000

2010 89.5000 89.8000 90.4000 91.0000 91.2000 91.4000 91.3000 92.1000

2011 98.0000 99.4000 100.6000 101.0000 100.4000 100.6000 101.0000 100.9000

2012 100.6000 101.2000 101.9000 102.3000 102.3000 101.8000 103.1000 105.1000

2013 106.4000 106.8000 106.4000 105.7000 105.4000 105.0000 104.6000 104.2000

2014 102.9000 103.0000 103.1000 103.3000 103.3000 103.1000 102.5000 102.1000

2015 99.1000 100.5000 100.7000 101.1000 101.3000 100.6000 100.2000 99.7000

2016 97.8000 97.5000 97.6000 97.4000 97.9000 97.8000 97.3000 96.9000

2017 98.6000 99.0000 98.9000 99.1000 98.7000 98.1000 97.9000 98.0000

2018 100.1000 100.1000 100.4000 101.1000 102.0000 101.9000 102.2000 102.7000

2019 103.6000 104.1000 104.4000 104.6000 104.4000 103.8000 103.7000 103.3000

2020 103.6000 103.4000 102.3000 101.7000 101.7000 101.8000 101.8000 101.8000

2021 104.5000 106.4000 107.6000 107.9000 108.5000 109.6000 110.9000 111.6000

2022 120.3372 122.1372 123.7475 125.1475 126.6475 129.1475 128.7475 129.4475

2023 129.8342 128.5782 127.6490 125.7685 123.8522 122.4108 121.2518 122.5805

Sep Oct Nov Dec

2005 80.5000 80.7000 80.3000 80.4000

2006 81.9000 82.1000 82.3000 82.5000

2007 88.1000 89.5000 91.1000 91.9000

2008 100.6000 99.5000 97.7000 95.8000

2009 90.1000 89.7000 89.4000 89.3000

2010 93.7000 95.0000 95.6000 96.6000

2011 101.3000 101.3000 101.2000 101.0000

2012 106.0000 106.5000 106.4000 106.3000

2013 103.7000 103.0000 102.7000 102.7000

2014 101.6000 101.0000 100.4000 99.5000

2015 99.6000 99.5000 99.3000 98.3000

2016 97.0000 97.4000 97.2000 98.3000

2017 98.4000 98.9000 99.2000 99.3000

2018 103.6000 104.6000 104.5000 103.8000

2019 103.7000 103.6000 103.3000 103.5000

2020 101.5000 102.1000 102.6000 103.1000

2021 113.2000 114.7372 116.7372 117.7372

2022 130.0475 130.1765 130.1878 128.9857

2023 122.9006 122.4146 121.4245 120.0314ip_20023 <- window(ip_corrige, start = c(2023, 1), end = c(2023, 12))

ip_20023 # recuperation des donnes pour 2023 de la série corrigé Jan Feb Mar Apr May Jun Jul Aug

2023 129.8342 128.5782 127.6490 125.7685 123.8522 122.4108 121.2518 122.5805

Sep Oct Nov Dec

2023 122.9006 122.4146 121.4245 120.0314Graphique Prévisions de modeles comparés au données corrigés

dec_2022 <- 128.9857 # derniere valeur observé, pour la reintegration

# data frames avec les dates et les prévisions

df2 <- data.frame(

Date = forecast_dates,

AR1 = dec_2022 + cumsum(df$AR1),

ARP = dec_2022 + cumsum(df$ARP),

ARIMA = dec_2022 + cumsum(df$ARIMA),

HOLT_WINTER = as.numeric(forecast_hw2$mean),

ADAM_ETS = as.numeric(forecast_ae2$mean),

ADAM_ETS_SARIMA = as.numeric(forecast_aea2$mean),

SSARIMA = as.numeric(forecast_ssarima2$mean),

CES = as.numeric(forecast_ces2$mean),

NAIVE = as.numeric(forecast_naive2$mean),

corrige = as.numeric(ip_20023) # on integre les données corrigés

)

df2 Date AR1 ARP ARIMA HOLT_WINTER ADAM_ETS ADAM_ETS_SARIMA

1 2023-01-01 128.2190 128.2553 128.3163 126.8253 126.7827 126.7636

2 2023-02-01 127.7501 127.6288 127.7517 126.1869 126.2061 126.1681

3 2023-03-01 127.4887 127.1352 127.2755 125.5485 125.7241 125.6880

4 2023-04-01 127.3718 126.7386 126.8738 124.9101 125.3410 125.2948

5 2023-05-01 127.3556 126.4215 126.5350 124.2717 125.0289 124.9711

6 2023-06-01 127.4095 126.1676 126.2493 123.6333 124.7638 124.7042

7 2023-07-01 127.5123 125.9644 126.0083 122.9950 124.5520 124.4836

8 2023-08-01 127.6491 125.8018 125.8051 122.3566 124.3797 124.3059

9 2023-09-01 127.8097 125.6717 125.6336 121.7182 124.2318 124.1553

10 2023-10-01 127.9867 125.5675 125.4891 121.0798 124.1225 124.0212

11 2023-11-01 128.1753 125.4841 125.3671 120.4414 124.0340 123.9137

12 2023-12-01 128.3719 125.4174 125.2642 119.8030 123.9569 123.8230

SSARIMA CES NAIVE corrige

1 126.8350 128.0169 127.4637 129.8342

2 126.3923 128.4711 127.4637 128.5782

3 125.9496 128.9841 127.4637 127.6490

4 125.5069 129.2816 127.4637 125.7685

5 125.0643 129.6860 127.4637 123.8522

6 124.6216 129.7981 127.4637 122.4108

7 124.1789 129.9620 127.4637 121.2518

8 123.7362 130.1308 127.4637 122.5805

9 123.2935 130.6903 127.4637 122.9006

10 122.8508 130.9689 127.4637 122.4146

11 122.4082 131.2151 127.4637 121.4245

12 121.9655 131.2254 127.4637 120.0314# Transformer les données en format long

df_long2 <- pivot_longer(df2, cols = -Date, names_to = "Model", values_to = "Value")

# graphique plotly

p <- ggplot(df_long2, aes(x = Date, y = Value, color = Model)) +

geom_line() +

theme_minimal() +

labs(title = "Comparaison des prévisions avec les données corrigées

Jan 2023 à Déc 2023 - série corrigée",

x = "Date",

y = "Valeur",

color = "Modèle") +

theme(legend.position = "bottom")

ggplotly(p)Qualité de prévision 2

# Erreur de prévision , comparatif entre la valeur predicte de chaque modele et la valeur real corrigé

models2 <- names(df2)[-which(names(df2) == "Date" | names(df2) == "corrige")]

# erreur pour chaque modèle

errors_df2 <- data.frame(Date = df2$Date) # dataframe pour stocker les erreurs

for (m in models2) {

errors_df2[[m]] <- df2[[m]] - df2$corrige

}

errors_df2 Date AR1 ARP ARIMA HOLT_WINTER ADAM_ETS

1 2023-01-01 -1.6152638 -1.5789155 -1.5179610 -3.0089699 -3.0515339

2 2023-02-01 -0.8281255 -0.9493990 -0.8265399 -2.3913205 -2.3721289

3 2023-03-01 -0.1603209 -0.5138232 -0.3735271 -2.1004811 -1.9248853

4 2023-04-01 1.6032491 0.9700791 1.1052792 -0.8584087 -0.4275532

5 2023-05-01 3.5033665 2.5692765 2.6828353 0.4195268 1.1766829

6 2023-06-01 4.9987269 3.7568333 3.8385359 1.2225666 2.3530480

7 2023-07-01 6.2605204 4.7126506 4.7565452 1.7431792 3.3002001

8 2023-08-01 5.0686520 3.2213268 3.2245871 -0.2239071 1.7992301

9 2023-09-01 4.9091052 2.7710774 2.7330636 -1.1823827 1.3311923

10 2023-10-01 5.5721035 3.1528381 3.0744088 -1.3348308 1.7078153

11 2023-11-01 6.7508276 4.0596141 3.9426118 -0.9830596 2.6094938

12 2023-12-01 8.3405208 5.3859881 5.2328625 -0.2283349 3.9255302

ADAM_ETS_SARIMA SSARIMA CES NAIVE

1 -3.0706459 -2.9992521 -1.8173516 -2.3705860

2 -2.4100997 -2.1859010 -0.1071476 -1.1145528

3 -1.9609525 -1.6993598 1.3351557 -0.1853295

4 -0.4737175 -0.2615857 3.5131256 1.6951268

5 1.1188498 1.2120516 5.8337478 3.6114462

6 2.2934081 2.2107930 7.3873484 5.0528698

7 3.2318656 2.9271074 8.7101886 6.2118663

8 1.7254134 1.1557228 7.5502669 4.8831639

9 1.2547635 0.3929489 7.7896926 4.5630722

10 1.6065967 0.4362026 8.5542312 5.0490080

11 2.4891993 0.9836755 9.7905907 6.0391630

12 3.7916682 1.9341019 11.1939762 7.4322716df2$corrige [1] 129.8342 128.5782 127.6490 125.7685 123.8522 122.4108 121.2518 122.5805

[9] 122.9006 122.4146 121.4245 120.0314CSPE 2

# errors_df contienne déjà les erreurs pour chaque modèle calculées comme précédemment

cspe_df2 <- data.frame(Date = df2$Date) # nouveau dataframe pour stocker le CSPE

for (m in models2) {

cspe_df2[[m]] <- cumsum(errors_df2[[m]]) # Calcul du CSPE

}

cspe_df2 Date AR1 ARP ARIMA HOLT_WINTER ADAM_ETS

1 2023-01-01 -1.615264 -1.5789155 -1.517961 -3.008970 -3.0515339

2 2023-02-01 -2.443389 -2.5283145 -2.344501 -5.400290 -5.4236628

3 2023-03-01 -2.603710 -3.0421377 -2.718028 -7.500772 -7.3485481

4 2023-04-01 -1.000461 -2.0720586 -1.612749 -8.359180 -7.7761013

5 2023-05-01 2.502905 0.4972179 1.070086 -7.939653 -6.5994185

6 2023-06-01 7.501632 4.2540512 4.908622 -6.717087 -4.2463704

7 2023-07-01 13.762153 8.9667017 9.665168 -4.973908 -0.9461704

8 2023-08-01 18.830805 12.1880285 12.889755 -5.197815 0.8530597

9 2023-09-01 23.739910 14.9591059 15.622818 -6.380198 2.1842520

10 2023-10-01 29.312013 18.1119440 18.697227 -7.715028 3.8920673

11 2023-11-01 36.062841 22.1715581 22.639839 -8.698088 6.5015612

12 2023-12-01 44.403362 27.5575462 27.872701 -8.926423 10.4270914

ADAM_ETS_SARIMA SSARIMA CES NAIVE

1 -3.0706459 -2.9992521 -1.8173516 -2.370586

2 -5.4807456 -5.1851530 -1.9244991 -3.485139

3 -7.4416980 -6.8845128 -0.5893434 -3.670468

4 -7.9154155 -7.1460985 2.9237822 -1.975341

5 -6.7965657 -5.9340469 8.7575299 1.636105

6 -4.5031577 -3.7232539 16.1448783 6.688975

7 -1.2712921 -0.7961466 24.8550668 12.900841

8 0.4541213 0.3595762 32.4053337 17.784005

9 1.7088848 0.7525251 40.1950263 22.347077

10 3.3154815 1.1887277 48.7492576 27.396085

11 5.8046808 2.1724032 58.5398483 33.435248

12 9.5963490 4.1065050 69.7338245 40.867520# on pivot cspe_df2 pour l'utiliser avec ggplot2

cspe_long2 <- tidyr::pivot_longer(cspe_df2, cols = -Date, names_to = "Model", values_to = "CSPE")

a<- ggplot(cspe_long2, aes(x = Date, y = CSPE, color = Model)) +

geom_line() +

geom_hline(yintercept = 0, linetype = "dashed", color = "black") +

labs(title = "Cumulative Sum of Prediction Errors (CSPE) ",

x = "Date",

y = "CSPE") +

theme_minimal() +

theme(legend.position = "bottom")

ggplotly(a)Calcul du R2OOS 2

# DataFrame pour stocker le R^2 OOS de chaque modèle

r2oos_df2 <- data.frame(Model = character(), R2OOS = numeric())

# R^2 OOS pour chaque modèle, avec modèle naïf comme référence

models2 <- setdiff(names(df2), c("Date", "corrige", "NAIVE")) # Exclure Date, corrige, et NAIVE de la liste des modèles

for (model in models2) {

r2oos_value2 <- calculate_r2oos(df2$corrige, df2[[model]], df2$NAIVE) #on reutilise la fonction crée avant

r2oos_df2 <- rbind(r2oos_df2, data.frame(Model = model, R2OOS = r2oos_value2))

}

r2oos_df2 Model R2OOS

1 AR1 -0.1186581

2 ARP 0.5136306

3 ARIMA 0.5210950

4 HOLT_WINTER 0.8839270

5 ADAM_ETS 0.7315731

6 ADAM_ETS_SARIMA 0.7428897

7 SSARIMA 0.8470932

8 CES -1.3871863Calcul du MSE 2

# dataFrame pour stocker le MSE de chaque modèle

mse_df2 <- data.frame(Model = character(), MSE = numeric())

for (model in models2) {

mse_value2 <- mean((errors_df2[[model]])^2) # Calcul du MSE

mse_df2 <- rbind(mse_df2, data.frame(Model = model, MSE = mse_value2))

}

mse_df2 Model MSE

1 AR1 23.193565

2 ARP 10.084083

3 ARIMA 9.929321

4 HOLT_WINTER 2.406585

5 ADAM_ETS 5.565397

6 ADAM_ETS_SARIMA 5.330766

7 SSARIMA 3.170275

8 CES 49.494445DM test 2

# DataFrame pour stocker les résultats du

dm_results2 <- data.frame(Model = character(), DM_Statistic = numeric(), P_Value = numeric(), stringsAsFactors = FALSE)

# DM test pour chaque modèle comparé au modèle naïf

for (model in setdiff(models2, "NAIVE")) {

dm_test_result2 <- dm.test(errors_df2$NAIVE, errors_df2[[model]], alternative = "less")

# résultats

dm_results2 <- rbind(dm_results2, data.frame(Model = model, DM_Statistic = dm_test_result2$statistic, P_Value = dm_test_result2$p.value))}

dm_results2 Model DM_Statistic P_Value

DM AR1 -1.716421 0.0570373979

DM1 ARP 4.390655 0.9994600888

DM2 ARIMA 4.259706 0.9993281653

DM3 HOLT_WINTER 3.396124 0.9970150632

DM4 ADAM_ETS 3.588031 0.9978708541

DM5 ADAM_ETS_SARIMA 3.561305 0.9977686888

DM6 SSARIMA 3.519984 0.9976007031

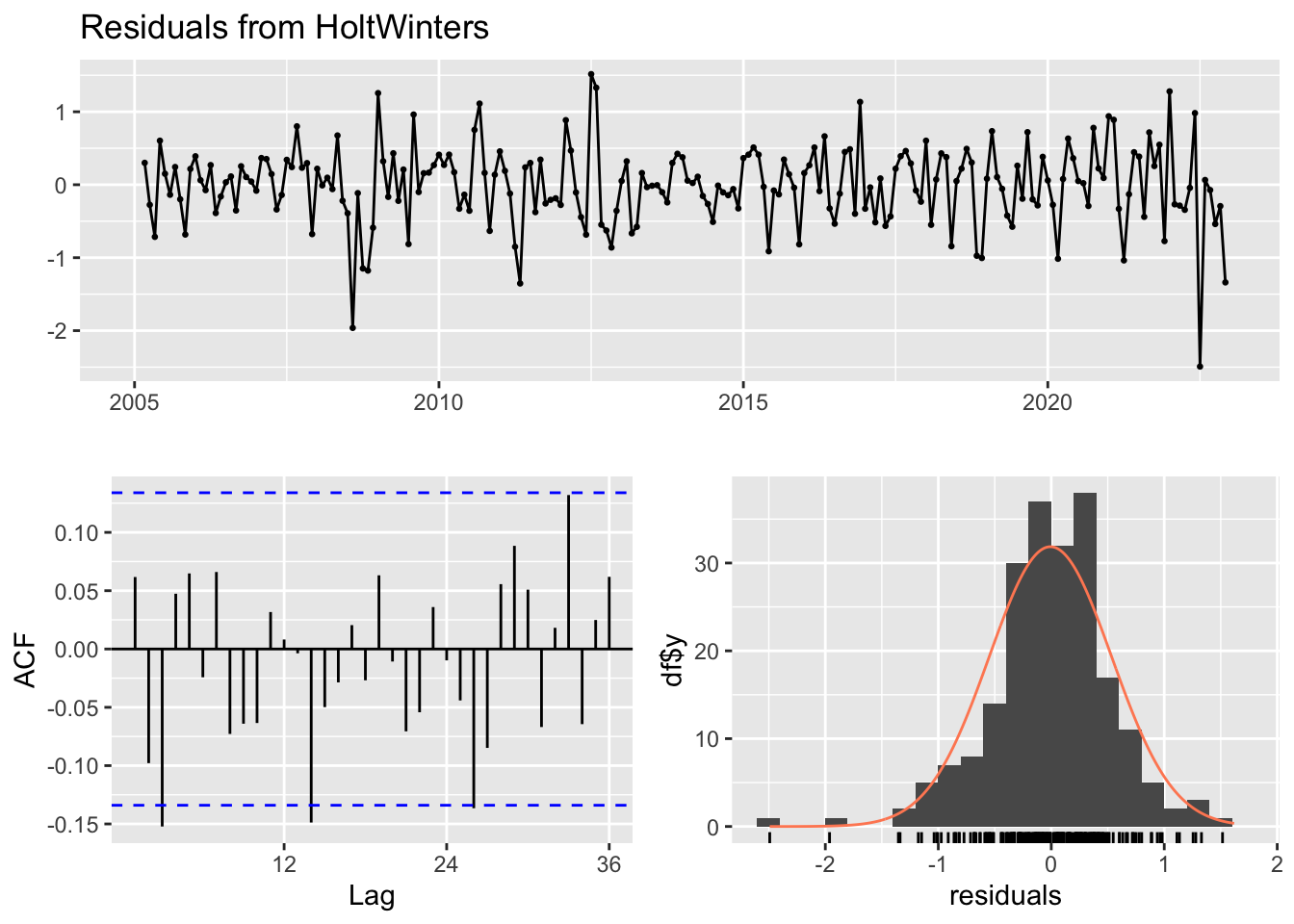

DM7 CES -4.181538 0.0007662846Prévision modele Holt Winter

checkresiduals(forecast_hw2)

Ljung-Box test

data: Residuals from HoltWinters

Q* = 23.15, df = 24, p-value = 0.511

Model df: 0. Total lags used: 24forecast_hw2$mean Jan Feb Mar Apr May Jun Jul Aug

2023 126.8253 126.1869 125.5485 124.9101 124.2717 123.6333 122.9950 122.3566

Sep Oct Nov Dec

2023 121.7182 121.0798 120.4414 119.8030df2$corrige [1] 129.8342 128.5782 127.6490 125.7685 123.8522 122.4108 121.2518 122.5805

[9] 122.9006 122.4146 121.4245 120.0314